by Blaine Rollins, CFA, 361 Capital

Ice cream wasn’t the only thing melting last week. It was a good, short trading week for U.S. equities, helped by the strong set of Goldilocks-looking jobs data. But was there also a melting of increased trade worries as the initial tariffs were implemented? Not only was there the direct economic impact caused by the tariffs on agriculture and other end-use products, but there was the uncertainty of tariffs on all intermediate goods which is causing Oracle and SAP software to run overtime on every accounting IT server. Some think the new Trade Wars will be around for a bit, while others moved into the ‘this is absurdity camp’ late last week and were betting long in the market that the Trade Wars would end soon. While I agree that the broad tariffs are absurd and not well thought through, I do not know if they will be turned off like a light switch. Volumes in the market are currently low with the summer holiday, so stocks could be giving us a false read.

What we do know for certain is that there is plenty of uncertainty. So not a bad idea to be flexible in your portfolios and have your investment bets spread out, with cash available to jump as opportunities arise. Earnings will begin in full later this week with big bank stocks launching first. From these reports, we will see data points of credit health and economic growth activity. So welcome back to the heat of the market. Time to get busy.

Join me for our upcoming webcast, 2018 Mid-Year Review, where I’ll discuss the first half of 2018 and what may lay ahead for investors. You can register here.

To receive this weekly briefing directly to your inbox, subscribe now.

Perfectly put…

“Investors have this unusual set of dual realities,” said Rebecca Patterson, chief investment officer at Bessemer Trust. “You have a risk of an escalating, truly global trade war which creates a huge amount of uncertainty. But if you look at the economic data coming out each day most of it is still suggesting robust growth — it still looks really good and that is supportive for earnings.”

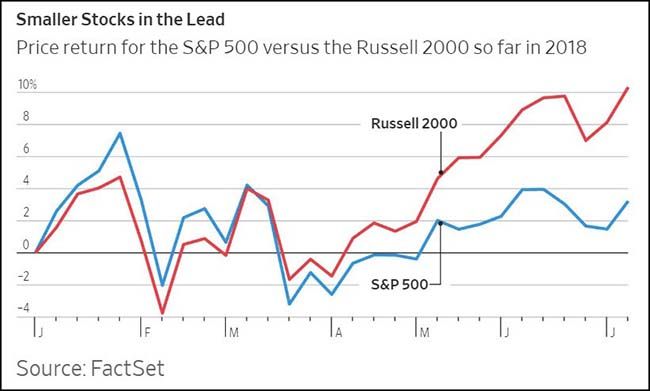

The likelihood of an all-out trade war is still batted away by many investors as a remote possibility. Nonetheless, there has over the past month been a rotation in US equities, out of globally exposed, growth-oriented “cyclical” stocks such as industrials, into more defensive sectors like utilities. The Russell 2000 index of smaller company stocks, which are better shielded from any tit-for-tat on tariffs, has easily beaten the S&P 500 in performance terms of late.

“It is fairly clear from an equity market standpoint that the more cyclical, globally exposed sectors have come under pressure and defensive parts of the market have done well,” said David Lebovitz, global market strategist at JPMorgan Asset Management.

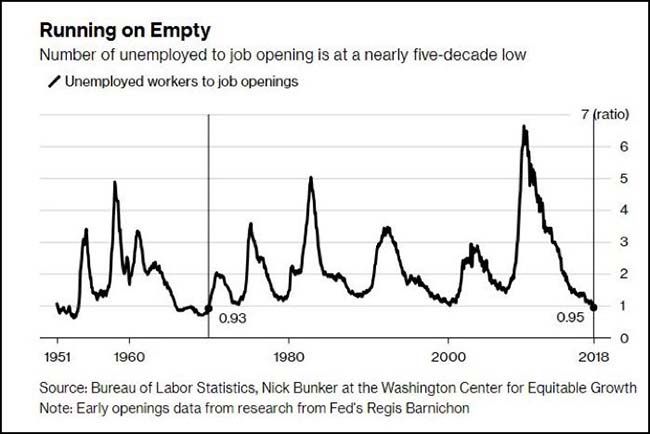

Smoking Hot #1: Unemployed divided by job openings now at a 50-year low…

(@PlanMaestro)

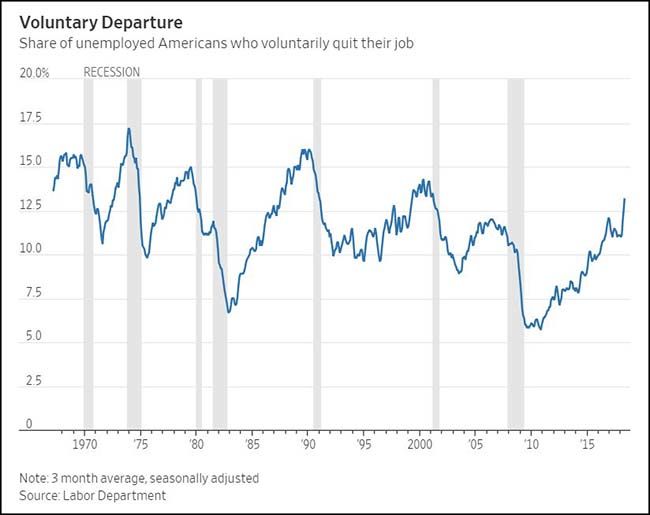

Smoking Hot #2: Take this job and shove it…

Workers are choosing to leave their jobs at the fastest rate since the internet boom 17 years ago and getting rewarded for it with bigger paychecks and/or more satisfying work.

