by Lance Roberts, Clarity Financial

There has been lot’s of analysis lately on what message the recent gyrations in the market are sending.

Is this just a correction in an ongoing, and seemingly never-ending, bull market?

Maybe. Anything is possible.

Or, is the financial market starting to pick up on what we have been warning about for the last several months which is simply higher rates, slowing global growth, and trade wars are going to impact the economy?

The consensus is that with the current spat of strong economic growth, unemployment and jobless claims at record lows, and confidence near record highs, there is simply no way the economy is even close to starting a recession. Furthermore, with economic growth slated to come in at 3.4% for the 3rd-quarter, this is further evidence a recession is “nowhere in sight.”

“Finally, it’s here. The bad news the financial media has been searching for, doggedly, for the last six months. As stocks plunge across the planet, fears of a recession are resurfacing.

We can say this with some confidence: The stock market panic is overblown. And a US recession is not imminent.” – Gwynn Guilford, Quartz

And what is the basis for Gwynn’s vote of confidence?

“American growth is indeed strong. Last quarter, the US economy expanded a whopping 4.2%, in real annualized terms. Unemployment is at 48-year lows. Inflation is in check. Consumer confidence is strong. Wages are rising (if only grudgingly). Investment could be better, for sure. But the fact of the matter is, overall, things are looking pretty good right now.”

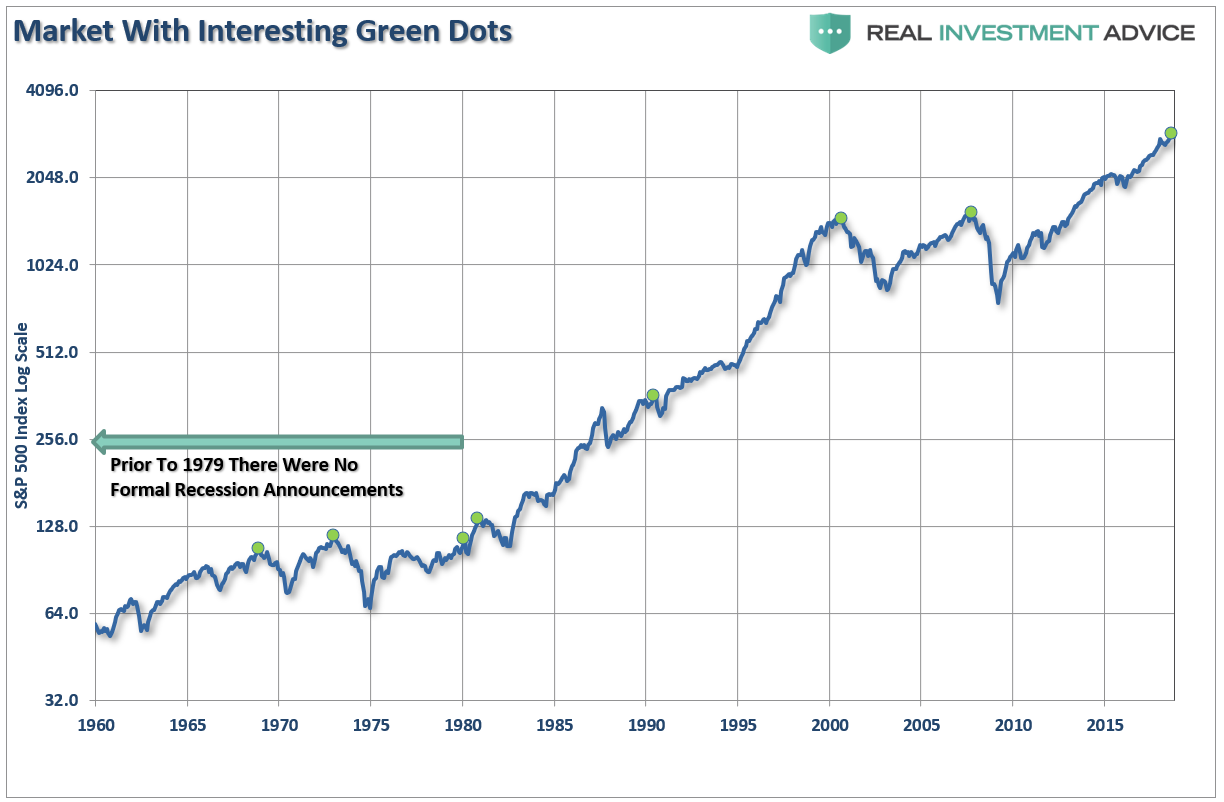

See, nothing to worry about? Obviously, the recent spasms of the market this year are really nothing more than just one of the normal market corrections which happen every now and then. The chart shows the S&P 500 going back to 1960 with some “interesting green dots.” (Cheap trick to get you to keep reading.)

