As the dog days of August arrive, world stock markets find themselves at a potential turning point. Historically, the middle of August through the middle of October has been the weakest and most volatile season for stock markets.

Back in May and June, stocks were rattled by concerns over growing trade tensions between the US and China, Canada and other countries. Positive earnings over the last month gave stocks in the US a reprieve but now that earnings season is winding down, uncertainty and volatility have emerged.

The headlines of the last week have been dominated by growing tensions between the US and Turkey that has led to a crash in the Turkish Lira. While Turkey itself is not a major player in the global economy or financial markets, it’s troubles have spooked some investors who remember past times when problems in smaller countries like Iceland and Thailand have been the lead domino in a global contagion. This is why such a big deal has been made of Greece’s debt problems over the last decade.

As the week has progressed, focus has turned back to the biggest players in the global trade war, the US and China. Chinese retail sales, industrial production and foreign investment growth were all disappointing last month, while the latest readings on US retail sales, Empire State Manufacturing and productivity were all better than expected. With US midterm elections coming this fall and data suggesting the US is winning in its trade war against China, at this point it appears President Trump is more likely to increase pressure on US trade partners than declare victory and negotiate.

Chinese stock markets and other markets sensitive to China like copper have been under pressure through the summer and continue to decline. A miss on earnings by internet giant Tencent has also been weighing on sentiment toward China. Turkey’s troubles and signs of stress outside of North America have European indices like the FTSE and Dax in decline as well. At the moment, the US is looking like an island of stability in terms of both economic and stock market performance, but one has to wonder how long that can last in an environment of increasing global headwinds.

In this week’s issue of Equity Leaders Weekly we look at the Hang Seng as an indicator of sentiment toward China. We also investigate why Gold, traditionally viewed as a haven for capital in times of turmoil, has been falling rather than rising in this uncertain and volatile environment.

Hang Seng Continuous Contract (HS.F)

Through the spring the Hang Seng ran into significant resistance near 31,650. In June, the index started to turn downward, but after taking out a support line near 30,100 the bottom has really fallen out from under it. In recent weeks, the index has plunged down below 30,000, then 29,225 which completed a bearish Spread Triple Top, and on under 28,000. Next potential support may appear near 26,200 or 25,425 on trend. Initial rebound resistance may appear near 28,935.

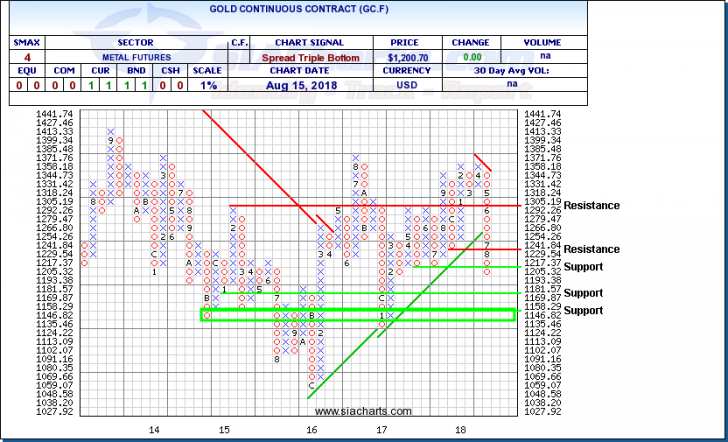

Gold Continuous Contract (GC.F)

Historically, gold has acted as a store of value, attracting capital in times of political, economic, and financial turmoil, and rising inflation. Despite growing trade war threats and signs of increasing headline inflation in recent months, gold has been under distribution during a time when one would have historically expected gold to be rising.

Back in June, gold broke an uptrend support line near $1,260 signalling a downturn that has continued with the completion of a bearish Spread Triple Bottom as $1,205 support failed. This week, gold has broken below $1,200 confirming ongoing selling pressure. Next potential support for gold appears near $1,180 then the $1,125 to $1,135 area.

There are a number of reasons that gold could be under pressure in the current environment. First, inflation pressures may be starting to ease. Crude oil’s advance has levelled off while grains and metals like copper have fallen off a cliff.

Second, as one of the few countries with a strong domestic economy and rising interest rates, the US has been attracting capital leaving risk markets for defensive havens, pushing up gold’s nemesis, the US Dollar.

Third, China has been a source of significant demand for physical gold and it’s possible that with China’s economy slowing and vulnerable to a trade war, investors may be anticipating that demand for physical gold could weaken.

Finally, coming off of a day where gold fell 1.5% against the US Dollar and silver fell 4.25% while Bitcoin gained 2.9%, one has to wonder if the emergence of cryptocurrencies as an alternative asset class may be taking some of the demand for assets outside the central banking system that previously would have sought out gold.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.