by Blaine Rollins, CFA, 361 Capital

Welcome to October. Only five weeks until the midterm elections and 11 weeks until Christmas. For investors, we are rounding the final corner as we look to finish out the 2018 performance numbers. With three quarters down, it has been a good one for U.S. Equity investors focused on growth stocks. And, if you had stockpiled barrels of crude oil in your garage, very well done. If trends persist in the fourth quarter, then all other investors will get to sweep the stands and clean the paddocks after the crowds and horses have left.

Of course, there are still three months left and I can quickly draw up a list of worries that will have you raising your cash levels. Global growth is slowing down. U.S. corporate earnings estimates are moving lower. The Federal Reserve is tightening liquidity and raising rates (along with the Bond market). Emerging markets are a mess, while Italy and the United Kingdom muddy up the European scene. While the U.S. elections will be a big deal in the news, for the markets, it should be a non-event as it looks very likely that the GOP will lose the House which will cause a split government in D.C. Historically, a split government is better for the markets. Of course, if the Democrats also take the Senate, then I would be worried for the markets because the impeachment uncertainty would only be good for volatility traders.

So onto Q4. Let’s first see how the market reacts to third quarter earnings which will start trickling in next week. On the trade front, NAFTA was settled last night which was a good thing. Now let’s hope for progress on the Chinese talks to give companies some better talking points for their earning’s calls. Giddy-up!

To receive this weekly briefing directly to your inbox, subscribe now.

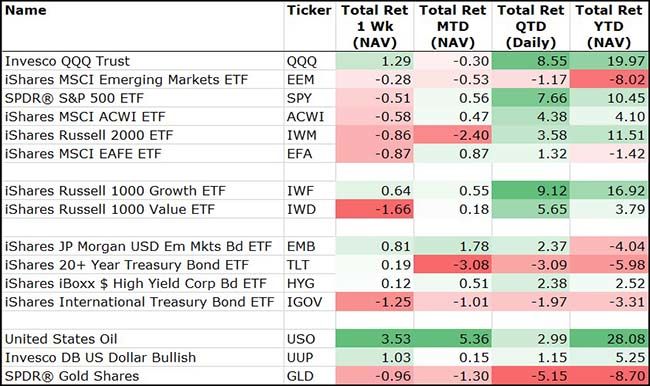

End of the week, month, 3rd quarter and oil and the Nasdaq are crushing it…

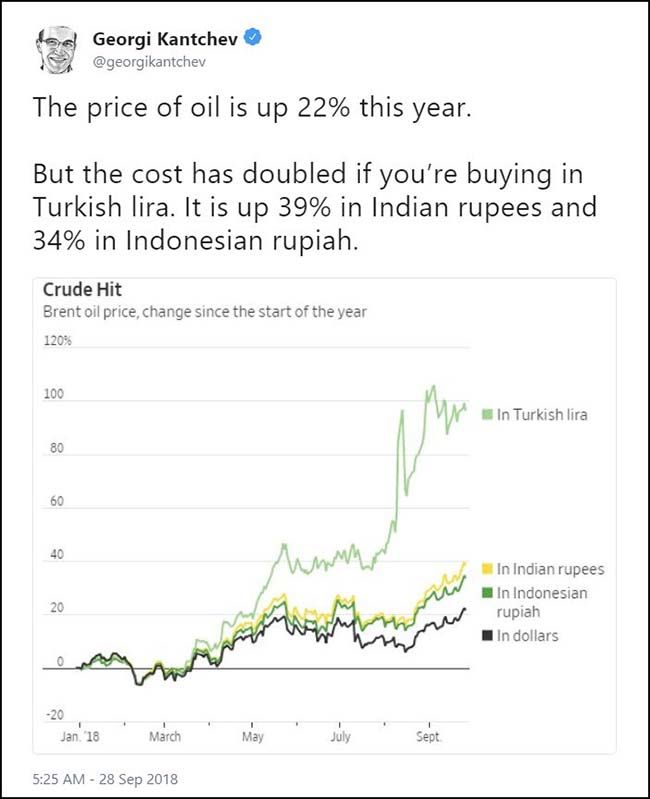

At the other end of the performance spectrum are the Emerging Markets…

Which are very tough to get excited about until oil prices and the U.S. Dollar take a breather.

If you are looking for a foreign market which is outperforming, look to the land of the rising sun…

@jsblokland: Chart of the day! #Nikkei index closes at at highest level in 27(!) years.

