by Sharon Fay, Head and CIO, Equities, AllianceBernstein

Emerging-market (EM) stocks fell in the third quarter and continued to diverge sharply from developed-market equities. While it may be too soon to buy into the weakness, investors should watch for signs that could herald a quick rebound.

US, European and Japanese stocks have all advanced this year. But the MSCI Emerging Markets Index has tumbled in local-currency terms—and even more in US-dollar terms (Display below, left). EM returns have been dragged down by Turkey’s currency crisis and concerns that China’s challenges could be aggravated by the escalating trade war with the US. Investors are asking whether the sharp pullback since January will continue and are watching for signs of contagion to other markets.

After a two-year EM recovery, investors are fearful that a systemic crisis is imminent. We think it’s important to separate the issues and put the risks into perspective before withdrawing investments from EM stocks or allocating more to EM stocks in anticipation of a recovery.

Individual country performance provides a reminder that emerging markets aren’t all made of the same stuff. Turkish and Argentinian stocks were the worst EM performers this year, while markets in China and South Korea have also fallen. Russian and Thai stocks posted gains. In many markets, sharp declines in local-currency values led to much steeper losses in US-dollar terms (Display above, right).

Two Types of Problems, Two Types of Risks

There are two types of problems on the EM landscape today. First, there are countries mired in major economic and currency crises. Second, there is China.

Turkey, South Africa and Argentina are members of the first group. These countries are dealing with classic EM crises: poor policy decisions, wide current account deficits, excessive foreign-denominated debt and collapsing currencies. There’s no way to sugarcoat it: each country— and its people—faces an arduous road to rehabilitation.

After large inflows to EM stocks and bonds from 2016 through early 2018, a panicked withdrawal by investors could spread elsewhere. The strong dollar and rising developed-market interest rates could create contagion beyond the developing world, for example, spreading to European banks with large Turkish assets. And investor sentiment could also hurt returns even if fundamentals outside these countries are relatively sound. That said, these countries have relatively small economies, and their weights in the benchmark are also limited. So, we believe that their troubles are likely to remain ring-fenced and their ailments probably won’t infect the rest of the world.

China’s Challenges: Getting Policy Right as Trade War Escalates

China is a different story. What happens to the world’s second-largest economy matters profoundly to the rest of the world, and the issues it faces are unprecedented. Here, the challenge for policymakers is to carefully manage slowing growth and a shifting economy while strategically navigating a trade war with the US.

Pressure is mounting on China’s policymakers. On September 23, the US imposed tariffs on a further $200 billion of Chinese goods. China retaliated with tariffs of $60 billion on US goods, but its broader response has been relatively restrained. We think China has three options to stimulate growth if the trade war begins to weigh on its slowing economy. None are risk-free:

-

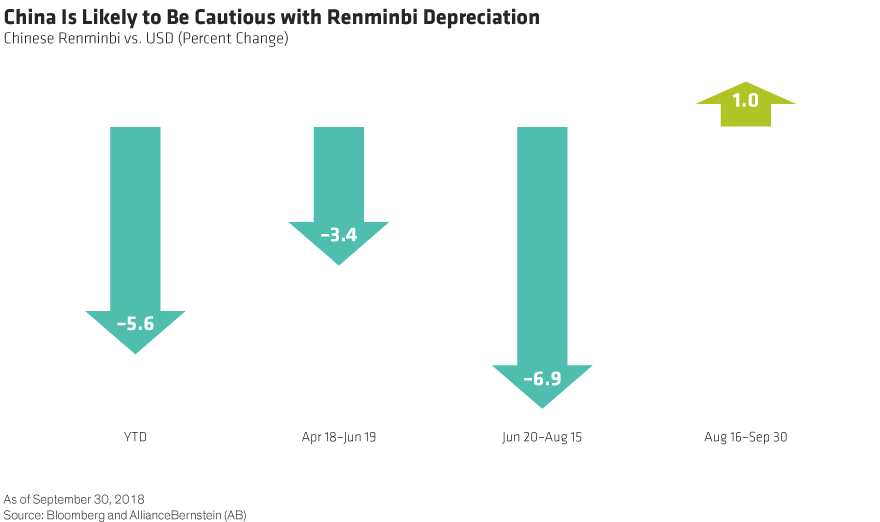

- Devaluation—devaluing the renminbi is the easiest way to combat the symptoms of a trade war. It would make Chinese exports more competitive on world markets, and could help offset much of the potential damage from tariffs. But too much depreciation could prompt Chinese citizens to start shipping their money out of the country, which would weaken the domestic economy and create a vicious cycle. And a devaluation policy may only spark further retaliation from the US.There are some mitigating factors, however. First, the renminbi’s depreciation has been modest so far—after depreciating sharply from June 19 through August 15 this year, the currency has actually appreciated (Display). Second, policymakers are acutely aware that devaluation is a double-edged sword. Indeed, Chinese Premier Li Keqiang said on September 19 that a devaluation would “do more harm than good.” Third, we believe that Chinese policymakers have learned lessons from previous currency episodes; controls to prevent capital flight have been tightened, which would help minimize the impact of any devaluation to the stability of its financial system.

- Fiscal Stimulus—if channeled to the right places, stimulus could go a long way toward supporting Chinese economic growth. New infrastructure projects in certain areas could generate tangible returns. For example, Beijing has a population of 24 million and desperately needs a second airport. Stimulus could also add to China’s debt problems. But we’ve observed that the Chinese financial system has matured; many banks are acutely aware of the dangers of overextending credit. So, some self-regulation should reduce the risk of potential excesses. Still, the type of broad-based stimulus that China embarked on a decade ago may not be realistic in today’s environment.

