by Urban Carmel, The Fat Pitch

Summary: Although US equities are up about 2% in 2018, Europe is down 10% and emerging markets are down more than 15%. Part of the reason: fund managers came into 2018 very bullish, with cash levels at 4-year lows and allocations to global equities at 3-year highs.

How have fund managers responded to an increasingly tough environment for equities?

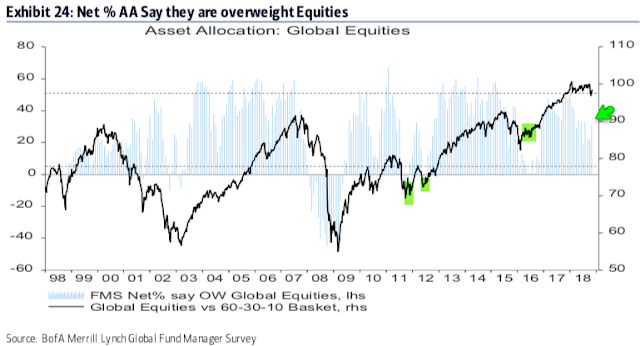

In one respect, they are still bullish: global equity allocations are still 31% overweight. Into the major lows in 2011, 2012 and 2016, fund managers were underweight. Allocations could easily fall much further before global equities reach a bottom.

But in most other respects, fund managers are already very bearish:

They are overweight cash (by nearly one standard deviation), which is typically a tailwind for equities.

They view the US dollar as the most overvalued in 12 years, which has a very good track record of marking a turn to dollar weakness, a tailwind for US multi-nationals as well as ex-US equities.

Their profit expectations are the most bearish in 6 years, and at a level which also marked equity lows in 2010, 2011, 2012 and 2016.

Their global macro growth expectations are the most pessimistic in 10 years, more than at the major equity bottoms in 2011 and 2016.

A third believe the world's largest equity benchmark, the S&P 500, has already peaked. This number holding this view has doubled in just one month.

They believe 'value' will outperform 'growth' stocks; similar peaks (in 2009, 2014, 2016 and 2017) marked excellent times to be long equities, especially growth stocks.

The US is the most favored region in the world. That's not surprising: during a global equity sell off, the US is usually regarded as the safest haven. It should underperform. Europe is the most hated region and is likely to outperform.

* * *

Among the various ways of measuring investor sentiment, the Bank of America Merrill Lynch (BAML) survey of global fund managers is one of the best as the results reflect how managers are allocated in various asset classes. These managers oversee a combined $600b in assets.

Our sincere gratitude to BAML for the use of this data.

The data should be viewed mostly from a contrarian perspective; that is, when equities fall in price, allocations to cash go higher and allocations to equities go lower as investors become bearish, setting up a buy signal. When prices rise, the opposite occurs, setting up a sell signal. We did a recap of this pattern in December 2014 (post).

Let's review the highlights from the past month.

Overall: Relative to history, fund managers are overweight cash and neutral equities. Enlarge any image by clicking on it.

Within equities, the US is overweight while Europe, in particular, is underweight. This is a significant change from the past year.

A pure contrarian would overweight European equities relative to the US and underweight cash.

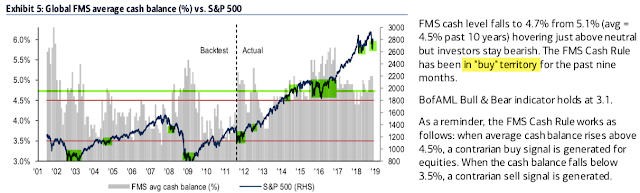

Cash: Investors' cash balance is high at 4.7% (BAML considers cash levels above 4.5% to be a contrarian buy for equities, and below 3.5% to be a contrarian sell). This is supportive of further gains in global equities. A recap:

Fund managers' cash levels rose to 5.8% in October 2016, the highest cash level since November 2001. This set up a contrarian long in equities.

Cash remained near 5% until November 2017, when it fell to 4.4%, the lowest level since October 2013.

With the equity sell off earlier this year, cash rose to 5% in April and remains high in November; this is a tailwind for global equities.

