I am talking about credit spreads. Many investors have been patiently waiting for credit to break to get them more cautious about the markets. Well, last week was it. Credit spreads across the spectrum broke higher. This is not a good sign as it will cause lenders to pull back their pens making it more expensive to borrow and finance business, thus tightening liquidity across the system.

The cost of capital of risk-seeking investors will increase, which will pause new investments and maybe even cause them to sell assets as they now require a higher rate of return. Bank credit officers will tighten their lending screws and require higher standards for that new credit card, auto loan, mortgage or commercial line of credit. There was no real specific reason for the cause last week.

Maybe it was the explosion in General Electric credit default swaps. Or maybe it was Paul Tudor Jones’ or Jeffrey Gundlach’s comments about the credit markets. Or maybe it was the continued plunge in oil prices. What we do know is that it has been a very good nine years driven by a ZIRP (zero interest rate policy). ZIRP is now dead so maybe time for a big market and global economy rest.

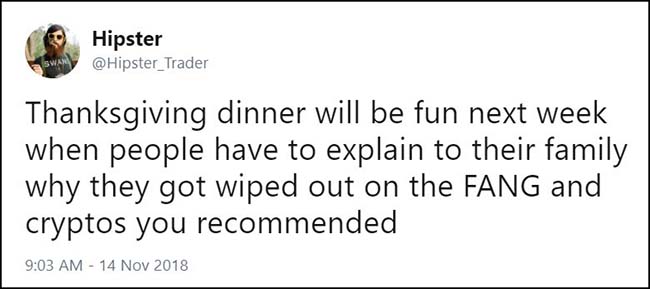

Don’t think that the market is going to be making new highs anytime soon. It doesn’t work that way in correcting credit markets. Plus, just look at the tape. Lots of bear markets out there: GE, Oil, China, Biotech, Homebuilders, Autos, Carlos Ghosn, Apple, Facebook, Netflix, Google. Hey, it’s the FANG! (Wonder where those FANG linked credit instruments are trading.) Check out Nvidia which was +50% YTD just a month ago and is now -25%. This is not a normal, healthy market.

So, if you were clinging to stable credit spreads as the crutch to save your portfolio during the correction, then that crutch has been kicked out. Time to readjust your outlook and positioning. The tape is broken, don’t fight it. Rake your portfolio for losing stocks that you can replace with better companies. A losing stock would be one without pricing power, control over its costs, too much debt, etc. A better company would be one with the opposite attributes. Once again, if you can, find a way to get into a hedged portfolio of longs and shorts where you have the chance to win on both sides of the equation. The current market is very uncorrelated across the sectors which is giving many hedged investors this ability. Also, never forget, cash is an asset that now yields 2-3% which is not bad.

I apologize for the long note this week. There is a lot to consider given the new events surrounding credit deterioration in the financial markets. Spend time on the pieces and consider the new data. And talk about it with your friends and relatives over the break. Plenty of opportunity to compare notes over turkey, sweet potatoes and games of Uno. Have a great Thanksgiving.

To receive this weekly briefing directly to your inbox, subscribe now.

Junk Bonds broke down last week…

Here is the HYG chart which shows a lower low below the 200-day moving average on significantly higher volume. Credit investors are now awake.

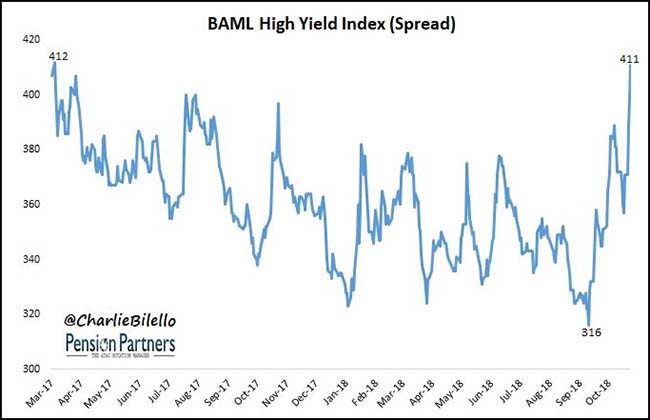

High yield spreads have broken meaningfully higher…

@charliebilello: US High Yield credit spreads move up to 411 bps, widest since March 2017. $HYG

Paul Tudor Jones didn’t hold back on credit last week…

Mr Tudor Jones, the founder of Tudor Investment Corporation, said rising interest rates are “going to stress test our whole corporate credit market for the first time”, and cautioned that the fallout could have systemic implications for the global economy.

“If you go across the landscape you have levels of leverage that probably aren’t sustainable and could be systemically threatening if we don’t have . . . appropriate responses,” he said at the Greenwich Economic Forum in Connecticut…

“These zero rates and negative rates encourage excess lending and that’s of course why we’re in such a perilous time right now, because if you just think about how repressed and how depressed interest rates have been for so long, the consequence of that is we have an enormous corporate credit bubble here in the United States, the largest corporate credit as a percentage of GDP ever,” Mr Tudor Jones said.

“I don’t know whether we’re supposed to run for the exits but we are at a point in time that I think is really challenging to that paradigm of an ever-growing debt relative to the carrying capacity.”…

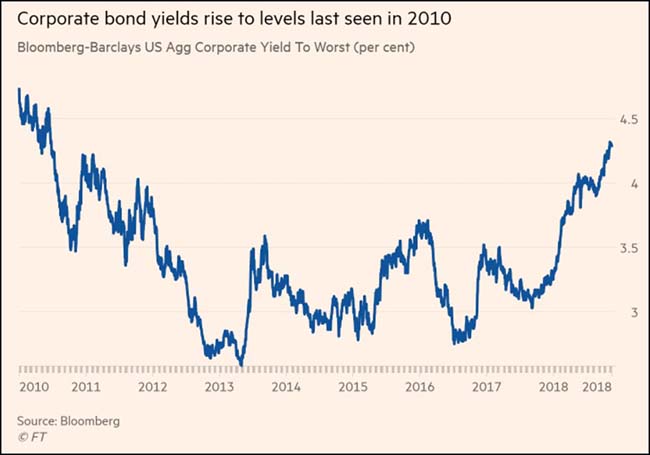

Cracks have begun to emerge in several corners of the corporate debt ecosystem. The yield on a widely-tracked Bank of America Merrill Lynch junk bond index moved above 7 per cent for the first time since July 2016.

