by Blaine Rollins, CFA, 361 Capital

Market worries grew faster than market comfort last week. While earnings on average were good and stocks were better rewarded, most of us went home Friday feeling a bit worse for the wear. Global interest rates continued to move higher due to inflation and upcoming Central Bank uncertainty. Growth stocks got whooped by value stocks leaving many to wonder if the rotation is finally here after 12 years of continued underperformance. It didn’t help that Facebook decided to poke its investors with a poisoned tipped lance. As increasing trade war comments ripple through the earnings call, little progress is being made in the global tariff talks. Meanwhile, the rest of the world continues to line up and trade around us. Shocked to find out that Brazil will be buying U.S. soybeans on the cheap to resell to China at a premium.

This is the last big week of earnings with about 30% of the S&P 500 reporting. Many Central Bank meetings; but the big one will be on Tuesday when the Bank of Japan makes their announced policy changes. And jobs data on Friday here in the U.S., which many will be watching for any signs of weakness. Hopefully the data and news flow will improve this week, otherwise we could probably start selling rocks to throw through some computer monitors.

To receive this weekly briefing directly to your inbox, subscribe now.

Some say that the U.S. had historic GDP growth last week…

@TBPInvictus: Just gonna leave this here. Y’all judge for yourselves.

But the forward-looking data points show that growth is slowing globally…

(WSJ/Daily Shot)

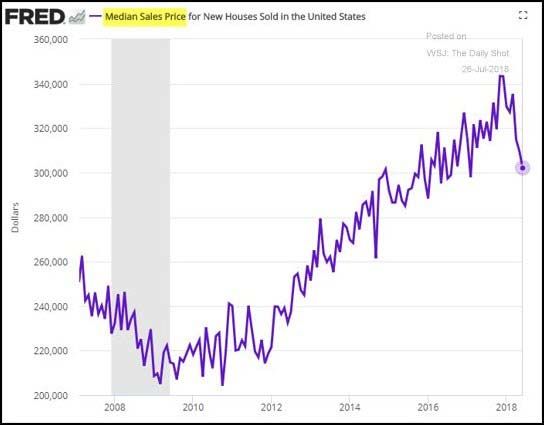

The summer housing slowdown is an increasing concern given how big a driver it is to the U.S. economy…

The U.S. housing market — particularly in cutthroat areas like Seattle, Silicon Valley and Austin, Texas — appears to be headed for the broadest slowdown in years. Buyers are getting squeezed by rising mortgage rates and by prices climbing about twice as fast as incomes, and there’s only so far they can stretch…

A slew of figures released this week gives ample evidence of at least a cooling.

Existing-home sales dropped in June for a third straight month. Purchases of new homes are at their slowest pace in eight months. Inventory, which plunged for years, has begun to grow again as buyers move to the sidelines, sapping the fuel for surging home values. Prices for existing homes climbed 6.4 percent in May, the smallest year-over-year gain since early 2017, and have gained the least over three months since 2012, according to the Federal Housing Finance Agency. Shares of PulteGroup Inc.fell as much as 4.9 percent Thursday morning after the national homebuilder reported that orders had declined 1 percent from a year earlier, blaming rising mortgage rates.

The slowdown is now impacting housing prices…

(WSJ/Daily Shot)

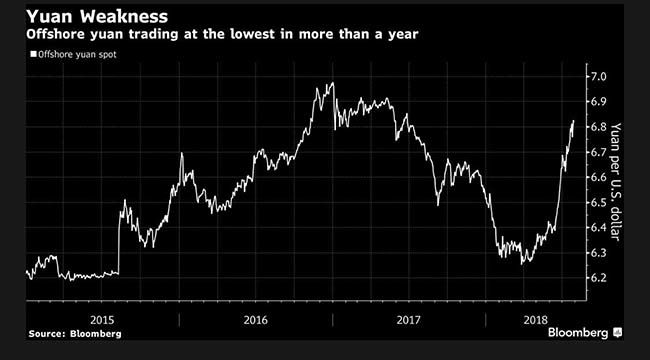

China continues to allow the Yuan to depreciate, which is great for their manufacturing economy…

