by Jeffrey Kleintop, Chief Global Investment Strategist, Charles Schwab and Co.

Key Points

- Solid gains in the third quarter were supported by a stabilization in the trade-weighted U.S. dollar, global economic data coming in line with expectations and the easing of some trade tensions.

- We believe there are three positives, three negatives and three wildcards for stock market performance in the fourth quarter.

- We expect the balance of these factors to result in further gains for global stocks, but with the economic and earnings cycle getting late, paying attention to the risks is increasingly important.

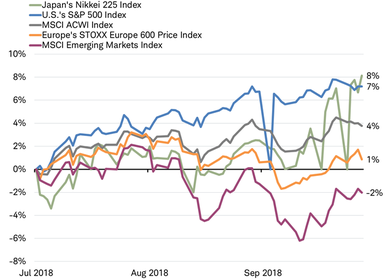

In the third quarter, Japan lead global stock markets with an 8% gain for the Nikkei 225 Index, just edging out the U.S. gain in the S&P 500 Index of 7%. Europe and Emerging Markets had lackluster quarters finishing up 1% and down 2% respectively. The MSCI ACWI index, which tracks the overall global stock market, was up 4% for the quarter, in contrast to the declines seen in both of the first two quarters of this year.

Third quarter performance

Source: Charles Schwab, Bloomberg data as of 9/30/2018.

Three drivers for quarter three

We believe the solid gains for global stocks in the third quarter can be largely attributed to three macro factors that allowed investors to focus on solid growth in corporate earnings:

- Stabilization in the value of the trade-weighted U.S. dollar after a sharp rise in the second quarter weighed on international stocks and drove much of the turmoil in emerging markets.

- Global economic data was generally in line with economists’ expectations after disappointing during the second quarter.

- The fading of some trade tensions as a U.S.-Korea trade deal was signed, an updated NAFTA deal between the U.S., Mexico and Canada was reached, and talks between the U.S. and the European Union (EU), Japan and Canada are taking place, even though U.S.-China trade tensions escalated.

What macro factors will we be watching that may impact fourth quarter performance for global markets? Let’s categorize them into positives, negatives and wildcards.

Three positives

Three potential positives for the fourth quarter that may not yet be fully priced in to the market are: China’s stimulus boosting growth, better than expected economic data, and Japan breaking out.

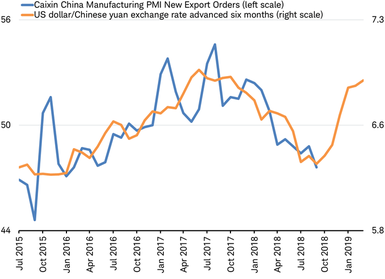

1. China stimulus kicks in - Chinese growth may stabilize in the fourth quarter, supported by a cheaper currency along with actions by the government in recent months to lower interest rates, accelerate government infrastructure spending, and improve bank lending. We will be watching trends in the manufacturing PMI, industrial electricity use, and exports from Korea to China (which includes many components for use in manufacturing).

China’s weaker currency may point to rebound in export orders

Source: Charles Schwab, Bloomberg data as of 10/1/2018.

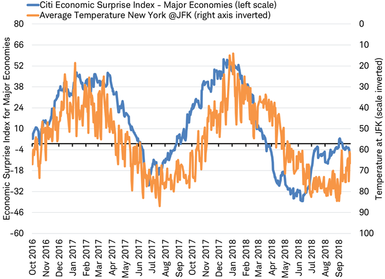

2. Better than expected economic data – The economic surprise index rises above zero when economic data exceeds economists’ expectations and falls below zero when it disappoints. The pattern of economic data surprises seems to closely track the temperature—weakening as the mercury rises and firmed back up again as the weather cools down, as you can see in the chart below. If this seasonal pattern continues as temperatures fall in the fourth quarter, better-than-expected economic data may support stocks.

“Surprising” seasonal pattern may repeat

Major economies is defined as the Group of Ten (G10) countries: Australia, Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, Switzerland, United Kingdom, and United States.

Source: Charles Schwab, Bloomberg data as of 9/30/2018.