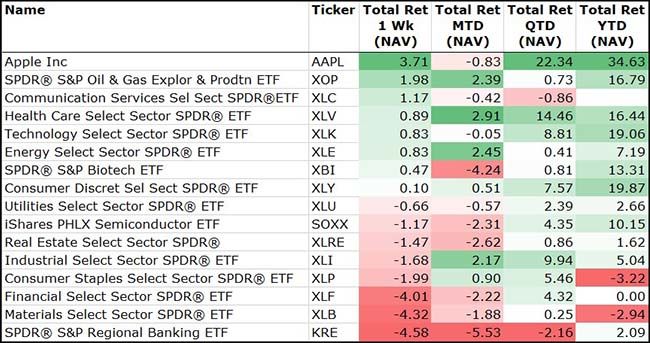

Plenty of dispersion among the U.S. equity sectors…

Tech, Healthcare and Consumer Discretionary continue to lead. Banks and Materials lag.

Another sign of diverse returns among U.S> equities…

New highs in the market last week, but new lows in breadth. Interesting…

@AndrewThrasher: Another new low in relative performance for equal weight vs. cap weight S&P 500 yesterday.

Two important big picture pieces to read this weekend. The first from Martin Feldstein…

As short- and long-term interest rates normalize, equity prices are also likely to return to historic price-to-earnings ratios. If the P/E ratio of the S&P 500 regresses to its historical average, 40% below today’s level, $10 trillion of household wealth would be wiped out. The past relationship between household wealth and consumer spending suggests such a decline would reduce annual spending by about $400 billion, shrinking gross domestic product by 2%. Add in the effects on business investment, and this spending crunch would push the economy into recession.

Most recessions are short and shallow, with an average of less than a year between the start of the downturn and the beginning of the recovery. That’s because the Fed usually responds to recessions by cutting the federal-funds rate substantially. But if one hits in the next few years, the Fed will not have enough room to cut rates, as the fed-funds rate is expected to rise to only 3% by 2020. There also won’t be much room for a major fiscal intervention. Federal deficits are expected to exceed $1 trillion annually in the coming years, and publicly held federal debt is predicted to rise from 75% of GDP to nearly 100% by the decade’s end.

(WSJ)

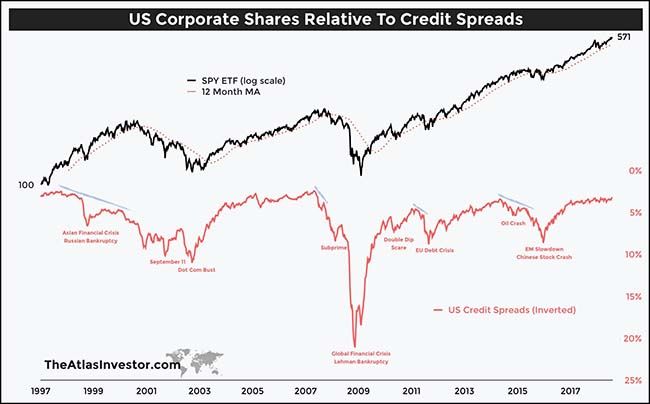

And the second from Howard Marks…

You have to pay attention to Howard because he is first a credit investor, and the heads up that you get from the credit markets will make or break your long-term performance stream…

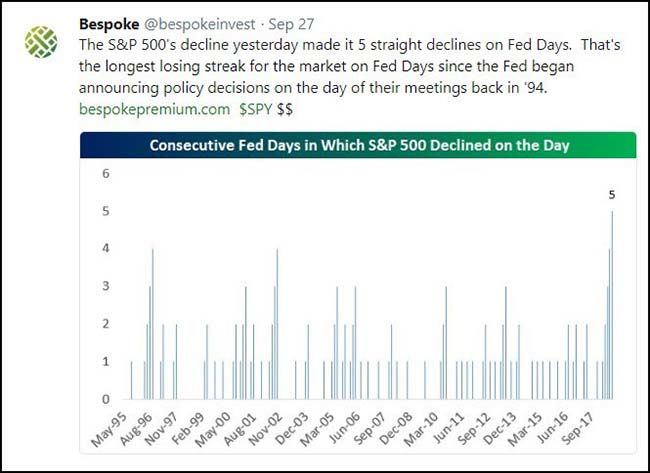

So the market now hates Fed Days…

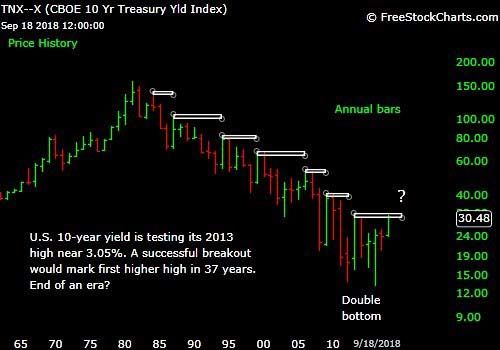

Could this be the first higher high in interest rates in 37 years?

