With so much politically driven volatility in Europe, it’s easy to lose sight of what’s really happening in the markets. Investors in European stock markets should watch three big themes that we think will shape the environment next year.

European stocks have had a tough year. The MSCI Europe Index has fallen by 8.5% through December 7 in euro terms, while the MSCI EMU Index of euro-area stocks dropped by 10.6%. Heightened uncertainty about issues from Brexit to Italian politics to the looming withdrawal of central bank liquidity has rattled investor confidence in the region. And the economic recovery, which was proceeding gradually, is facing new challenges.

Despite these concerns, stock valuations and corporate earnings are still appealing. By the end of November, the MSCI Europe’s price/earnings ratio was 12% cheaper than the average over its own 40-year history and traded at a 26% discount to US stocks. European companies also posted solid third-quarter earnings, delivering 10.0% earnings growth in aggregate, with 52% beating estimates, according to J.P. Morgan data. While tougher macroeconomic conditions could weigh on earnings next year, we still expect European companies to post solid profit growth. In fact, based on consensus forecasts, the MSCI Europe is projected to deliver earnings growth of 9.7% in 2019, outpacing the S&P 500’s 8.7%.

But the fundamental outlook and political risks only tell part of the story of European markets. To position for the long term, we think investors should focus on three important themes that may not always make the headlines but could significantly influence individual European companies and stocks as 2019 unfolds.

Theme 1: Changing Players—Activists and Private Equity Buyers Take Center Stage

New types of investors are poised to play a bigger role in European equity markets next year. Activist investors, who use their positions to influence management behavior and strategy, have never really been a dominant force in European markets. But that may be about to change. After raising a lot of assets in the US, activist investors are now turning their attention to Europe.

Activist campaigns in Europe are beginning to target larger companies. During 2018, Nestlé, one of Europe’s largest companies, has faced a highly public campaign from activist investors to break up its business into three units. Activists are showing they aren’t afraid to take their fights to regions that have been challenging to penetrate in the past. For example, in Italy, intense activist pressure on Telecom Italia this year led the company to oust its CEO in November.