The yield of the Bloomberg Barclays Corporate Aggregate, a benchmark of safer, investment-grade debt, has also climbed to the highest level since mid-2010, hitting 4.3 per cent this month.

“I would say just in the past three or four days we’ve seen a variety of credit indices break down,” said Mr Tudor Jones.

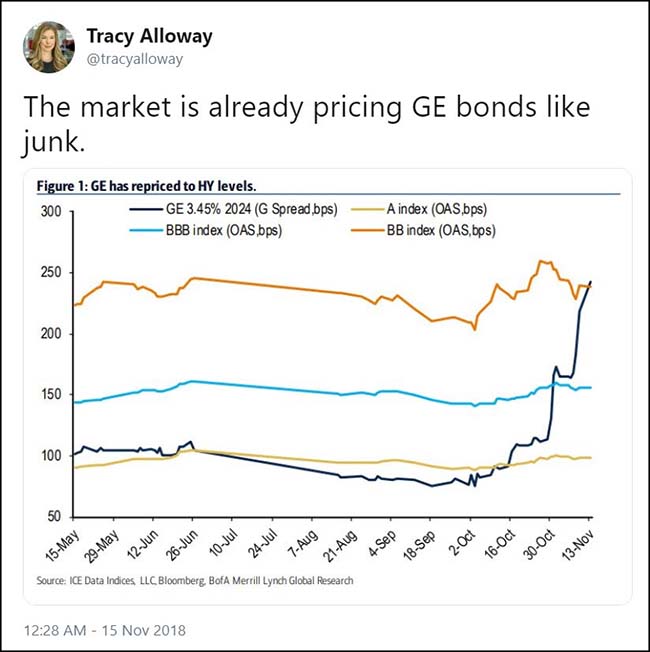

The junk bond market would like to welcome its newest member…

GE used to be a AAA rated credit. In the last month it has traded from the A-rated debt levels to BB-rated debt levels. Moody’s and S&P rating downgrades cannot be far behind. And this will have significant impact in the world of insurance company and mutual fund/ETF holdings which have corporate debt quality restrictions. If GE debt is a top holding in those portfolios, it will need to be reduced or sold.

If the economy slows, expect GE to have plenty of company moving to junk bond land…

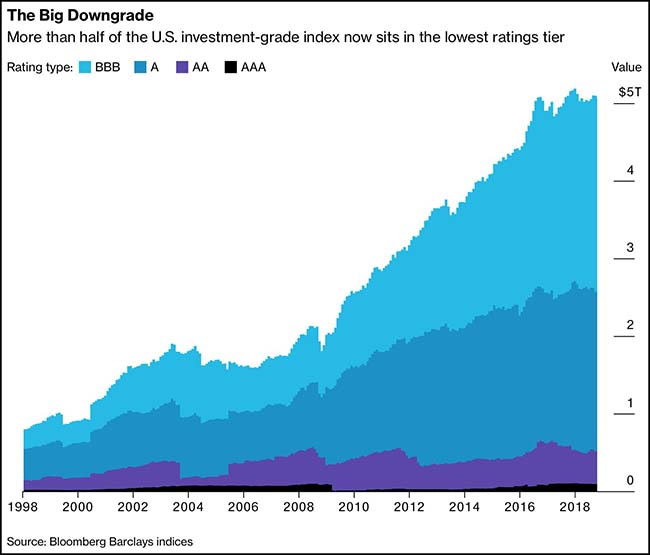

About half of the $5 trillion market for investment-grade bonds now resides in the lowest tier of ratings. Many investors fear that as global economic growth shows signs of slowing, the rosy assumptions built into companies’ profit forecasts could prove wrong, and at least some of the lowest-rated high-grade debt may end up getting cut to junk.

Blue-chip company debt has been clobbered this week, and is on track for its worst year since 2008. One of the biggest whipping boys in corporate bond markets has been GE, which is facing weak demand for gas turbines, high debt levels and a federal accounting probe. Now investors are looking at other companies with big borrowings, including Anheuser-Busch InBev NV and Ford Motor Co., for any signs of fragility.

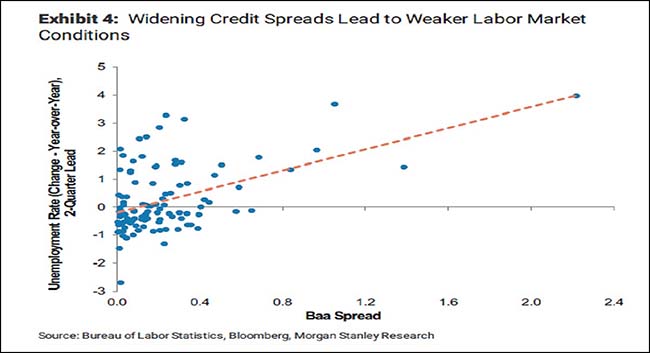

Morgan Stanley had a good piece showing credits impact on the economy…

As you would guess, it is not positive.

A sustained 10 basis-point widening in BBB spreads would spur a 0.3 percentage point reduction in growth while the unemployment rate would rise by 0.15 percentage point, all else being equal, according to the study published this week.

“The risk bears watching as a sustained tightening in corporate credit conditions can create strong headwinds for economic activity,” economists including Robert Rosener wrote in a report.

Morgan Stanley used as its sample set the $2.5 trillion of bonds rated BBB, which make up about half the investment-grade corporate debt market and now seen as a hotspot for leverage and downgrade risk in a recession.

Spreads for the swathe of borrowers Morgan Stanley looked at have surged almost 20 basis points this month to 161 basis points, the most since 2016.

All told, a sustained 100 basis-points increase in BBB premiums over the course of a year is the equivalent to a 62 basis-point hike in the benchmark federal funds rate, it said.