(@mark_ungewitter)

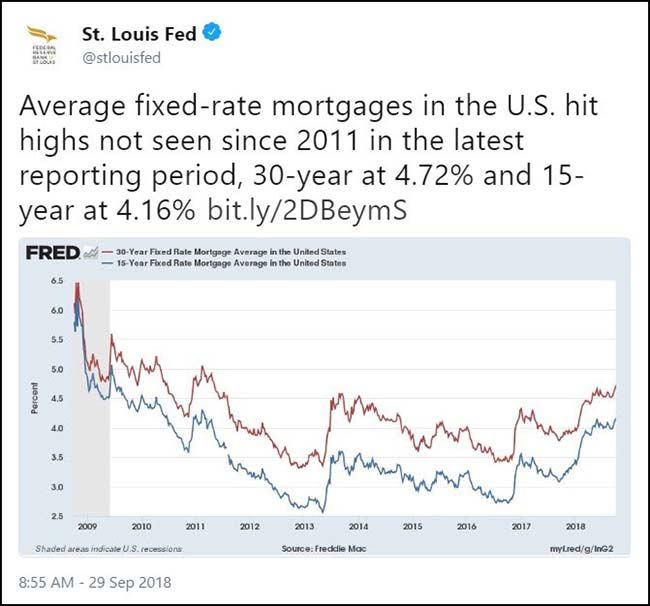

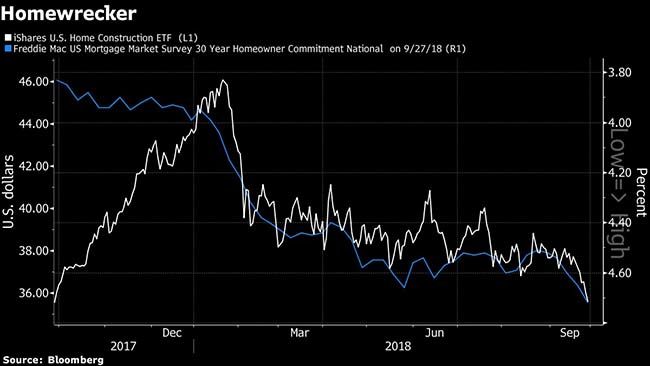

The St. Louis Fed would like to remind you that mortgage rates have not been this high in seven years…

And as mortgage rates move higher, Housing stocks move lower…

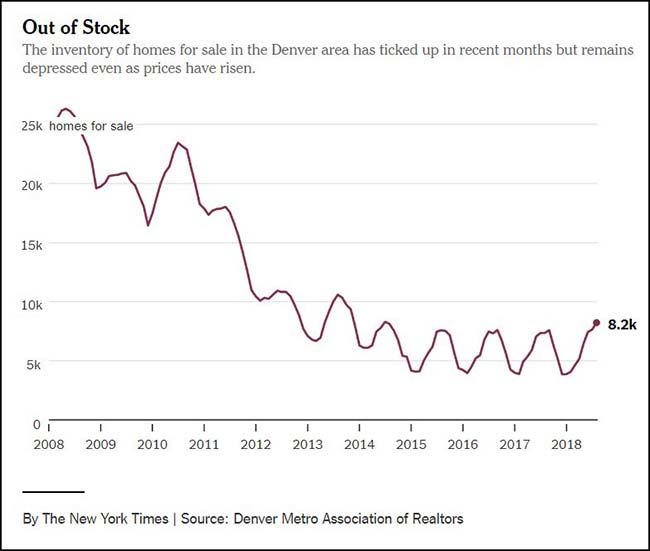

Speaking of homes, Denver’s topping housing market gets ink in this weekend’s New York Times…

Tariffs benefit U.S. raw materials producers because they can raise prices without driving customers to foreign competitors, said Scott Mills, president of Smith Brothers Pushrods in Redmond, which makes after-¬market parts for drag racing and other vehicles.

DENVER — By nearly any measure, this city is booming. The unemployment rate is below 3 percent. There is so much construction that a local newspaper started a “crane watch” feature. Seemingly every week brings headlines about companies bringing high-paying jobs to the area.

Yet, Denver’s once-soaring housing market has run into turbulence. Sales and construction activity have slowed in recent months. Houses that would once have drawn a frenzy of offers are sitting on the market for days or weeks. Selling prices are rising more slowly, and asking prices are being slashed to attract buyers.

