by Blaine Rollins, CFA, 361 Capital

Would you have thought that this World Cup could be less predictable than the stock market? Germany and Spain are both out early, along with Ronaldo and Messi. Russia is still in. This is madness and a heck of a lot of fun, even though my bracket has been blown to bits. This past weekend, I was lucky enough to be in a city of three million people—all who cheered at the top of their lungs when their national team scored the game-winning goal to advance. It was definitely a lucky coincidence that my family and I will never forget.

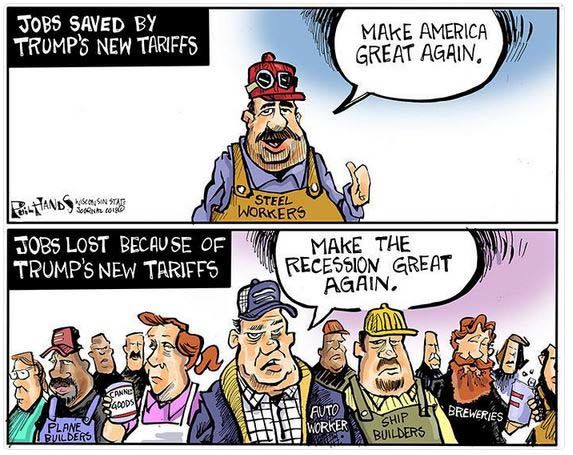

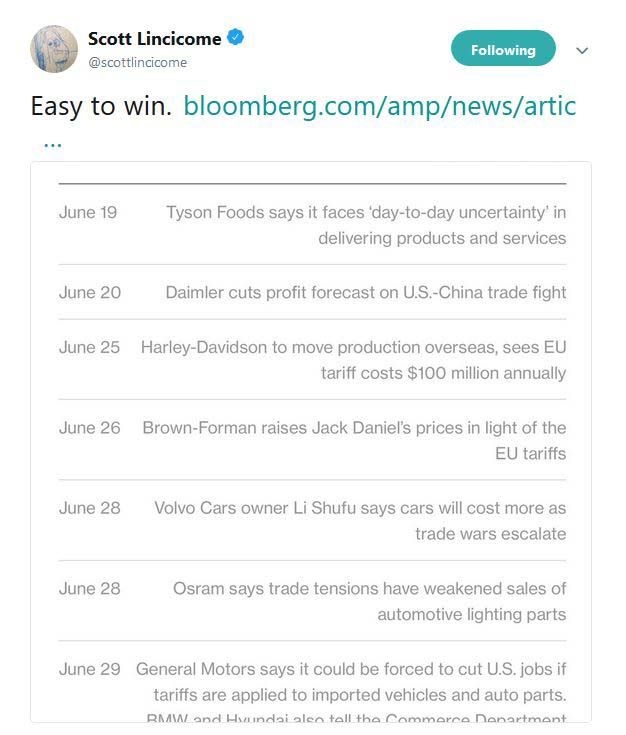

As for the market, the trade wars fell another step into the abyss as many countries increased their tariff talk on U.S. goods while lowering their tariff rates on other countries goods at the same time. As the news gets worse for U.S. manufacturers, I was surprised that U.S. stocks performed as well as they did last week. While many international indexes are entering bear markets (-20%)m some U.S. segments (e.g., Financials) have moved into corrective conditions (-10%). Year to date, only oil assets, U.S. stocks and Asian sovereign debt are producing meaningful positive returns. Slim pickings that have, no doubt, concentrated even more investing into U.S. equities. But let’s see if it continues as the trade tariffs are fully digested. It is quite easy to paint a picture of slowing momentum in the U.S. manufacturing and services sectors, as prices for goods that we create fall, while prices for inputs rise. Will soybean farmers, lobster fishers, and Harley builders continue to support the GOP as they lose their financial well being? We will find out in five months.

So, as the headwinds of trade increase and the jobs data begins to look at a potential new trend, I can’t see how any multiple expansions will continue. In February, we had a strong volatility signal that risk was again in play, and the market worked extra hard to try and set new highs. I am not sure what the catalyst could be for the market to find a ‘ludicrous mode’ button to send it back to new highs now. The Fed is not going to be able to help as they are still in tightening mode as they take liquidity out of the system to prepare for the next financial crisis. It will be tough for us to get help from foreign investors, if we are going to start blocking their investments in the United States. Maybe if all the trade rhetoric were to stop, the market could return to normal. Betting on that might be a longer shot than Russia playing in the World Cup finals in Moscow.

I’m back in this week preparing for my upcoming webcast, 2018 Mid-Year Review, where I’ll discuss the first half of 2018 and what may lay ahead for investors. You can register here.

To receive this weekly briefing directly to your inbox, subscribe now.

