by Craig Basinger, Chris Kerlow, Shane Obata, Derek Benedet, Connected Wealth, RichardsonGMP

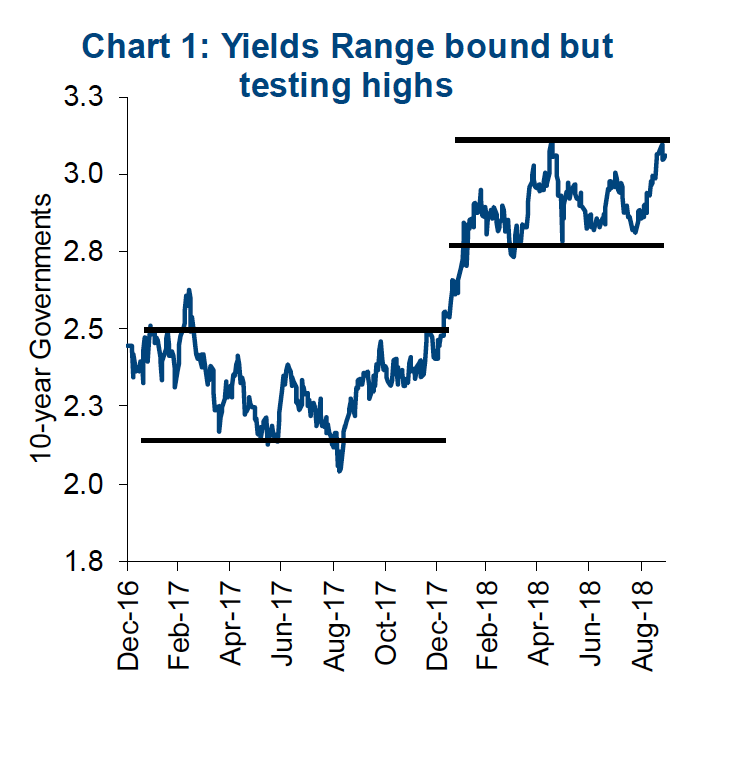

The market correction experienced in late January and February of this year was largely attributed to rising bond yields. Yields, as measured by the 10-year U.S. Treasury had remained largely rangebound for all of 2017 between 2.2- 2.5%. It was the move from 2.5% to 3.0% that seemed to be the primary culprit for the market sell-off. Since the correction, yields have remained rangebound again from March till now, yet in a higher range of 2.8% to 3.1%. With yields as of today sitting at 3.05% (chart 1).

From a simplistic perspective, higher yields are negative for equity prices. If you agree a company or equity is worth its future cash flow discounted back to today, then higher yields apply a higher discount rate to those cash flows. Hence, higher yields = lower equity prices. $1 in 10 years time is worth $0.82 present value with a 2.0% discount compared to $0.74 if discounted at 3.0%.

Moreover, there is a strong argument that the market is historically more sensitive to yields today than in decades past. Following the financial crisis, global central banks did everything they could to lower bond yields via uber low central bank rates and very aggressive quantitative easing. After such a long period of low rates/yields, the sensitivity to a move higher should have a greater impact.

Successful investing is really about figuring out who is wrong

Investing, at its purest form is really about trying to find out where and when the market is wrong, and when we say ‘market’ we mean the consensus of everyone trading in the market. Sure, every manager dresses up their process with fancy marketing pitches such as ‘we buy great companies, with solid management that are trading at a discount’, but managers are trying to profit from the mistake of others. We believe one mistake the ‘market’ is making today is in not appreciating the inflationary pressures that are building….and how these could be transmitted into bond yields and asset prices.

“It has been said critically that there is a tendency in many armies to spend the peacetime studying how to win the last war” – Lieutenant Colonel Schley 1929. This tendency to focus and prepare for a repeat of the last conflict instead of adapting and preparing for different subsequent scenarios has undermined many military commanders.

Investors, and even central bankers are not so different. Just look around at how many products/strategies have been created that would perform better if we have a repeat of 2008/09. And on the yield/inflationary side, after years of being fearful of deflation or not enough inflation, we believe the market continues to pay little heed to the balance of risk tilting away from deflation and more towards inflation.