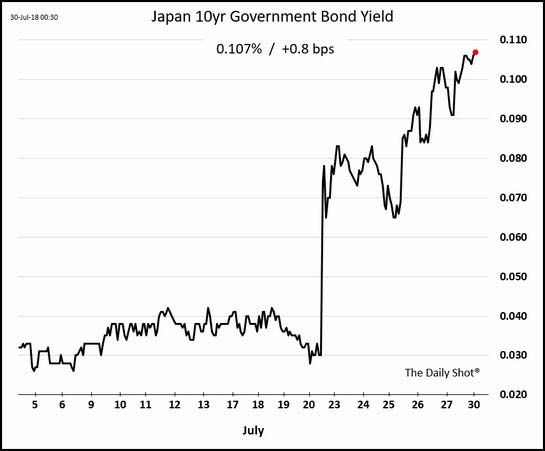

Big Bank of Japan decision on Tuesday…

Inflation is moving higher which could cause the BoJ to allow interest rates to follow.

Pay close attention to the Fed’s Bullard’s warning about the yield curve…

“There is a material risk of yield curve inversion over the forecast horizon (about 2 ½ years) if the FOMC continues on its present course,” James Bullard, President of the St. Louis Fed, said in a presentation delivered in Glasgow, Kentucky .* The Federal Open Market Committee has raised interest rates several times since December 2015, bringing official borrowing costs to a range of between 1.75% and 2%.

“Yield curve inversion is a naturally bearish signal for the economy,” Bullard said. “This deserves market and policymaker attention. The risks of yield curve inversion are best avoided by FOMC caution in raising the policy rate during 2018.”

You have to agree with Marty Feldstein here…

Raising interest rates now is the prudent thing to do to help protect from an even worse future recession.

But controlling inflation isn’t the primary reason for the Fed to keep raising the short-term interest rate. Rather, raising the rate when the economy is strong will give the Fed room to respond to the next economic downturn with a significant reduction.

That downturn is almost surely on its way. The likeliest cause would be a collapse in the high asset prices that have been created by the exceptionally relaxed monetary policy of the past decade.

It’s too late to avoid an asset bubble: Equity prices already have risen far above the historical trend. The price/earnings ratio of the S&P 500 is now more than 50% higher than the all-time average, sitting at a level reached only three times in the past century. Commercial real-estate prices also are extremely high by historical standards.

The inevitable return of these asset prices to their historical norms is likely to cause a sharp decline in household wealth and in the rate of investment in commercial real estate. If the P/E ratio returns to its historical average, the fall in share prices will amount to a $9 trillion loss across all U.S. households.

Large drops in household wealth are usually accompanied by declines in consumer spending equal to about 4% of the wealth drop. That rule of thumb implies that a $9 trillion drop in the value of equities would reduce consumer spending by about 2% of gross domestic product—enough to push the economy into recession. The fall in the value of commercial real estate would add to the decline of demand. And with consumer spending down sharply, businesses would cut back on their investment and hiring.