Labor Department data show that 3.4 million Americans quit their jobs in April, near a 2001 peak and twice the 1.7 million who were laid off from jobs in April.

Job-hopping is happening across industries including retail, food service and construction, a sign of broad-based labor-market dynamism.

Workers have been made more confident by a strong economy and historically low unemployment, at 3.8% in May, the lowest since 2000.

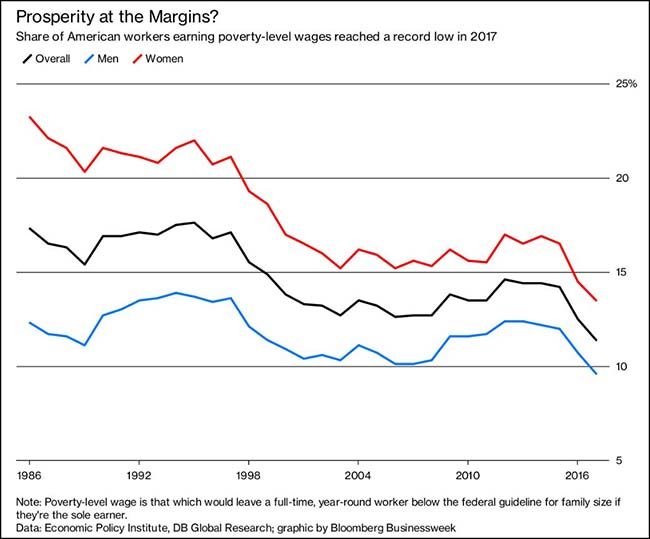

Smoking Hot #3: Rising tide is lifting all boats…

A record-low 11.4 percent of U.S. workers earned poverty-level wages last year, according to the Economic Policy Institute, and that share is likely to fall further, said Torsten Slok, chief international economist at Deutsche Bank. With the unemployment rate for those with a college degree at 2.1 percent, “any incremental increase in jobs going forward will go to people with lower skills and wages,” he said. The labor market is at an inflection point, with wages “moving higher simply because there are today economy-wide more job openings than unemployed people.”

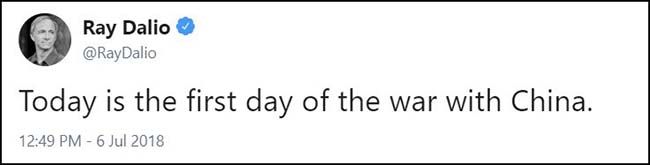

Noted by one of the biggest portfolio managers in the world…

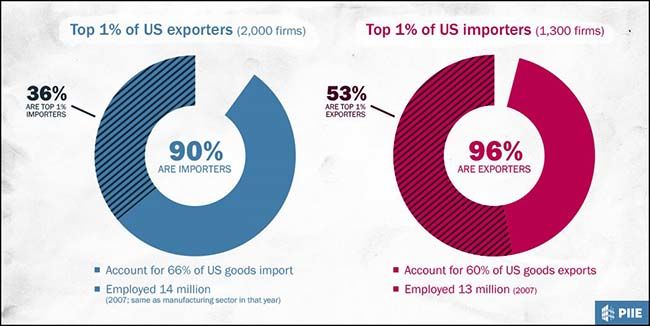

Think of it like slapping your left hand with your right hand, repeatedly…

The common view that exports are good and imports are bad is fundamentally misguided. Imports and exports are inextricably related—it is access to the best, least expensive inputs (wherever they are produced) that enables firms to focus on what they do best. Increasing the cost of importing would hurt our most competitive firms.

(Peterson Institute for International Economics)

One top Carolina technology company now in the line of fire…

Does this mean that we have to return to using the incandescent bulb?

Cree Inc., a North Carolina maker of lighting products, has said the new tariffs will cause it “disproportionate economic harm.” Cree makes light-emitting diode chips at its Durham, N.C., plant, then ships them to a company facility in Huizhou, China, to be assembled and packaged in housings. Some of those LED housings come back to the U.S., to be used in lighting products made by Cree and its customers. When they do, the products will be hit with a new 25% duty.

The end result of these trade wars will be fewer manufacturing jobs in the U.S., not more…

Like Harley-Davidson, many manufacturers who export from the U.S. may have to shift that activity abroad. “We export to more than 100 countries,” one manufacturer in the food, beverage and tobacco industry told the Institute for Supply Management in its latest monthly survey. “We are preparing to shift some customer responsibilities among manufacturing plants and business units due to trade issues (for example, we’ll shift production for China market from the U.S. to our Canadian plant to avoid higher tariffs).”

The end result of Mr. Trump’s efforts to make Americans spend more on American made products is that foreigners will spend less.