Before we get to those “interesting green dots,” we need to make a point about Gwynn’s assessment of the current economic outlook.

While Gwynn is absolutely correct about the current state of economic growth, the view is also wrong.

The problem with making an assessment about the state of the economy today, based on current data points, is that these numbers are “best guesses” about the economy currently. However, economic data is subject to substantive negative revisions in the future as actual data is collected and adjusted over the next 12-months and 3-years. Consider for a minute that in January 2008 Chairman Bernanke stated:

“The Federal Reserve is not currently forecasting a recession.”

In hindsight, the NBER called an official recession that began in December of 2007.

But Gwynn goes on to state:

“And when the next recession does hit, chances are good that economic conditions will already feel quite different from the present moment.”

If Ben Bernanke did even know that we were in a recession will we?

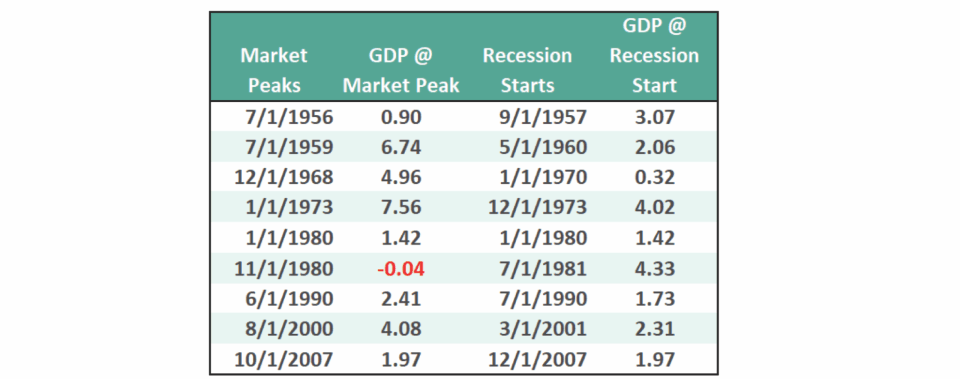

Well, that isn’t necessarily correct. For example, let’s take a look at the data below of real (inflation-adjusted) economic growth rates:

- September 1957: 3.07%

- May 1960: 2.06%

- January 1970: 0.32%

- December 1973: 4.02%

- January 1980: 1.42%

- July 1981: 4.33%

- July 1990: 1.73%

- March 2001: 2.31%

- December 2007: 1.97%

Each of the dates above shows the growth rate of the economy immediately prior to the onset of a recession. If Gwynn had been writing an article about the markets and the economy in 1957, it would have read much the same way.

“The recent decline from the peak in the market, is just that, a simple correction. With the economy growing at 3.07% on an inflation-adjusted basis, there is no recession in sight.”

You will note in the table above that in 6 of the last 9 recessions, real GDP growth was running at 2% or above.

At those points in history, there was NO indication of a recession “anywhere in sight.”

But the next month one began.

Let’s go back to those “interesting green dots” in the S&P 500 chart above.

Each of those dots are the peak of the market PRIOR to the onset of a recession. In 8 of 9 instances the S&P 500 peaked and turned lower prior to the recognition of a recession.

In other words, the decline from the peak was “just a correction” as economic growth was still strong.

In reality, however, the market was signaling a coming recession in the months ahead. The economic data just didn’t reflect it as of yet. (The only exception was 1980 where they coincided in the same month.) The chart below shows the date of the market peak and real GDP versus the start of the recession and GDP growth at that time.

The problem is in the waiting for the data to catch up.

