by Jeffrey Saut, Chief Investment Strategist, Raymond James

The Endless Summer (1966) is the crown jewel to ten years of Bruce Brown surfing documentaries. Brown follows two young surfers around the world in search of the perfect wave, and ends up finding quite a few in addition to some colorful local characters (Endless Summer). Well, summer has officially ended with the Labor Day celebration. Traditionally, for Americans it marks a change in attitudes and latitudes, from leisure, play and vacation, to work, school, and more serious attitudes. With the entrance of fall comes September and October.

While October is considered to be the “cruelest” month for investors, September is actually the worse month statistically for the stock market. That said, October has been the most spectacular with two crashes, the end of the 1990 bear market, the “Crashette” of 1989, and a few nasty setbacks in the 1970s. We reflected on the endless summer on our recent six hour plane ride from San Francisco. Our problem was that we were sitting next to a person who did not bring any reading material. All he wanted to do was talk.

In a bar, or other situations, we are always able to get up and move to another location, but on a plane you are trapped. Normally, when confronted by someone who is interested in talking, and asks us what we do, we tell them we are auditors for the IRS and that usually ends the conversation. Failing that, we revert to writing and tell our inquisitor we have a deadline and cannot talk. Thus defensive writing was invented.

During the plane ride we also recalled some comments from our departed friend, Ray Devoe, who was considered to be one of the best writers, and best strategists, on Wall Street. It was back in 1997 that Ray wrote:

Against the Gods by Peter Bernstein is probably the most difficult books I have ever read. Not that the style or content makes it hard to read, but so many points made by Peter got me thinking extensively and then writing out lengthy notes to myself about the points he made. Perhaps “difficult” is not appropriate – if “time consuming,” “provocative,” and “thought inducing” could be rolled into one phrase that might do it. Throughout the book he makes the point that risk cannot be avoided, only shifted. This is not a book that “New Era” investors would enjoy. One quotation that every new investor should keep in mind is, “At the extremes, the stock market is more likely to destroy fortunes than make them. The stock market can be a risky place if one does not manage risk.” This will come as heresy to those who believe that 1) the only risk is being out of the market and/or 2) there is no risk in stocks held over the longer term, only short-term volatility.

The book states unequivocally that individuals are risk adverse financially. They will always attempt to avoid risk WHEN THEY ARE AWARE THAT RISKS EXSIST. His conclusion is that “Losses will always loom larger than gains,” which has been reinforced by behavioral scientists. The public may have one attitude about pain when paper profits are being eroded, but when actual losses are incurred the pain can become physical. I know this from personal experience. Steve Leuthold’s “Perception for the Professional” cites financial behaviorists Amos Tversky and Daniel Kahneman, who have estimated that the pain of losses is over three times as great as the pleasure from gains.

We revisit Ray Devoe’s sage writings this morning because we continue to stress how important it is to “manage risk.” We emphasized this point following the Dow Theory “sell signal” of September 23, 1999, and again with the Dow Theory “sell signal” of November 21, 2007.

Most recently, we advised that trading types raise some cash in January of this year and then put that trading capital back to work in early February after the ~10% decline. Further, last Tuesday we wrote:

It would not surprise to see the S&P 500 stall around the 2900 level, but eventually it is going to poke through 2900 and travel above 3000, which we have said repeatedly was going to happen in these missives since the February 9th undercut low. And, while the short-term market energy has been used up, there is still plenty of intermediate “internal energy” built up to power things higher.

Yet last week the equity markets did indeed “stall” and our sense is the “energy mix” is likely going to continue to keep the equity markets in stall-mode for the near term. However, since the February 9th low (2532) the S&P 500 (SPX/2901.52) has not stalled, crashed, or even stayed range-bound. Indeed, since that February low the SPX has gained some 15%, but the gains do not stop there.

