If you have de-risked your portfolios and piled up some tall stacks of cash as risks have risen in the market, then you deserve an enjoyable holiday break. In fact, take a long one because there is nothing to suggest that there are many investable catalysts are on the horizon. A U.S. Government shutdown looks inevitable as D.C. heads towards spiked eggnog, and the President wants his wall. China and U.S. trade talks won’t get serious again until January. Ditto for the U.K. Parliament and Brexit. Now let’s pile on some new worries in the last week:

- Oil prices below $50

- POTUS has worst week of his Presidency

- A Federal judge in Texas hits Obamacare—making the previously investable Healthcare sector less investable

- Retail stocks enter a bear market suggesting future signs of stress in 2019 as more retailers hit the wall and close stores

- The junk bond market has been closed to all new business for the month of December

- The S&P 500 makes a new 2018 low

Is there a dove anywhere? Well yes, we could get a dove toss or two midweek as the Fed meets to discuss their policies. The market expects another 25bp Fed Funds rate hike but their comments surrounding the global economy and markets since the last meeting will be more important. If the market gets some dovish signals, then the market could take a break from going down for a few days until the market returns to worrying about the naughty list above.

So what would be my #1 pick of an investable catalyst that would get me to buy stocks and risky credits? How about this dream Christmas POTUS tweet…

Navarro & Ross have resigned. I was wrong on tariffs. I am eliminating ALL taxes on U.S. imports and exports. FIRE UP THE U.S. ECONOMIC ENGINE!!! Happy Holidays and Merry Christmas!

If you see the above tweet or anything close to it, just go and buy a basket of the worst-performing stocks in this 4th quarter and hang on for the ride. I will be working here everyday watching and waiting for this tweet so you don’t have to.

Enjoy your downtime over the holidays. As our last edition for 2018, we wish you a very happy holiday season. My next briefing will be January 7, 2019 and I will be hosting a webcast reviewing 2018 and providing an outlook into 2019 on January 9. Register Now. And thanks for reading.

To receive this weekly briefing directly to your inbox, subscribe now.

So, I forgot that marijuana was now legal in Washington D.C…

Fact check: most broad measures of U.S. inflation are running at about 2%.

White House advisor Peter Navarro — just hours after President Donald Trump blasted the Federal Reserve — doubled down Monday, singling out the central bank as the biggest threat to U.S. economic growth.

Appearing on CNBC’s “Squawk on the Street,” Navarro said the Fed should pause its interest rate hikes — not because growth is slowing, but because growth is strong with barely any inflation.

“We have zero inflation for all practical purposes” and strong economic growth, Navarro told CNBC’s Rick Santelli.

(CNBC)

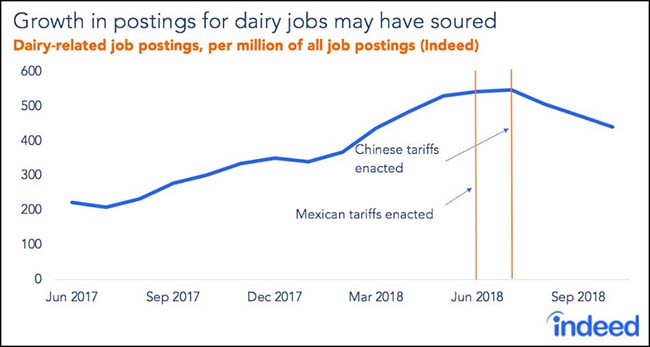

The Fed has nothing to do with the slowdown in dairy job growth…

Mr. Navarro gets full credit for ending these job openings (along with thousands of others).

Goldman setting the bar low for a U.S./China trade deal…

Trade policy developments are likely to continue to affect trade data over the next several months. In the near-term, an important factor will be potential Chinese purchases of US commodity exports following the meeting between President Trump and President Xi on December 1. However, to date, no major purchases or tariff reductions in this area have been announced. More importantly, the potential rise in the tariff rate from 10% to 25% is scheduled for March 1 (no formal delay has been published in the Federal Register, but we expect this to occur soon). While we think it is a close call, we believe it is slightly more likely that negotiations will fall short of what is necessary for a further delay.