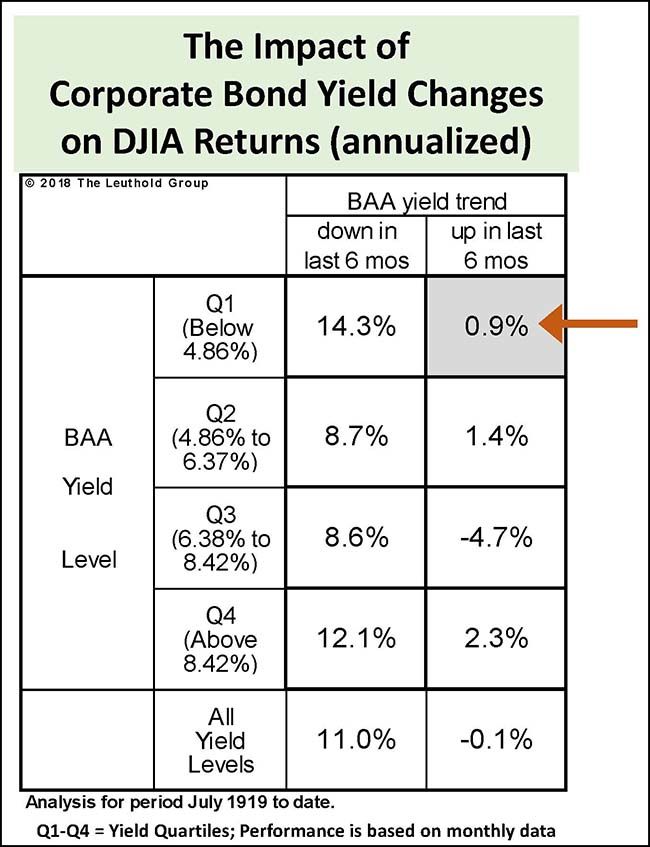

But maybe the big bottom line last week was that interest rates are moving higher globally, and that is not good for equities…

@LeutholdGroup: Rising #BondYields are a headwind for #stocks, regardless of yield level. Nearly 100 years of data shows that increasing rates, even from lowest quartile levels, is a hindrance for $DJIA returns.

Small Caps led the markets back to its highs. Ugh. What now?

Small Cap growth was the dagger last week with Tech and Biotech especially punished.

Value stocks haven’t had a two-year winning streak over Growth stocks since 2006…

Another busy week of earnings with almost 30% of the S&P 500 reporting…

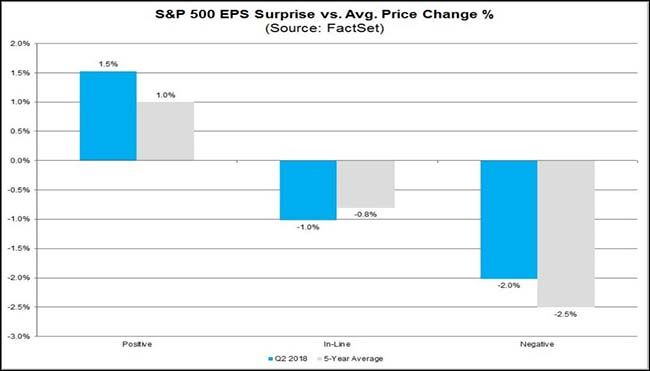

Last week was a much better one for Earnings reactions…

These numbers are much better across the board from last week’s data. So stock prices continue to be rewarded for better than expected bottom lines.

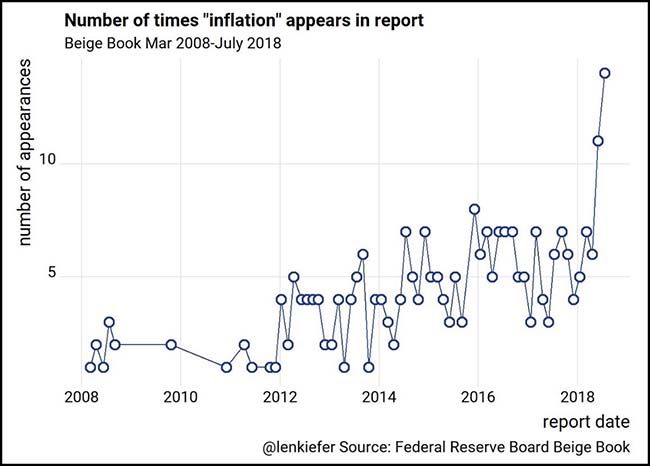

Companies across the board are talking about inflation on their earnings calls…

“Topic number one is inflation…you can’t pick up a newspaper without reading about it or turn on the news and hearing about it.” –WR Berkley CEO Robert Berkley (Insurance)

“We began this year expecting pressure from raw material prices and foreign exchange rates…The challenge has become significantly greater than we originally expected, and we believe it will continue in the second half of the year.” –General Motors CEO Mary Barra (Auto)

“freight, yes; plastic resins, yes; metal in all its various forms for many reasons, including tariffs. So there is some broad-based push on input costs that have kind of come in and affected us and many other industries as well. ” –Coca Cola CEO James Quincey (Beverage)