Everything is bigger in Texas. Including the pain from the Trade Wars…

Texas is America’s leading export state; in 2017, according to Census data, we exported roughly $265 billion worth of goods, or 17 percent of the nation’s total. And Texas imports a lot of goods, to boot.

Many of the goods the state exports, for that matter, are produced using goods we import. The Toyota trucks produced in San Antonio, for example, include parts made in Mexico. The oil and natural gas extracted from the Permian Basin would be stuck there, if not for pipelines made from aluminum and steel.

In the event of a trade war, then, Texas is effectively doomed to be caught up in the crossfire. Last year, as Abbott noted, Texas farmers exported about $1 billion of agricultural products to China. This week’s retaliatory action from Beijing will hit close to home.

Meanwhile, Texas imported twice as much steel and aluminum as any other states, so Trump’s own tariffs will raise the costs of doing business in the oilfield. As Abbott rightly observes, that has implications for America’s overall energy portfolio.

“If the new tariffs continue to drive up the cost of oil and gas production, America’s quest for global energy dominance could be significantly hindered,” the governor wrote.

And now the Lobster fisherman in Florida are sharing the pain of their Maine cousins…

“I was really praying that wasn’t going to occur,” Nichols said. “And at this moment I don’t know what is going to happen, we’re all just in limbo.”

Nine years ago, when the price for lobster dropped to $3 a pound, Nichols nearly lost everything. Then along came the China, whose growing economy and burgeoning middle class developed an insatiable taste for the Spiny lobster. Nichols was one of the first to figure out how to ship live lobsters to China and it helped save the commercial fishing industry in the Keys.

“We’ve been very fortunate over the last several years with the Chinese market,” he said.

At its height, lobster prices hit $24 a pound. In recent years it has settled in to an average price of about $10. But now the trade war threatens everything.

To stay competitive, Florida lobstermen are going to have to drop their prices otherwise buyers in China may turn to other markets, including Australia, Brazil and Nicaragua – none of which will have the added 25 percent cost.

“If we go back down without this Chinese market we’re looking at a lobster price that is down in that $5-$6 range which just doesn’t pay the bills,” he said. “With the fuel costs increasing, labor costs increasing, and running these businesses, it’s going to be a real struggle; especially coming off a hurricane season where we lost a million dollars. It is going to take years to rebuild after the storm.”

The U.S. ranchers’ 2018 just went from bad to worse…

At Suzhou Huadong, the importer that lost its race to bring all the American meat onshore before the new tariffs took effect, Gong says customers will look for alternative suppliers if he tries to pass the tariffs onto restaurants and supermarket chains.

“There’s a high-end portion of 10 percent: restaurants where people pay thousands of yuan for a steak, who said they still need American beef. But the vast majority say they cannot accept any cost increase,” Gong said. “If we try to even push 5 or 10 percent of the cost to them, they will switch to other types of beef.”

Suzhou Huadong, which has annual revenue of about 3 billion yuan, has suspended any further deliveries from U.S. ports. “We are not going to let them onto the sea if this is not resolved,” Gong said.

Back for more in Texas…

A trade war could sink aspirations for the Port of Corpus Christi, which has been booming in recent years with two large grain terminals exporting grain sorghum to China — U.S. sorghum exports, nonexistent in 2011-12, rose to nearly $1.5 billion in 2015-16 — as well as companies making heavy investments in export capabilities for oil and gas.

Houston-based Cheniere Energy in May decided to build a third unit to process liquefied natural gas for export to the Chinese market, part of $50 billion in construction and investment happening in and around the port since discovery of the Eagle Ford Shale. The Chinese have so far excluded LNG from its list of tariffs.

“Sorghum from Corpus Christi is certainly affected,” said port CEO Sean Strawbridge. “But our additional concern is based on volumes and investment in LNG and WTI (West Texas Intermediate) crude oil.”

“China doesn’t want a trade war any more than we do,” he added. “Thus, we are confident cooler heads will prevail.”

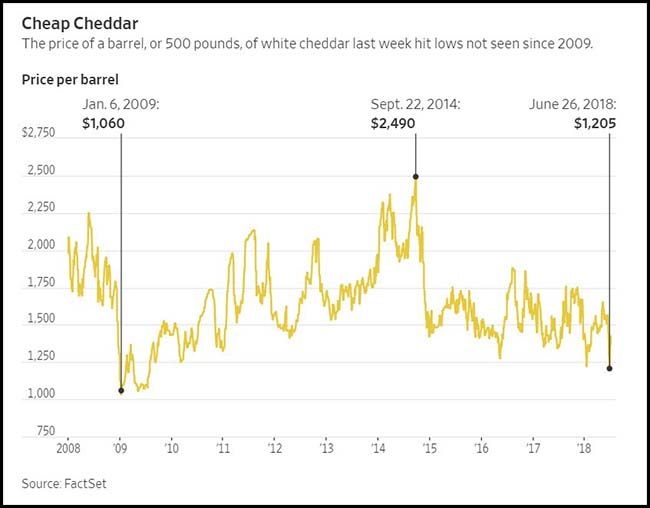

The good news is that now you can put extra cheese on everything that you eat…

Cheese makers that rely on foreign sales are suffering as China and Mexico raise tariffs on U.S. mozzarella and provolone.