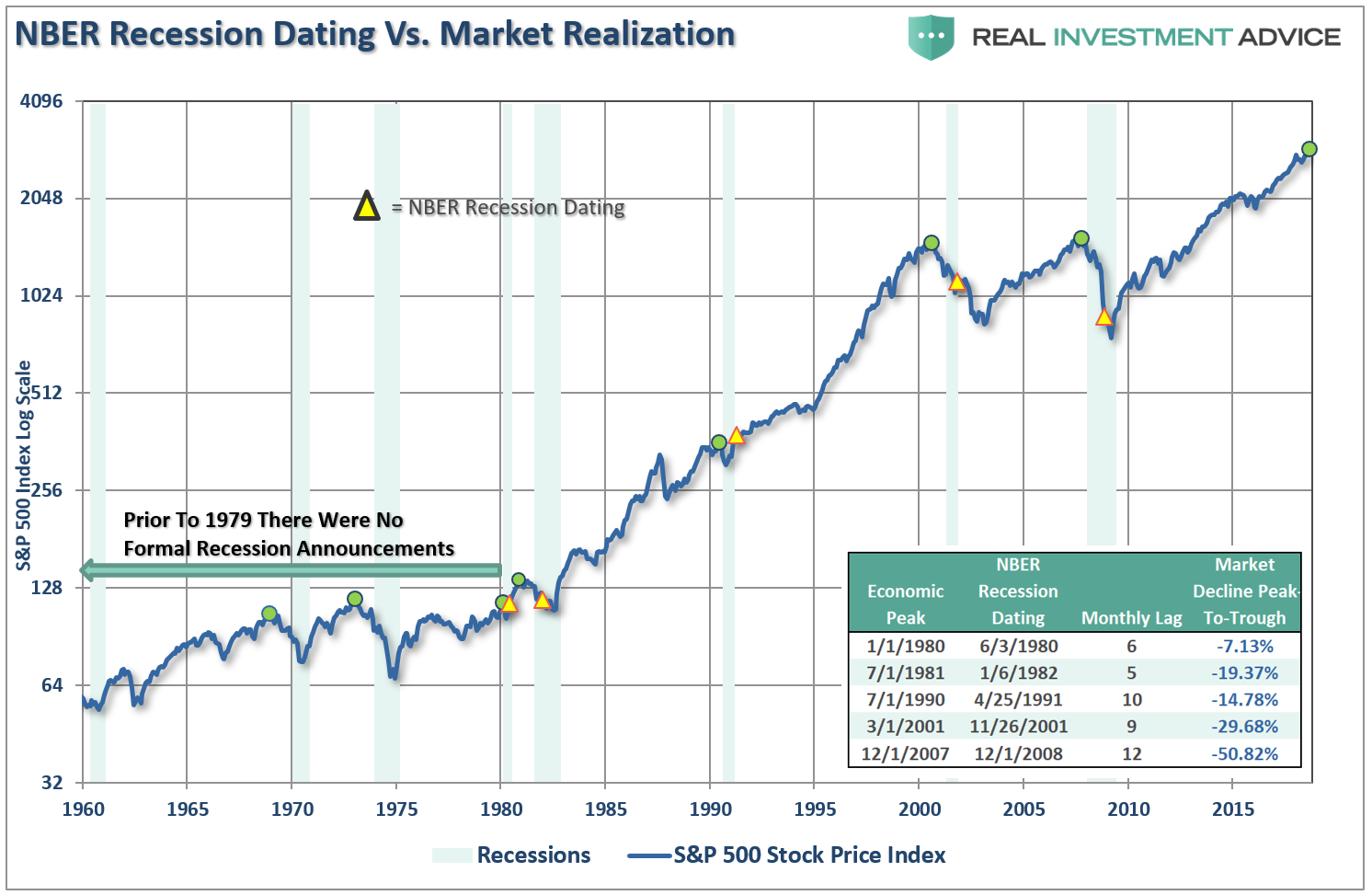

Let’s take the chart of the S&P 500 index above, and add official recessions as dated by the National Bureau of Economic Research (NBER) and the dates at which those proclamations were made.

Prior to 1980, the NBER did not officially date recession starting and ending points.

