by Blaine Rollins, CFA, 361 Capital

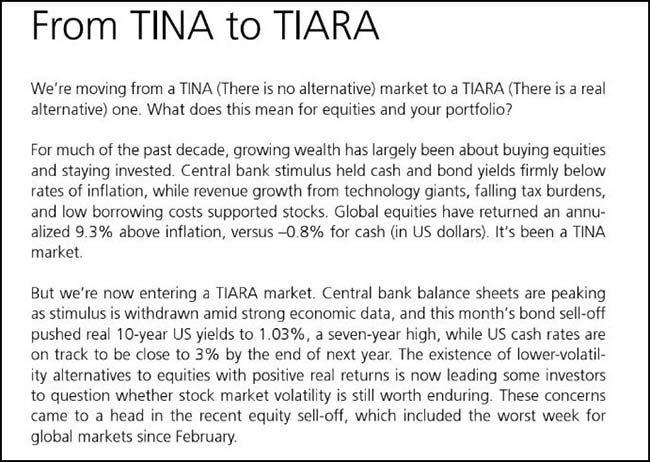

I wish that I would have thought of TIARA. Nice work UBS. While we have been talking about rising rates and how the safest investments actually now have a real yield, UBS may be remembered for many years as the firm that came up with TIARA. If only I were more creative and less of a geek.

So where are we? Earnings, falling stock prices and rising interest rates. Earnings beats are continuing, but sales are coming up lighter than in the past. More important to investors is that the reception to good numbers is not good, and the reception to bad numbers is very bad. Companies are definitely taking a conservative road to guidance given the many uncertainties in front of them. Stock prices are lower because of the early corporate returns, plus higher interest rate fears, plus growing global macro worries.

On the global macro front, the outlook for Saudi Arabia gets worse by the day. World governments are circling the confused country while journalists dig into every lead and story on their desk. Will global investments made by the Kingdom and into the country be unwound? What is the discount bid for a $10b piece of Uber? As we watch the search for Khashoggi, other global puzzle pieces remain flipped with few signs of resolution: Italy, China and the U.K. And the U.S. election is only two weeks away. (Thank God!)

So, back to digging thru earnings and looking for the best TIARA to own until the investment climate improves.

To receive this weekly briefing directly to your inbox, subscribe now.

Barron’s also hits on ‘Cash is no longer Trash’…

Investing in shorter-term bonds, a wasteland for many years thanks to ultralow interest rates, is a lot more appealing these days—though it’s hardly risk-free.

The two-year U.S. Treasury note is now yielding around 2.87%, up from 1.55% a year ago, as the accompanying chart shows.

The recent spike in yields has also made shorter-term securities much more competitive against longer-term holdings and dividend-paying stocks.

The 10-year U.S. Treasury note was recently at 3.15%, about 30 basis points above the two-year note’s yield. (A basis point is 1/100th of a percentage point.) But the shorter-dated note has the added appeal of being less sensitive to changes in interest rates, or duration risk. Meanwhile, the average S&P 500 stock yields about 1.9%.

Ultra-short-term bond funds are “currently offering more yield than they have since before the financial crisis, and given how flat the yield curve is, investors aren’t getting paid much more to invest further out the maturity spectrum,” says Miriam Sjoblom, a director of fixed-income manager research at Morningstar.

(Barron’s)

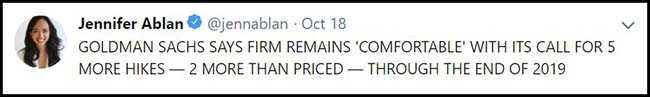

DJ Goldman’s Fed rate hike outlook is more aggressive than yours…

Love that Alan Greenspan just says whatever he wants in his Barron’s interview…

There’s a lot of concern about the unwinding of quantitative easing, especially as emerging markets struggle with weakening currencies. Should the Federal Reserve take that into consideration, as you did in the late 1990s?

I don’t discuss what the Fed does.

What’s the ramification of the end of QE?

Interest rates are going up.

What does this all mean for the markets and bonds?

I’ve been saying for a while we have a bond market bubble—and we still have one. It’s the nature of a bubble that it continues to inflate with nothing happening. That’s the problem.

Investors often look to bonds for safety. Should they no longer think that?

People believe there are people on Mars.