BelGioioso Cheese Inc., a second-generation family company in Wisconsin, has seen sales to Mexico drop since officials there implemented tariffs of up to 15% in early June on most U.S. cheese. The levies were a response to tariffs the U.S. placed on Mexican steel and aluminum.

On Thursday, Mexico was slated to raise its levy on most U.S. cheese to as much as 25%, while China on Friday is implementing tariffs on $34 billion of U.S. goods, including cheese and whey, a dairy byproduct often fed to livestock.

“It’s a nightmare,” said BelGioioso President Errico Auricchio.

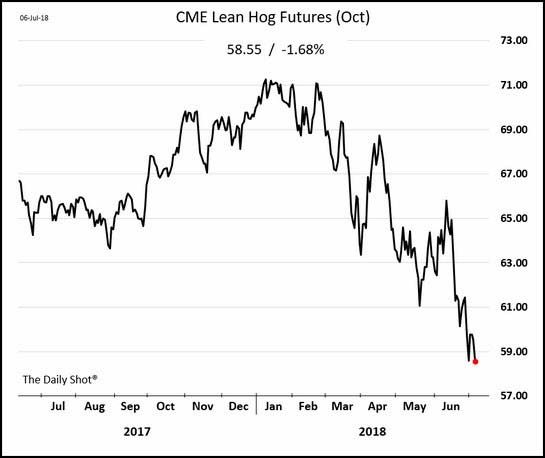

And you can put bacon on everything!

I am beginning to wonder if the Trade Wars were started by the U.S. Ketogenic Diet association.

(WSJ/Daily Shot)

But as personal economics are being impacted, votes are shifting…

Jimmy Tosh’s sprawling hog farm in rural Tennessee is an unlikely battleground in the fight for control of the U.S. Senate.

Yet his 15,000 acres (6,000 hectares) two hours west of Nashville showcase the practical risks of President Donald Trump’s trade policies and the political threat to red-state Republican Senate candidates such as Tennessee’s Marsha Blackburn.

Tosh, a third-generation farmer who almost always votes Republican, said he’s voting this fall for Blackburn’s Democratic opponent, former Gov. Phil Bredesen, in part because Trump’s trade wars are hurting his family business — a sizable one with some 400 employees and 30,000 pigs. The cost of steel needed for new barns is up, Tosh said, and the expanding pork market stands to suffer under new tariffs.

“This tariff situation has got me very, very, very concerned,” Tosh told The Associated Press. “I just think Bredesen would be better on that situation.” He said Blackburn has shifted “toward the center” on tariffs, “but in my opinion, it’s a little late and not far enough.”

Similar concerns are roiling high-profile Senate contests in Missouri, Indiana, Pennsylvania and North Dakota and forcing GOP candidates to answer for the trade policies of a Republican president they have backed on almost every other major issue.

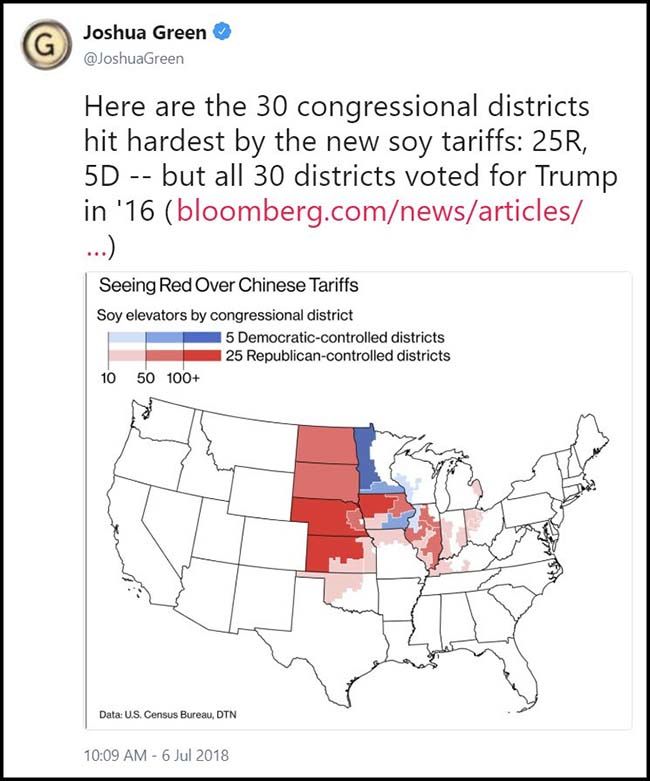

While meat rancher and lobster fisherman votes may be in play, no congressional vote is more up for grabs right now than that of the soybean farmer…

T-shirt that all the cool kids are wearing this summer…

But wait, some are willing to lose everything to support the Trade Wars…

For Mid Continent Steel and Wire, which does business as Mid Continent Nail Corp., the crisis began June 1 when the Trump administration imposed tariffs on steel and aluminum imports from Canada, Mexico and the European Union as part of its strategy of boosting American manufacturers.

Founded in 1987 by two local brothers and taken over in 2012 by a Mexican company, Mid Continent imports 70% of its steel from Mexico. When the tariffs forced the company to raise prices 19% to cover higher costs, orders plummeted. Within two weeks, it had idled one of its production plants and laid off dozens of contract workers.

