by Blaine Rollins, CFA, 361 Capital

Much to think about this week, but the acceleration in the global trade wars has once again moved to the top of the list. Going tit for tat with China has upset the financial markets. Will this set a precedent for how the U.S. ‘negotiates’ with Europe, NAFTA and the rest of the world? If so, U.S. economic growth will certainly slow. For now, the Fed continues to think that the U.S. will avoid the trade wars and that growth will continue. As a result, the Fed increased rates 25 basis points last week. As rates moved higher, so did the U.S. dollar putting a further hurt on Emerging Market currencies, equities and debt. Will EM be the tipping point for the global markets? It has happened before. But for now, the financial markets have competition for attention as the World Cup started off with an incredible weekend of games. Hats off to Mexico, Iceland and Ronaldo.

To receive this weekly briefing directly to your inbox, subscribe now.

Trade tariffs with China have expanded to include the building blocks of technology…

Will semiconductor investors stay put in their stocks?

The U.S. semiconductor industry bristled at President Donald Trump’s plan to impose tariffs on about $50 billion of Chinese goods, arguing they will hurt American business and make the country less competitive.

The rules, which take effect July 6, will place 25% tariffs on a variety of goods including semiconductors and related product imports, products brought into the U.S. that amounted to $2.5 billion in 2017, according to the Semiconductor Industry Association, a U.S. trade group.

A second set of tariffs, which would take effect at a later date, includes additional semiconductors and related products—and that impact is more extensive, including a wider collection of components in chips than the original list, the group said. The trade group said it was still determining the financial impact.

China, in a retaliatory move, said it would impose tariffs of 25% on U.S. products including autos, agriculture and seafood.

How to delete a 100-year old American company with tariffs…

Lyon Group Holding owns Lyon and Republic, century-old companies that dominate the market for American-made lockers. The companies’ combined annual sales are around $100 million, and they employ some 400 full-time workers at three manufacturing plants in Indiana and Illinois.

Steel has long accounted for 45% of the cost of making lockers at Lyon and Republic, the single biggest expense. Mr. Trump’s 25% tariff has driven up the price of foreign steel and given domestic steel the chance to raise prices. American hot-rolled steel coil recently sold for $900 per short ton—the highest price in a decade. That’s up 38%, or $248 per ton, since the beginning of January.

Lyon and Republic now spend $40.68 on steel for their $100 individual locker units, up from $33.90 before the tariffs. In this low-margin business, that’s the difference between a $5 profit and $1.78 loss on each unit.

“This is do or die for businesses,” Mr. Altstadt says. “Either you fix this problem, or if you can’t fix it somehow, the business will have to close completely because you can’t have a negative profit on the product you sell.”

Raising locker prices isn’t an option. Even before the tariffs, Lyon and Republic’s clients were paying a 10% premium for the convenience of buying American instead of Chinese, and they can’t afford to go any higher, Mr. Altstadt says.

(WSJ/Daily Shot)

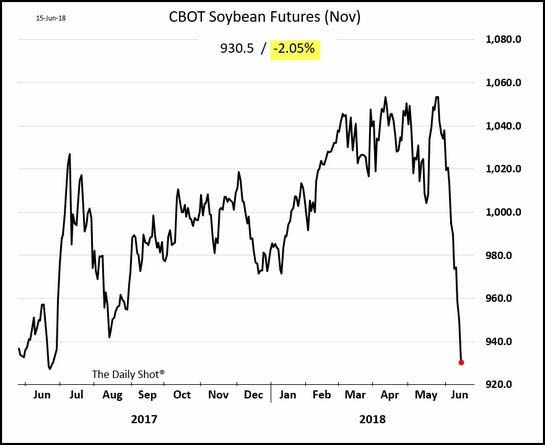

It now looks like planting soybeans was the wrong bet for this year’s agricultural crop…

Perhaps Iowa farmers’ biggest fear is becoming a harsh reality: The escalating U.S.-China trade dispute erupted Friday, with each country vowing to levy 25 percent tariffs on $50 billion in goods.

U.S. and Iowa agriculture is caught in the crossfire, with farmers selling $14 billion in soybeans to China last year, its top export market.

Soybeans are among hundreds of U.S. products China has singled out for tariffs. The U.S. has an equally long list that includes taxing X-ray machines and other Chinese goods.

Iowa farmers could lose up to $624 million, depending on how long the tariffs are in place and the speed producers can find new markets for their soybeans, said Chad Hart, an Iowa State University economist.

U.S. soybean prices have fallen about 12 percent since March, when the U.S.-China trade dispute began.

But almost anything planted in U.S. soil is having a difficult year as agricultural conditions remain difficult and tariffs reach many products…

Oil and metals can travel the globe by ship. But fruits have a very short shelf life…

Growers of apples, pears and cherries in Washington, Oregon and Idaho are rushing to figure out what they can do with perishable fruit that’s now the target of retaliatory tariffs in markets such as China, India and Mexico. Mark Powers, president of the Northwest Horticultural Council, said its 4,700 growers in those states export about $1 billion worth of produce each year. Finding new, tariff-free markets requires lengthy negotiations between countries.

“Quantifying the results of this is a guessing game,” he said. “We’re already seeing customers coming back and asking for discounts and offsets.”

Cherries are a pressing concern, particularly because members are enjoying a bountiful crop. The fruit lasts only about seven days once picked, and most exports are shipped in planes to Asia.

“If China closes, that’s our largest cherry market, and it’s hard to divert on the fly,” Powers said.

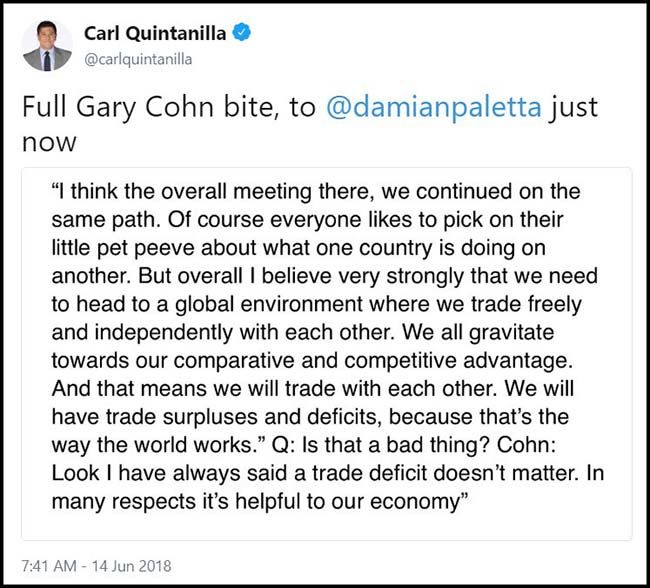

The smartest economic brain is no longer in the White House…

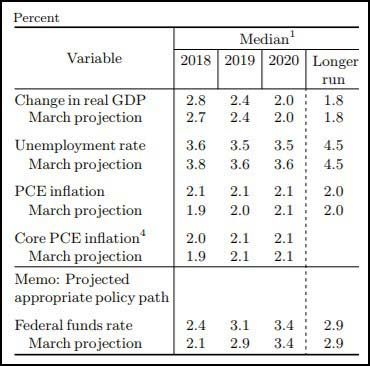

As a result of improving conditions, the Fed raised Fed Funds rates last week by 0.25%…

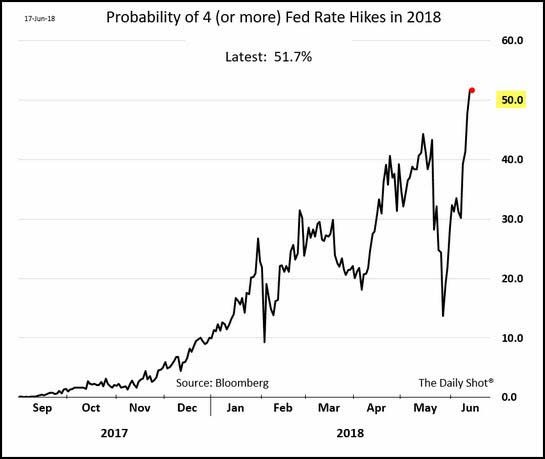

And the market moved their projection of hikes to four on the year (so two more anticipated)…

(WSJ/Daily Shot)

What the Fed is seeing #1: A hot job market in Charleston is causing IHG to pull the plug on its call center…

The tightening labor market is costing the region more than 600 jobs.

InterContinental Hotels Group notified workers this week that it is closing its North Charleston call center later this year because of “staffing challenges,” spokesman Neil Hirsch said Thursday.

“We’ve seen a high level of turnover, so that impacts the performance of the center,” he said.

The closing is scheduled for November, and about 630 employees are affected.

The task of handling thousands of inbound calls a day from hotel guests will be transferred to a third-party customer service provider, IHG said.

What the Fed is seeing #2: The hot job market in Denver is holding back growth…

Metro Denver’s low unemployment rate is hindering business expansion plans, but employers aren’t giving up on trying to fill vacant positions, according to a new survey from Korn Ferry, a global human resources consulting firm.

In April, the unemployment rate in Metro Denver’s stood at a low 2.5 percent, on par with April 2017, according to the U.S. Bureau of Labor Statistics. The region hasn’t seen a run of unemployment rates this low since the tech boom in 1999 and 2000.

About six in 10 of the business professionals that Korn Ferry surveyed said the shortage of talent was affecting the ability to grown, while the remainder didn’t seen any impact.

The Fed might also be looking at the prices of freight, trucking and railroad stocks…

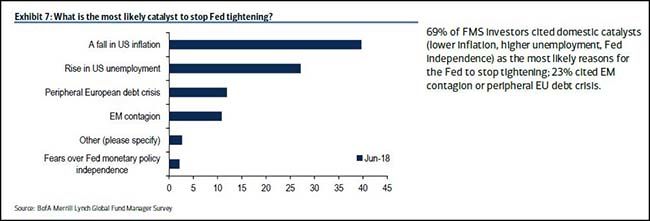

So what will get investors to think the Fed’s job is done?

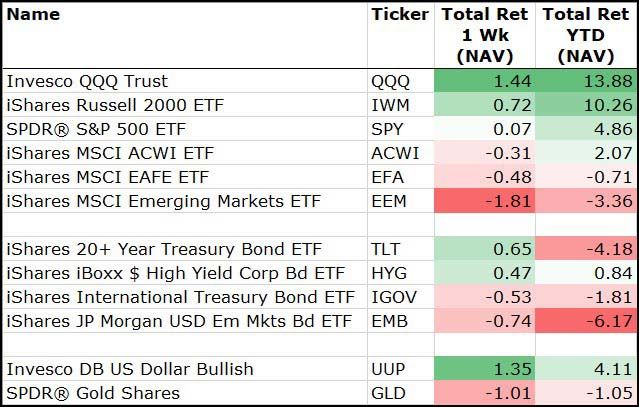

A strong U.S. dollar last week helped Small Caps and Technology stocks surge to new highs…

On the flipside, more brutality for Emerging Market equities.

(6/15/2018)

While Semiconductors may have lost momentum, Internet, Software and Consumer stocks have accelerated to push the Nasdaq 100 higher…