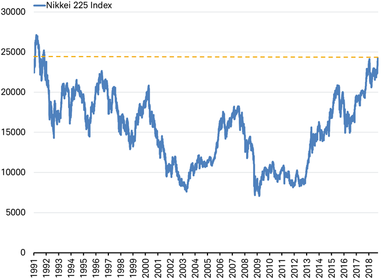

3. Japan may break out – Japan’s profit margins are near a twenty year high helping boost profits. Output prices have now risen for 21 consecutive months (the longest period since the inception of Japan’s Purchasing Managers Index in 2001). Tax cuts may be encouraging business spending and boosting Japan’s economy. All this may lift Japan’s Nikkei 225 Index to a new 27 year high.

Japanese stocks just short of highest level since 1991

Source: Charles Schwab, Bloomberg data as of 10/1/2018.

Three negatives

Three potential negatives for the fourth quarter which the market may react to this quarter are: a confrontation between Italy and the EU over Italy’s budget, the United Kingdom and the EU over Brexit, and rising oil prices.

1. Italian budget – Italy is setting the stage for a confrontation with the Eurozone over its budget. The Italian budget from the new government is not due until October 20, but the preview on September 27 showing an increase in the deficit from the current 1.6% to 2.4% in the coming years was a warning sign. Italy may be set for a fight with Europe over a breach of its obligations under the fiscal rules that bind Eurozone members. If Italy doesn’t rein in their spending in response to their internal pressure or that of the Eurozone, markets may be forced to bring discipline to Italy just as it did to other Eurozone countries like Greece.

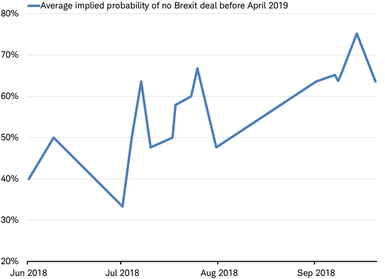

2. Brexit battle – A confrontation with the EU looms in Q4. With little chance, in our view, of an agreement on the future trading relationship by the end of October, it seems likely that U.K. Prime Minister May will put it off in favor of securing a divorce agreement to extend the Brexit transitional period through the end of 2019. This would prolong uncertainty and drag on investment in the U.K. If the May government cannot reach an exit deal with the EU or reaches one but then cannot garner enough support in Parliament with the Labour party pledging to oppose any deal, it could trigger a new election or a second referendum with risks to U.K. stocks.

Betting odds favor no deal by Brexit date of April 1, 2019

Source: Charles Schwab, Bloomberg data as of 9/26/2018.

3. Rising oil prices – For the first time since 2014, the price of Brent crude oil traded above $80 per barrel, up 44% from a year ago. With U.S. sanctions on Iran going into effect on November 4 and Venezuela’s collapsing production, global oil supply is struggling to keep up with growing demand, pushing prices higher. Higher prices may have some negative impact on the fourth quarter holiday shopping season and could compound stress for emerging market countries like Turkey and Argentina.

Oil bubbling up

Source: Charles Schwab, Bloomberg data as of 9/30/2018.

Three wildcards

We see three wildcards for the fourth quarter that could go either way for global stock markets.

1. U.S. dollar – A renewed material rise in the dollar in the fourth quarter could fuel turmoil in EM. The sharp rise in the dollar from mid-April to mid-August not only weighed on international market performance in dollar terms, but exposed weaknesses in troubled emerging market economies with large dollar-denominated debt obligations such as Turkey and Argentina.

The value of the trade-weighted dollar stabilized in Q3

Source: Charles Schwab, Bloomberg data as of 9/30/2018.

2. Trade tension – While tensions over widespread protectionism have faded as talks have been scheduled and some deals have been struck, U.S.-China tensions have escalated. A deal is still possible, but so is escalation. Investors will be watching for any fallout from the tariffs evident in the hard economic data.

3. U.S. mid-term elections - Will markets see an outcome with closely divided chambers as “gridlock is good” or extrapolate a wave election into prospects for major change in 2020? In addition, a number of countries will be watching the November 6 midterm elections for a result that increases the probability Congress asserts its trade authority over the Trump administration.

Fourth quarter gains likely

With other market influencing factors like corporate earnings and central banks likely to perform as expected, it may be the positives, negatives and wildcards that we have described that exert the most influence over global stocks in the fourth quarter. We expect the balance of these factors to result in further gains for global stocks, but with the economic and earnings cycle getting late, paying attention to the risks is increasingly important. Investors should consider rebalancing their portfolios in line with long-term targets.

Copyright © Charles Schwab and Co.