by Fred Alger and Company

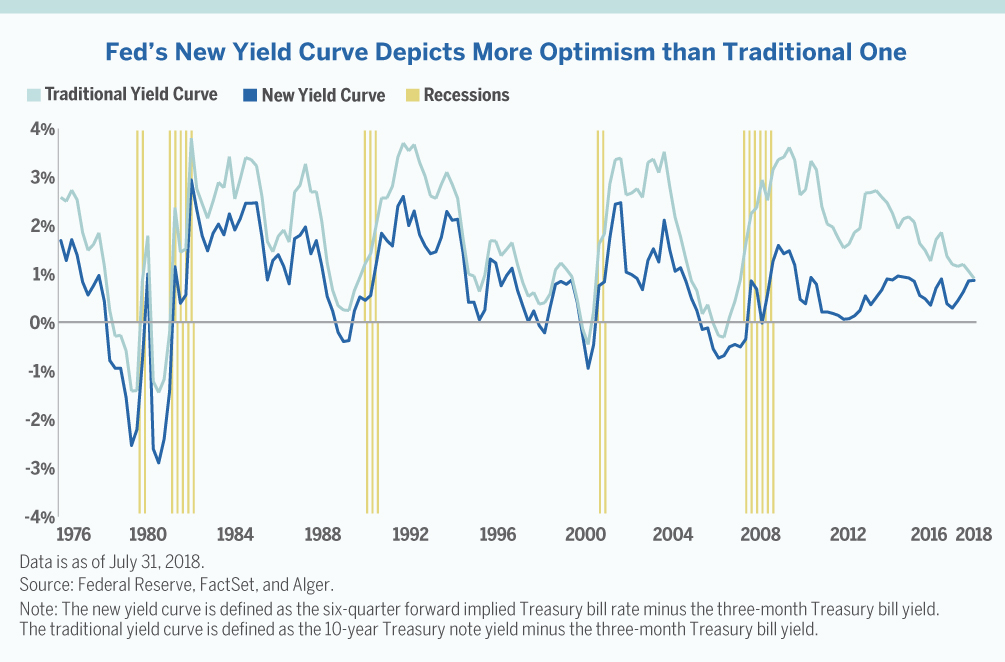

The yield curve has a strong track record of predicting recessions. However, recently the Federal Reserve published a paper that shows a shorter term yield curve is a more accurate forecaster of recessions than the traditional yield curve. Interestingly, the short-term yield curve tells a different story than the traditional one.

- The traditional yield curve contains signals about the fixed income market’s outlook on interest rates. When the curve is flatter, the market is less bullish on medium-term interest rates relative to current rates, implying a less positive view of growth over the intermediate term or the possibility of recession. However, global monetary policy and other factors may be distorting mid-to-long-term yields and therefore this metric.

- According to the Fed, a shorter term curve may serve as a better “proxy for market expectations of Federal Reserve policy.” When negative, it indicates the market is anticipating the federal funds rate to decline because of a recession, and when positive it indicates the expectation of a rising federal funds rate because of strong growth.

- Unlike the traditional longer term yield curve, the shorter term curve has not been trending down and is less indicative of a recession. In our view, it implies approximately less than a 15% chance of recession in the next few quarters. This new yield curve may not signal a curve in the road of investing; slowing down may be unnecessary.