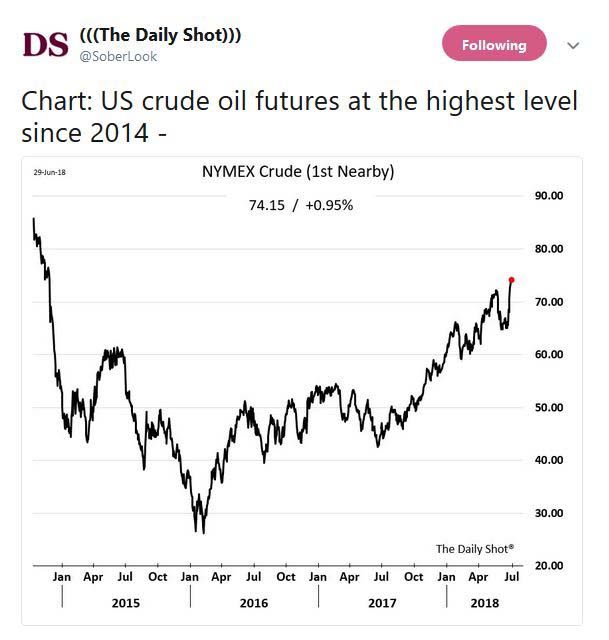

An amazing recovery in the price of oil this year…

@SoberLook: Chart: US crude oil futures at the highest level since 2014

The trade wars are ramping up…

(Bloomberg)

Canada is going right after most important businesses in key GOP districts…

Canada’s retaliation list includes whiskey, a famous export of Republican Senate Majority Leader Mitch McConnell’s Kentucky, and frozen pizza, produced by several companies in House Speaker Paul Ryan’s Wisconsin.And it includes toilet paper. Mehoopany, Pa., a tiny community represented by Republican congressman and Senate candidate Lou Barletta, is home to a massive Procter & Gamble plant that makes Charmin toilet paper.

Pennsylvania, a state key to Trump’s victory, is also targeted by the tariffs on chocolate and licorice, both made by the Hershey Co.

“We make products in the United States that are exported to Canada and we also make products in Canada that are shipped to the United States. While we are disappointed the issue has not been resolved yet, we remain committed to working with both countries to find a reasonable path forward,” said Hershey spokesperson Jeff Beckman.

Canada’s tariff on ketchup achieves a double whammy: it is made by Pennsylvania-based Heinz at a plant in a Republican-leaning part of Ohio, another Trump bastion and one of the country’s top steel-producing states. Even Ohio’s Democratic senator, Sherrod Brown, supports Trump’s tariffs.

Maine lobster fisherman have also been thrown into a hot pot…

@scottlincicome: “Trump Boils Maine Lobstermen” https://www.wsj.com/amp/articles/trump-boils-maine-lobstermen-1530315457

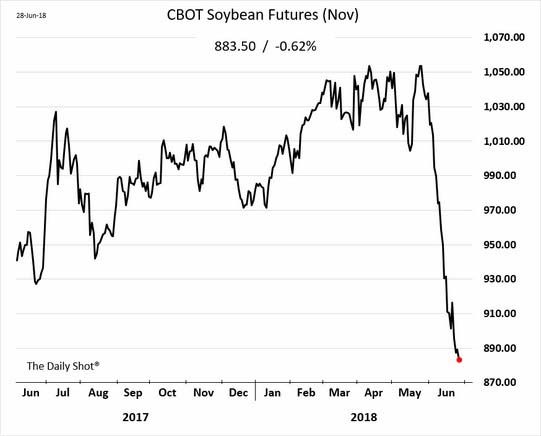

And come harvest time…

…it might be cheaper for soybean farmers to set fire to their crops if the recent price trend continues…

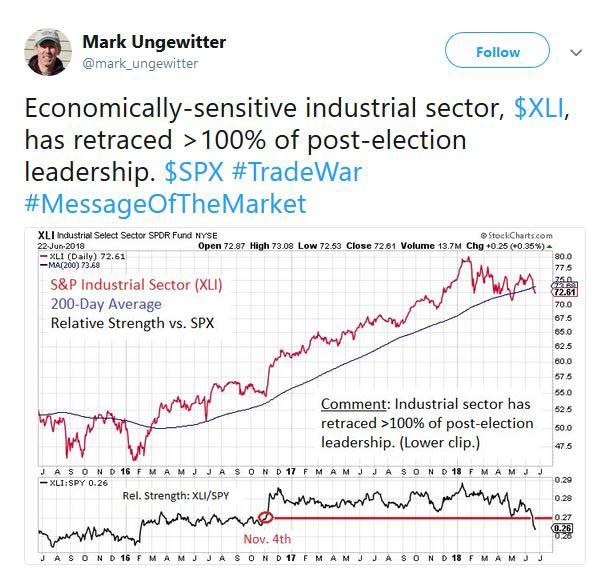

U.S. industrial stocks have given up on the trade war battles…

@mark_ungewitter: Economically-sensitive industrial sector, $XLI, has retraced >100% of post-election leadership. $SPX #TradeWar #MessageOfTheMarket