(Barron’s)

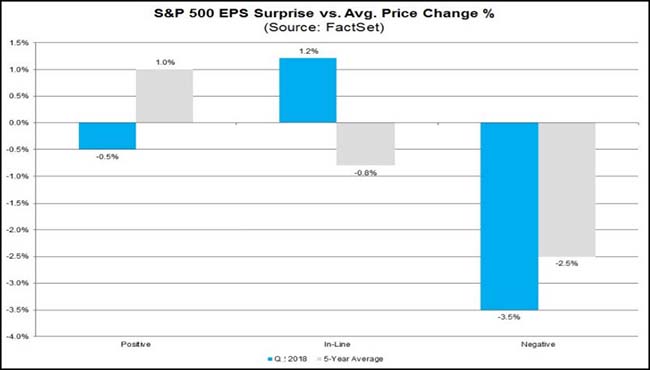

Definitely not a good sign when both positive and negative get penalized…

Given the chart below, I would try and report my numbers exactly in line with guidance.

Market Punishing Earnings Beats and Earnings Misses

To date, the market is punishing positive earnings surprises and negative earnings surprises more than average. Companies that have reported positive earnings surprises for Q3 2018 have seen an average price decrease of -0.5% two days before the earnings release through two days after the earnings. This percentage decrease is well below the 5-year average price increase of +1.0% during this same window for companies reporting upside earnings surprises. Companies that have reported negative earnings surprises for Q3 2018 have seen an average price decrease of -3.5% two days before the earnings release through two days after the earnings. This percentage decrease is larger than the 5-year average price decrease of -2.5% during this same window for companies reporting downside earnings surprises.

Netflix becomes the Q3 poster child for a high profile quarterly earnings beat which gives up all of post earnings gains…

Speaking of earnings, the peak for large caps will hit this week…

(@eWhispers)

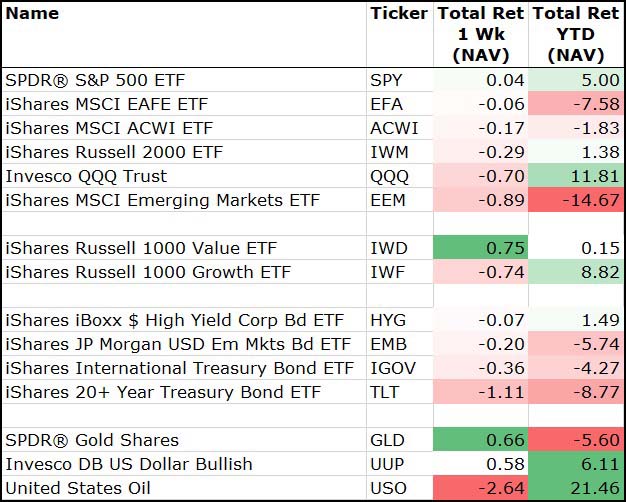

Do you honestly believe that the U.S. stock market is going to ignore the pull backs suffered by the rest of the world?

Wonder if it will be months or years until the worst performers can converge and crush the top performers.

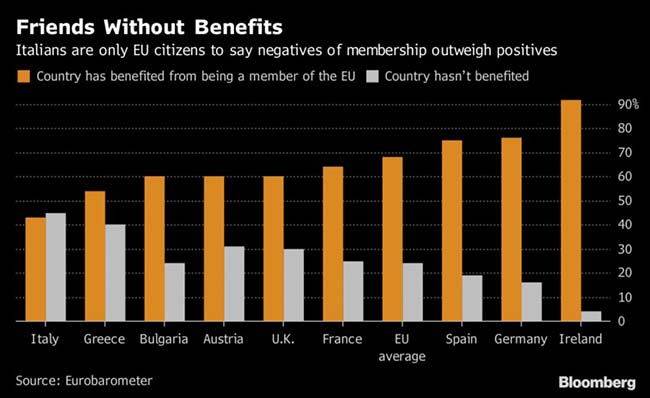

The Italians should talk to the Brits before they unplug their EU ATMs…

In a rough week for risk, Value stocks climb back into the green…

Meanwhile fixed income investors are double checking their portfolio statements. (I know as I got one of those calls this weekend.)