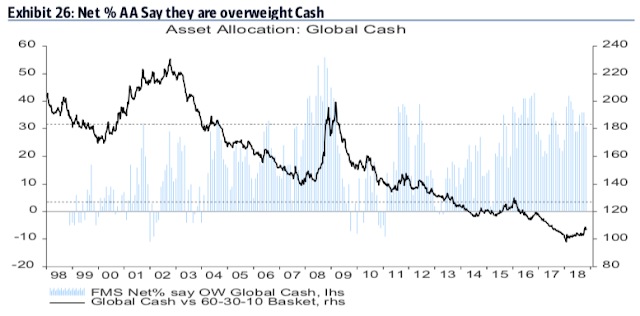

Likewise, fund managers are a net +31% overweight cash (+0.8 standard deviations above its long term mean). In the context of a bull market, cash should underperform a 60-30-10 basket.

Global equities: After reaching a bullish extreme in January 2018, global equity allocations have fallen to neutral. Equity allocations can fall much further into a major stock market low. A recap:

Fund managers were just +5% overweight equities at their low in February 2016; since 2009, allocations had only been lower in mid-2011 and mid-2012 (notable bottoms for equities).

By January 2018, equity allocations had increased to +55% overweight, the highest level in nearly 3 years. Outside of 2013-14, over +50% overweight has historically been bearish. Our view was that "this is a headwind to further gains."

With the ongoing correction, equity allocations have fallen to 31% overweight in November (+0.1 standard deviations above its long term mean). This is neutral; at major lows in 2011, 2012 and 2016, fund managers were underweight equities.

On a net basis, fund managers expect profits to deteriorate in the next 12 months, their most bearish view in 6 years. Negative profit expectations also marked equity lows in mid-2010, late-2011, mid-2012 and early 2016 (arrows).

Similarly, macro expectations have fallen hard in recent months: a net -44% expect a better economy in the next year - the lowest since equities crashed 10 years ago in November 2008 - down from a net +47% in January 2018. This is more pessimistic than the major equity bottoms in 2011 and 2016. Investors are bearish on the global economy.

Among the highest percent of fund managers expect 'value' stocks to outperform 'growth' stocks in the next year. Similar peaks occurred in early 2009, 2014, early 2016 and early 2017, all excellent times to be long equities, especially growth (second chart).

A third of fund managers believe the globe's largest equity benchmark, the S&P 500, has already peaked, double the number from last month.

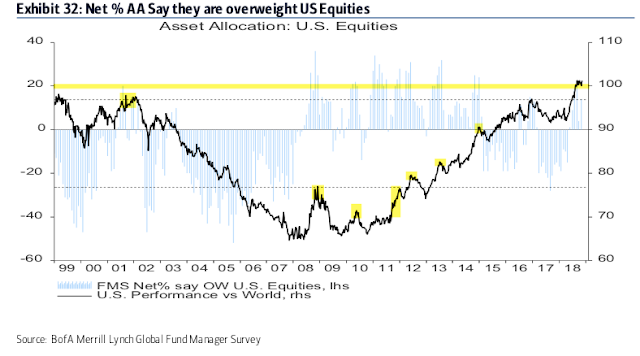

US equities: US equities are now the most favored region in the world; it should underperform. A recap:

Fund managers were underweight US equities for a year and a half starting in early 2015, during which US equities outperformed.

From December 2016, to February 2017, investors overweighted US stocks. US equities underperformed their global peers.

In September 2017, investors again became bearish US equities, giving them the lowest allocation in 10 years. US equities have since outperformed.

Fund managers are now overweight US equities: allocations in November were +14% overweight. It's nearly an extreme (+0.9 standard deviations above its long term mean). Above +20% overweight and sentiment typically becomes a strong headwind (yellow shading). The US should underperform.

Note that the relationship between performance and weighting worked less well in the prior expansion cycle (2003-07) as emerging markets outperformed developed markets by about 5 times.

European equities: European equities are now the least favored region in the world; it should outperform. A recap:

Fund managers had been excessively overweight European equities in 2015-16, during which time European equities underperformed.

