by Blaine Rollins, CFA, 361 Capital

The list of topics to rattle your portfolio continues to grow. Last week saw a gauntlet of bad news as most earnings reports were met with the selling of stocks. While a few names, like Intel, managed to surprise and finish higher, most earnings stocks finished significantly lower on any quality of report. Some, like Texas Instruments and MMM, scared the breath out of us because their sales breadth is so broad across multiple industries and geographies. It’s tough to want to own much of anything after listening to those earnings calls. The market is responding with the following sector drawdowns: banks and housing -23%, biotechs -17%, energy -16%, and consumer discretionary -13%. These aren’t small pullbacks. The market is concerned and is screaming.

Can the market be mended and sent back to its recent highs? It will be tough. The trade wars need to be reversed as they are a new major factor in all Q3 earnings releases. With the current White House looking to dig in on tariffs and the trade wars, it will take a change in the Government to reverse the cost increases to U.S. companies and consumers and to get American agricultural products moving again. We can’t do much to reduce the impact of rising global financial tightening conditions or higher rates. Rates are going up and central banks are shrinking their balance sheets. That horse has left the gate and you aren’t going to catch it until you don’t want to. Italy, Brexit and other geopolitical events can go any direction, but right now they are all headed the wrong way for global markets. And, the recent hate crimes and domestic terror can only remove multiples from the stock market, not add them.

So what do you do? If you are a patient, long-term investor, you settle in for a tough market. The drawdown will likely get worse as the slowdown eventually rolls into the credit markets and equities take another leg lower. If you are a more aggressive investor, you get defensive, hide in cash (which now has a decent interest rate), hedge your long positions with short positions, and look for opportunities in new trending areas, such as consumer staples and commodities, and in countries like Brazil. With very large passive asset managers seeing redemptions exceeding contributions for the first time in eons, I think you have to let the lower valuations in the U.S. play out for a while and see what happens next. This is no time to be a hero in the markets—save the superpowers for your Halloween costume.

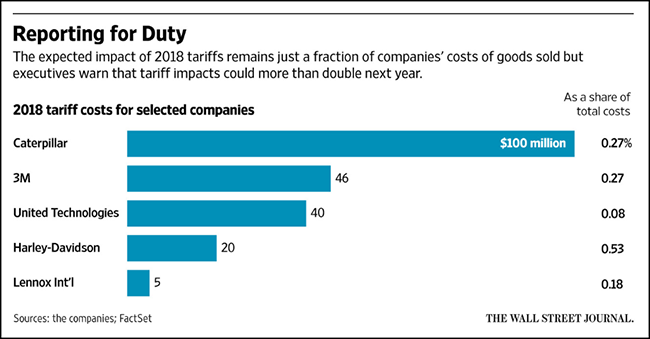

Caterpillar said tariffs the Trump administration implemented earlier this year on foreign steel and aluminum made parts for the machinery it manufactures in the U.S. more expensive. Caterpillar said tariff-related costs for this year would likely come in at the low end of the previous range of $100 million to $200 million it forecast. 3M expects the tariffs to push up costs by about $20 million this year and $100 million next year.

3M also said sales of its face masks and other products in China were dropping as economic growth there cools. Paint-and-coatings maker PPG Industries Inc. said last week that demand in China was falling due to lower spending on cars. China’s economic growth of 6.5% in the third quarter was its weakest pace since the financial crisis.

“We see other signs of slowing in China; the automotive build rates are down significantly and that has a knock-on effect,” 3M Chief Executive Michael Roman said. 3M reported slower sales growth across most of its business lines in the third quarter.

(WSJ)

You are correct to assume that private tech valuations are also in a steep valuation decline…

The Renaissance IPO Index, which may shed some light on the market’s appetite for speculative names, fell more than 4 percent last week, and is also off about 20 percent from its highs. SVB Financial, which offers banking services to tech startups, tanked 12 percent on Friday after earnings. It’s down 30 percent just since Oct. 3. Finally, WeWork’s bonds that mature in 2025 are now trading below 93 cents on the dollar, which is close to their worst level yet. With this information, you can try to guess yourself how shares of Uber, Airbnb, WeWork and others would have fared last week if they were liquid and traded publicly.(Bloomberg)

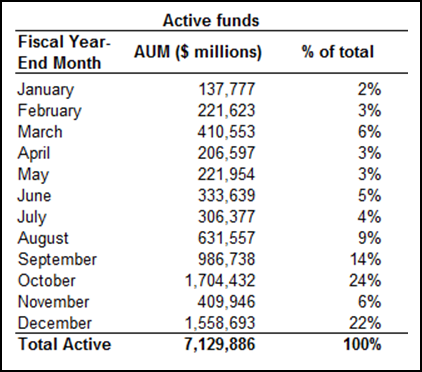

One quarter of mutual funds have October fiscal year-end dates…

This could explain some of the selling last week as few portfolio managers want to show underperforming dogs at the top of their portfolio holdings next week.

Former Fed Chair Janet Yellen warns…

The US needs to deal with a “huge deterioration” in the standards of corporate lending instead of focusing on deregulation, Janet Yellen has warned. In an interview with the Financial Times, the former chair of the Federal Reserve said she was particularly alarmed by loosening standards in the $1.3tn market for leveraged loans, which are offered to companies with weaker credit ratings. “I am worried about the systemic risks associated with these loans,” said the former central banker. “There has been a huge deterioration in standards; covenants have been loosened in leveraged lending.”…

“If we have a downturn in the economy, there are a lot of firms that will go bankrupt, I think, because of this debt. It would probably worsen a downturn.”

