by Fixed Income Research Team, AllianceBernstein

When it comes to high-yield bank loans, we don’t mince words: we think the risk rarely justifies the potential reward.

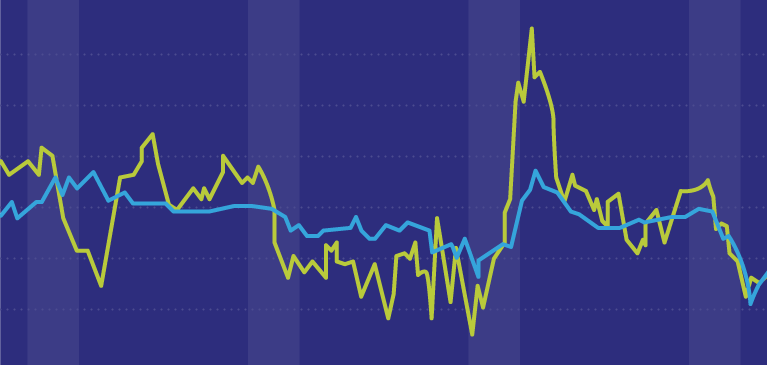

Do bank loans sometimes outperform high-yield bonds? Sure. But the conditions have to be just right: the Federal Reserve raising rates, high-yield bond spreads tight and the economy still growing. Those are the conditions that prevail in the US today. But they typically don’t last long. And as we’ve seen, bank loans have often underperformed high-yield bonds—and even US Treasuries—in the years after the credit cycle turns.

What’s more, these brief periods when bank loans pull ahead during Fed tightening cycles have been getting ever shorter. During the Fed’s 13-month tightening cycle in the mid-1990s, bank loans beat high yield 77% of the time. But high yield was on top roughly 60% of the time during the Fed’s 2004–2006 cycle and the current one.

One little known reason for this is the Securities and Exchange Commission’s 2000 decision requiring bank loan mutual funds to use available price data, such as dealer bid/ask spreads, to mark these assets to market. Previously, managers determined value themselves by estimating how likely the borrower was to repay lenders.

The change has made it easier for investors to discover an accurate price for loans, making the market more transparent. It has also meant a more volatile bank loan market and increased downside risk. This matters, because the quality of today’s bank loans and the covenant protection they offer lenders have declined sharply. That suggests to us that default risk may be higher and recovery rates may be a lot lower when this cycle turns than they’ve been in past cycles.

The way we see it, investors should consider ditching bank loans and reducing other types of credit exposure in favor of higher-quality, interest rate–sensitive assets that stand to bolster their portfolio against future volatility. For those with high income needs, we think a global, multi-sector high-income approach that includes high-yield bonds is a better option than bank loans.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein