by Scott Brown, Ph.D, Raymond James

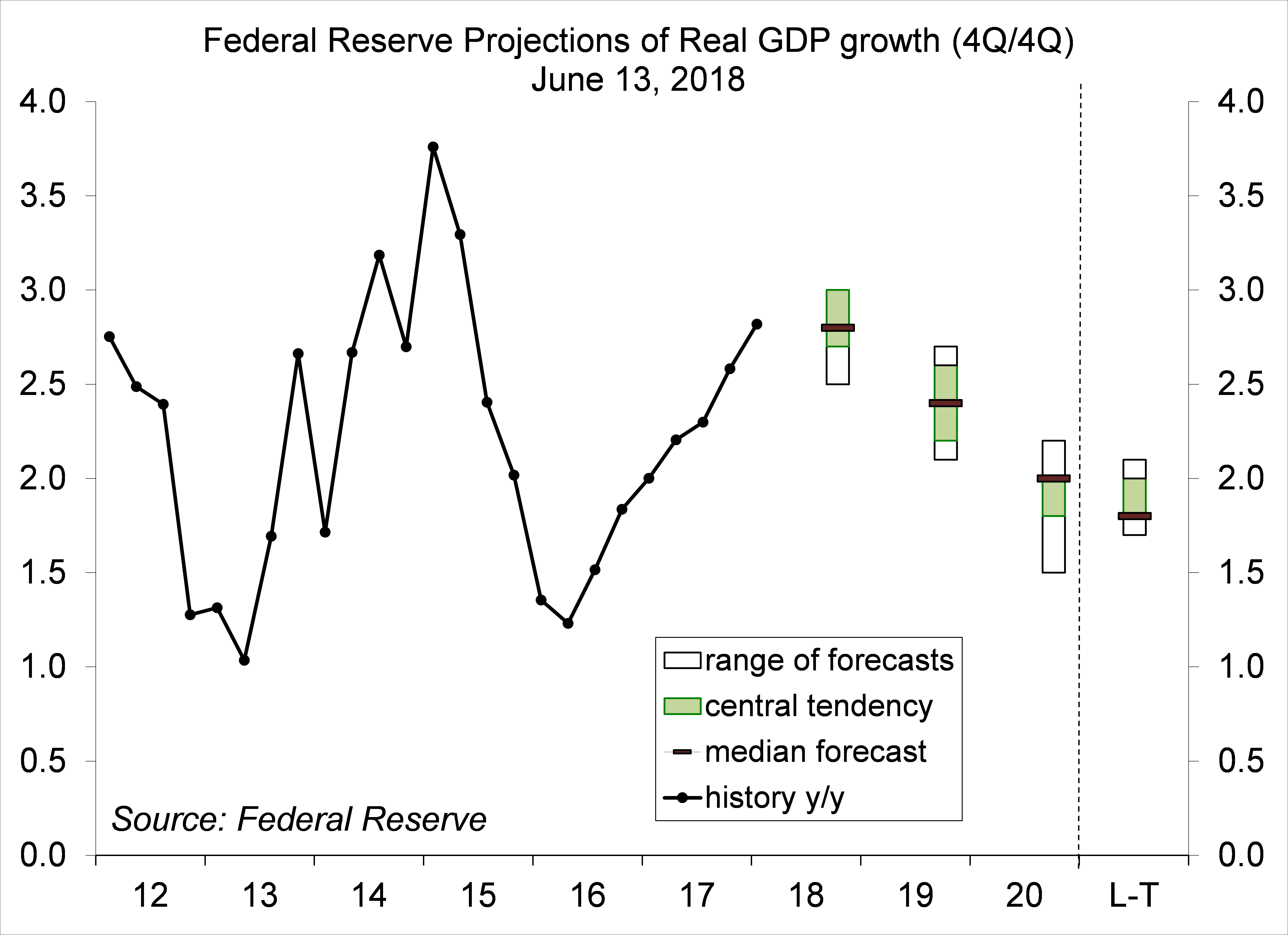

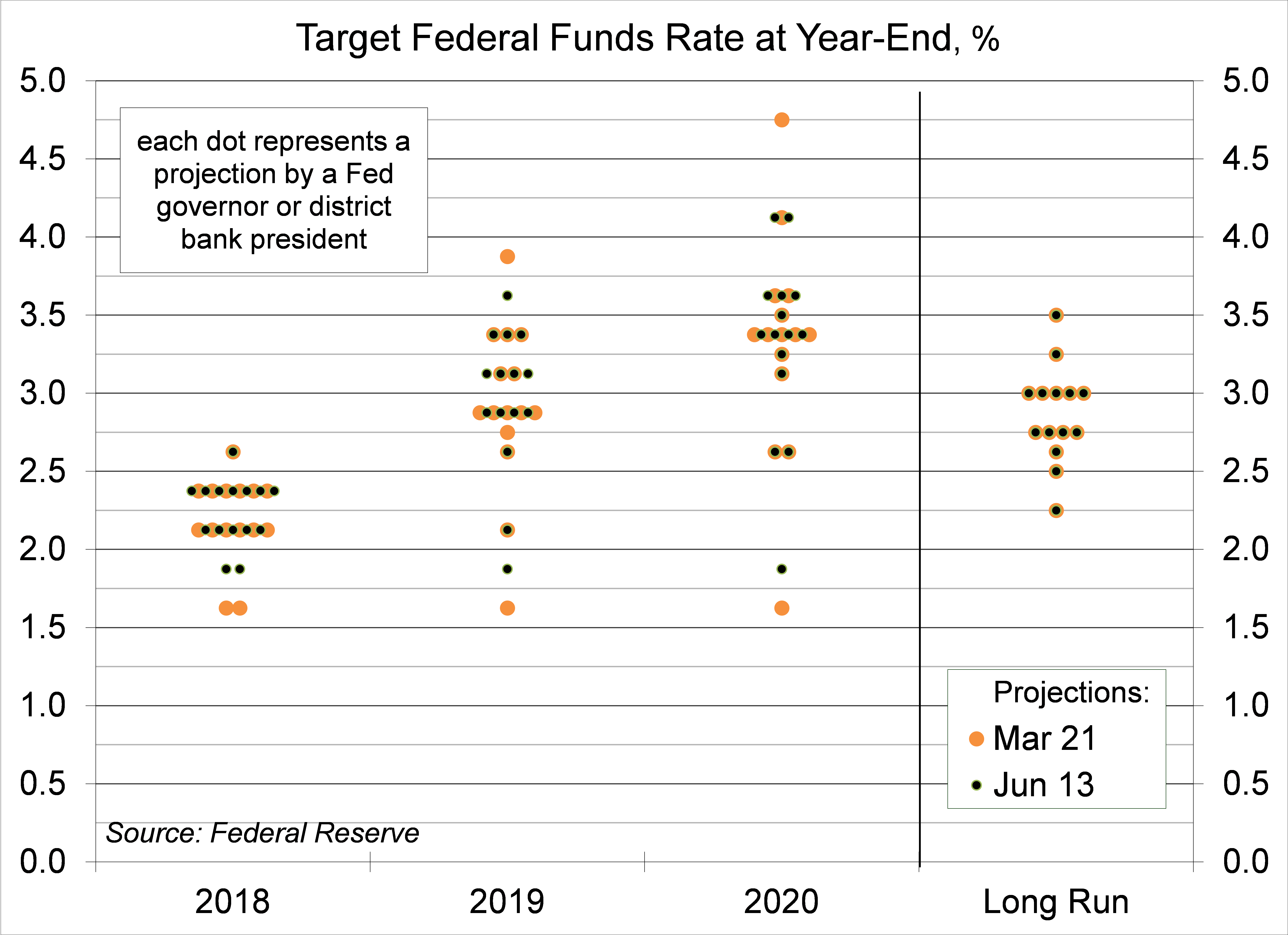

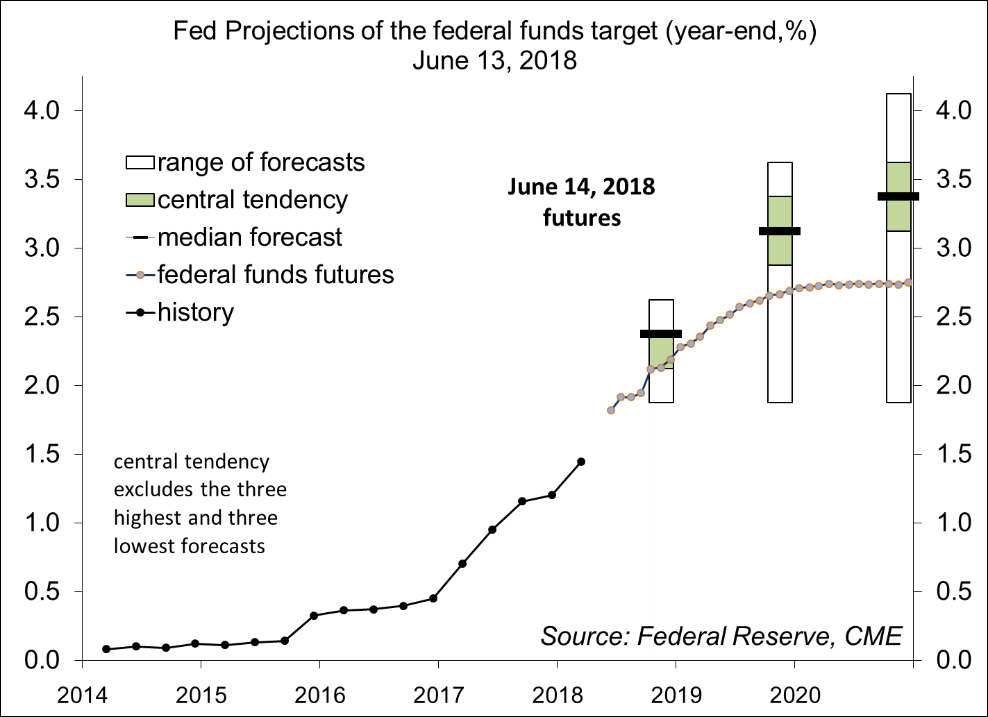

As expected, the Fed raised short-term interest rates following the June 12-13 policy meeting. Investors were more concerned about the pace of future rate increases and the revised dot plot showed a median of four rate increases in 2018, although (as in the March plot), most fed officials were divided between three and four. More importantly, Fed officials generally believe that above-potential growth will push the unemployment rate lower and inflation a bit higher, and that would likely require that the Fed boost the overnight lending rate above a neutral level in 2019 and 2020.

In his post-meeting press conference, Fed Chair Powell indicated that most Fed policymakers (and indeed, most economists) believe that individual and corporate tax cuts will provide support for demand this year and next. Faster business fixed investment would, in turn, facilitate faster growth in productivity. While there is a possibility that lower taxes will add to labor supply (by inducing workers back into the labor force), the timing and magnitude of that is uncertain (and some would argue, very much in doubt). Demographic changes (the aging of the population) and limitations on immigration, will severely constrain labor force growth relative to recent decades. If labor force growth is about 0.5% per year and productivity growth is 1.0-1.5%, then potential GDP growth would be 1.5-2.0%. The Fed’s long-term GDP growth estimate is 1.8-2.0%.