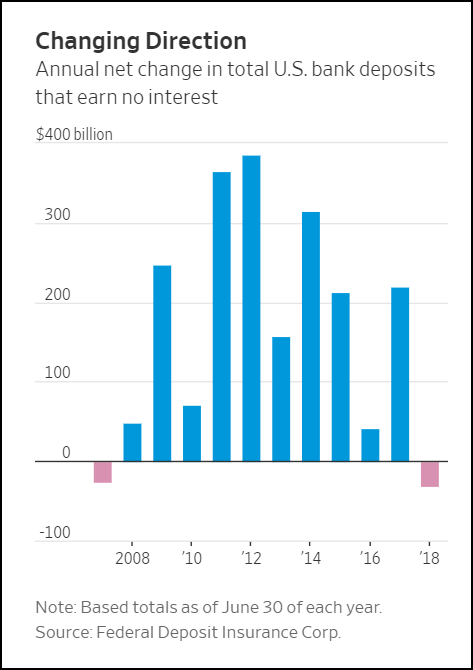

As we talked last week, bank earnings have been under pressure…

One new reason is that banks are now having to compete and pay more for their funding as customers are more educated and it is easier to move deposits.

After nearly three years of rate increases from the Federal Reserve, customers are pulling billions of dollars out of accounts that don’t earn interest and putting their money into higher-yielding alternatives. That will crimp banks’ ability to grow profits going forward.

The four largest U.S. banks— JPMorgan Chase JPM -2.28% & Co., Bank of America Corp. BAC -3.69% , Wells Fargo & Co. and Citigroup Inc. —reported a combined 5% drop in U.S. deposits that earn no interest in the third quarter compared with a year ago. Customers withdrew more than $30 billion from U.S. bank accounts that don’t earn interest over the year that ended June 30, the first such annual decline in more than a decade, according to Federal Deposit Insurance Corp. data…

When the Federal Reserve started raising rates in December 2015, bank profits quickly benefited. That was because lenders started charging more on certain loans like credit cards and lines of credit to businesses, but didn’t immediately pay depositors more.

Slowly, lenders started paying higher rates to some savvy corporate and wealth-management customers who might otherwise take their money elsewhere. Still, money in noninterest accounts continued to grow.

That is now reversing, even if slowly. Noninterest deposits of around $3.2 trillion were equal to 26.3% of domestic deposits at U.S. banks in the second quarter, according to FDIC data. Although way above precrisis levels, the ratio is down from 27.5% a year ago. That equates to about $30.6 billion less in noninterest accounts.

(WSJ)

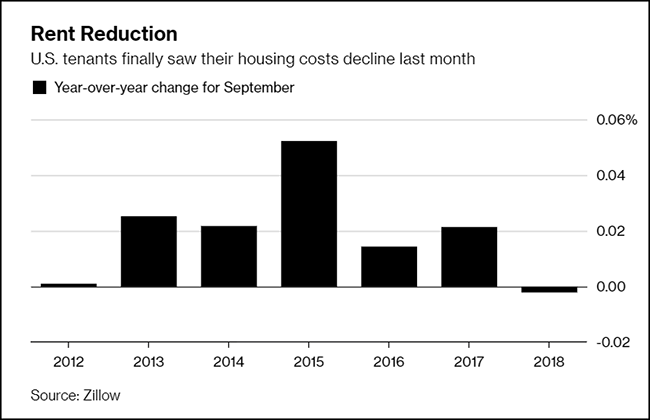

Renters get some leverage…

Renters finally have reason to rejoice: their housing costs dropped last month for the first time in six years.

The median rent for apartments, single-family homes and other residences across the U.S. was $1,440 in September, down 0.2 percent from a year earlier and the first year-over-year decline since July 2012, according to listings website Zillow. Rents have jumped 14 percent since September 2011, or about 2.3 percent a year…

Rents fell in more than half of the 35 largest U.S. markets in September, with the biggest declines in Portland, Oregon, where they dropped 2.7 percent, and Seattle, with a 2.2 percent decrease. Rents jumped the most in Riverside, California, a more-affordable option than Los Angeles for those willing to commute, with a 3 percent increase.

For those Reese’s lovers out there…

Be sure to stop by once your kids go to sleep and you have access to their candy stash.

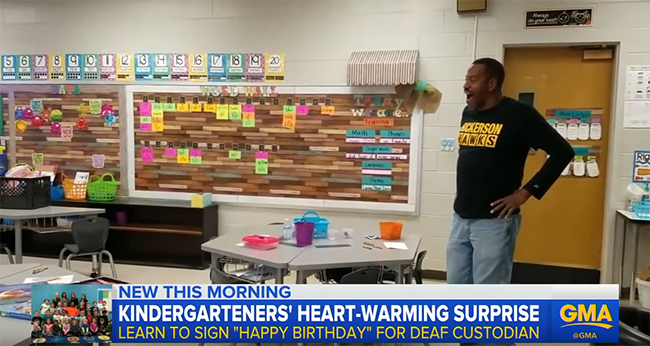

Finally, your feel good story of the week…

A deaf custodian at a Tennessee elementary school was left in shock as a kindergarten class surprised him with a special happy birthday song in sign language.

Copyright © 361 Capital