by Ryan Detrick, LPL Research

Second-quarter earnings season kicks off this week, and S&P 500 companies are expected to report an eighth consecutive increase in quarterly profits. Consensus estimates are calling for a 21% year-over-year increase for the quarter, setting up a potential second-straight quarter of earnings growth higher than 20%.

We expect several factors to drive this strong earnings growth:

- Corporate and individual tax cuts.

- Strong manufacturing activity.

- Higher oil prices, which boost energy sector profits.

- A weaker dollar versus the year-ago quarter, which supports overseas profits.

We expect modest upside to those estimates based on historical patterns, positive S&P 500 earnings revisions during the quarter, and an above-average ratio of positive to negative pre-announcements. While escalating tensions around tariffs have dominated headlines recently, we do not expect any anticipated or implemented tariffs to meaningfully impact second-quarter earnings results.

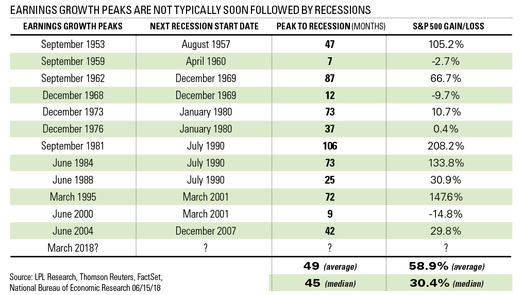

Lofty expectations for this earnings season beg the question “is this as good as it gets?”. Even if this is the pinnacle for earnings growth, we see it as a positive signal for stocks, not a reason to sell. As mentioned in the Midyear Outlook 2018: The Plot Thickens (and shown in the LPL Chart of the Day), a peak in earnings growth has not historically been a sign of imminent trouble for the U.S. economy or stocks. LPL Research Chief Investment Strategist John Lynch noted, “Historically, about four years have passed, on average, between an S&P 500 earnings growth peak and the next recession, during which stocks have produced solid gains.”

We increased our S&P 500 earnings forecast for 2018—from $152.50 per share to $155—in our Midyear Outlook publication, an 18% year-over-year increase over 2017, citing strong first quarter results amid a continued solid backdrop for corporate profits. While our forecast is below the consensus estimate of $160, we prefer to be conservative due to the potential for further U.S. dollar strength, wage pressures, and tariff-related costs. Applying a target price-to-earnings ratio of 19 to this estimate gets us to our year-end fair value range of 2900-3000, or a 10-12% gain for the year (without dividends). As of July 12, the S&P 500 has returned 5.7% year-to-date.

For more on this topic, look for an earnings update on July 23, 2018 in the Weekly Market Commentary along with the first of a series of updates to our Earnings Season Dashboard.