(10/19/2018)

Another bad sign for the market, momentum stocks breaking down and taking the Nasdaq with it…

Speaking of big momentum stocks, this one had better hold that $150 level…

Another very big momentum stock being tested…

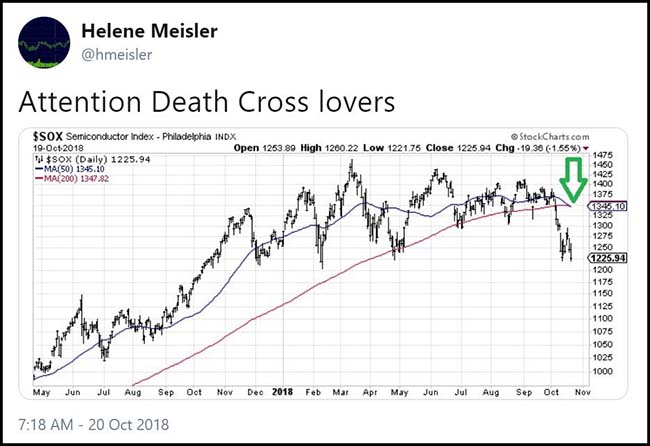

Just in time for Halloween…

Semis have moved out of the desirable camp as the global slowing auto and industrial sector slows down their chip buying.

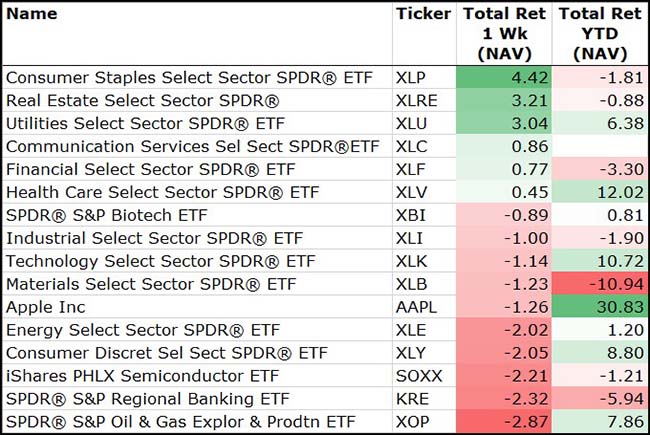

If you are long Equities right now, the Staples, REITs and Utility sectors are not the ones that you want leading this market…

Meanwhile the Semis go negative for 2018, while Bank stocks dig an even bigger hole.

(10/19/2018)

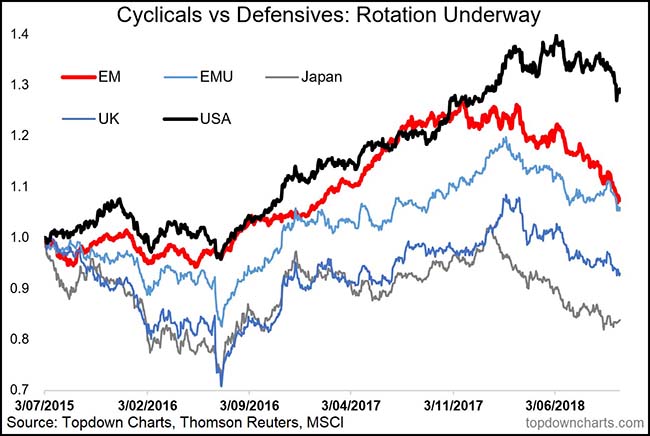

The rest of the world started the rotation. Now the U.S. is looking to catch up…

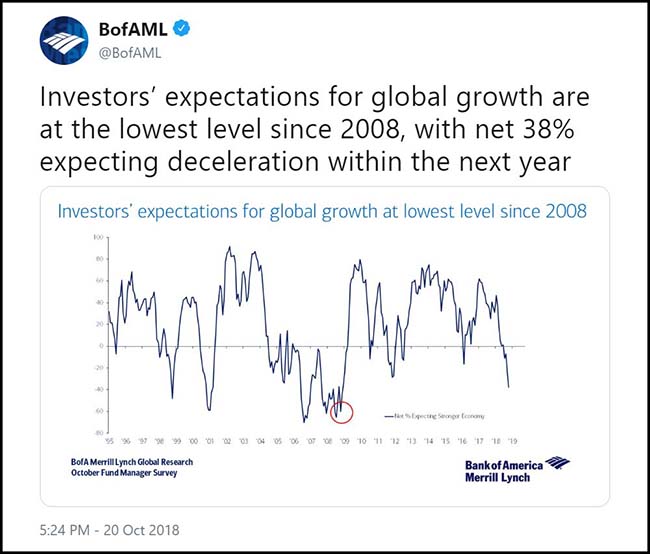

Investors are preparing themselves for a global growth slowdown…

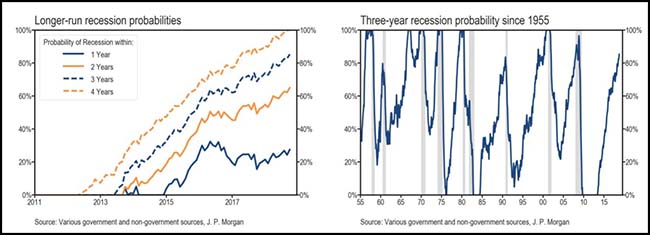

J.P. Morgan’s models see a U.S. recession in 12 months as low…

But their two, three and four year probabilities are rising at a worrying pace.