The Fed’s Beige Book has a disturbing trend appearing…

And inflation also posted a new higher high in Friday’s GDP data…

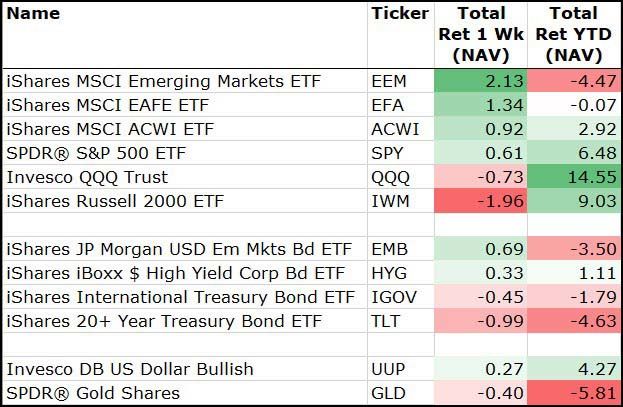

For the week, International Equities outperformed while Small Caps followed Bonds lower…

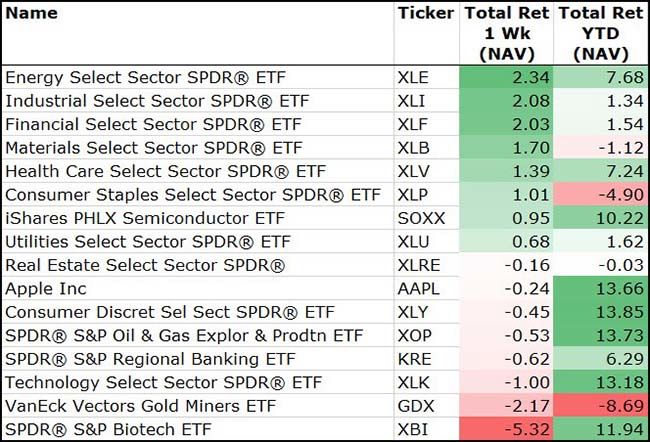

And risk-off among the Sectors as Growth areas like Biotech and Technology were significant underperformers…

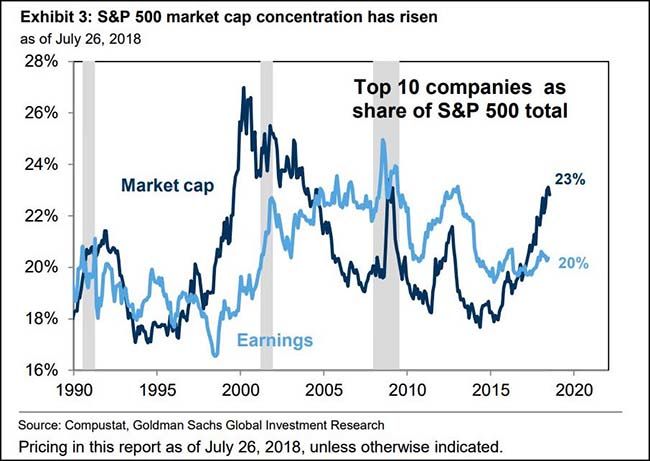

Watch this chart if FANG becomes a four letter word…

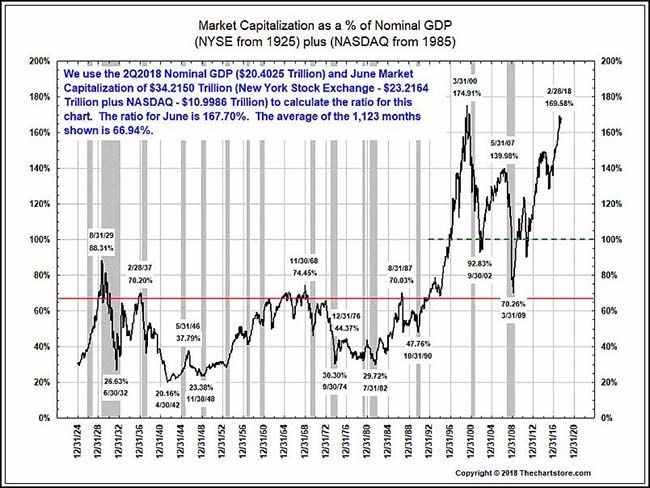

An updated “Buffet Indicator Chart”…

(@TheChartmeister)