“You would think as long as houses are being built and pallets are being made we would be secure,” said Sean Hughey, 51, a machine shop supervisor who has worked for the company for eight years. “All of sudden, it just came to a crashing halt.”

Hughey continues to back Trump, even as he worries that if the company shuts down, he will not be able to make his $800 monthly mortgage or come up with $700 a month for payments on his Dodge pickup, Chrysler sedan and Harley-Davidson Street Fighter.

“I feel like maybe the tariff policy might have been just a tad misguided, you know?” he said. “Maybe they didn’t think it through.”

Will cooler heads prevail?

Many people hope that Trump’s tariffs and trade talk are simply a negotiating ploy consistent with those described in his book The Art of the Deal. Others note that exports account for only 14% of gross domestic product, and that a trade war might reduce growth by less than 1%.

The same types of arguments were made about Smoot-Hawley and its impact on the U.S. economy in the 1930s. But the issue isn’t the impact of tariffs on GDP; it is the impact on corporate earnings, which support the price of stocks. A trade war could send earnings down 5% to 10%.

Additionally, a trade conflict could wipe out all of 2017’s market gains. Most Americans have some type of stock market exposure, directly, or indirectly, through a 401(k) plan, an IRA, or 529 college accounts. Protectionism on both sides of the ocean will cause these accounts to lose value.

The president boasts that America will win a trade war. But everyone will lose. The U.S. can’t control the actions of other nations. Worse, we risk driving our allies into the hands of a welcoming and aggressively expanding China. That country’s president, Xi Jinping, is a proponent of global trade and could be the primary beneficiary of America’s unwise actions.

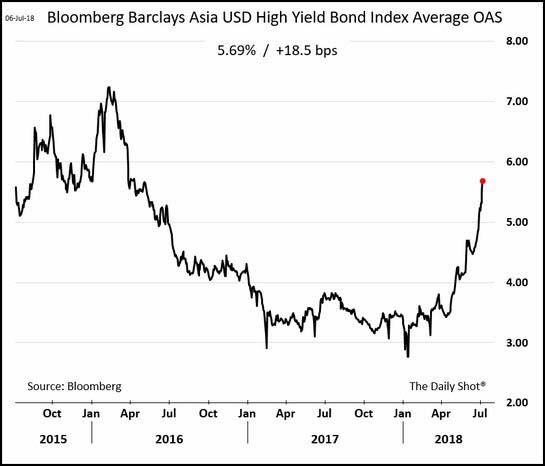

The Trade Wars are scaring Asian high-yield bond spreads which are widening significantly…

(WSJ/Daily Shot)

BBB credits in Europe are seeing widening…

(RenMac)

And even high quality U.S. credit is being impacted…

Hopefully, I have your attention because widening credit spreads is a big yellow flag for me.

While the total return for the S&P 500 is north of 4% this year, U.S. investment-grade corporate bonds have been heading steadily in the wrong direction since February. The spread between the yield on U.S. Treasurys and that on investment-grade company debt has widened to 1.28 percentage points, from a postcrisis low of 0.9 percentage point at the start of February, ICE BofAML index data show. The index has returned minus 2.7% this year, underperforming Treasurys, down 0.9%.

The move isn’t as dramatic as this year’s blowup in Italian bonds, or steep drops in emerging-market currencies. But it has shown little sign of reversing, even as more economically sensitive assets such as stocks and high-yield bonds have posted modest gains, shored up by the idea that U.S. growth is strong relative to the rest of the world.

Many investors are taking notice as ETFs are now seeing redemptions at the largest rate since 2008…

Investors pulled $350 million from ETFs in June, marking the third month of net redemptions this year and the highest number of monthly outflows in a year since the 2008 financial crisis, according to data from State Street Global Advisors.

One more month of outflows would put 2018 on par with the record of four months of net redemptions in a year, which happened a few times in the late 1990s, the Boston-based manager says.

As with February and March, the other two months with net outflows, equity ETFs were the main sales drag, with investors yanking a net $5.9 billion from such products last month. But unlike earlier this year, when the bulk of the redemptions came from U.S. equities, “now the other side of the pond is wiping out,” wrote Matthew Bartolini, head of SPDR Americas research for SSGA in a client note.

International ETFs bled $9.9 billion in June, following a May that saw $3.3 billion leave ETFs in the category. Trade war rhetoric and a rising U.S. dollar have hurt the performance of foreign stocks and, subsequently, investor sentiment, Bartolini argues.

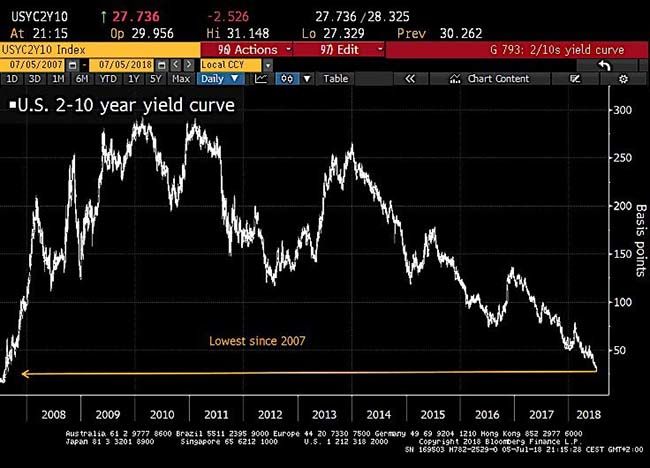

Another puzzle in the market as the 2- and 10-year treasury yield spread flattens to new lows…

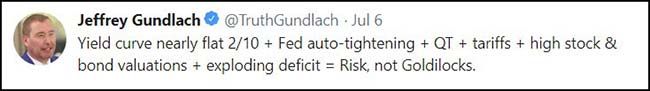

Gundlach’s antennae are up…

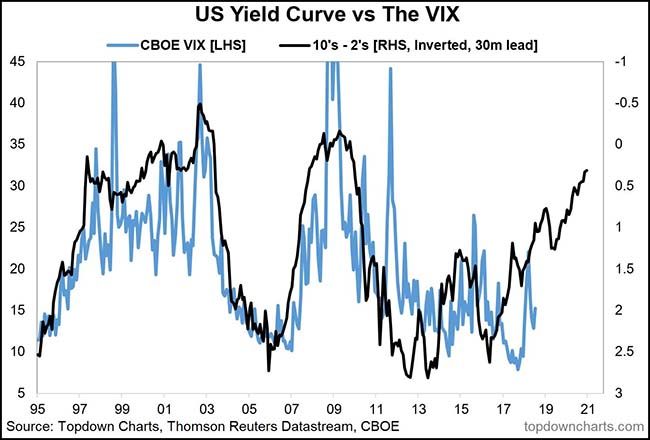

Typically a flattening in the yield curve leads to a move in higher risk…

This chart shows the 2-yr vs. 10-yr yield curve and a 2.5-year lead over the Volatility Index.

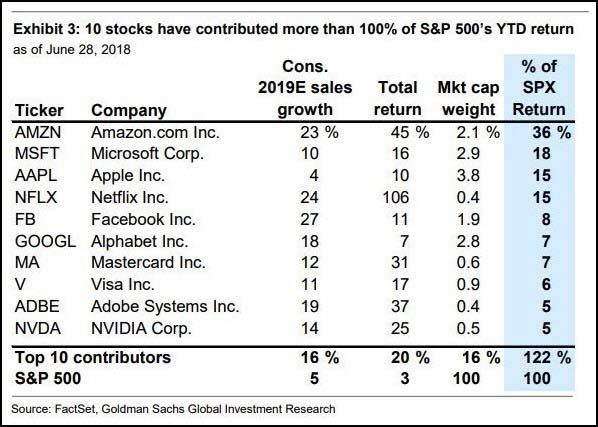

Performance at the top too narrow?

Some would also say that the bulk of the market’s performance in 2018 has come from a narrow list of large cap growth stocks.

(@Callum_Thomas)

Others would say that value portfolios have chased their way into growth stocks…

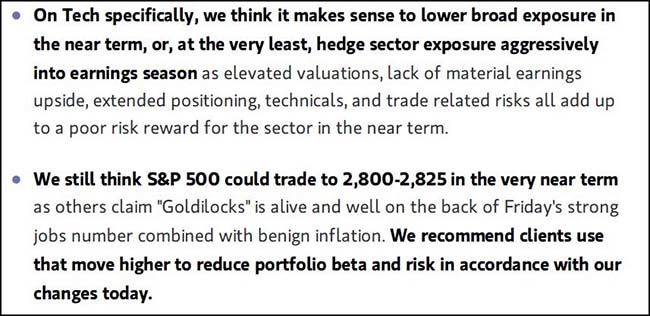

Morgan Stanley thinks now is a very good time to get defensive…

@thenotablecalls: $SPY – Morgan Stanley US Equity Strategy team is cutting Technology to Underweight

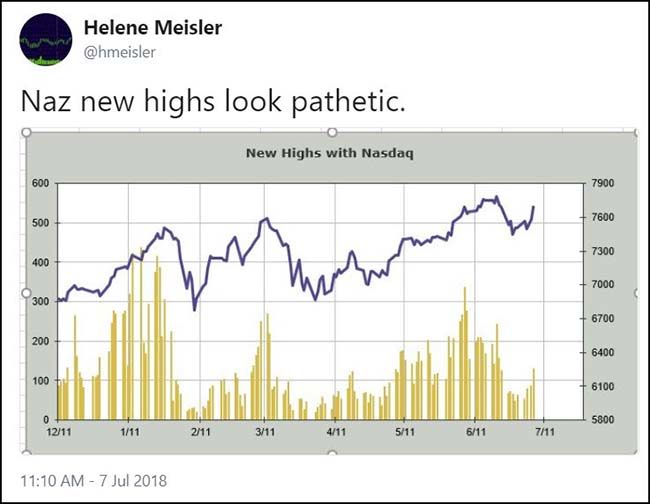

Nasdaq’s number of New High bars below does look tired versus the Index…

For as long as the Trade Wars rage, Small Cap stocks should remain the U.S. equity capitalization to be over allocated into…