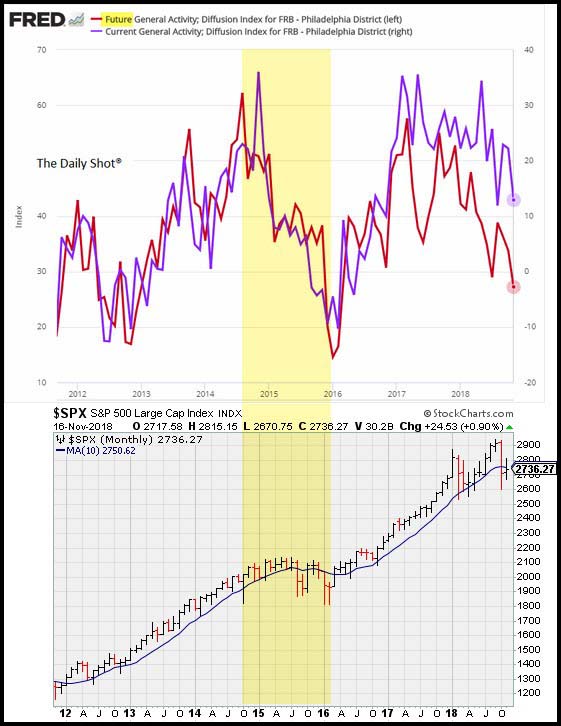

The Philly Fed Current and Future Activity Indexes continue to slow…

The last time that they pulled back, the S&P 500 had a 8% drawdown.

Also, the housing slowdown is accelerating…

“For the past several years, shortages of labor and lots along with rising regulatory costs have led to a slow recovery in single-family construction,” said NAHB Chief Economist Robert Dietz. “While home price growth accommodated increasing construction costs during this period, rising mortgage interest rates in recent months coupled with the cumulative run-up in pricing has caused housing demand to stall.”

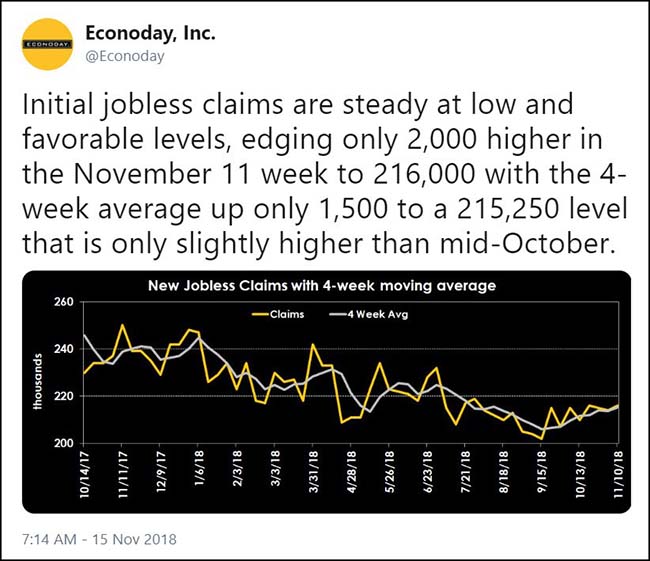

The weekly initial jobless claims have likely bottomed for this cycle…

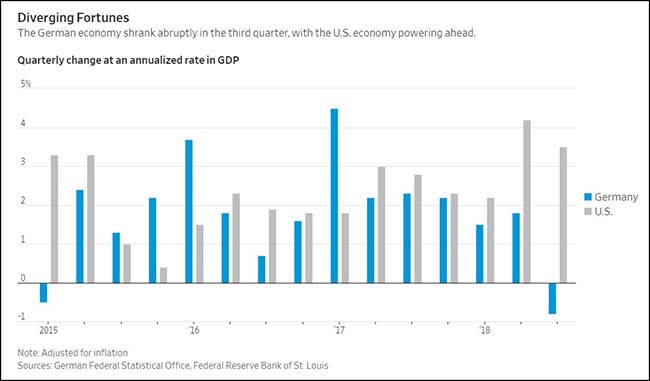

Overseas, the German and Japanese economies just contracted…

TThe global economy has hit a soft patch, putting the U.S.’s robust growth at risk should the slowdown persist.

Economic output in Japan and Germany contracted in the third quarter, while in October consumer spending in China hit its slowest pace in five months and bank lending fell, according to data released Wednesday about the world’s biggest economies after the U.S.

“You’ve seen a bit of a slowdown—not a terrible slowdown,” Federal Reserve Chairman Jerome Powell said Wednesday evening. “It is concerning.”

(WSJ)

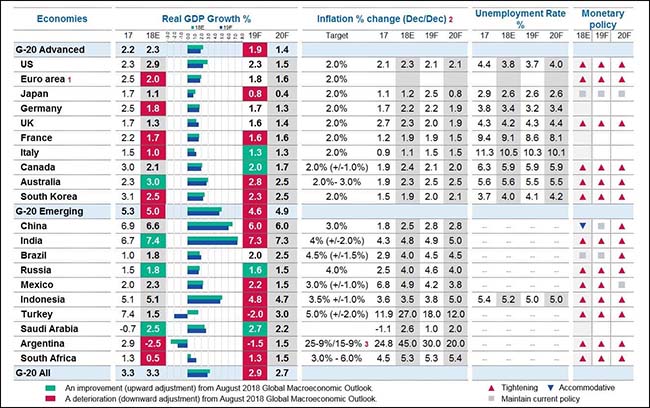

A good look at the global economic picture shows plenty of slowing…

@TayTayLLP: Moody’s global macroeconomic outlook for G-20 countries, 2019-20 (November 2018 update)

The big question is “Will China blink?”

Pence told me in an interview that Trump is leaving the door open for a deal with Xi in Argentina, but only if Beijing is willing to make massive changes that the United States is demanding in its economic, military and political activities. The vice president said this is China’s best (if not last) chance to avoid a cold-war scenario with the United States…

If Beijing doesn’t come up with significant and concrete concessions, the United States is prepared to escalate economic, diplomatic and political pressure on China, Pence said. He believes the U.S. economy is strong enough to weather such an escalation while the Chinese economy is less durable.