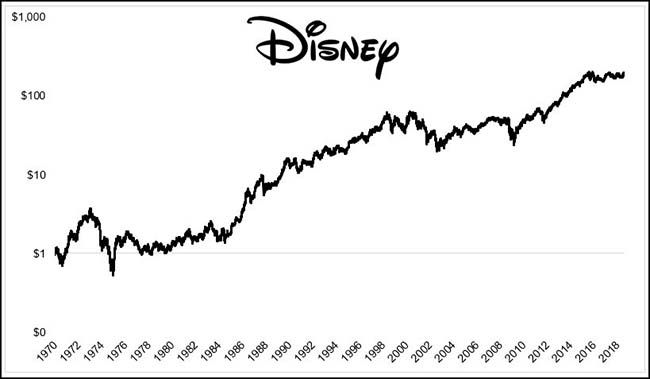

Wish I would have listened to my 3-year-old self and just bought Disney…

$1 invested in Disney in 1970 is now worth $197. $1 invested in the S&P 500 is worth $125, for comparison. The 19,500% return in Disney had plenty of bumps in the road. The stock lost 10% on a single day 11 times, including a 29% loss on October 19, 1987. Disney gained 11.5% for 48 years.

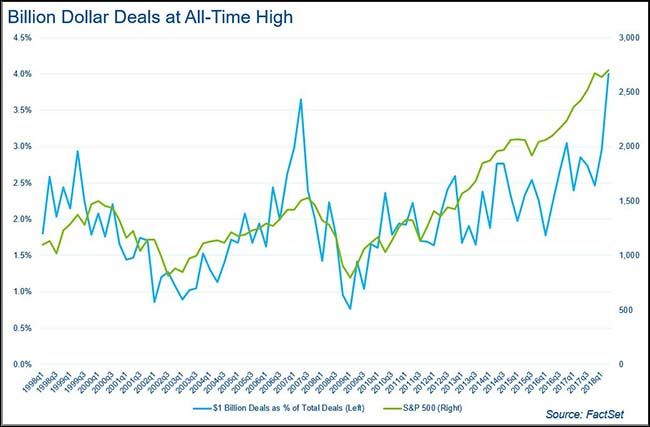

Oh great. Billion dollar deals again at a record high…

Now onto the global trade wars and tariff impacts. First up, BMW…

BMW will become the first big carmaker to raise prices on US-built vehicles exported to China as the global trade war starts to hit consumers.

The German luxury carmaker is responding to higher tariffs imposed by Beijing in retaliation against President Donald Trump’s duties on imported Chinese goods.

BMW is the US’s largest vehicle exporter to China by value, thanks to its popular sport utility vehicles made in Spartanburg, South Carolina — its biggest factory in the world. The plant exported more than 70 per cent of the 371,316 vehicles it produced last year.

As of Monday BMW will raise the prices of its X5 and X6 SUV models in China by 4 per cent and 7 per cent, respectively, the company said on Sunday, as it passed some of the costs from new tariffs to consumers.

CAT went out of its way to put a figure on the cost of trade tariffs…

Big exporter Caterpillar gave a figure on how much tariffs will affect its bottom line.

In its second-quarter earnings statement, the Dow Jones Industrial Average member said Monday it expects recently imposed tariffs to shave off $100 million to $200 million from its bottom line in the second half of the year…

So the higher tariff costs represent about 3 percent of the company’s expected full year profits.

Harley Davidson is doing all it can…

Harley-Davidson Inc. cut its forecast for profit margin this year by an amount that suggests it’s finding a way to cope with the damage done by President Donald Trump’s trade war.