That changed in July 2016, with the region becoming underweighted for the first time in 3 years. The region then began to outperform.

Allocations to Europe have been excessively overweight the past year, during which time the region has underperformed.

Allocations fell to just +1% overweight in November, a 2 year low and below neutral (-0.6 standard deviations below its long term mean). This is when the region started to outperform in 2013 and 2016 (yellow shading).

Emerging markets equities: Fund managers are now neutral on emerging market equities. A recap:

In January 2016, allocations to emerging markets fell to their second lowest in the survey's history (-33% underweight).

As the region outperformed, allocations rose to +31% overweight in October 2016, the highest in 3-1/2 years. That made the region a contrarian short: emerging equities then dropped 10% in the next two months.

Allocations fell to -6% underweight in January 2017, making the region a contrarian long again: the region then outperformed.

In April, allocations rose to +43% overweight, near a 7 year high. Since then, the region has underperformed the US by 2200bp.

In November, allocations were -13% overweight (-0.3 standard deviations below its long term mean). The region is now neutral.

Global bonds: Bond sentiment has deteriorated in recent months; fund managers are very underweight. A recap:

In July 2016, global bond allocations rose to -35% underweight, nearly a 3-1/2 year high. Bonds subsequently underperformed a 60-30-10 basket.

In January 2018, allocations to bonds dropped to -67% underweight (-1.2 standard deviations below its long term mean), a 4 year low. This was a capitulation low, and US 10 year treasuries have since outperformed US equities (NYSE) by about 700bp.

In November, allocations fell to -58% underweight, among the lowest in 10 years (-0.8 standard deviations below its long term mean). This is close to an extreme and represents a contrarian tailwind for bonds.

Moreover, 70% of fund managers expect higher inflation over the next 12 months; this is near the 14 year high set in April (82%). Higher inflation is a strongly consensus view (first chart). Prior to 2018, the consensus view has corresponded to a drop in US 10-year yields in the months ahead (second chart).

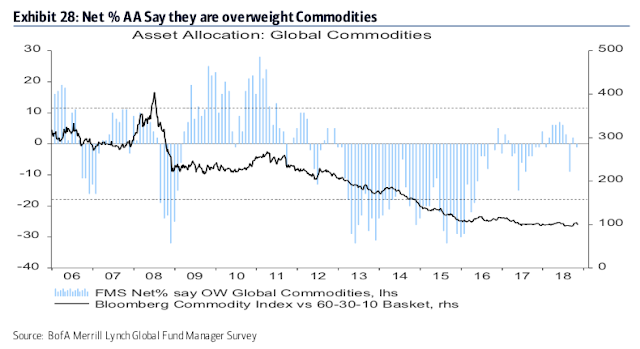

Higher inflation expectations often goes in hand with higher commodity allocations, but in November, fund managers' dropped exposure to a net -1% underweight (-0.1 standard deviations below its long term mean). This is neutral.

Dollar: The US Dollar is considered the most overvalued in 12 years, a possible tailwind for US multi-nationals and ex-US equities. A recap:

Since 2004, fund managers surveyed by BAML have been very good at determining when the dollar is overvalued (highlighted in yellow).

In March 2015, they viewed it as overvalued for the first time since 2009; the dollar index fell 7% in the next two months.

In late 2015, they viewed the dollar as overvalued and the index lost 8%.

In late 2016, they again viewed the dollar as overvalued and the index lost 7%.

The dollar is now considered the most overvalued since 2006. Risk is to the downside. A weaker dollar benefits US multi-nationals as well as European and emerging markets equities.

Survey parameters are below.

- Cash: The typical range is 3.5-5.0%. BAML has a 4.5% contrarian buy level but we consider over 5% to be a better signal. More on this indicator here.

- Equities: Over +50% overweight is bearish. A washout low (bullish) is under +15% overweight. More on this indicator here.

- Bonds: Global bonds started to underperform in mid-2010, 2011 and 2012 when they reached -20% underweight. -60% underweight is often a bearish extreme.

- Commodities: Higher commodity exposure goes in hand with improved sentiment towards global macro and/or inflation.