“We really believe we are in a strong position either way. We are at $250 billion [in tariffs] now; we can more than double that,” Pence said. “I don’t think it’s a matter of promises. We’re looking for results. We’re looking for a change of posture.”

Speaking of China trade…

Honda Motor will increase output of its Acura luxury vehicles in China by switching to local production of a new version of an SUV model, rather than importing it from the United States.

Sales of the new China-made Acura RDX will start by the end of this year.

Vehicle imports from the U.S. are subject to 40% tariffs amid escalating trade friction between Washington and Beijing…

By shifting production, Honda aims to improve cost competitiveness and capture more local demand.

China in July lowered tariffs on imported vehicles to 15% from 25%, except for U.S.-manufactured cars, for which levies were raised to 40%.

The vehicles themselves will be free from the higher tariffs, although some components will still be imported from the U.S. and thus be subject to the levies.

Honda expects the new model to be about 20% cheaper than the previous version, which is priced at 399,800 yuan ($57,400).

Fed’s Hawker is not a voting member this year but he isn’t certain about another 2018 rate hike…

Federal Reserve Bank of Philadelphia President Patrick Harker said Friday he isn’t ready to support the central bank raising short-term interest rates again next month, given the modest outlook for inflation.

“At this point, I’m not convinced a December rate move is the right move,” Mr. Harker said in an interview with The Wall Street Journal. “But I need to watch the data over the next few weeks” before determining whether it is prudent to boost the cost of borrowing again, he said.

The current state of inflation argues against action, Mr. Harker said. “We’re not seeing the recent data telling us that inflation’s moving rapidly past our target. So I think we have some time to let this evolve,” he said.

“In the beginning of the year, I had put in my forecast three 25-basis-point rate increases, and I haven’t moved from this too much,” Mr. Harker said. “Over the next year and a half, we can move slowly up to what I see as the nominal neutral rate, which I see as 3%.”

(WSJ)

Tim Duy says a Dec hike is coming…

Despite slowing growth, the Fed remains on track for a December rate hike. The reasoning is simple – even a substantial slowdown in growth from the pace of recent quarters leaves the US economy operating at a pace that exceeds the Fed’s estimates of potential growth. This means that inflationary pressures will continue to grow even if the pace of growth slows. It is not an environment in which the Fed is likely to call off rate hikes. Of course, if growth looks likely to slow more than anticipated, the Fed will react and adjust their expected policy path accordingly. Without more evidence that inflationary pressures are translating into higher actual inflation, the Fed will neither accelerate the pace of rate hikes nor hesitate to pause if the data turns sharply lower than expected.

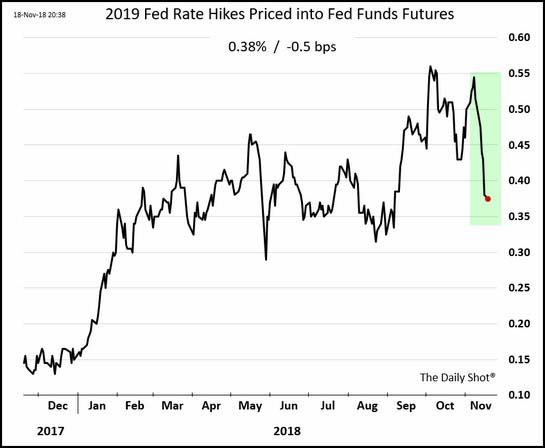

The market is beginning to cut its expectations for 2019 rate hikes…

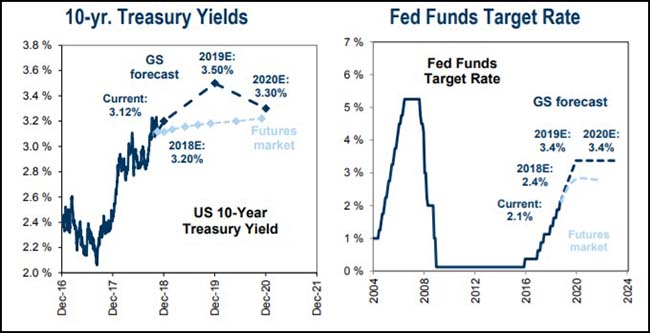

Goldman sticking by its five more Fed hikes call…

Our economics research colleagues forecast US real GDP growth will decelerate from 2.9% this year to 2.5% in 2019, 1.6% in 2020, and 1.5% in 2021. Inflation, as measured by core PCE, will rise from 1.9% this year to 2.2% in each of the next two years, a level slightly above the central bank’s 2% objective. The unemployment rate will fall to 3.2% in 2019 and 3.1% in 2020. The Fed is expected to tighten five times between now and the end of next year, lifting the funds rate to 3.25%-3.5%. Ten-year US Treasury yields are forecast to peak at 3.5% during 2H 2019 and decline to 3.3% in 2020. The 2s-10s portion of the yield curve will invert in 2H next year. In 2019, we forecast the USD will weaken by 6% vs. the Euro and 5% vs. Yen.

(Goldman Sachs)

The tightening financial picture causing UBS models to avoid risk…

A $30 billion computer entrusted by some of the world’s richest looks poised to underweight stocks as real money and systematic investors pare risk amid flagging bull-market momentum.

The quantitative-investing platform run by UBS Group AG’s wealth-management arm is close to trimming its equity holdings to 20 percent from a neutral 50 percent, according to Andreas Koester, head of global asset allocation at UBS Wealth, which oversees $2.4 trillion in total.

After slicing and dicing a slew of signals from GDP, PMIs, corporate earnings and retail sales, the so-called Systematic Allocation Portfolio is mulling the relative safety of cash and high-quality bonds over growth-sensitive assets.

“At the moment, the momentum signal is strongly negative,” said Koester in an interview. “While the economy is doing fine, the market is worried about something else, and you can argue that it might be protectionism, oil prices, fear of a recession in 2020.”…

The quant strategy from the Swiss institution looks at economic as well as equity and credit indicators to help determine whether to overweight or underweight shares in the MSCI World Index. By design, the bot launched in 2015 isn’t as sensitive as those run by quant investors like CTAs, which respond to hair-trigger moves with breakneck speed.