(Goldman Sachs)

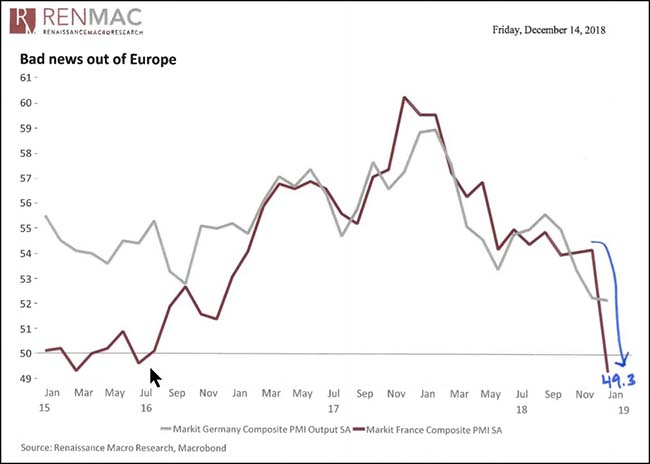

Major global economic data continues to slowdown…

Germany has begun to contract while France’s growth rate is slowing down meaningfully.

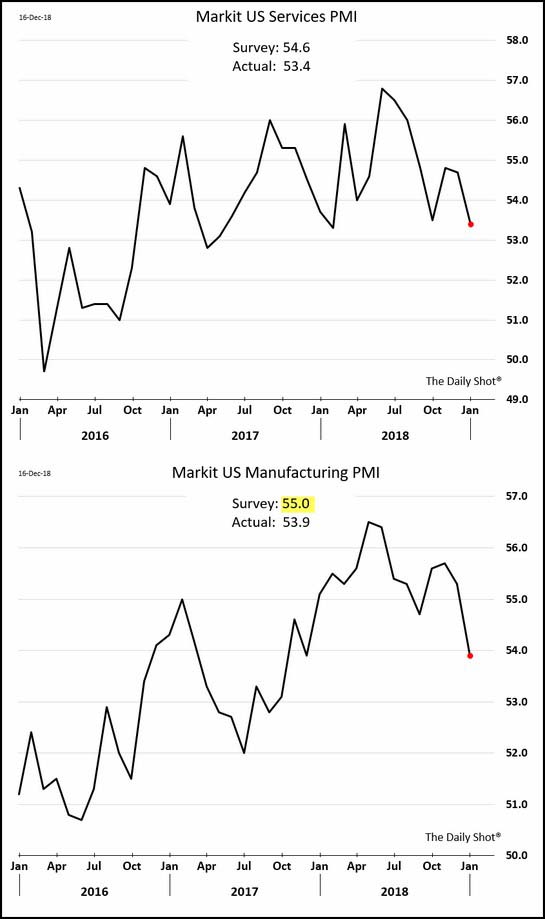

The U.S. is also showing slower growth both in Services and Manufacturing…

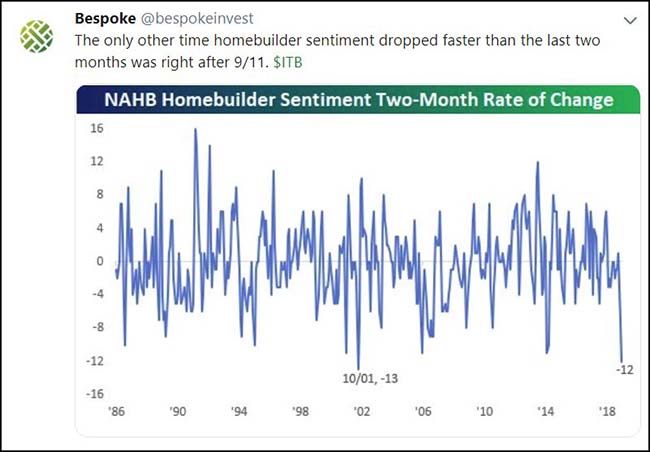

The U.S. housing slowdown is now on par with post 9/11…

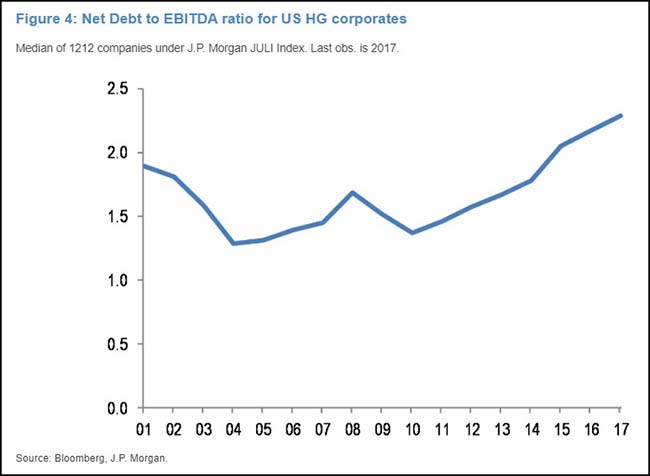

J.P.Morgan highlights the debt that high-grade corporates in the U.S. have taken on…