Harley sped up shipments to the European Union to blunt the impact of higher tariffs that the bloc enacted last month. As a result of the tariffs, operating margin this year will drop to about 9.5 percent, the midpoint of a range the Milwaukee-based manufacturer gave in a statement Tuesday, compared with a previous projection of about 10 percent.

“We are doing everything we can as a company to absorb the costs that we can,” Chief Financial Officer John Olin said on the call. “We never contemplated moving our European volume out of the U.S. Consequently we’re analyzing the capacity options that we have, manufacturing costs, supply chain, logistics, in an effort to optimize it and to reduce and mitigate those tariffs.”…

And increasing worries over at Winnebago…

“We’ve had to go to the market a bit more frequently and a bit more aggressively with some price increases as of late,” said Michael Happe, chief executive of recreational-vehicle manufacturer Winnebago Industries Inc. Winnebago wouldn’t say how much it has raised prices, and said it has made changes such as modifying RV floor plans to trim costs…

But Mr. Happe said the tariffs, broader trade tensions and rising inflation are clouding the outlook for Winnebago. “Uncertainty is never a great thing for the economy and the more noise there is there’s a risk that consumers will press pause,” he said.

The oil drillers are getting drilled over the price of equipment…

Steel tariffs imposed by the Trump administration are driving a “fairly significant” increase in costs for oil-driller ConocoPhillips, the company said Thursday.

Prices for steel used in pipes, valve fittings and other equipment have risen 26 percent in the U.S. since the start of the year, Executive Vice President Al Hirshberg told analysts on a conference call. The Houston-based company raised its capital budget for the year by a half-billion dollars earlier in the day, partly due to rising costs.

“There’s been a significant move in the market,” Hirshberg said on the call. Conoco spends about $300 million a year on equipment affected by the tariffs, he said.

Expect to see farmers and pitchforks Washington D.C. soon…

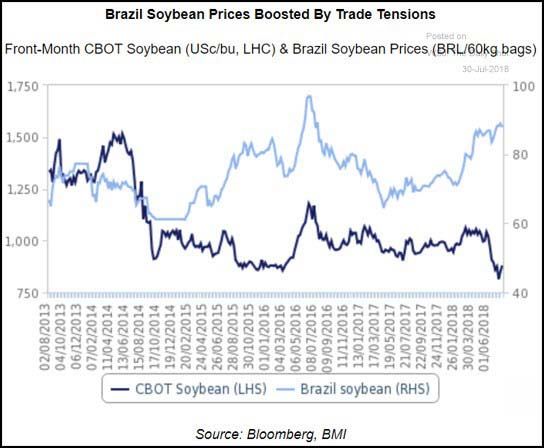

This is just crazy. Trade wars have pressured U.S. soybean prices to lows and Brazil prices to highs. So now the Brazilians are going to arbitrage the difference from buying U.S. soybeans to resell to others.

Brazil, the world’s biggest soybean exporter, may import as much as 1 million metric tons from its main rival in global sales in a twist of the topsy-turvy trade row between the U.S. and China.

As American soybean shipments to China ease, they’re being discounted. At the same time, rising demand for Brazilian beans has exports fetching a premium, leaving reduced supplies for domestic processors. That means some buyers in Brazil may need to rely on farmers in Iowa rather than Mato Grosso.

(WSJ/Daily Shot)

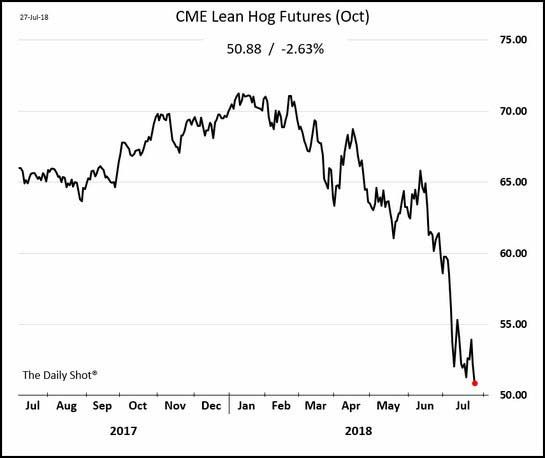

Trade wars have caused the U.S. meat freezers to fill to capacity…

Meat is piling up in U.S. cold-storage warehouses, fueled by a surge in supplies and trade disputes that are eroding demand.