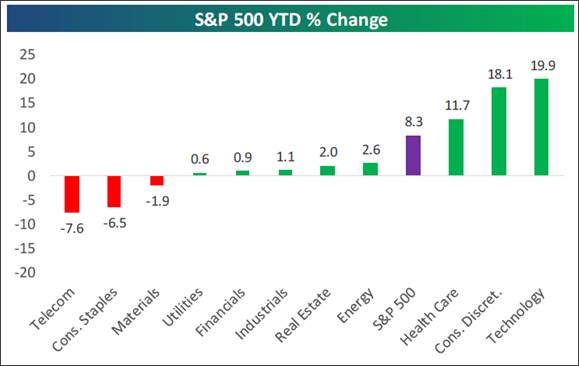

The technology sector has advanced 19.9% YTD, the consumer discretionary space has improved by 18.1%, and healthcare is better by 11.7%. Those have been our favored sectors, but alas our other favored sector, namely the financials, has lagged (+0.9%), which is a real surprise because the financials are just plain “cheap” (Chart 1). To reiterate, the way we suggest investing in said group is through the David Ellison funds (Hennessy Financial Funds) and Anton Schultz (RMB Financial Services Fund). Of course the sectors we have shunned, telecom, consumer staples, and utilities, have materially underperformed (Chart 2).

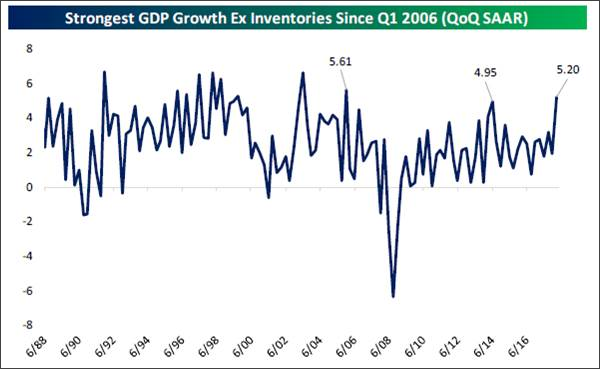

Also of note is that the SPX just had its best summer (May – August) since the March 2009 lows with a gain of 9.25% and we have been bullish. Moreover history shows that when the SPX is up 5%+ through August, the scary month of September has shown a positive return (Chart 2). Interestingly, with the SPX breaking out to new all-time highs, the stock market’s valuations are actually contracting. Given the excellent technical and fundamental conditions (Chart 3) it is tough not to be bullish! As we tend to do during earnings season, we screen for companies that beat on earnings and revenue estimates and raise forward guidance.

They also must carry a positive rating from our fundamental analysts and screen well using our proprietary models. Two such names are: Analog Devices (ADI/$98.85/Outperform) and Splunk (SPLK/$128.15/Outperform). Another article we perused during our six hour flight noted, “Some 16.5 million passengers are expected to fly on U.S. airlines in the week-long Labor Day travel period, which started last Wednesday and runs through today.” That quip piqued our interest and caused us to look at the charts of the Raymond James’ airline research universe of stocks. The name that jumped out at us was Alaska Air (ALK/$67.49/Strong Buy), which is breaking out to the upside in the charts and has just turned green on our proprietary model (Chart 4).

The call for this week: Given the softer short-term internal “energy mix” it would be surprising if the SPX can initially vault above the 2930 – 2935 level immediately. Longer term, however, the energy mix is wildly bullish. Last week ALL of the Advance-Decline Lines we monitor registered new all-time highs; and, as the astute Lowry Research organization writes:

The balance of Supply and Demand remains positive, with the percentage spread between Buying Power and Selling Pressure reaching 31.1% this week, one of the most positive readings of the year and far above the 20.9% positive spread that accompanied the Jan. 26th high in the S&P 500. Thus, in terms of the key measures of Supply and Demand, this bull market remains healthy and with little of the evidence that typically precedes the formation of a major market top.

This morning the preopening S&P 500 futures are flat as DJT takes aim at Chapter 19 of NAFTA.

Chart 1

Source: Bespoke Investment Group

Chart 2

Source: Bespoke Investment Group

Chart 3

Source: Bespoke Investment Group

Chart 4

Source: Eikon

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Copyright © Raymond James