This leverage metric has been rising steeply over the past decade to levels that are much higher than those seen at the peaks of the previous two cycles in 2007/2008 and 2001/2002. In other words companies are currently much more vulnerable to a decline in incomes and/or rise in interest rates that in the previous two cycles. This is especially true in the US where the Fed hikes coupled with its balance sheet shrinkage have pushed corporate bond yields close to the 5% mark, creating vulnerability for credit in a risk scenario where earnings contract next year.

(J.P. Morgan)

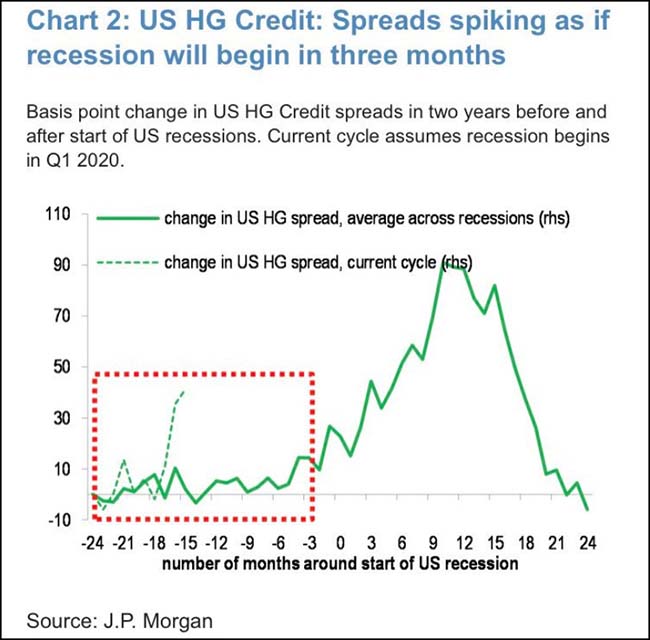

The credit markets have begun to price in future risk…

(@RobinWigg)

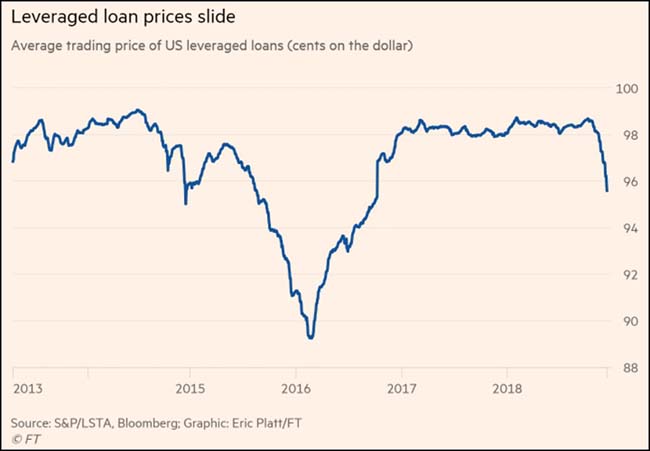

We wrote last week about the meltdown in the bank loan ETFs. Now the underlying market is also melting…

Banks have been stirred into action by a rapidly weakening leveraged loan market, as would-be buyers of the loans shift to the sidelines. According to an S&P/LSTA index, existing loans are selling at less than 96 cents on the dollar, compared with 98 cents just a month ago.

Several recently issued loans, including debt syndicated by Goldman Sachs and JPMorgan to finance private equity buyouts, have been offered to investors with substantial discounts…

A growing chorus of central bank governors, credit rating agencies and investors have warned of the risks in the leveraged loan market, which has ballooned in size over the past two years. Federal Reserve governor Lael Brainard raised concerns last week, saying that leveraged loan risk-management practices at banks may have “weakened”. The International Monetary Fund and former Fed chair Janet Yellen have also argued standards are deteriorating.

Banks’ demands for greater flexibility and investors demands for higher interest rates or steeper discounts are tightening financial conditions for borrowers, making leveraged buyouts more expensive for private equity buyers.

To receive this weekly briefing directly to your inbox, subscribe now.