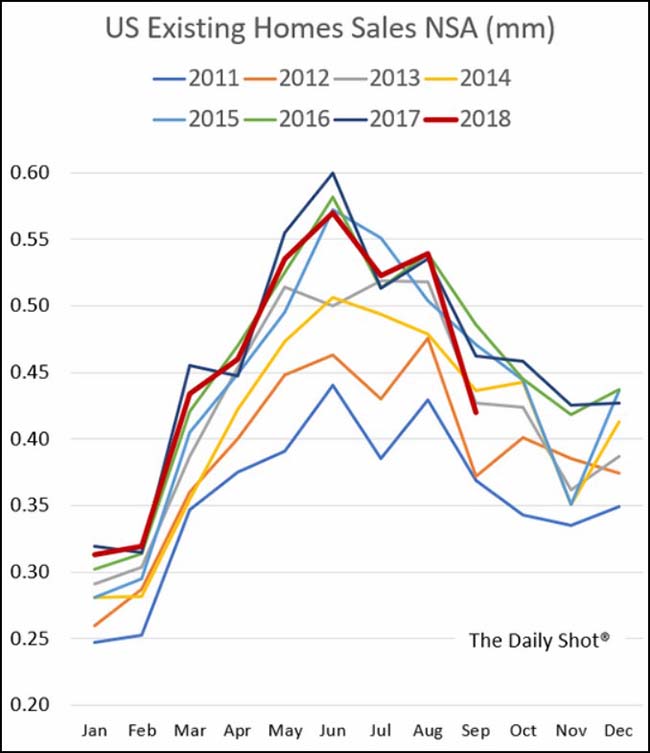

U.S. home sales are now winding lower…

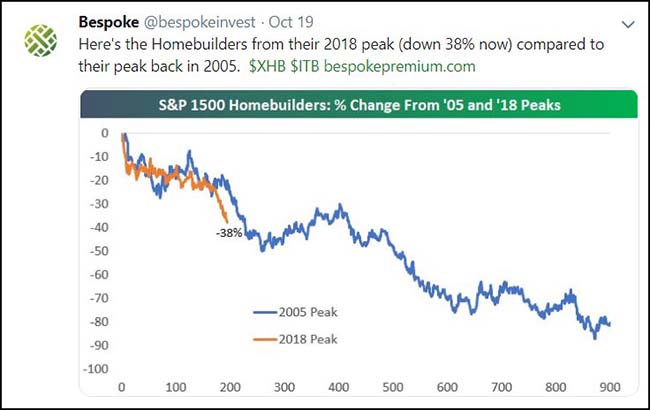

Maybe just a coincidence that the Homebuilder declines from their last peaks are tracking closely…

But with interest rates rising and construction material and labor costs soaring, I don’t want to be anywhere near the stocks.

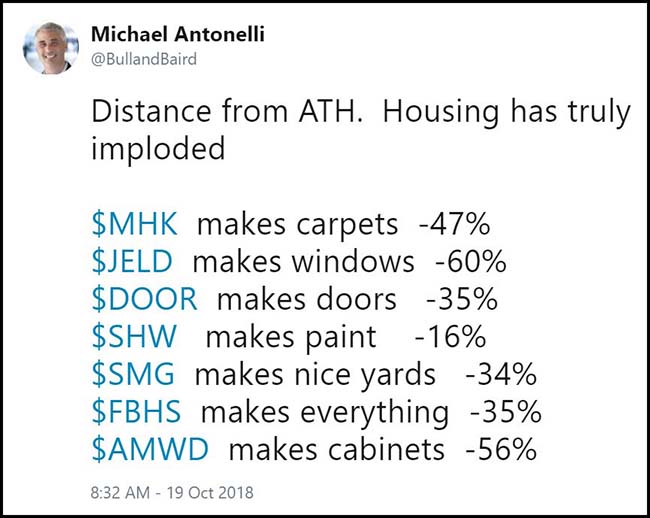

Not just the Homebuilders, but their components are also getting destroyed…

Bank stocks crashed again last week as one of their own blows two tires at high speed…

Rising interest rates hit zombie assets at a big regional lender in addition to raising their cost of funding. As TINA becomes TIARA, more and more zombie assets will be left to die and the banks will need to kill them off their books. And if they haven’t been written down enough, then surprise reserve additions will occur.