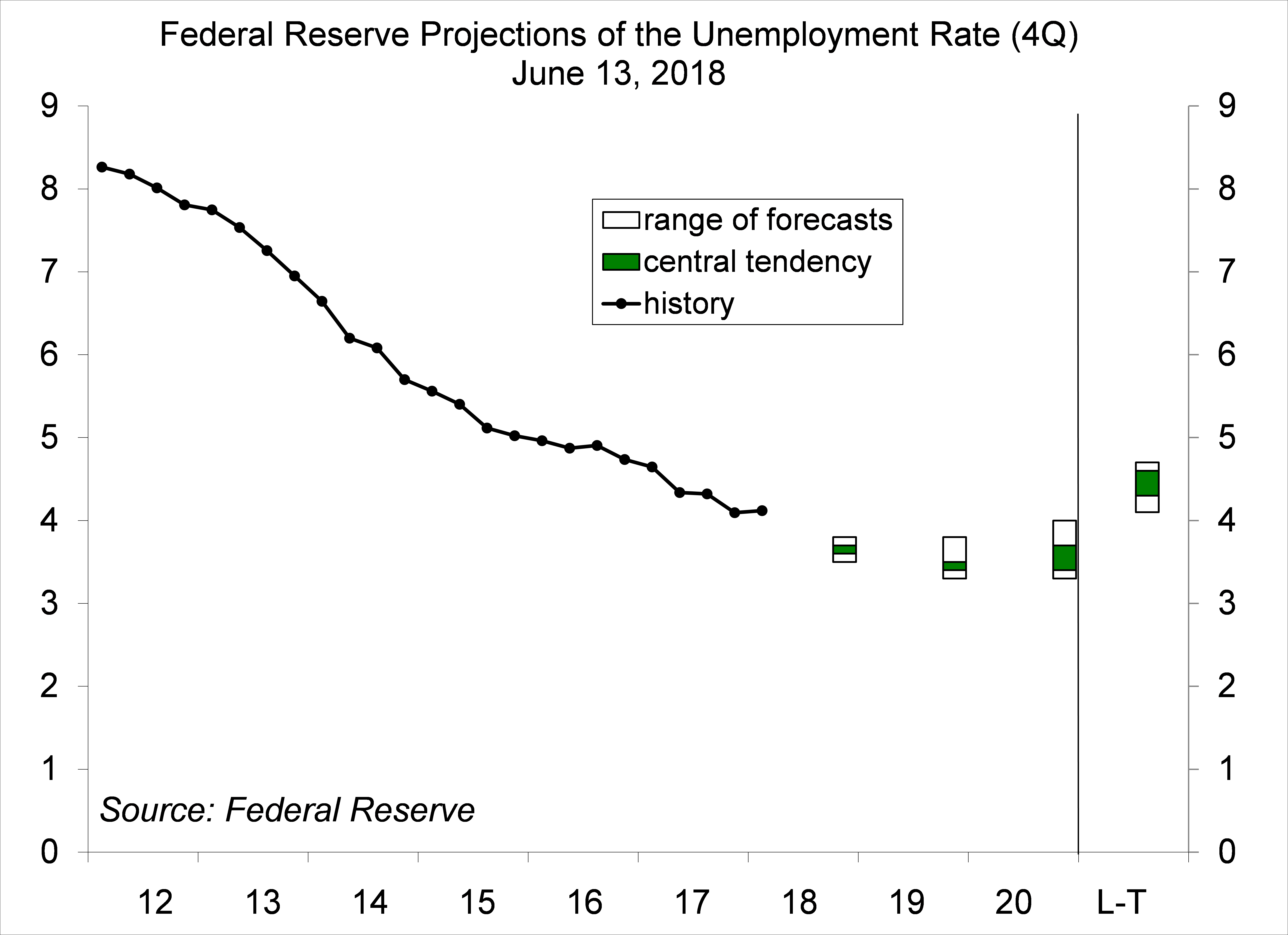

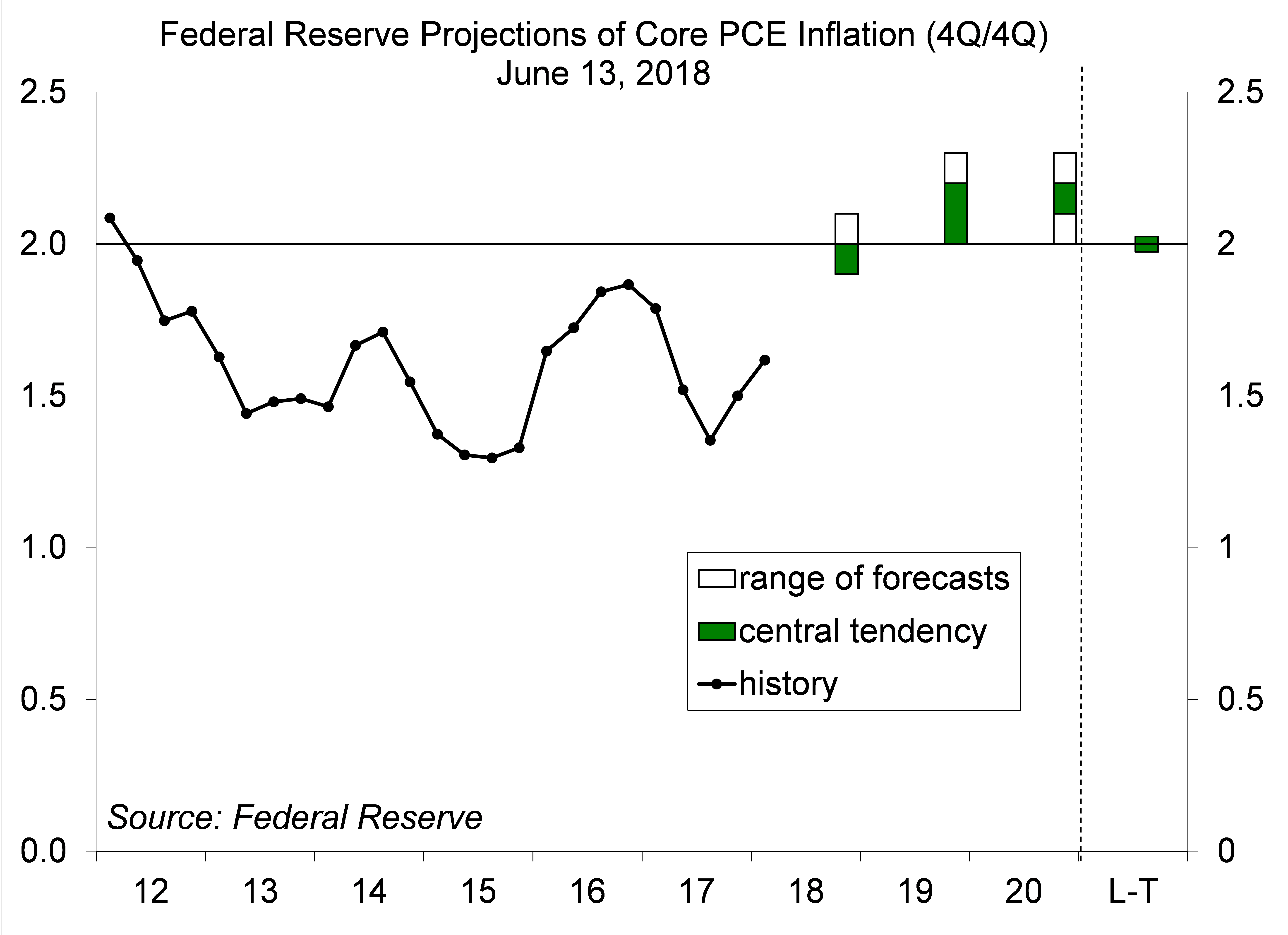

The Fed expects that the unemployment rate (currently 3.8%) will fall a bit further (averaging 3.6-3.7% in 4Q18 and about 3.5% in 4Q19). That seems a little high given the Fed’s expectations for GDP growth (unless there is a lot more slack in the job market than is currently believed). Nobody knows the natural rate of unemployment (the rate consistent with normal frictional and structural forces), but Fed officials peg it at around 4.5%. We’re well below that now, which should imply upward pressure on inflation. However, there’s been little evidence of a steady relationship between the unemployment rate and inflation over the last 18 years (suggesting that the Phillips curve is dead, or at least very flat – but it could be resting).

There’s a good chance that the unemployment rate will fall further than the Fed expects. We’ve already seen the Fed’s unemployment rate forecasts come down over time. If that’s the case, then inflation ought to be higher than the Fed is forecasting. In his post-meeting press conference, Powell signaled a willingness to allow inflation to stay above the 2% goal for a while. This sentiment should help establish 2% as a goal rather than a ceiling. Inflation in prices of raw materials remains elevated, and higher oil prices have boosted transportation costs. Tariffs aren’t going to help (in the Consumer Price Index, the component for laundry equipment rose 16.1% in the last two months, following tariffs on washing machines). However, while inflation is expected to move higher, this isn’t the 1970s. We’re unlikely to see a much sharper pickup in consumer price inflation.

Monetary policy isn’t easy. Decisions are made based on data that may be unreliable (noisy and subject to revisions). As one looks through the Fed’s economic forecasts, it’s clear that there are major uncertainties and inconsistencies in the outlook. In a late-cycle economy, the Fed always has to walk a fine line - and it’s nearly impossible to get that right. In the near term, as Powell noted, “the economy is doing very well.” There are no storm clouds on the immediate horizon. Trade policy missteps remain a concern, obviously, but the bigger risks involve Fed policy in 2019.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report's conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Copyright © Raymond James