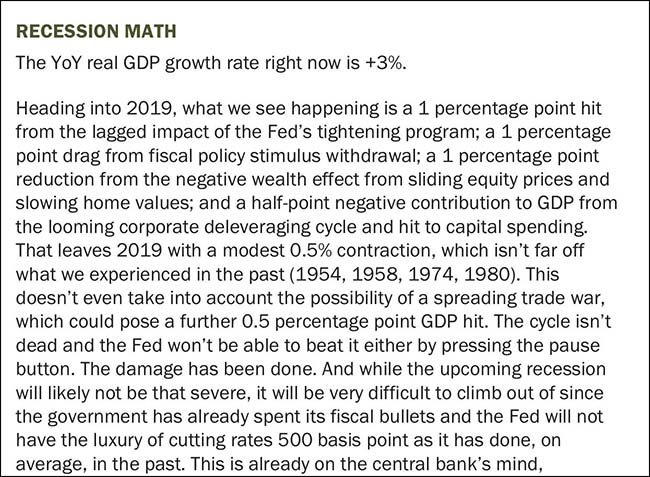

I like PIMCO’s choice of a 30% chance of a recession for 2019…

My dial is definitely nearing 100% for 2020.

Declining global economic growth rates will boost defensive stocks and could lead to opportunities in emerging market currencies and mortgage bonds in the year ahead, asset manager Pacific Investment Management Co (Pimco) said in its 2019 outlook on Thursday.

Higher interest rates and fading fiscal stimulus will leave the U.S. economy at a 30 percent chance of falling into a recession, the highest probability at any point during the nine-year economic expansion, Pimco said.

(Reuters)

David Rosenberg’s Recession Math…

Stocks follow earnings. So I agree strongly with Liz…

What is the outlook for earnings growth in the U.S.?

I don’t think that earnings growth will persist next year. Unless there is a reversal back up in oil or a big drop in the dollar, the consensus earnings growth estimates for 6% to 8% for 2019 seem too high. There is not an insignificant risk that we move into an earnings recession, like we saw in late 2015 and early 2016. That didn’t turn into an economic recession because it was concentrated in energy. There’s a cushion in energy so that it won’t be as deep as we had in 2015-16, but exports and capital expenditure-tied industries could take a significant haircut from mid-single- digit earnings growth to negative territory. And that’s not in stock prices.

(Barron’s)

J.P. Morgan now penciling some downside earnings projections which places the market at a more fair value…

“if growth figures globally don’t begin to at least stabilize, investors will start haircutting the $178 ’19 EPS consensus – “whispers” have already been bleeding down into the mid/high $160s over the last few weeks and putting 15-16x on a ~$168 number obviously will change the SPX ranges.”

(JP Morgan)

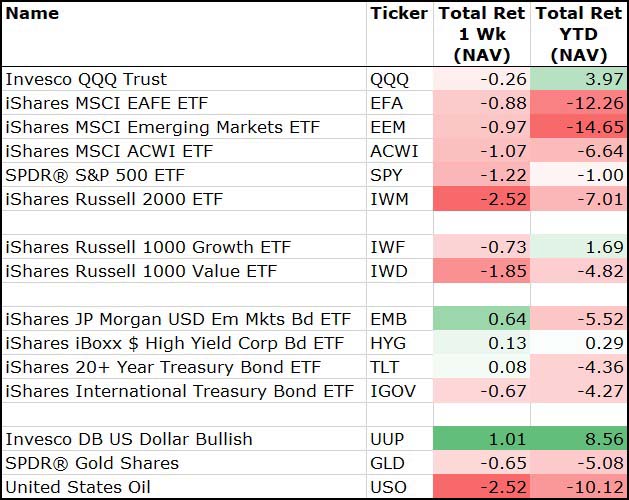

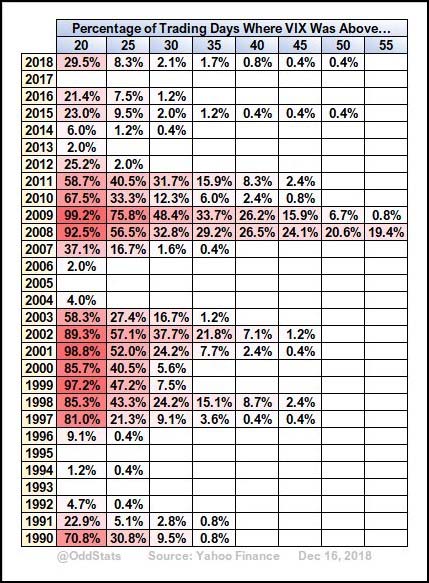

Last week, most assets lost value except for the U.S. Dollar and Bonds…

And lots of red among the sectors with Materials, Energy and Financials joining the bear market…

The market has a difficult time when the put/call ratio is going in the wrong direction.

