by Gershon Distenfeld, Director, High Yield, AllianceBernstein

US investment-grade corporate bonds look cheaper today than their lower-quality counterparts in the high-yield market. Is this the buying opportunity of a lifetime? Not exactly. A closer look reveals there’s actually method to the madness.

Both investment-grade and high-yield corporate bond valuations have declined somewhat in recent years. That’s not unusual. The US is in the late stages of a decade-long credit cycle. Interest rates are rising. At some point, rates will rise high enough to cool down the economy, reducing corporate profits.

Here’s something that is unusual: investment-grade bonds have cheapened more than high-yield ones. Usually, market stress or changing credit conditions show up in the high-yield market first. High-yield companies have more debt relative to income and higher business risk, which makes them more likely to default when growth slows.

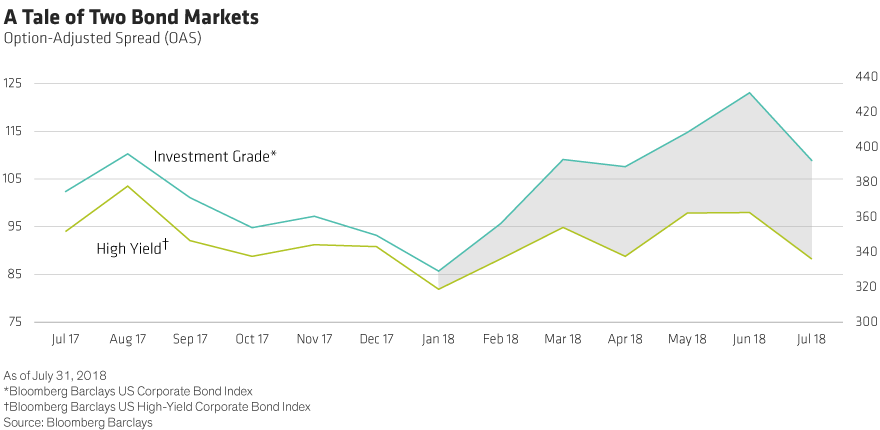

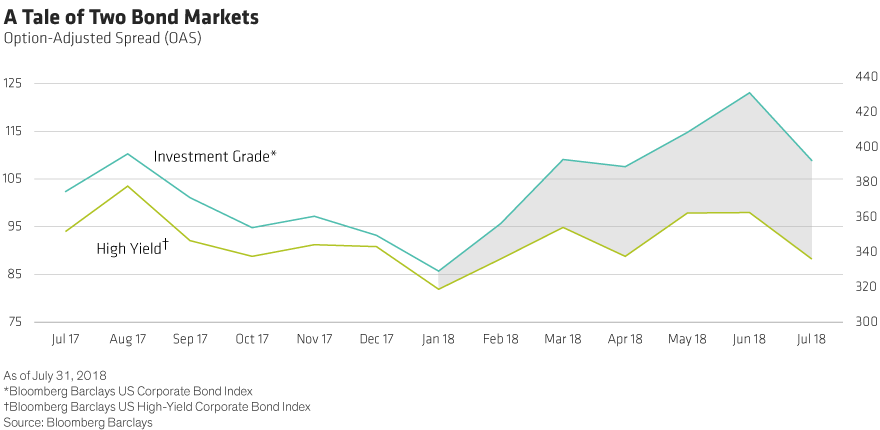

But since January, the average option-adjusted spread (OAS) for US investment-grade bonds has risen 27%, while the OAS in the US high-yield market is just 5% higher (Display). OAS measures the extra yield that investors get over comparable government debt for taking on the credit risk of a corporate bond.

A Tale of Two Corporate Bond Markets

What’s going on? We think it has a lot to do with how the last credit cycle ended. The 2008 financial crisis posed the biggest threat to the global economy since the Great Depression. The Federal Reserve responded by slashing interest rates to record lows and pumping liquidity into the financial system.

With the cost of capital so low, many investment-grade companies that would normally have used the recession as a time to reduce debt and clean up their balance sheets decided to take on more leverage. This was especially so for companies in the food-and-beverage and technology sectors whose business models were facing disruption. The cost of debt was cheap, so many opted took more leverage to pivot their business models and “buy” growth through mergers and acquisitions. Leverage metrics became stretched beyond what they had typically been for companies at the low end of the investment-grade ratings scale.

High-yield issuers, who had higher debt levels and more business risk when the crisis hit, had to retrench. As a result, the average leverage ratio in the US high-yield market has increased more slowly than it has in the US investment-grade market (though both are at their highest point since the start of the current credit cycle).

This is reflected in average credit quality, which improved in the high-yield market. At the end of 2008, CCC-rated junk bonds accounted for 19.5% of the US high-yield market. By July 31, 2018, their share had slipped to about 13.5%. Over the same period, BB-rated bonds—the highest-quality high-yield bonds—rose from 38% to more than 43%.

But investment-grade credit quality got worse. Today, 48% of the bonds in the index are rated BBB, the lowest rung on the investment-grade ladder, up from 33% at the end of 2008. A-rated bonds declined from 50% to 41% over that time.

While rates were low, this didn’t matter much. The cost of raising capital for BBB-rated companies was only marginally higher than that for A-rated ones. But things are different now. The Fed is raising rates and slowly draining the trillions of dollars it spent the last decade injecting into the financial system. Because of their higher leverage ratios, many investment-grade issuers look more vulnerable to rising rates and slower growth than they have in the late stages of prior credit cycles. Market participants are reacting rationally by pricing in more risk.

Some high-yield issuers will struggle in a tighter credit environment, too. But the broad high-yield market looks relatively healthy, which we think explains why it has held its own despite this year’s market volatility.

The High Cost of Currency Hedging

Fed tightening may also start to drive away some non-US investors. Frustrated by abnormally low bond yields at home, many European and Japanese buyers in recent years have gravitated to US bonds for their higher yields. But to reduce volatility, most hedge out the currency exposure. This involves selling the cash rate of the currency you’re hedging from—in this case, the dollar—and buying the cash rate of the currency you’re hedging to (euros or yen).

Hedging was a minor expense when US short-term rates were only marginally higher than those in Europe and Japan. But seven Fed rate hikes since late 2015 have widened interest-rate differentials, making hedging costlier. As of August 13, a European investor who wanted to hedge his dollar-denominated investment into euros would have had to shoulder an annual cost of 2.81%. The cost was similar for Japanese investors. That can wipe out most of the yield advantage.

Know What Makes Your Markets Tick

Does this mean high-yield corporates are more attractive than investment-grade? No. We see value in both markets.

In the investment-grade universe, it’s important to note that not all BBB-rated securities fall into the same basket. We still see opportunities, particularly in cyclical sectors such as energy and mining that did use the last recession to clean up their balance sheets and lower their cost structure.

But we expect some BBB credits to get downgraded to junk status when the cycle turns. That’s why it’s important for investors and their managers to do their homework before deciding where to invest.

An active approach can also pay off in the high-yield market. Take “fallen angels”—the market term for bonds that slide from investment-grade to high-yield. These can hurt returns for investors who own them at the time of a downgrade. But as we saw a few years ago with a wave of energy company downgrades, these securities often overshoot, with spreads widening more than their credit fundamentals suggest they should. Investors who can recognize the mispricing may be in a position to benefit when these credits rebound.

Making sound investment decisions means understanding the factors and credit metrics driving a given market at a given time. Investment-grade corporate bond spreads have widened for good reasons. Investors who don’t understand them may overreact. Those who do understand them are more likely to ferret out the market’s most attractive opportunities.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein