by Jeff Hussey, Russell Investments

Note: This is the third in a three-part series: Running with the bulls without getting trampled, focusing on how to potentially get returns in today’s market while protecting against the downside. Part 1 can be viewed here, and part 2 can be viewed here.

2017 was a Goldilocks year. Market conditions seemed just right: the global economy was generally steady, interest rates remained low and many equity markets had high returns and low volatility. But 2018 has given us less sanguine conditions. Global economic growth is still solid, but slower. Interest rates remain low, but are rising. And equity markets have relatively higher volatility and lower returns. We’re not suggesting the bears have come home to find Goldilocks asleep, but we believe challenges facing investors makes it an ideal time to consider exposure to alternatives.

In a market environment of increased risk, why should investors consider alternatives?

Alts are a key part of a multi-asset approach—because, as part of a total portfolio, we believe they create a greater likelihood of meeting the overall objectives. Multi-asset includes traditional assets such as stocks and bonds, but also features alternative investment strategies that offer opportunities for additional sources of alpha. Importantly, alts opportunities have had historically relatively low correlation to public-equity markets.

Alternative investments include a broad range of potential assets, each with its own risk, return and diversification characteristics distinct from each other and from traditional asset classes. Alternative investments include real assets such as real estate, infrastructure, and natural resources. These can be accessed through listed or private vehicles. Other types of alternative investments include private debt, private equity, venture capital, and hedge funds. The investments within each strategy have distinct advantages and risks, which can make investing in them complex, and may require specialized expertise.

Though alternative investments have differences among them, they have a common characteristic: They typically have less volatility than equities and therefore offer diversification benefits and the potential for improved risk-adjusted returns within a total-portfolio context. In a market environment like 2018, where volatility has increased, this can help investors.

Why care about reducing volatility?

Volatility can wreak havoc on account value. For institutional investors—such as pension funds with obligations to pay retirement benefits to pensioners, endowments needing to meet distribution commitments, or a hospital needing to fund capital improvements to its facilities—big changes in account value is a challenge. Pension funds must adhere to funding requirements and want to mitigate the volatility of their funded status. For individuals saving for retirement many years in the future, volatility in the short term may not have a big impact over the long run. But most individuals get nervous when the value of their retirement account has big changes in value. Large swings are particularly troubling when an institution or individual has near-term spending needs. Dampening the extreme value changes is a goal for most investors, and exposure to alternatives can help reduce volatility at the total-portfolio level.

Reducing volatility makes sense, but what about returns?

One of the advantages of less liquid alternatives such as private markets is that they offer a return premium partly because they have less liquidity. Clients with a longer-term time horizon can take advantage of this illiquidity premium by getting exposure to funds that are available for redemption on a quarterly basis, such as hedge funds and core private real estate.

The example of private markets

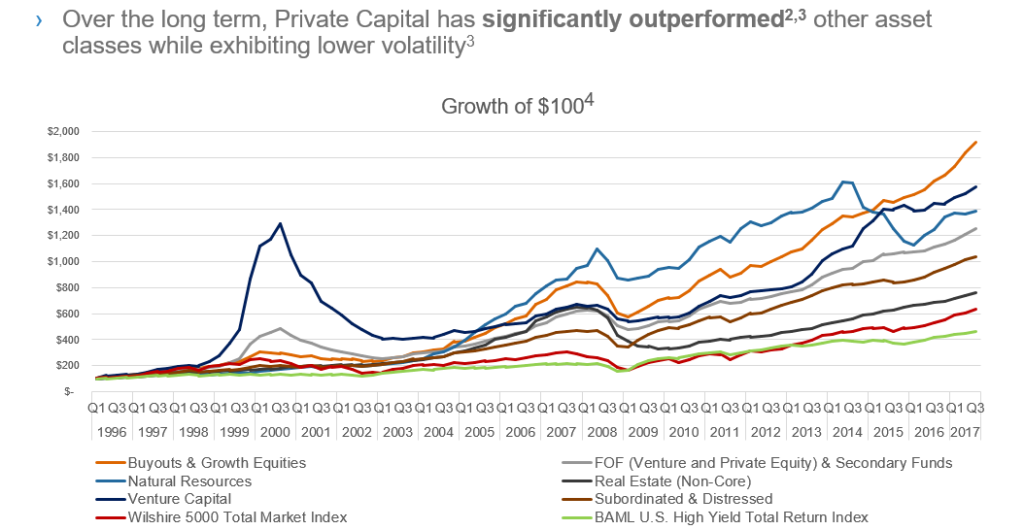

Investors might also consider private markets—such as opportunistic real estate, private debt, or private infrastructure, among others—that typically have a fund life of approximately 10 years. Critics may lament this inherent illiquidity, but this feature also serves as a strength. Longer-term investments have historically outperformed broader public markets.1 The premium varies by asset class, but historically, private equity, for example, has delivered returns of 400-600 basis points over public equity markets.

Source: Russell Investments. Data from Cambridge Associates Private Fund Performance Benchmark Calculator, Wilshire 500 Total Market Index and BAML U.S. High Yield Total Return Index. Indexes are unmanaged and cannot be invested in directly. Indexes are unmanaged and cannot be invested in directly. For illustrative purposes only. Past peformance is no guarantee of future results. Data as 31 December 2017.

We often see gaps in client portfolios, where they are missing out on exposure to private markets, and we typically recommend filling this gap, for a number of reasons:

- Portfolios can have allocations to assets that are relatively oriented toward generating either income or growth.

- Private markets can provide exposure to differentiated and attractive investment opportunities with asymmetric return profiles, for which there is no passive alternative.

- We believe access to less researched, less efficient markets can generate excess returns, with reduced volatility relative to traditional, more liquid markets.

The bottom line

In a market environment where volatility has increased and forward-return expectations are low, we believe it’s prudent to look to alternative investments for both potential diversification benefits and the potential for enhancing returns. Of course, these are key advantages. But alts take expertise and like everything there is timing risk when entering a new strategy or asset class. We believe they work best as part of a total-portfolio approach—as a powerful set of tools to help seek upside and help to manage risk.

1 Based on a growth of a dollar calculation for 10 and 20 years, using quarterly returns from Thomson Reuters for Private Equity and the following indexes to represent each asset class: S&P 500® Index, Bloomberg Barclays U.S. Aggregate Bond Index, NCREIF Property Index, NCREIF Open-End Diversified Core Index (ODCE), and FTSE/EPRA NAREIT Developed Markets Real Estate Index.

2 Harris, Robert S., Tim Jenkinson, and Steven N. Kaplan. “Private equity performance: What do we know?.” The Journal of Finance 69.5 (2014).

3 “Alternative Assets: More Important Than Ever”, BCA Research, March 11, 2016.

4 Private Asset Returns taken from the “Cambridge Associates Private Fund Performance Benchmark Calculator”. Data as of September 30, 2017. Returns Wilshire and BAML Index accessed through FRED. Indexes/benchmarks are unmanaged and cannot be invested in directly. Past performance is not indicative of future results. Cambridge Associates Private Equity Performance is NET OF UNDERLYING