“This is more like timing the big cycles right,” said Koester, who wouldn’t comment on the strategy’s performance or fees. “It’s not for being in and out every second week.”

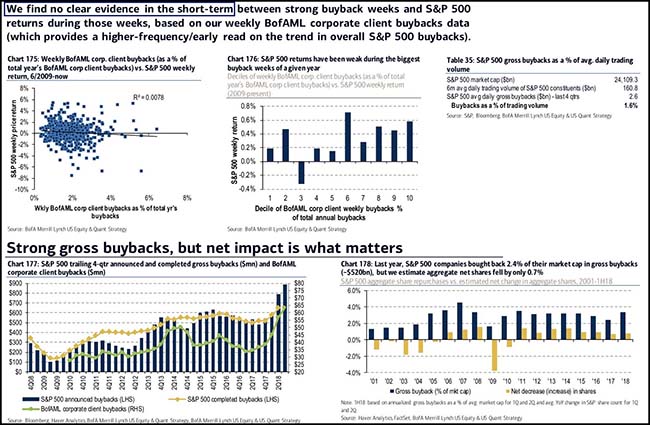

Stock buybacks do not help the stock market in the short-term…

No doubt BofA Merrill Lynch’s unpopular opinion will send the data geeks to their digging. But their 10 years of data do not show a positive correlation. Let the fights begin!

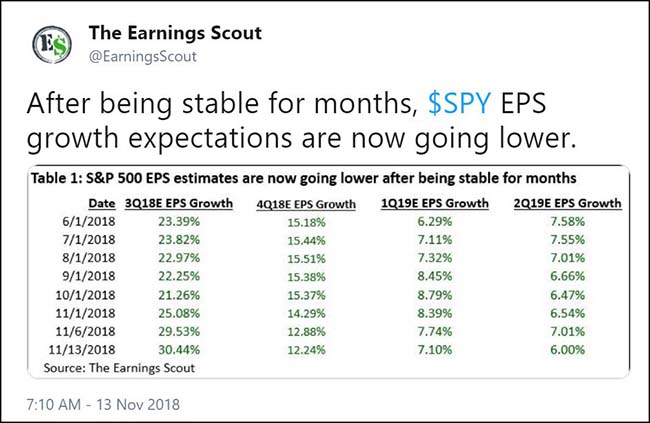

Stocks follow earnings…

And starting in the third quarter, future earnings estimates have continued to move lower…

More earnings misses are coming…

Everyone knows S&P 500 profits are gangbusters now. Third-quarter earnings rose 26 percent in the S&P 500 and the full year’s results will almost match that. But for all the cheer about the present, companies are notably dour on the future. Guidance is deteriorating.

Over the past three months, firms saying sales will miss analyst estimates outnumbered those saying they will exceed them by the most since 2009, data compiled by Evercore ISI showed. The trend also worsened for the bottom line.

When guidance weakens, it dims many of the cases for owning equities, particularly valuation, which bulls usually frame against next year’s estimates. While the S&P 500 looks cheap at 16 times forecast profits, it would prove less so should those forecasts turn out wrong.

From a strengthening dollar to rising costs of wages and raw materials, and higher interest rates to trade tensions, the list of headwinds is building for corporate America.

“As long as the dollar is headed higher and rest-of-world growth remains weak, the outlook for revenue and earnings growth is likely to remain under pressure,” Dennis Debusschere, head of portfolio strategy at Evercore, wrote in a note to clients. Last month, he lowered his 2019 estimate for S&P 500 earnings and said if historical valuations prevail, the S&P 500 may not bottom till 2,550.

With the U.S. equity markets looking increasingly worrisome, all investors might learn something from the farmers in Peru…

In the mid-1980s Carol Goland spent two years in the Andes. The subsistence farmers she studied in Cuyo Cuyo, in Peru, planted as many as 20 fields scattered around the mountain. They used up precious calories going back and forth between each field. Yet on closer inspection, this pattern had a logic to it. Crop yields varied widely from field to field, because of erratic microclimates. By spreading their bets the farmers reduced their risk of starvation.

The farmers knew the penalty for failing to diversify. That lesson ought to be heeded in investing, too. But it isn’t. Three-quarters of equity funds in America are held in shares listed there, according to Morningstar, a data-tracking firm. American stocks have beaten a broad index of other rich-world stocks in seven of the past ten years. Even so, it is a lot of eggs to have in one basket. Those who seek to diversify by buying a global index find they are still heavily exposed to America. American-listed stocks account for 55% of the value of the msci All-Country World Index, a widely used benchmark.

When the harvest in one place has been consistently good, people are reluctant to look elsewhere. But wiser investors follow the practice of Peru’s mountain farmers and spread their bets far and wide. America’s stockmarket cannot outperform forever. When the investment climate changes, a heavy tilt towards a single country can be costly.

In principle, investors would be best off holding a broad range of equities from many countries. In practice, they have a tendency to favour their domestic market. This “home bias” is a puzzle. Domestic equities are a poor hedge against one of the biggest hazards to wealth—the loss of a job due to a faltering economy. Of course, many firms listed in America have substantial foreign earnings. But the risk-diversification they offer is still limited. Home bias, it seems, is mostly a quirk of behaviour. Investors think of foreign stocks as more risky than they really are.

A 7.45% return assumption for the long term is still wildly ambitious…

Despite already feeling the financial strain from their obligations to public pensions, state and local governments can expect to face increased commitments to their retirement systems as investment return assumptions have fallen to an all-time low this year.

According to the National Association of State Retirement Administrators (NASRA), nearly 75% of the 128 public plans it has tracked have reduced their investment return assumptions since fiscal year 2010, which has resulted in an all-time low median investment return assumption of 7.45% as of November, from 8% eight years earlier…

Of the 128 public pension plans tracked by NASRA, only six still have investment return assumptions at the 2010 median of 8.0%, which is the highest assumed rate of return among the plans, and only 22 have assumed rates of returns of 7.5% or higher. A majority of the plans (69) have assumed rates of return that range between 7.0% and 7.5%, and 37 plans have assumed rates that are 7.0% or lower.

(AICIO)

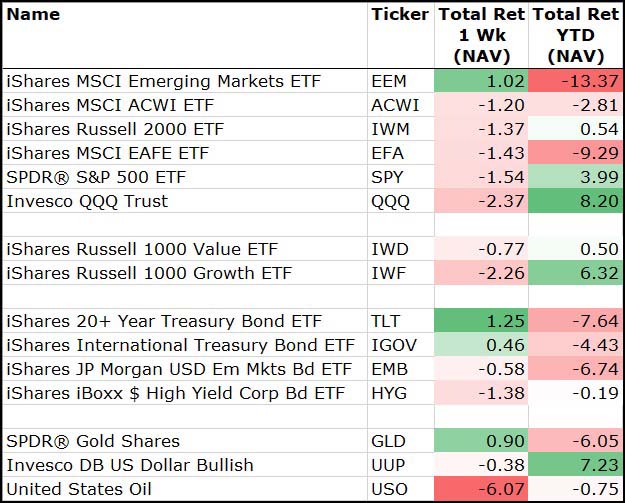

For the week, Treasuries, Gold and EM stocks were the place to be…

Oil, Nasdaq, Growth Stocks and Junk Bonds were to be avoided.

Morgan Stanley calling the top in the U.S. Dollar…

“We believe the USD has reached its peak at around current levels,” Morgan Stanley’s global head of FX strategy Hans Redeker wrote in a note. “The USD may weaken as credit spreads widen, equity prices fall, and sovereign bond yields also begin falling amid disinflationary pressure and falling oil prices.”

Escalating trade tensions, climbing Treasury yields and a robust U.S. economy have fuelled investor demand for the world’s biggest reserve currency. The Bloomberg Dollar Spot Index has gained 8 percent since mid-April, cheered on by bullish hedge funds who recently raised their net long positions on the currency to the highest since January 2017.

However, Morgan Stanley reckons recent foreign flows into U.S. assets have been short-term and are prone to a quick reversal — another sign dollar weakness may come.

“Instead of strong inward foreign direct investment or other long-term flows, we see evidence that flows to the U.S. have been into money market funds and are carry trade motivated,” Redeker said…

Adding fuel to the bearish fire will be a slowing American economy, falling oil prices, a stabilizing Chinese currency and tighter liquidity in U.S. markets, Redeker said.

This means emerging-market assets that have been battered by rising Treasury yields and dollar strength now look set to shine, according to Redeker. Lower oil prices and stable building material prices including those of iron ore and copper may augur an emerging market rally, he said.

“We expect slowing U.S. growth to benefit countries that are either reliant on USD-denominated funding or vulnerable to higher global funding costs,” Redeker said.

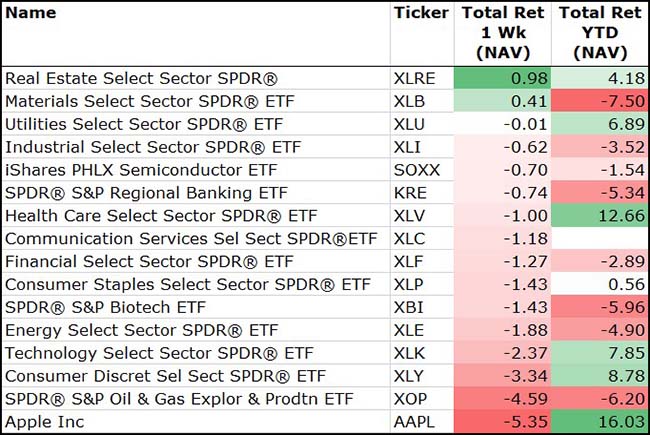

A very defensive week among the sectors with REITs leading…

Energy, Consumer Discretionary and Tech were a wreck.

Oil service breaking through 2016 lows…

Expectations of significant Saudi Arabia production cutbacks as retaliation for Iran sanction waivers?

GE’s balance credit and balance sheet worries tend to weigh on the market…

@NorthmanTrader: Better hope it’s different this time $GE $SPX

Can the market move higher when the largest stock in the market faces top-line headwinds?

Lower-than-expected demand for Apple Inc.’s AAPL -3.79% new iPhones and the company’s decision to offer more models have created turmoil along its supply chain and made it harder to predict the number of components and handsets it needs, people familiar with the situation say.

In recent weeks, Apple slashed production orders for all three of the iPhone models that it unveiled in September, these people said, frustrating executives at Apple suppliers as well as workers who assemble the handsets and their components.

Forecasts have been especially problematic in the case of the iPhone XR. Around late October, Apple slashed its production plan by up to a third of the approximately 70 million units it had asked some suppliers to produce between September and February, people familiar with the matter said.

And in the past week, Apple told several suppliers that it cut its production plan again for the iPhone XR, some of the people said Monday, as Apple battles a maturing smartphone market and stiff competition from Chinese producers.

(WSJ)

Also semi cap equipment leader Applied Materials said the chip industry is pulling back…

Applied Materials Inc., the biggest maker of equipment used to manufacture semiconductors, gave weak forecasts that indicate the chip industry is holding off on expansion plans in the face of a murky outlook for electronics demand. The stock fell in extended trading.

The company is a bellwether for the industry because chip makers must buy gear from Applied Materials well ahead of new manufacturing plans. When the industry is cutting back, Applied Materials is often one of the first to feel those chills, too.

The increasing difficulty of manufacturing chips and the addition of electronic functions in everything from cars to fridges fueled a four-year boom. But there are now signs this could be followed by another cyclical downturn.

Speaking of FANG…

If you haven’t read this New York Times piece on Facebook, you should. Mandatory reading for all shareholders and customers of Facebook, Instagram or What’sApp (which thus could include most of planet earth).

But as evidence accumulated that Facebook’s power could also be exploited to disrupt elections, broadcast viral propaganda and inspire deadly campaigns of hate around the globe, Mr. Zuckerberg and Ms. Sandberg stumbled. Bent on growth, the pair ignored warning signs and then sought to conceal them from public view. At critical moments over the last three years, they were distracted by personal projects, and passed off security and policy decisions to subordinates, according to current and former executives.