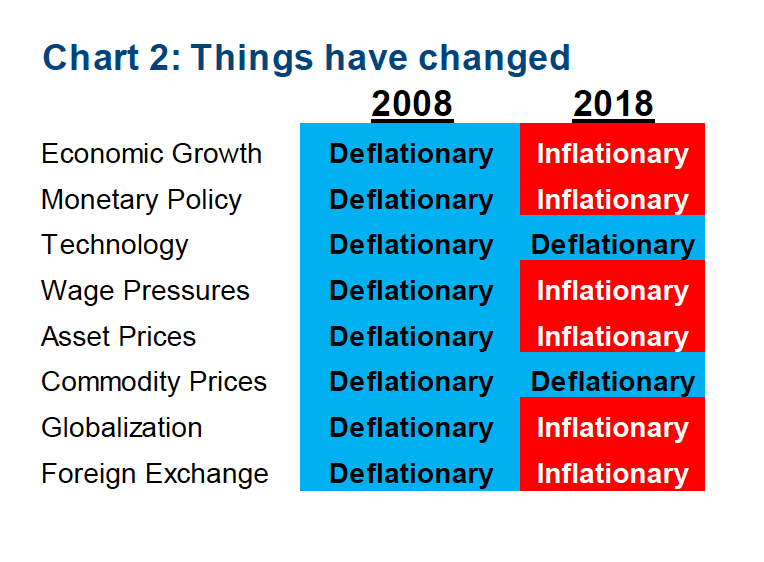

MRB Partners did a great in-depth dive on inflation/deflation, much of which we agree within our analysis. Specifically, they broke down pricing pressures from various sources and contrasted today’s environment with that of a decade ago. Chart 2 contains these price drivers and which is either putting upward or downward pressure on inflation. As you can see, ten years ago it was all eliciting deflationary pressures. Fast forward to today, and while technology and commodity prices are still providing some deflationary pressures, the other six factors appear to have switched.

The changes have been gradual, there is no one day these switch, which can cause market participants not to register the change as easily. Today, economic growth is rather robust and evident in most economies, many of which are now expanding above capacity. Monetary policy has switched with some central banks tightening policy. Wage pressures, while still not strong, are rising. Asset prices have become much more elevated.

Commodity prices are probably a bit more mixed now, some higher and some lower. Global trade for years offered steady deflationary pressure as production was moved from higher to lower cost countries. This trend has slowed dramatically as many of these lower cost countries are now seeing higher prices. Tariffs also slows this deflationary pressure. Finally, the rise of the U.S dollar has stopped or slowed, mitigating the currencies historical deflationary pressure.

While we do believe bond yields will continue to move higher, not just in the U.S. but globally, and this isn’t necessarily a bad thing. Yes, there are likely pain points for the equity market where yields may trigger a sell-off. It’s anyone’s guess where these are, and we would note, any sudden move on better data could easily spill over into equity market weakness. However, as long as these moves in bond yields are driven by improving economic activity, the sell-offs should be brief.

And to refute our simple present value of future cash flow example from earlier, if economic activity is higher and the company earns $1.20 in 10 years instead of just a $1.00, well that pretty much takes care of the higher discount rate.

Portfolio Implications

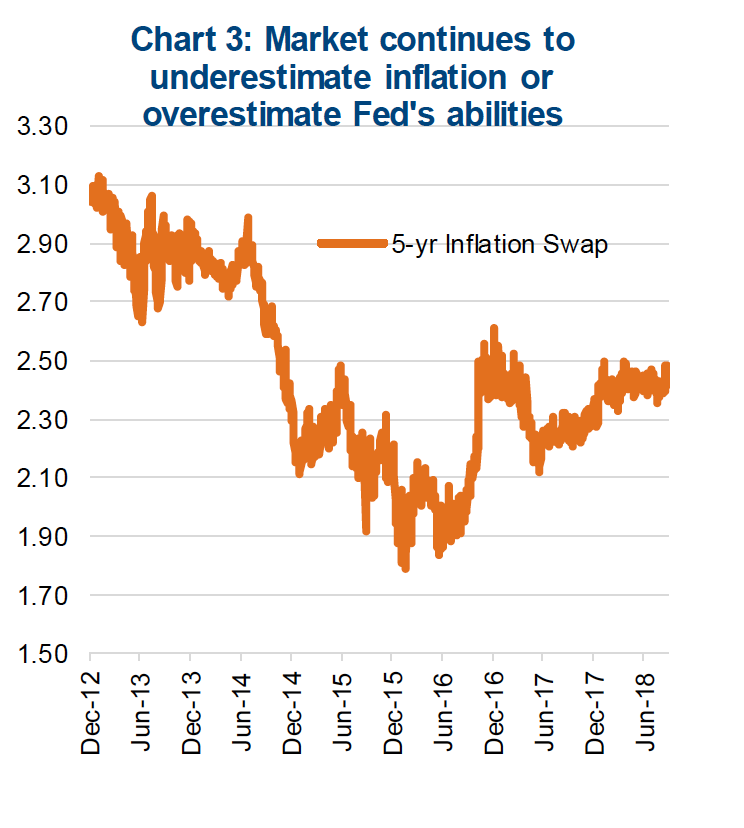

We don’t even have to be 100% right to win, we just need to be less wrong to add value. Today we believe the market is wrong in its implied pricing of future inflation. This can be seen Chart 3 which is how much inflation is priced into the bond market. With our expectations that the market is underpricing, the risk of higher inflation pressure, hence a fast pace of interest rate hikes and higher bond yields, this does have portfolio positioning implications.

Remain shorter duration on fixed income allocations. Even the short end is starting to offer an attractive yield. We would say to be underweight, but this view on yields must be tempered with the fact that we are late in the market cycle and now is not the time to be too light on defensive bonds.

Within equities, continue to remain cautious or underweight in the more interest rate sensitive ‘bond proxies’. This includes utilities, real estate, pipelines, telcos and to a lesser extent consumer staples. We would say some of these are starting to offer greater value than years past, thanks in part to the recent rise in yields. And some value-oriented positioning is warranted, but in aggregate: best to keep the group lighter than normal.

*****