(@Callum_Thomas, @mark_ungewitter)

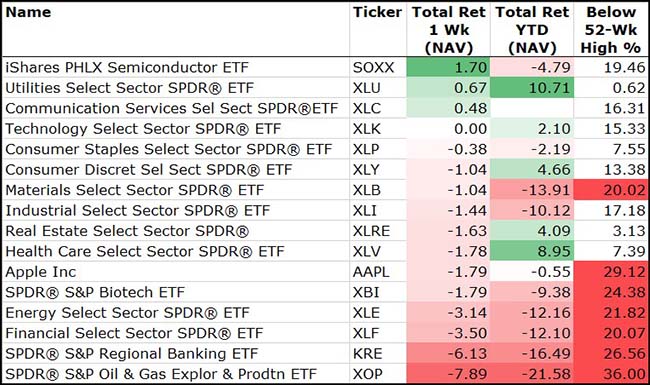

Very interesting visual of VIX trading levels…

An incredible and detailed long read on the meltdown at GE…

The GE teams started offering discounted turbine upgrades to customers in exchange for extending the length of contracts to as far out as 2050. Executives scoured existing contracts for ways to change underlying assumptions, such as the frequency of overhauls, to boost their profitability.

GE Power even sold its receivables—the bills its customers owed over time—to GE Capital to generate short-term cash flow. The unit gave customers discounts on their service contracts, lowering their overall value, in exchange for renegotiations that let the company bill the customers sooner.

The accounting maneuvers were legal, if aggressive, GE executives assured one another. But it also meant that the profits were mostly on paper. Rarely was a new dollar of profit flowing in the door.

Bolze’s team was operating in a tradition that stretched at least as far back as the glory days of Jack Welch, but the scale of the aggressive contract accounting was far bigger.

(WSJ)

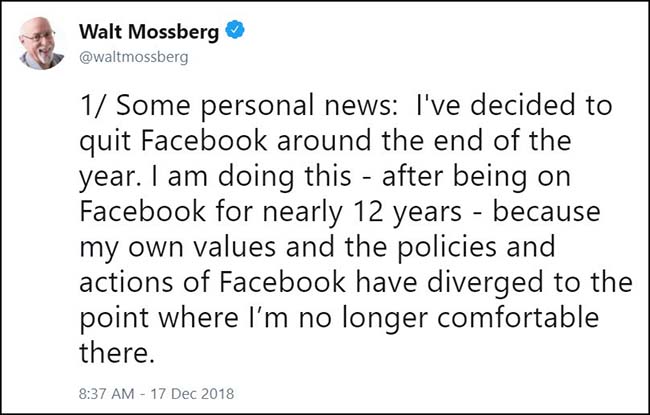

Walt dumps Facebook and Instagram…

Time to ask yourself if Facebook has made your life and the world a better place. If not, then find a better way to connect with your friends, family and favorite Russian hackers.

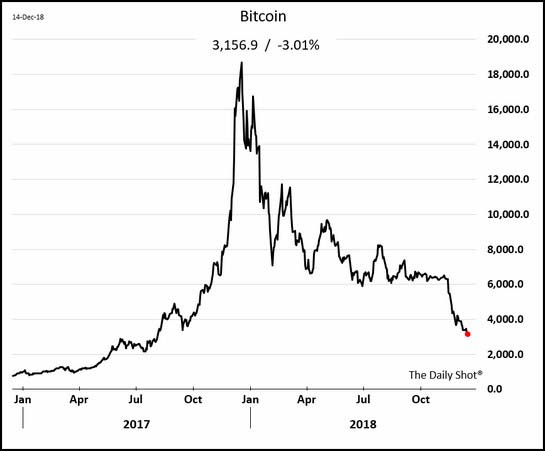

What an epic one-year collapse…

(WSJ/Daily Shot)

1. Go public and be successful (think Amazon)

2. Go public and really wish they didn’t (think Snapchat)

3. Go public and go straight to the glue factory (think Pets.com)

Lin and Charles. Such a great story…

“Your dad is one of the happiest people I’ve ever met in my life,” Barkley said. “I’m not just saying that — I mean, think about it: It’s fun to be with your friends, you know? ‘Cause, I don’t have that many friends that I want to be around, to be honest with you. I mean, you know a lot of people. But when you go spend time with your friends, it’s a whole different animal.”

(WBUR)