When Facebook users learned last spring that the company had compromised their privacy in its rush to expand, allowing access to the personal information of tens of millions of people to a political data firm linked to President Trump, Facebook sought to deflect blame and mask the extent of the problem.

And when that failed — as the company’s stock price plummeted and it faced a consumer backlash — Facebook went on the attack.

While Mr. Zuckerberg has conducted a public apology tour in the last year, Ms. Sandberg has overseen an aggressive lobbying campaign to combat Facebook’s critics, shift public anger toward rival companies and ward off damaging regulation. Facebook employed a Republican opposition-research firm to discredit activist protesters, in part by linking them to the liberal financier George Soros. It also tapped its business relationships, lobbying a Jewish civil rights group to cast some criticism of the company as anti-Semitic.

In Washington, allies of Facebook, including Senator Chuck Schumer, the Democratic Senate leader, intervened on its behalf. And Ms. Sandberg wooed or cajoled hostile lawmakers, while trying to dispel Facebook’s reputation as a bastion of Bay Area liberalism.

(NY Times)

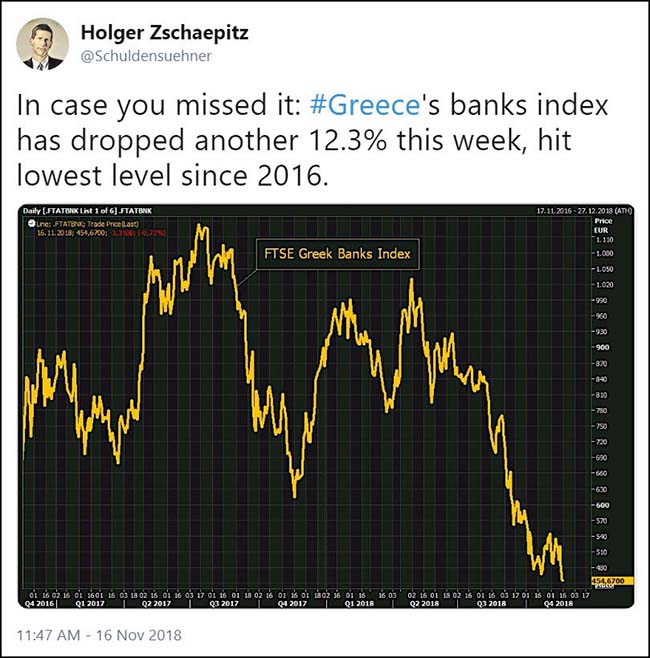

With everything else imploding, you have likely missed the mess in Greek banks…

Don’t forget that a few years ago, this small country caused a significant global volatility spike.

If you are wondering why you are eating turkey with a plastic knife this year…

Pray for $100 a barrel, not $50…

Who is going to explain to the White House that higher oil prices are now better for America? Maybe one of the 13,000+ Department of Energy employees could be tasked with walking 1.3 miles across the park to share the information.

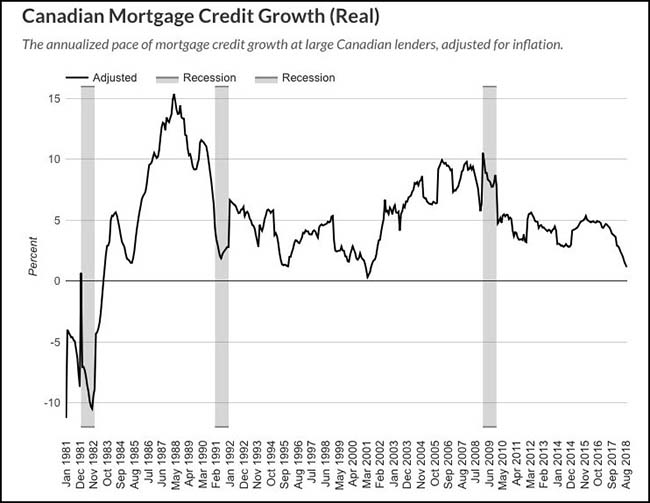

There is a mortgage credit crunch hitting north of our border…

@SteveSaretsky: As national home sales sink to a 6 year low and real mortgage credit growth drops to an 18 year low.

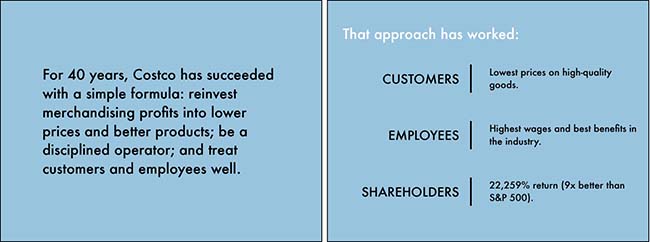

Agree, very good slide deck on Costco…

@rrhoover: Excellent analysis on Costco’s business:

Founders, even if you’re not interested in Costco, this deck might inspire more strategic thinking.

Amazon has concluded its newest Hunger Games contest…

Few citizens of its newest cities or states are excited. But shareholders of Amazon have got to be fired up.

We rarely agree with socialist Congresswoman-elect Alexandria Ocasio-Cortez, but she’s right to call billions of dollars in taxpayer subsidies for Amazon “extremely concerning.” These handouts to one of the richest companies in the history of the world, with an essentially zero cost of capital, is crony capitalism at its worst.

Amazon staged a year-long competition to find a second headquarters beyond its Seattle home, and politicians bid for it like millionaires at a Picasso auction. Except they were bidding with other people’s money. The two ostensible big winners, announced Tuesday, are Long Island City in the Queens borough of New York City, and Crystal City in Virginia, across the Potomac River from Washington, D.C.

They stand to split about $5 billion in Amazon investment, with the promise of 25,000 new jobs each at an average salary of $150,000 a year. Amazon plans to occupy about four million square feet of office space in each location, with the potential to double that if necessary. The kicker is that Amazon has extracted state and local subsidies of more than $2 billion for the privilege.

(WSJ)

Who thought that brick and mortar retailing could be so much fun…

I didn’t think that I would like going to the Amazon 4-star store as much as I did.

We created Amazon 4-star to be a place where customers can discover products they will love. Amazon 4-star’s selection is a direct reflection of our customers—what they’re buying and what they’re loving.

