by Russ Koesterich, Portfolio Manager, Blackrock

Russ discusses why the energy sector still looks attractive, despite having struggled recently.

Following a stellar start to the year, energy companies have stumbled in recent weeks. Although the U.S. sector is still one of only four that is higher year-to-date, energy stocks have dropped more than 3% during the past month, in the process under-performing the broader market. Bellicose trade rhetoric has not helped, but the main culprit has been the prospect of higher OPEC production and an accompanying 10% drop in the price of crude. That said, while the sector is vulnerable to another big drop in oil, current prices suggest the stocks may be a bargain. Here’s why:

1. Value versus history

At two times trailing price-to-book (P/B) the sector looks cheap relative to its own history. Since 1995 the large cap S&P Energy Sector Index has traded at an average of approximately 2.4 P/B.

2. Value versus broader market

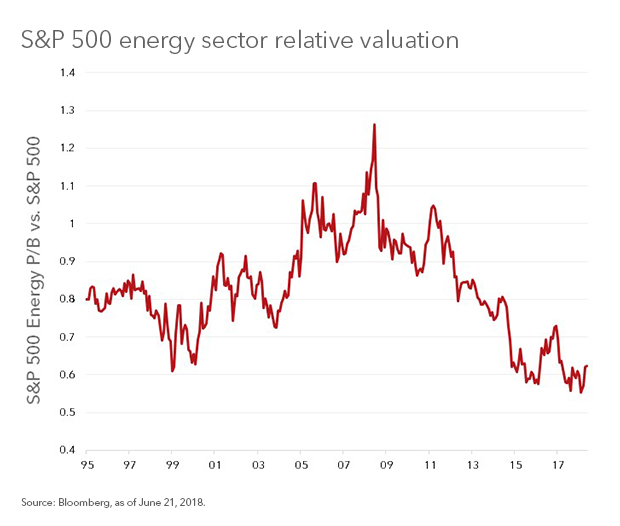

Energy stocks look even cheaper relative to the broader market. The sector currently trades at just 0.57 times the P/B of the S&P 500 (see Chart 1). This compares favorably to the long-term average of 0.82 and the post-crisis average of 0.76. This is one reason energy stocks are currently over-represented in value indexes.

3. Value versus fundamentals.

U.S. energy companies also appear cheap relative to two key fundamental factors: profitability and the price of oil. The fact that energy companies trade in line with crude should come as no surprise. Historically, investors have been willing to pay a premium, or at least a smaller discount, when the price of oil is high. Since 1995, this relationship has explained approximately 20% of the variation in the relative value of the energy sector. Today, with WTI crude at approximately $65 a barrel, the energy sector looks approximately 20% undervalued versus the broader market. A similar picture emerges when comparing current valuations to profitability. Measured by return-on-equity (ROE), profitability also explains about 20% of the variation in valuations. Based on this metric, energy companies appear about 10% too cheap.

Lower oil would take the sector down

What could change my view? The biggest risk is the most obvious one: oil prices. To state the completely obvious, energy stocks move with energy prices. Given the massive moves in crude oil in the post-crisis era, this relationship has been particularly strong. Since 2010, monthly changes in crude prices have explained approximately 50% of the variation in energy sector returns.

If OPEC’s resolve cracks or the global economy stumbles on the back of an escalating trade war, oil is vulnerable, and along with it the energy sector. While the risk is real, for now my assumption is that the global economy remains firm. Assuming that is correct, even if oil prices remain range-bound energy companies look like a bargain.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.

Copyright © Blackrock