Similar slowdowns have hit New York, Seattle and even San Francisco, cities that until recently ranked among the nation’s hottest housing markets. The specifics vary, but economists, real estate agents and home builders say the core issue is the same: Home buyers are reaching a breaking point after years of breakneck price increases that far exceeded income gains.

“The local economy is still fantastic, all the fundamentals are there, but obviously wages are not keeping pace,” said Steve Danyliw, a Denver realtor. “As the market continues to move up, buyers are being pushed out.”

(NY Times)

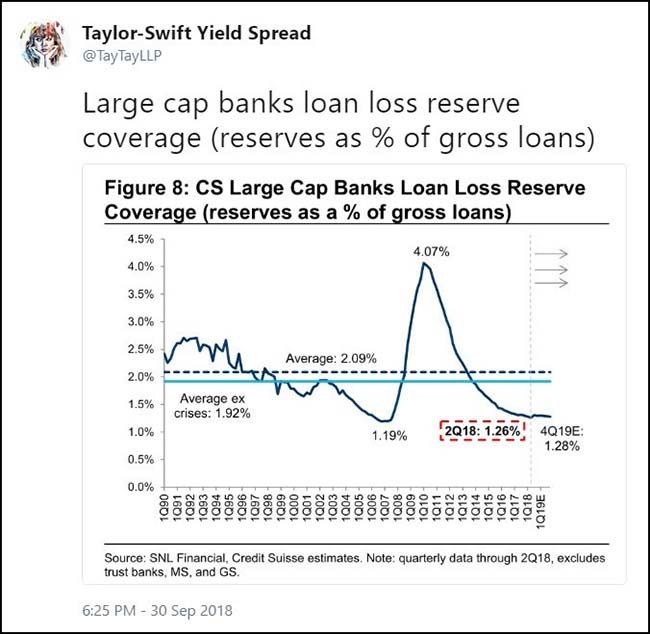

So, you just don’t want to be overweight bank stocks at this point in the cycle…

If you want to make a lot of money in bank stocks, you will make it when their bad loans are going from worst to better. Think 1991-1999, 2002-2006 and 2011-2017. You can see these time frames on the below chart as to when the Loan Loss Reserve Coverage line was in decline. It is not going to get much better from here. World growth is slowing, credit is easy to get and losses are going to begin to rise. The worst losses may not happen at banks but instead inside of less regulated loan portfolios. But they are going to rise for everyone as a whole. So just go look into other areas of your Equity book for outperformance potential because it won’t be in the banks.

The big head scratcher has been the continued strength in junk bonds…

If and when this breaks, then we will have certain worries to follow. (Right now would be a good time to go back and re-read the Howard Marks article.)

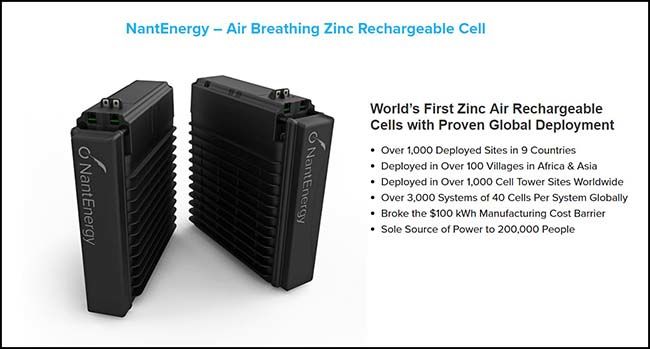

The owner of the L.A. Lakers might have cracked the new battery technology puzzle…

NantEnergy, based in Phoenix and in El Segundo, Calif., says it expects to expand the use of its product in telecommunications towers and eventually extend it to home energy storage, beginning in California and New York. Beyond that, it anticipates use in electric cars, buses, trains and scooters.Dr. Soon-Shiong, who recently acquired The Los Angeles Times and is a part owner of the Los Angeles Lakers, made a fortune from the development of drugs to fight diabetes and breast cancer and the sale of pharmaceutical companies he had created.

His energy company says it is the first to commercialize the use of zinc air batteries and has more than 100 related patents. It is taking orders for delivery next year and sees the potential for a $50 billion market.

Dr. Soon-Shiong said the cost of his zinc air battery had dropped steadily since development began. NantEnergy says the technology costs less than $100 per kilowatt-hour, a figure that some in the energy industry have cited as low enough to transform the electric grid into a round-the-clock carbon-free system.

(NY Times)

Copyright © 361 Capital