Federal data, coming as early as Monday, are expected to show a record level of beef, pork, poultry and turkey being stockpiled in U.S. facilities, rising above 2.5 billion pounds, agricultural analysts said.

U.S. consumers’ appetite for meat is growing, but not fast enough to keep up with record production of hogs and chickens. That leaves the U.S. meat industry increasingly reliant on exports, but Mexico and China—among the largest foreign buyers of U.S. meat—have both set tariffs on U.S. pork products in response to U.S. tariffs on steel, aluminum and other goods. U.S. hams, chops and livers have become sharply more expensive in those markets, which is starting to slow sales, industry officials said.

And the “oversupply of protein” just caused Tyson Foods to lower their projected earnings by 10%…

Tyson Foods Inc.., the largest U.S.-based meat producer, said profit this year will be less than it previously forecast because of the country’s escalating trade dispute with major importers of agricultural products.

Both China and Mexico have imposed import tariffs on American pork recently in retaliation against U.S. duties on metal shipments. The measures have sent hog prices plunging, eroding the profitability at Tyson’s pork business. The Springdale, Arkansas-based company said Monday it’s also grappling with higher commodity-market volatility and “sluggish” domestic demand for chicken.

“The combination of changing global trade policies here and abroad, and the uncertainty of any resolution, have created a challenging market environment of increased volatility, lower prices and oversupply of protein,” Chief Executive Officer Tom Hayes said in a statement.

(WSJ/DailyShot)

About those promised soybean sales to Europe…

“On agriculture, I think we’ve been very clear on that—that agriculture is out of the scope of these discussions,” Mina Andreeva, the European Commission spokeswoman, told reporters in Brussels on Friday. “We are not negotiating about agricultural products,” added Ms. Andreeva, who was part of the European delegation visiting Washington earlier this week…

The U.S. side “heavily insisted to insert the whole field of agricultural products,” Mr. Juncker told reporters right after the meeting. “We refused that because I don’t have a mandate and that’s a very sensitive issue in Europe.”

Comments from a hog and soybean farmer in Illinois…

It could dramatically change the look of rural America, Kai. I mean, we’ve seen the six big commodities drop in value on an annualized basis $20 billion since the trade war began. That’s $20 billion with a B in a year that we were forecasting agriculture to have a net income of $60 billion. So you see what that means, and so if this continues on, this is not just potentially damaging to my own personal economy but to the economy of rural America.

Nut farmers in California getting crushed…

U.S. almond farmers are getting crunched from all sides as they head into what is likely to be a record harvest season.

Prices for California almonds have fallen by more than 10% over the past two months, reflecting expectations for a bumper crop and steep tariffs imposed this year by China, which until recently was the second-largest importer of U.S. almonds after the European Union.

In response to China’s tariffs, which now add a 50% tax to almond prices, some Chinese businesses say they are trying to buy more nuts grown domestically and from other producers such as those in Australia and Africa.

Columbus, Ohio looking at highway building project delays…

“For us to get the raw plate material to fabricate it used to be we would order steel today and get the steel two months later. Now, it’s five to six months,” said Evan Morrison, vice president of Ohio Structures Inc. in Canfield.

Buying steel for a construction project is an unusual step for the city. Typically, contractors include materials in their bids, but the city won’t put the Route 315/West North Broadway project’s second phase out to bid until the fall. By then, it could be too late to get steel in time.

“It’s just like anything else: You place an order and you get put in line,” said Jim Pajk, the city’s assistant administrator for design and construction. “You’ve got to get yourself in line as early as you can. We’re seeing that line was stretching out.”