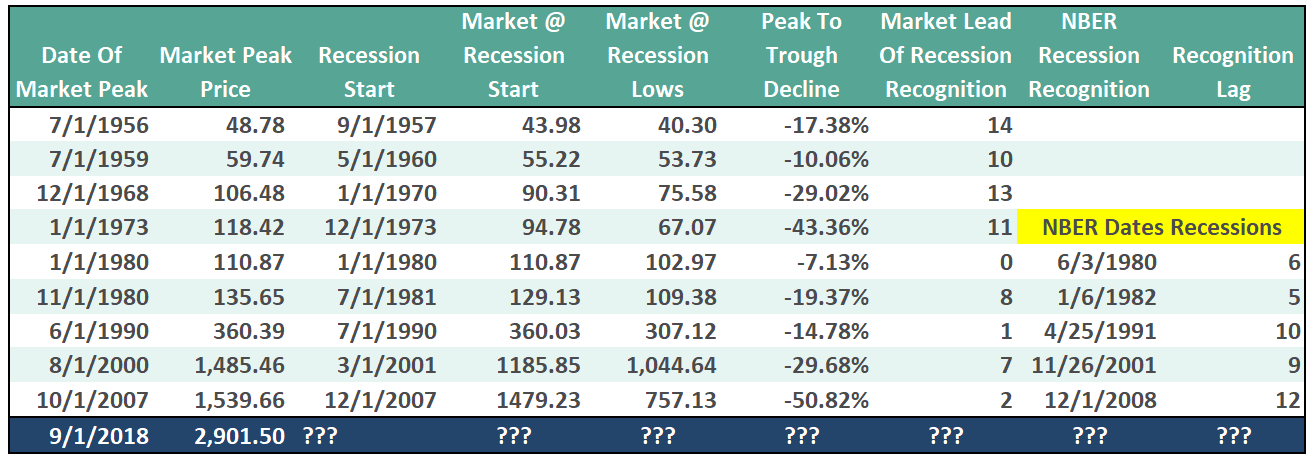

The table below breaks down the data. For example:

- In July 1956, the market peaked at 48.78 and started to decline.

- Economic growth was increasing from 0.9% and heading to 3.07% in 1957. (No sign of recession)

- In September 1957 the economy fell into recession and the market had already fallen by almost 10%.

- From peak to trough, the market fell 17.38%

- Importantly, the market had warned of a recession 14-months in advance.

You will also remember that during the entirety of 2007, the majority of the media, analyst, and economic community were proclaiming continued economic growth into the foreseeable future as there was “no sign of recession.”

At that time the trend of the data was obvious and the market was already suggesting that “something had broken.” Of course, it wasn’t until a full year later, after the annual data revisions had been released by the Bureau of Economic Analysis, that the recession officially revealed. Unfortunately, by then, it was far too late to matter.

Today, we are once again seeing many of the same early warnings. If you have been paying attention to the trend of the economic data, the stock market, and the yield curve, the warnings are becoming more pronounced. In 2007, the market warned of a recession 14-months in advance of the recognition.

So, therein lies THE question:

Is the market currently signaling a “recession warning?”

Everybody wants a specific answer. “Yes” or “No.”

Unfortunately, making absolute predictions can be extremely costly when it comes to portfolio management.

Note: In the table above, the time span between the market signal and the recession onset has been greatly compressed since 1973 when the NBER started dating recessions. This is due to the fact that when the NBER looks back they are seeing data after “revisions” by the BEA. Therefore, the data aligns more closely with what the market was signaling PRIOR TO the economic revisions.

There are three lessons to be learned from this analysis:

- The economic “number” reported today will not be the same when it is revised in the future.

- The trend and deviation of the data are far more important than the number itself.

- “Record” highs and lows are records for a reason as they denote historical turning points in the data.

We do know, with absolute certainty, when this cycle will end.

“Economic cycles are only sustainable for as long as excesses are being built. The natural law of reversions, while they can be suspended by artificial interventions, cannot be repealed.”

While there may currently be “no sign of recession,” there are plenty of signs of “economic stress” such as:

- Rising delinquency rates

- Rising levels of charge-offs

- Weakening rates of consumption

- Collapsing yield spreads

- Surging consumer and government debt levels

- The Fed’s insistence on hiking interest rates and reducing liquidity.

- Housing and automobiles have already shown signs of cracking.

- Tariffs, and higher oil prices, are an additional tax on both production and consumption

Being optimistic about the economy and the markets currently is far more entertaining than doom and gloom. However, it is the honest assessment of the data, along with the underlying trends, which are useful in protecting one’s wealth longer-term.

The best advice I have is the same as a recent quote from John Stepek:

“Be defensive when everyone else is being aggressive.

Why? So that when the time comes when there are lots of opportunities but hardly any money around (and it will come, because markets are cyclical and winter eventually arrives again), you’ll be in a position to take advantage.

And keep an eye on corporate debt. That’s where we’ll see the strains first.”

While the call of a “recession” may seem far-fetched based on today’s economic data points, no one was calling for a recession in early 2000, or 2007, either. By the time the data is adjusted, and the eventual recession is revealed, it won’t matter as the damage will have already been done.

The market may already be trying to tell you something.

Copyright © Clarity Financial