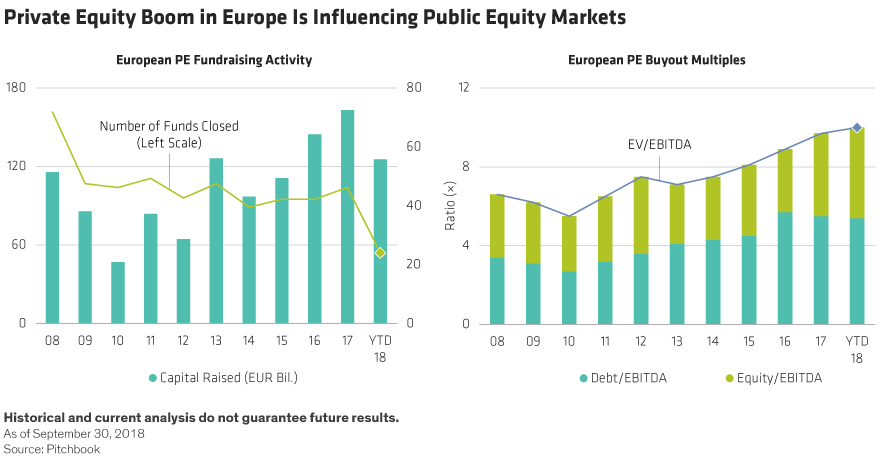

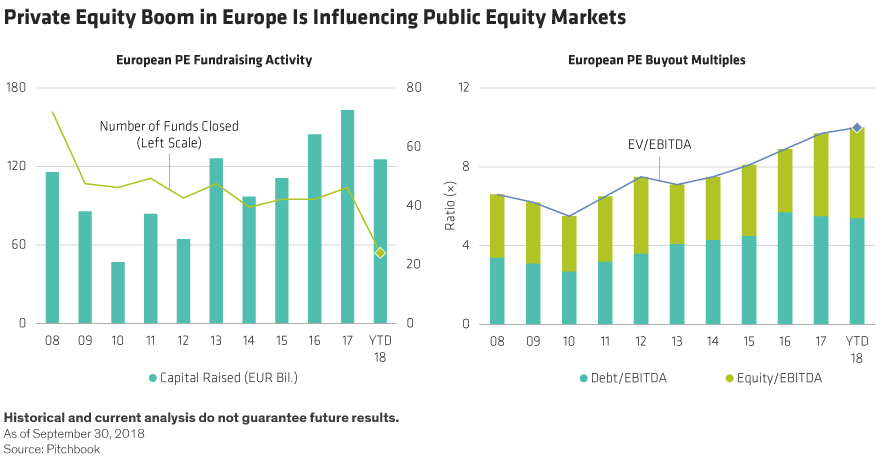

Private equity (PE) players are also raising their profiles on the European landscape after a two-year global funding boom. European private equity funds raised €55.8 billion in the first nine months of 2018 and are on pace for a record year, according to Pitchbook data (Display, left). In fact, PE funds are paying higher multiples and taking on more leverage to complete deals in Europe (Display, right), which adds risks for their investors. We believe that applying the mindset of PE investors to public equity markets, investors can generate long-term benefits similar to those of PE with less risk.

The increase in activity by activists and PE funds will have a profound impact on public equity markets, in our view. European companies that have avoided making tough changes to improve profitability will increasingly realize that they risk a hostile public campaign or a PE takeover if they don’t act to sharpen their businesses. Investors in public equity markets who deploy a private equity mindset could find hidden opportunities in challenged European markets. And public investors may find that European companies are becoming more receptive to engaged shareholders who are willing to work constructively with management on promoting business improvements.

Theme 2: Companies Are Simplifying

There are good reasons why activists and PE funds find European companies so appealing. Publicly listed European companies are much less profitable than their publicly listed US peers. In other words, there is much more scope for investors to help companies increase profitability and shareholder returns.

Why is European profitability lower than in the US? In part, because European companies are more complex than their US peers. Generally speaking, focused companies are more profitable than unfocused ones. And until now, European companies have had little motivation to do much about their poor performance.

Corporate culture explains the difference. US management teams are far more incentivized by total shareholder returns than are European management teams. European investors have also generally been quite passive and not willing to stand up to poor behavior by European management teams. This leaves the door open for activists to get involved. And when they do, companies have responded.

European divestments and spin-offs have been surging. In recent quarters, divestments by European companies have more than doubled, according to Goldman Sachs data. Examples include Merck’s sales of Consumer Health in April and Vivendi’s sale of Ubisoft in March. Spin-off announcements have also surged. European companies are clearly showing a new energy about simplifying their businesses. We expect the pace to pick up even further in 2019, which will help unlock shareholder value for investors in European companies.

Theme 3: Dislocated Valuations

When markets are driven by political fears, dislocations are often created as stocks in certain industries or sectors overreact to concerns about their earnings outlook. Europe’s travails generated some imbalances that present opportunities for active investors.

The auto industry is a good example. After underperforming this year, the SXAP index of European automakers now trades at a deep discount to the broader MSCI Europe Index. Other valuation metrics, such as the enterprise value versus EBITDA, show the industry stuck at exceptionally low valuations. Fears about new tariffs and the global economic outlook have hurt auto stocks, which are typically highly sensitive to the growth outlook.

But carmakers earnings have held up well despite some severe headwinds in China and Europe this year. We believe that shares in the industry are being driven by perceptions of risks instead of by the actual business outlook for individual companies.

In some cases, auto manufacturers are being priced as if another 2008-style crisis is looming, even though balance sheets are much stronger than a decade ago. Within the industry, select auto-parts manufacturers offer undervalued shares that benefit from an entirely different business dynamic. These companies are enjoying strong organic growth and better return on capital than carmakers, driven by structural growth globally in the amount of content per vehicle, while outsourcing and industry consolidation are keeping costs down.

The European materials sector is also trading at a deep 20% discount to the broader market. Shares have been depressed by concerns about the global economy in general and China in particular.

While margins have been unsustainably high in some industries, such as steel, current spot prices for certain base metals already incorporate expectations of a sharp slowdown in demand. Select European companies that produce copper, aluminum and zinc offer outperformance potential, in our view. Opportunities can also be found in some segments of the chemicals industry, where investors have pushed down prices because of concerns about exposure to the auto industry.

Today’s market conditions require an especially keen eye and a clear head to cut through the volatility. Identifying investment candidates in dislocated industries can only be done by deploying deep research and filtering out noise. By combining the search for attractive businesses with an understanding of the broader market trends, we believe investors will find Europe is brimming with hidden opportunities that offer strong long-term return potential.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Copyright © AllianceBernstein