We started with some of the most popular categories on Amazon.com including devices, consumer electronics, kitchen, home, toys, books, and games, and chose only the products that customers have rated 4 stars and above, or are top sellers, or are new and trending.

Today, the average rating of all the products in Amazon 4-star is 4.4 stars, and collectively, the products in store have earned more than 1.8 million 5-star customer reviews.

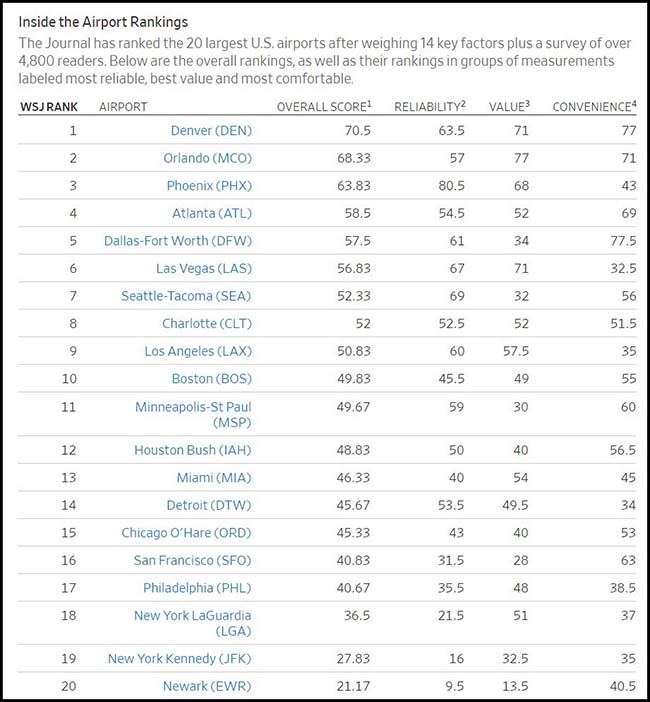

Quality of airport must not have been a highly ranked item in Amazon’s HQ2 search…

Denver International Airport opened in 1995 as perhaps the most hated airport in America. It was isolated on the prairie, miles from the middle of town. It was more than $2 billion over budget. Per-passenger costs ran so high Southwest Airlines refused to land there. And its high-tech baggage system didn’t work, a lemon that became a national joke.

But recent years have brought remarkable change, and Denver International has grown into one of the most convenient and competitive airports in the world, winning the top spot in the first-ever Wall Street Journal U.S. Airport Rankings.

Denver management worked to reduce costs to lure more airline service, which itself would lower fares and bring in more passengers, enabling the airport to grow. When it opened, airlines had to pay the airport $16 a passenger. This year, the charge will be below $11 a passenger, airport CEO Kim Day says.

(WSJ)

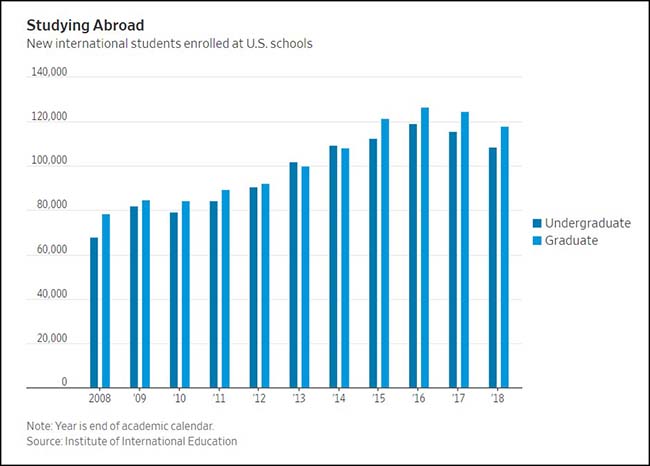

The foreign student withdrawal from U.S. campuses continues…

Expect many more phone calls from your college’s Alumni Relations office asking for money. Johns Hopkins excluded.

Foreign students are big business: They pumped $42 billion into U.S. college and university coffers in the 2017-18 school year alone.

Students from abroad are still flocking to the coasts, but are less interested in the South and Midwest.

The shift is due to a combination of politics, fear, geography and branding, said Alejandra Sosa Pieroni, an international recruitment expert with Ruffalo Noel Levitz, a company that consults with colleges to improve enrollment.

“Students are not feeling welcome in some states, so they are looking beyond those states and heading to places where they will feel welcome,” she said.

The slowdown comes as U.S. schools struggle with demographic and revenue challenges due to the falling number of Americans graduating from high school. As a result, U.S. colleges and universities have become increasingly dependent on revenue generated from international students. Public schools often charge international students more than what domestic students pay.

(WSJ)

I am a big fan of using gravity to store energy…

Here is a cool idea to use weighted blocks to store generated power from Energy Vault.

(YouTube)

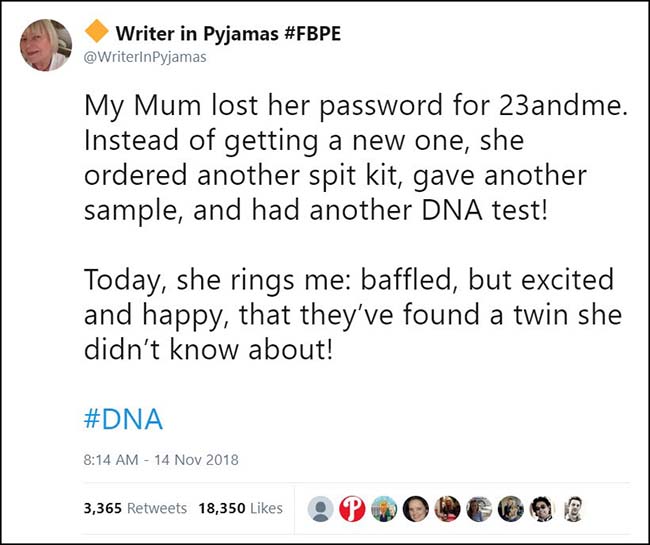

Tweet of the week. And validation that 23andMe works correctly…

Copyright © Blaine Rollins