On Thursday evening, OZK, a midsize bank based in Little Rock, Arkansas, that has become one of the nation’s most aggressive commercial real estate lenders, announced that its third-quarter earnings had unexpectedly dropped nearly 23 percent. Analysts had been expecting earnings to rise 20 percent. Investors on Friday morning sent the shares, which were already well off their March high of $51, down 23 percent to less than $27…

OZK reported that its expense for credit losses rose 439 percent to nearly $42 million, the result of two relatively large real estate loans, which had been on OZK’s books for more than a decade, going bad. A number of bankers, including Wells Fargo CEO Tim Sloan, have warned recently about potential problems in commercial real estate lending. And Sloan is the one who should be most worried. Wells Fargo has the largest commercial loan portfolio of the big banks at $145 billion, which was showing signs of early trouble in the first quarter, but appears to have improved lately.

But where OZK could signal a truly significant problem for the banks is interest costs. Rising deposit costs, which is the interest a bank has to pay its checking account holders to keep their money there, has been a concern. So far it hasn’t been a problem for the big banks, but it appears to be a growing problem for OZK. In the first nine months, OZK has had to increase what it pays on deposits by 0.53 percentage points, yet it has only been able to increase the average interest rate it charges on its loans by 0.31 percentage points.

What if Saudi money stopped funding global tech startups? Could the investments be replaced?

How much have Saudis invested in Silicon Valley?

Billions of dollars. Over the last five years, Quid estimates Saudi investors have directly participated in investment rounds totaling at least $6.2 billion. Since the exact composition of each round is not public, it’s not possible to say how much of this money came directly from the Saudis compared to other investors participating in the rounds. But the Saudis are among the world’s biggest check writers…

These direct investments come on top of Saudi Arabia’s role as one of the world’s biggest limited partners backing investment funds. Two $45 billion investments in SoftBank’s venture funds in the last three years have instantly made it among the world’s biggest financial players in the venture world.

(Quartz)

Goldman is big on Fed rate hikes and they like Commodities…

In recent weeks, questions around the impact of US sanctions on Iran and geopolitical tensions with Saudi Arabia fueled concerns about oil supply, helping drive Brent crude oil above $80/bbl. And we see good reason to remain overweight commodities as a hedge against these geopolitical risks.

But the main reason we like commodities right now isn’t what’s happening in Washington or the Middle East. It’s the fact that we’re late in the cycle, when commodities typically outperform. This is because while financial markets are driven by growth rates that typically slow as interest rates rise, physical markets like commodities are driven by activity levels that remain high even as growth slows. We therefore recommend staying long in what’s already been the best-performing asset class of 2018.

(Goldman)

The world that we live in these days: a CEO loses it on his quarterly conference call and tells the analysts they are an embarrassment to their parents…

Cleveland-Cliffs CEO went on bizarre rant directed at analysts in Q3 conference call:

* The NY Post reports that Cleveland-Cliffs CEO Lourenco Goncalves made several bizarre and inflammatory comments directed at Wall Street analysts on the company’s quarterly earnings call. Goldman Sachs analyst Matthew Korn was the primary target of some of the remarks.

* Goncalves’ comments included:

* “You guys should resign for your lack of knowledge of things. It’s not like you don’t understand our business … you don’t understand your own business.”

* “You are a disaster. You are an embarrassment to your parents.”

* “We are going to screw these guys so badly that I don’t believe that they will be able to only resign. They will have to commit suicide. So we are going to screw these guys so badly that it will be fun to watch.”

* “Matthew Korn, if you are in the call, it is still 10:42, why you don’t ask a freaking question,” and “Matthew Korn from Goldman Sachs, you can run, but you can’t hide.”

(NY Post)

The president of Toyota sends a strong warning to the U.K…

Double-decker buses, black cabs and electric scooters might be your only remaining transportation options for your next trip to London.