- Tax Reform—international observers don’t pay much attention to tax reform, but they should. After recent reforms of value-added taxes, Chinese corporate tax receipts are growing much faster than nominal GDP. According to many economists, this creates fertile ground for a tax cut that could also help stimulate the economy in private enterprise, consumer spending and services.

Channels for Contagion

In China’s case, fallout from the trade war and/or a policy misstep could be highly contagious. Even as China braces for supply chain disruptions, it will be very hard to quickly create local supply alternatives in some key industries, such as semiconductors. Devaluation could have unintended consequences on Asian currencies. And if China’s economic slowdown deepens, the effects could be painful; for example, a reduction in demand for commodities like iron and copper could hit other EM countries that supply raw materials.

That said, we think China’s economy is multidimensional—and its strengths are often understated. In fact, the domestic economy is relatively resilient to higher tariffs. Although car sales have slowed sharply, diverse industries from food to air traffic to residential housing are still posting solid growth. We think China’s fundamental economic health is stronger than widely perceived, which gives policymakers room to maneuver when managing the current challenges.

What Should Investors Do?

Even with some perspective on the risks facing China, Turkey and the rest of emerging markets, investors are understandably feeling unsettled. Should you pull existing assets out of EM stocks? Or, maybe it’s a good time to increase your EM allocation?

Emerging markets are an important part of an equity allocation. We think investors with long-term horizons should maintain strategic exposures to EM stocks. In our view, companies that are positioned to capture strong underlying economic growth offer attractive return potential when the current volatility settles.

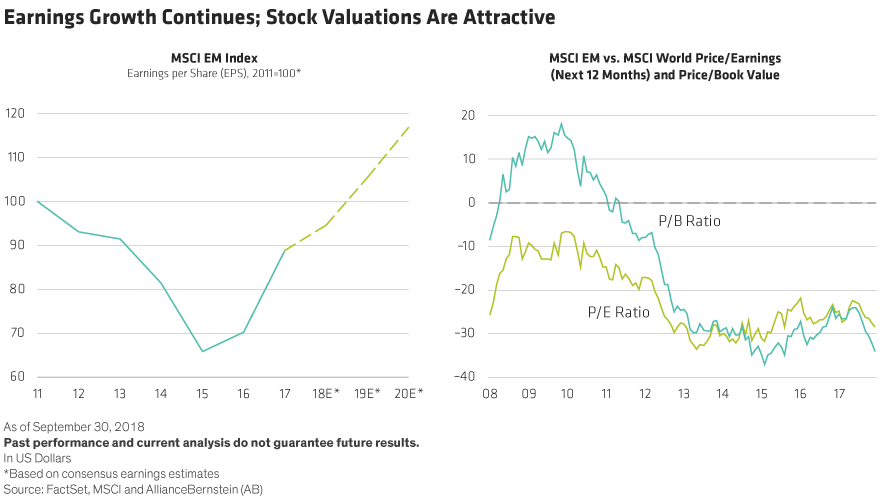

Despite today’s complications, GDP growth is still likely to be much stronger across emerging markets than across developed markets in the years ahead. Many countries have resilient current account balances with little foreign debt, and are less vulnerable to a stronger dollar than in the past. US economic growth, which remains solid, has supported EM economic growth in the past, via demand for commodities and consumer goods. Earnings growth of EM companies has rebounded strongly since 2015 and EM valuations are deeply discounted versus developed-market stocks (Display).

Still, caution is warranted in the short term. Various leading economic indicators still suggest that we haven’t hit the bottom yet. At the same time, we believe that markets can rebound very quickly from crises of confidence. Our research shows that EM equity performance cycles typically unfold over several years and often face bumps in the road (Display).

We think three guidelines can help investors make the most appropriate decisions about investing in EM equities today:

1. Too early for a tactical shift—it’s probably too soon to buy into the current EM weakness. But at the same time, we don’t recommend reducing exposure to EM stocks, because rebounds can happen quickly and are notoriously difficult to time. In addition to watching leading economic indicators, several gauges of market activity can point to signs of improvement or deterioration. For example, when momentum and earnings revisions stabilize, the market could be poised to rebound. The oversold indicator suggests when the asset class has fallen too far and may be ripe for recovery. And when EM equity valuations trade at historic lows versus developed-market peers, investors should perk up.

2. Don’t bet on the outcome of the US-China trade war—nobody really knows how it will end. As we’ve seen with the US-Mexico dispute, resolution can be swift and surprising. If the US and China reach an amicable resolution, we expect Chinese stocks to rebound. But beware of exposure to export-oriented companies, which will suffer if the trade war drags out. There are more than 4,000 stocks to choose from in China. Our EM portfolios generally focus on companies with exposures to long-term growth drivers that are unlikely to suffer a direct hit from tariffs.

3. Stay active, focus on fundamentals—passive portfolios are particularly risky in emerging markets today. Active portfolios can avoid the most hazardous pockets of the developing world, while focusing on companies that are better positioned to withstand the pressures. Should a rebound materialize, we believe that companies with strong business advantages and healthy balance sheets that have been unfairly punished in the downturn will be good sources of return potential.

There are no easy answers for EM investors today. But by looking at market and macro conditions through the right lenses, we think investors can adjust appropriately for the complex environment and prepare to position for a potential recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

Copyright © AllianceBernstein