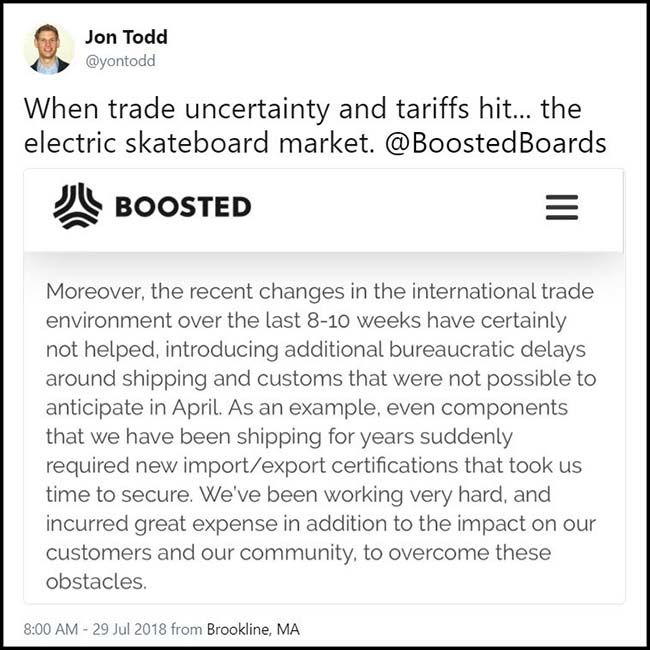

You don’t ever want to lose the electronic skateboard vote…

No joke. This is a big deal. While Boosted is only one of the best small companies in America affected by the Chinese slowdowns, it means that thousands of other companies are also being impacted. Highly likely that holiday gift giving will suffer this year.

Finally on tariffs, the CEO of McDonald’s hints that his Chinese stores might be feeling the effects the U.S. vs. China trade wars…

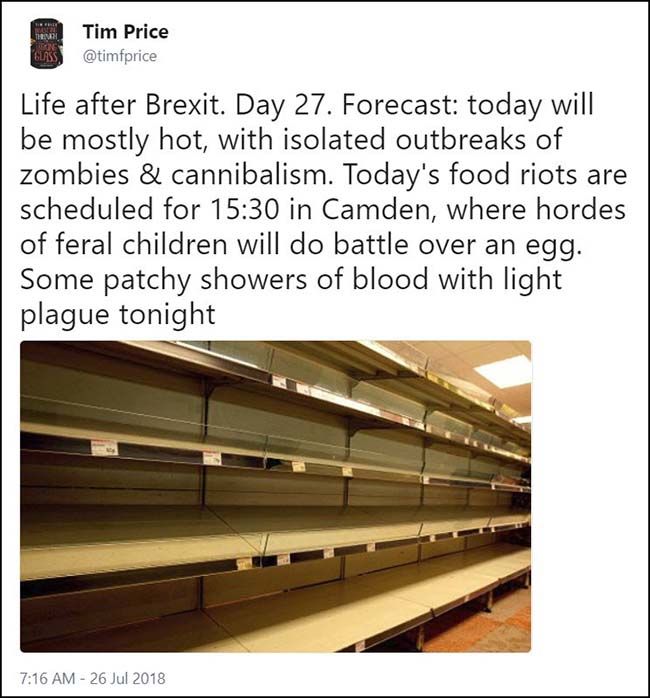

It could be worse for America. At least we didn’t choose to “Brexit”…

Finally, if you are looking for another sign to sell everything…

It is legal to own sharks, which can cost anywhere from a few hundred to thousands of dollars, according to Mr. Raymer. Some species, like great whites, are protected, and cannot be kept in homes.

Owning a shark can be “a power thing,” said Joe Caparatta, owner of Manhattan Aquariums and Unique Corals, who has owned catsharks and epaulette sharks in the past. “The shark is the most feared animal in the waters. To have one as a pet kind of puts you above it.”

Mr. Caparatta said he gets frequent requests for large sharks such as blacktips, but tries to steer his customers toward smaller species that are easier to take care of. “These big sharks don’t do well in captivity,” he said, while smaller species “are much better suited to life in a glass box.”

(This $35 million home built by developer Ario Fakheri in the Hollywood Hills comes equipped with around eight sharks. PHOTO: NEUE FOCUS PHOTOGRAPHY)

</a

</a