Tips for Addressing Longevity Risk with Clients

by Commonwealth Financial Network

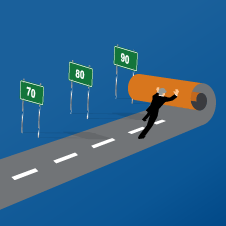

Even today, living to age 100 is considered an impressive accomplishment. But it isn’t as rare as it used to be, thanks to the efforts of those in the medical research field. In fact, according to an article published on DailyMail.com last year, Dutch scientists believe that life expectancy will increase to an astonishing 125 years by 2070! While this may be welcome news to many, it has created new pressures for the financial planning community to help clients prepare for retirement income needs that go past the long-accepted mark of age 90.

Even today, living to age 100 is considered an impressive accomplishment. But it isn’t as rare as it used to be, thanks to the efforts of those in the medical research field. In fact, according to an article published on DailyMail.com last year, Dutch scientists believe that life expectancy will increase to an astonishing 125 years by 2070! While this may be welcome news to many, it has created new pressures for the financial planning community to help clients prepare for retirement income needs that go past the long-accepted mark of age 90.

Let’s look at an example of how living longer can affect senior investors financially, as well as review some important tips for addressing longevity risk with clients.

To illustrate the impact that living to an advanced age can have on a retirement portfolio, let’s consider a test case. A 65-year-old client has a preretirement income of $100,000. She determines that she needs 75 percent of this income, which comes out to $6,250 per month, to meet retirement expenses. Assuming a life expectancy of 86, inflation of 3 percent, and a portfolio rate of return of 5 percent, she needs a starting balance of $1,266,000 to achieve this income goal.

Now, let’s extend her life expectancy by 10 years to age 96. To generate the same monthly income, she would need a starting balance of $1,704,000—that’s 35 percent higher than the above example! If she looked to performance to achieve the same result, she would need a 7.3-percent rate of return on that $1,266,000. Either way you look at it—a higher starting balance or a significantly higher rate of return—it’s a less desirable result.

This is a difficult question for planners to answer, especially when we look at the impact of adding 10 years to a life expectancy. What should we be doing then? We need to address longevity risk early and continue to discuss it throughout retirement. Your conversations should include these topics:

Health and lifestyle. This may not be conventional subject matter for planners, but it is increasingly important. To come up with an end date for a retirement plan, you need to collect data about factors that directly affect it. Lifestyle, fitness, and family history all play a part in how long a person will live. If you have a rock-star client who competes in triathlons, eats like a nutritionist, and has parents who lived into their 90s, you should probably test the retirement plan past age 90.

Realistic income goals. Planners often have conversations about realistic spending in retirement, but do they account for the longevity factor? Especially for healthy clients, be sure to consider what-if scenarios in your planning. By simply showing clients the potential impact of living to an advanced age, you’ll help them make better spending choices.

Downsizing. Clients may be adamant about not downsizing their homes when retirement begins, but this is the best time to broach the subject. Maybe they can afford to stay in their current living situation for the foreseeable future, but they need to consider change as a potential solution. Planners could frame it as a “backup plan” that can solve the problems of living too long or having a poorly performing portfolio. Reverse mortgages may also be a part of this conversation (though be sure to comply with your firm’s internal policies). All this talk can get clients to start thinking about their options, which will make everything that much easier if the time comes to start implementing these strategies.

Long-term care planning. A long-term health care event can be one of the most destructive risks to a financial plan. The longer people live, the greater the likelihood they will have to live with frailty—and the greater the amount of time they will need professional care services.

The family discussion. No one wants to burden their children while they age. But the truth is, the younger generation will be affected by their parents’ decline in health. Watching a parent age and eventually pass is difficult. Many family members find out about financial or health issues abruptly, after an accident, diagnosis, or some catastrophic medical event like a stroke. The family enters crisis mode when they learn about their parents’ plans for care and the resources they have available to pay for it.

Involving the family in plans for aging beforehand can help ease the burden of facing health care challenges later. Children who understand the financial plan are better able to focus on coping with the emotions of watching a parent struggle with health.

Everyone’s financial situation is different, so there’s no one-size-fits-all strategy for addressing longevity risk with clients. Make retirement income needs part of your planning discussions early on to minimize the burden of aging as much as possible. Having frank conversations with clients and their family today about what could happen and the decisions that need to be made will help them when faced with longevity and health care events down the road.

When addressing longevity risk with clients, how do you get the conversation started? How do you approach the topic of retirement income needs? Please share your thoughts with us below.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network