“If no withdrawal agreement is reached and the transition period through December 2020 is consequently not implemented, corporate activities and consumers will be adversely affected by the impact of suspended production activities resulting from failed just-in-time logistics operations, declines in revenue, and revised vehicle sales prices caused by spiralling logistics and production costs.”

“We hope that both the UK and EU governments will continue to make maximum efforts to reach a satisfactory settlement and that a “withdrawal without agreement” is avoided at all costs.”

The Japanese carmakers Nissan, Toyota and Honda account for almost half the cars made in Britain.

If you thought making autos was tough, try investing in the industry…

“Cars are at the centre of absolutely everything that’s is going on, whether it’s politics, global warming, technology, globalisation, tariffs, air quality — it’s all hitting the auto industry,” said Max Warburton, an analyst at Bernstein. “One can understand why investors are running for the hills.”

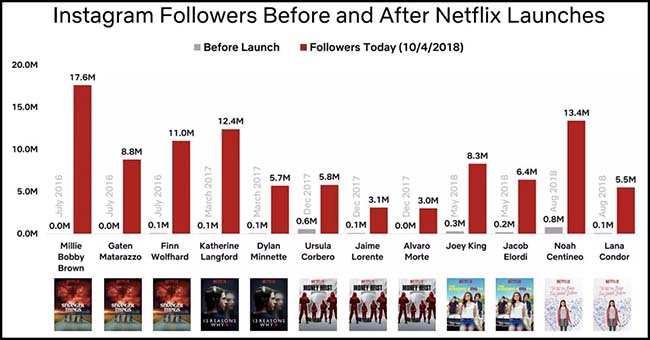

When I was a kid, the rule was whatever David Geffen touched drove pop culture…

But now that title belongs to Netflix.

(Recode)

At the auction estimate, it would be 17.4% annualized or a 5,882,252% gain…

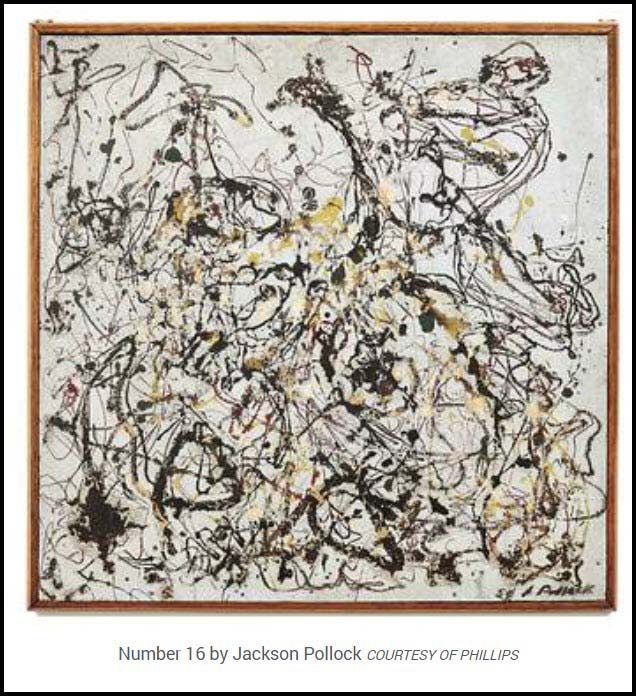

A masterpiece by Jackson Pollock that sold for $306 in 1950 to former U.S. Vice President Nelson Rockefeller is expected to fetch $18 million when it’s offered for sale for the first time in over seven decades.

Number 16, painted in 1950 by the famed abstract expressionist, has layers of swirls and drips on a silver background, with splashes of yellow, red, and green over thin lines…

This one is a group of 16 paintings that are painted on a 22-inch-by-22-inch square of Masonite, a type of pressed wood paneling that’s smooth on one side and textured on the other.

“He is famous for his drip paintings, but he only did them in the narrow windows of about three years, from 1947 to 1950,” Manley says. “It’s quite rare for his drip paintings ever to come onto the market.”

(Barron’s)

Finally, the world would be a better place if more kids wrote op-eds for the major papers…

“I pulled a 1,500-year-old sword out of a lake”

People on the internet are saying I am the queen of Sweden, because in the legend of King Arthur, he was given a sword by a lady in a lake, and that meant he would become king. I am not a lady –

I’m only eight – but it’s true I found a sword in the lake. I wouldn’t mind being queen for a day, but when I grow up I want to be a vet. Or an actor in Paris.

Copyright © 361 Capital