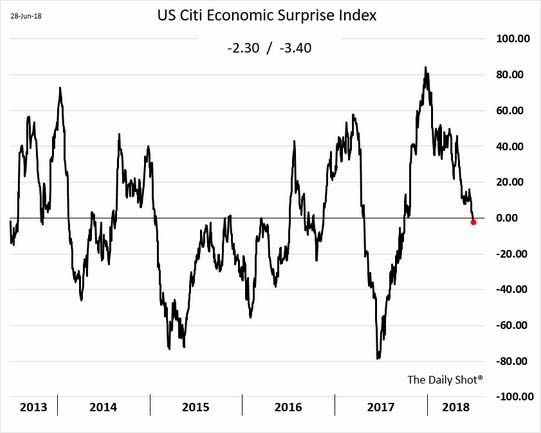

After peaking in January, the U.S. Economic Surprise Index has now gone negative…

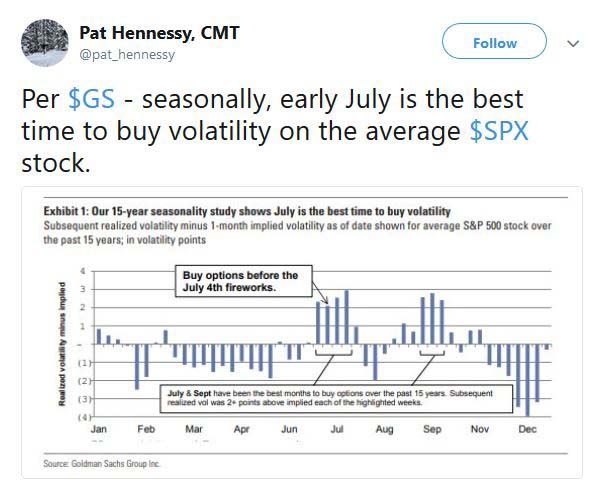

Coincidentally, July is a great work for fireworks in your driveway and in your stock portfolio…

@pat_hennessy: Per $GS – seasonally, early July is the best time to buy volatility on the average $SPX stock.

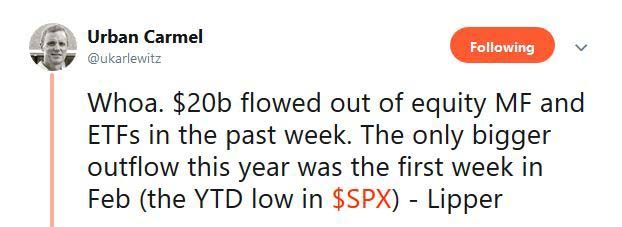

Other investors are also peeling chips off the table at an increasing rate…

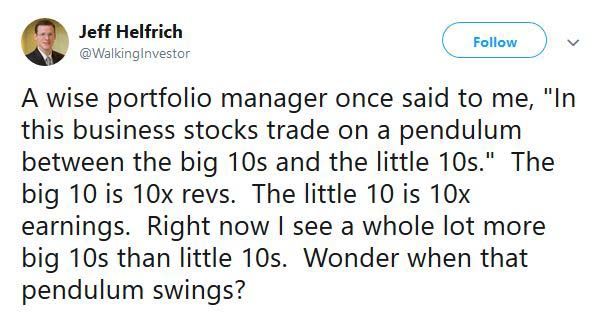

Jeff, I’d say that this market is now leaving the big ten and heading back toward the little ten…

And a final market thought from Eric Peters…

“One thing’s gone right this year: Tech,” bellowed Biggie Too, Global Chief Investment Strategist for one of those Too Big to Fail affairs. “I get the rationale, but that don’t make me trust it.” Tech fund inflows are running at a $37bln annualized pace this year, 2x last year’s stunning rate and 10x higher than any year in the past 15. “When tech gets sold, it won’t be because of tech, it’ll be something else,” barked Biggie, a big golden grin. The Nasdaq fell 33% in 1998, not because of tech, it was LTCM, Russia. “That’s how you play this game.”(Eric Peters)

Some updates from the 361 World Cup Challenge…

- Of total entries, only 0.40% have a chance of getting the final four teams plus the 2018 FIFA World Cup Champion correct.

- 34.32% of entrants could still get the FIFA World Cup Champion pick correct.

- Tunisia’s country market, TUSISE, has been the top ranking country by market return 83.33% of the days since the World Cup start with a total market return of 3.89% since June 15.

You can check the country market rankings here or follow us on Twitter for timely updates.

Lastly, we wish you and your family a happy 4th of July…

361 Capital is grateful to those that have sacrificed for our freedom. We are proud to announce that, in partnership with the Travis Manion Foundation, we will be hosting the Denver 9/11 Heroes Run this fall.

The 9/11 Heroes Run unites communities internationally with the goal to never forget the sacrifices of the heroes of September 11th and the wars since: veterans, first responders, civilians and the military. To learn more about the Travis Manion Foundation or to register for the Denver race, or one in your area, click here.