Second quarter earnings releases begin to drop this week…

(@eWhispers)

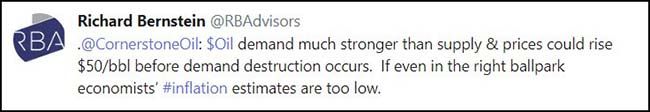

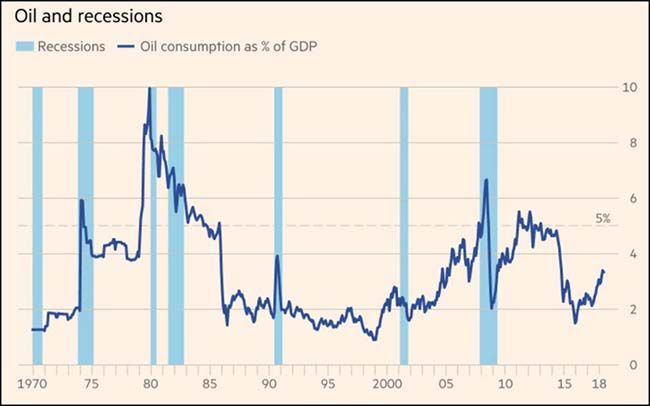

Oil prices are back…

@chris1reuters: Morgan Stanley raises forecasts for #Brent crude #oil by $7.5/barrel to $85 as it cuts projections for supply from #Iran #Angola and #Libya but raises estimates for #Saudi Arabia

Could the market handle another +$50 move in crude oil?

Oil price shocks are a contributing factor toward creating recessions…

Will the lack of Energy investment and rising demand cause Oil prices to spike further? We had better hope not.

Global industry-wide capital spending on oil exploration projects has dropped 60 per cent in the past four years. State-owned Saudi Aramco has invested into the downturn and promises another $400bn more in the decade ahead. Its boss has warned that without more spending on large-scale projects, a global supply crunch will come. Concerns about supply have pushed prices for Brent crude oil up 17 per cent this year to $77 per barrel. True, the kingdom has spare capacity that other countries do not. And it remains the world’s leading oil exporter. But until output from both the US and Russia falters, Saudi will struggle to control global oil prices the way it once did. Certainly its leaders will be watching nervously as consumption of oil relative to GDP climbs towards the highs of seven years ago.

