Even though it’s been around since the 1950s, factor investing is only just now gaining a toehold in the portfolios of some of Canada’s most sophisticated pension portfolios. As that happens, plan sponsors can gain a new window into asset allocation to better understand how their portfolios work in different market conditions.

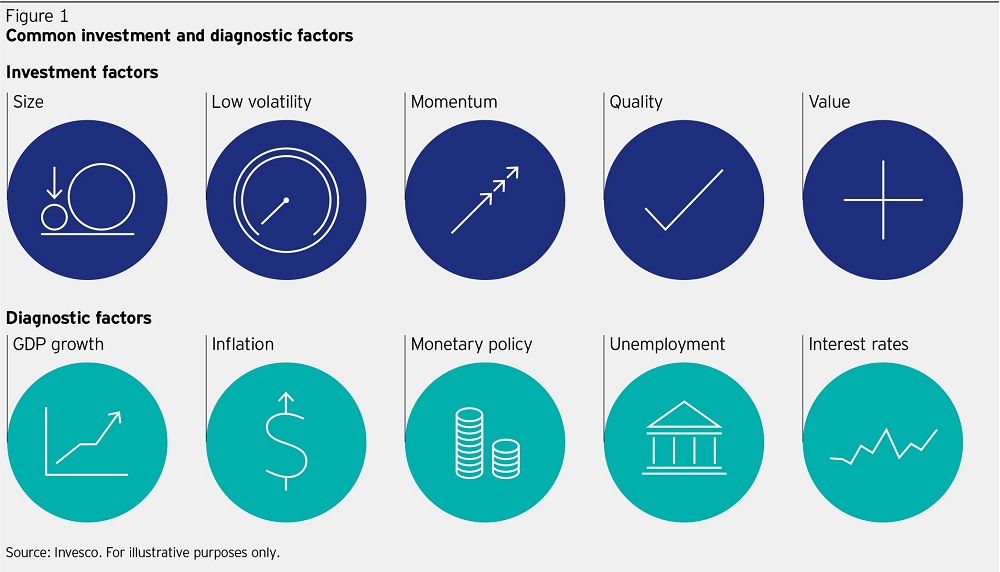

Factor investing itself is a systematic, evidence-based approach that targets specific characteristics of an asset, such as, value, momentum, quality, low volatility, and size. Academics have monitored these factors for decades and there are literally volumes of data on how each factor performs at different stages of the economic cycle and during different market conditions.

To understand the growing role factor investing now has in today’s pension portfolios, we’ve broken down the key findings from a new article by Stephen Quance, “Factor investing: the third pillar of investing alongside active and passive.” The paper examines the relationship between active and passive investing and why using factor investing could mark a permanent shift in asset management as we know it.

Here are his top 3 things to know about factors and how they are helping investors create better, more resilient portfolios:

It’s not about active vs. passive

Trying to fit factor investing into the active-passive discussion misses the point. Factor investing can and should be viewed as a completely different portfolio component, a so-called third pillar which, alongside market-cap weighted indexing and alpha strategies, allows investors to truly understand where their risks and returns are coming from.

A better understanding of risk and returns

Applying historically observed security performance and deploying factor-specific strategies gives investors a much more sophisticated level of understanding of how and why their portfolios move the way they do. By monitoring factors in a portfolio, investors gain an immediate and data-driven perspective based on how assets behave under conditions such as inflation, the economic cycle, or rising interest rates.

At the same time, factor-based investing draws on rigorous academic research that strengthens understanding of factor exposures and their relationship to historically observed security returns. Although investors have in the past tended to focus mainly on asset classes and sectors to create portfolios, factors help make the connection between those assets and the risks and opportunities in the investment environment. In this way, factors are a powerful framework for making asset allocation decisions based on specific diagnostic criteria (Figure 1).

Factors improve asset allocation

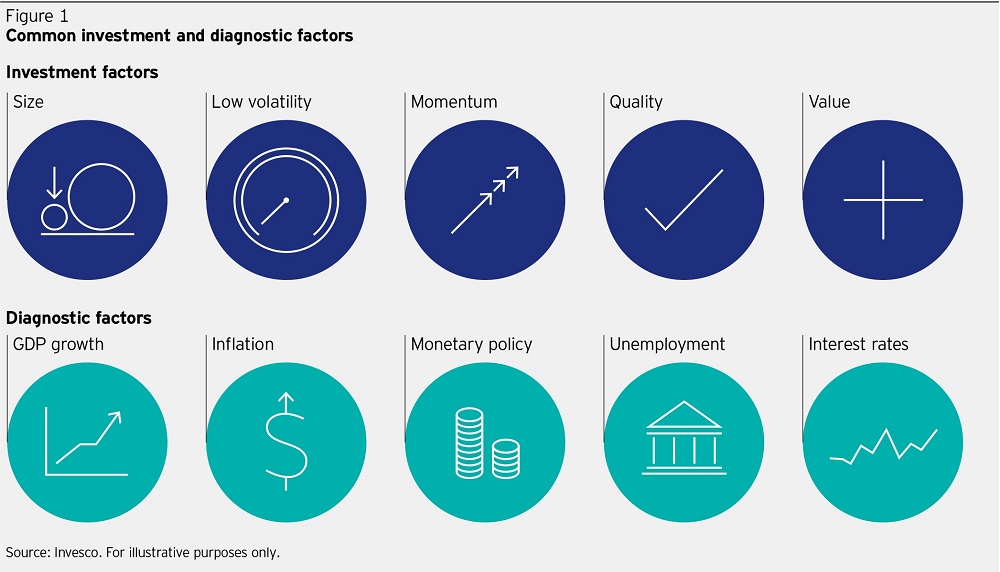

While passive investing reflects aggregate market performance and active investing is based on beating a benchmark, allocating to factors allows investors to build and monitor portfolios based on the long-established return patterns associated with factors. Investors can leverage three specific factor rationales that link performance to the premium or risk associated with each one – risk, behavioural and market structure (Figure 2).

These three sources of risk can be tied to a specific investors’ risk tolerance and objectives to create a customized portfolio. That makes it distinct from active and passive investing and it allows investors to customize portfolios based on individual needs and preferences.

This distinction is key. It means that factors aren’t just about active or passive investing. Rather, they should be considered a “third pillar” of investing.

Read the full paper here.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog