by Richard Turnill, Global Chief Investment Strategist, Blackrock

Richard explains why we see room for a further recovery in emerging market (EM) assets, particularly equities, after an unexpectedly prolonged selloff this year.

We see room for last week’s EM recovery to persist, especially in equities. The rebound came after an unexpectedly persistent selloff in EM assets this year, despite a solid near-term global growth outlook. Country-specific shocks and tightening global financial conditions have pressured EMs with the greatest external vulnerabilities. Yet we do not see the EM swoon as a broader threat to global markets.

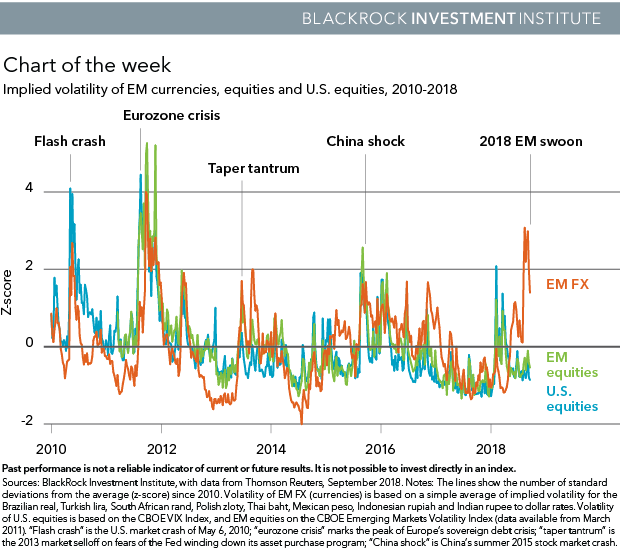

EM currencies have borne the brunt of the recent selloff. Volatility in EM currencies recently spiked to higher levels than the 2013 “taper tantrum” — when then Federal Reserve Chair Ben Bernanke signaled the beginning of the end of new central bank asset purchases. See the orange line above. Yet volatility in other asset classes has remained more muted, both in EMs and developed markets, as the chart shows. Currencies have also shown some signs of stabilization, with emergency rate hikes in Turkey stemming a sharp selloff in the lira. We see this as a positive sign for EM assets overall.

A canary in the coalmine?

This year’s EM troubles stem from a potent cocktail of negatives, as we write in our Global Investment Outlook Q4 2018. Catalysts include country-specific factors (Turkey’s credit-fueled growth running out of steam; Argentina’s policy missteps); worsening trade tensions; a crowded EM election calendar; and moderately tighter global financial conditions. Higher U.S. interest rates are adding to the EM stress by creating competition for capital and leading investors to reset their return expectations for riskier assets, especially EM assets and equities. The biggest casualties: currencies of EM economies with the largest current account deficits and highest external debt burdens. Countries with surpluses, such as South Korea and Thailand, have largely been spared a currency crunch.

We see this year’s EM selloff more as a series of idiosyncratic accidents masking stronger EM fundamentals rather than a canary in the coalmine for global markets. EM economies are holding up, and recessions in trouble spots like Turkey and Argentina should have limited impact. Our research shows developed markets are the key drivers of the global expansion and EMs’ fortunes, with China the linchpin for transmitting growth to EM broadly. Our BlackRock Growth GPS points to steady economic activity in China. EM fundamentals are generally robust, and economic strength is starting to translate into sustained strong EM earnings growth for the first time in a decade. We may also be near a peak in country-specific risks. With much of the steam let out of valuations, a robust growth backdrop, and potential for the Fed to start to slow its balance sheet wind-down next year, we see room for a further rebound. Risks include escalating trade frictions, hefty portfolio outflows, and a hawkish Fed pushing up global rates and the U.S. dollar.

Bottom Line

EM assets overall appear to offer attractive compensation for these risks, especially in equities, where we stick to our overweight. We are positive on the hard-hit tech sector, even as some high-flying tech shares remain expensive. In fixed income we prefer selected hard-currency EM debt. It provides insulation against currency declines and looks relatively cheap versus local-currency debt.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog

Copyright © Blackrock