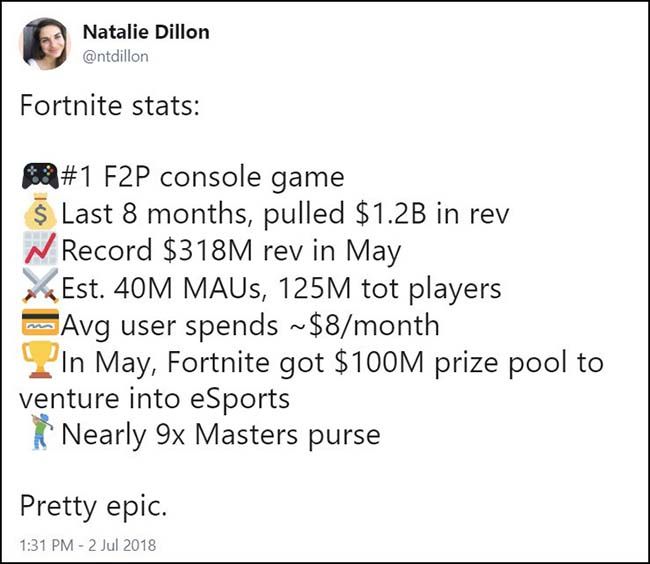

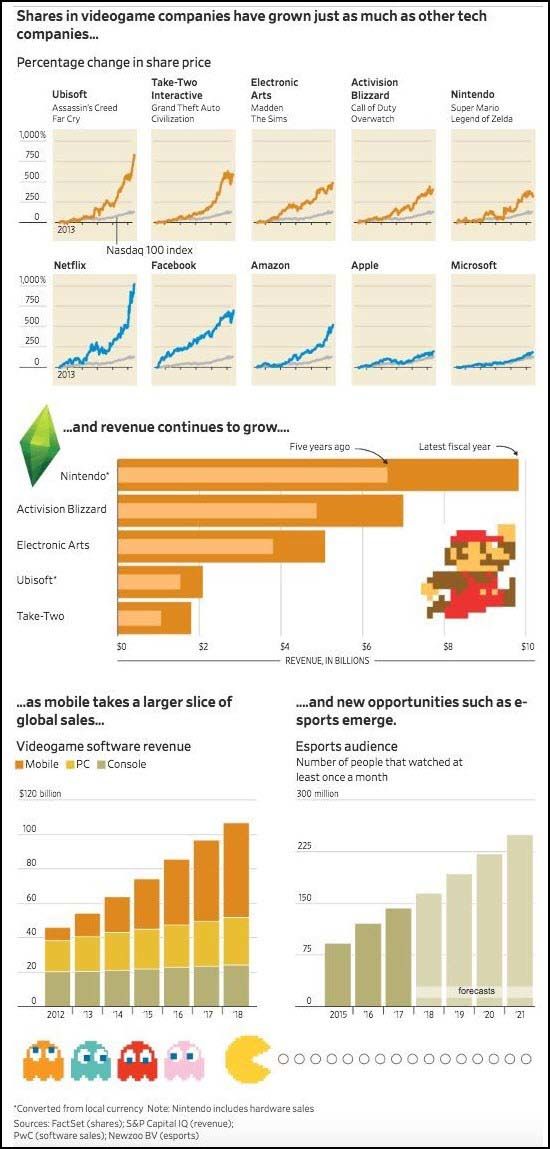

Video gaming continues to gather an audience…

Just ask your teenager about Fortnite…

$96 in revs per user…

Yes, you always want to have video game exposure in your portfolio…

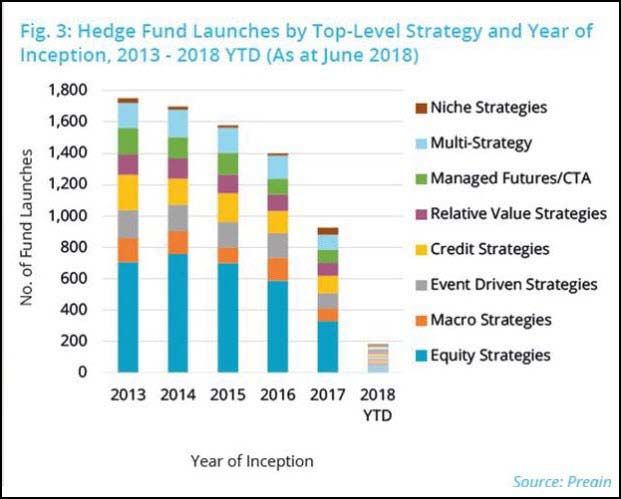

One industry that isn’t seeing wage pressures: Hedge Fund administration…

The steamroller that is putting dollars of savings into everyone’s pocket…

It started with a simple battery.

Around 2009, Amazon quietly entered the private label business by offering a handful of items under a new brand called AmazonBasics. Early offerings were the kinds of unglamorous products that consumers typically bought at their local hardware store: power cords and cables for electronics and, in particular, batteries — with prices roughly 30 percent lower than that of national brands like Energizer and Duracell.

The results were stunning. In just a few years, AmazonBasics had grabbed nearly a third of the online market for batteries, outselling both Energizer and Duracell on its site.

Inside Amazon’s Seattle headquarters, that success raised a tantalizing possibility. If, with very little effort, Amazon could become a huge player in the battery market, what else might be possible for the company?

Anyone who spends much time on the Amazon site can see the answer to that question. The company now has roughly 100 private label brands for sale on its huge online marketplace, of which more than five dozen have been introduced in the past year alone.

Many great stories in the world last week, but this one is tough to beat…

As soon as Hayden Hatfield started walking down the aisle, her eyes locked on her flower girl.

The bride thought about their special connection — years earlier, she had donated her bone marrow to help the toddler fight a rare form of childhood leukemia. They had stayed in touch through letters and phone calls and toys and trinkets sent through the mail. They had become like family. Now that Hatfield was getting married, she said, it meant everything to her to have the 3-year-old by her side during her wedding June 9.

“I didn’t want to take my eyes off her,” she said about the moment she saw Skye Savren-McCormick waiting at the altar at Shiloh Baptist Church in Hartford, Ala.

“Knowing she was not only there but that she was part of this life event for me, I was the most humbled person. They just don’t understand how important they are to me,” she said about Skye and her parents.

(Hayden Ryals poses with her flower girl, Skye Savren-McCormick. Mark Broadway Photography)

Imagine a 2018 NBA finals that didn’t include the Warriors, Cavaliers or Rockets and you have this year’s World Cup…

Anyone claiming to have predicted the specific semifinalists before the competition began — France, Belgium, England and Croatia — is lying. Separately, each carried plausible hope of making it to the final week, but the thought of all four advancing was far-fetched.

The last time the top four did not include at least one from the power group of Brazil, Argentina, Germany and Italy was, well, never. Since 1970, two or more from that quartet had appeared in the semifinals in every tournament except 1998 and 2010.

This year, France is the most decorated, having won the 1998 title at home and finishing second eight years later. Belgium last made it this far in 1986, England in 1990 and Croatia in 1998. All three lost right away.

“The big teams are home,” Croatia Coach Zlatko Dalic said. “The teams who are hard-working, compact, united and well organized, they are here in Russia. This is the character of the four teams remaining in the tournament.”

((Croatian players celebrate during a shootout against Russia in the quarterfinals. Manu Fernandez/AP)

Finally, updates from the 361 World Cup Challenge…

- 87.70% of all entrants incorrectly picked this year’s World Cup winner.

- Of the teams remaining, Mbappe and Les Bleus lead for predicted World Cup Champion with 7.14% of total entrant votes.

- Tunisia’s country market, TUSISE, has been the top ranking country by market return 73.33% of the days since the World Cup start with a total market return of 3.93% since June 15. However, favorites Russia and Brazil move into the #1 and #2 spots after July 9 market close.

You can check the country market rankings here or follow us on Twitter for timely updates.

Copyright © 361 Capital