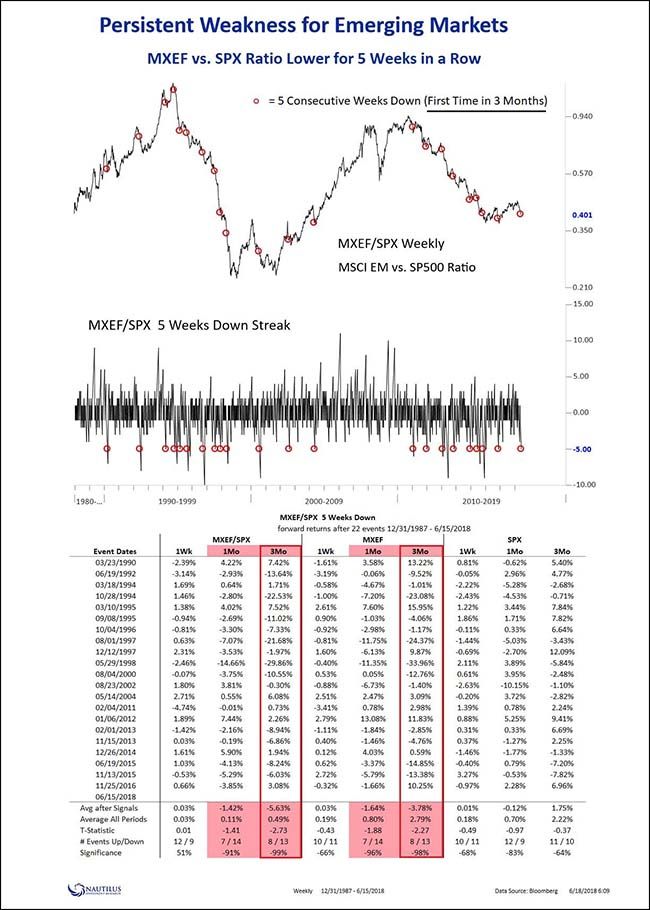

Don’t be in a rush to buy this pullback in Emerging Market equities…

Good analysis showing that weakness in Emerging Markets tends to be persistent. So aggressive selloffs typically continue lower. So if you are looking for a bottom, be patient.

(@NautilusCap)

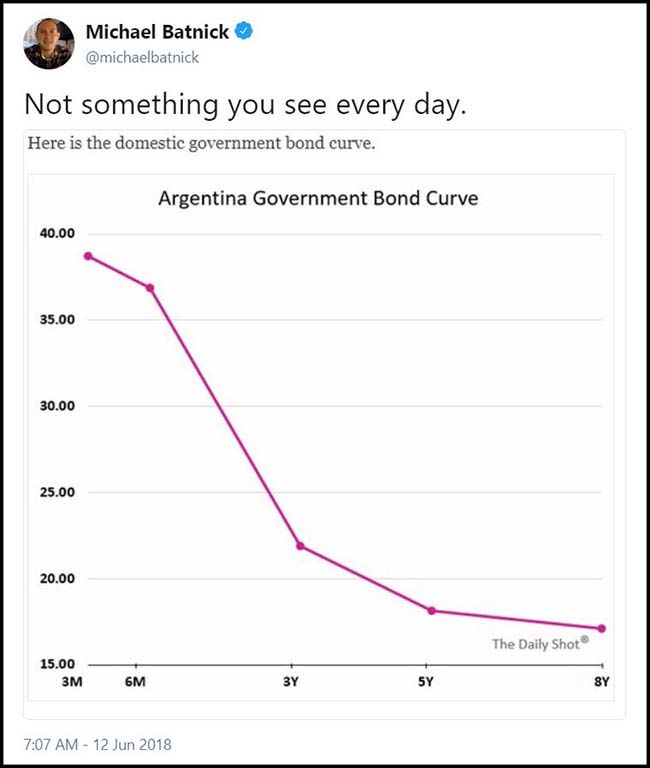

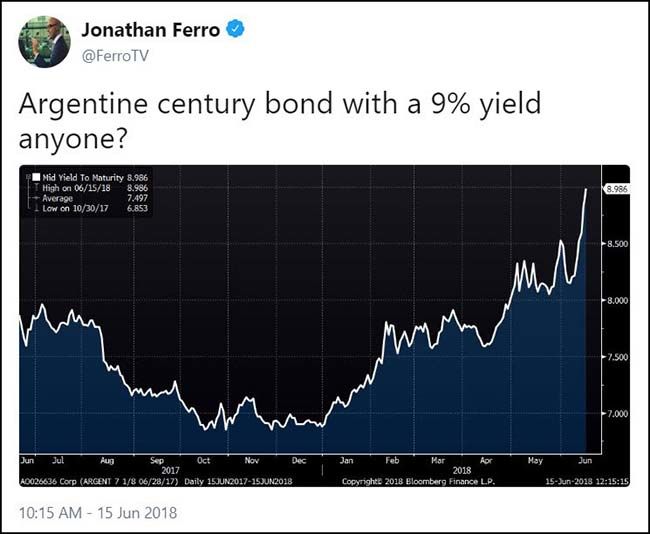

At least wait until the 100-year Argentinian bond yield peaks…

And maybe for the Argentinian yield curve to look less like a double black diamond ski hill…

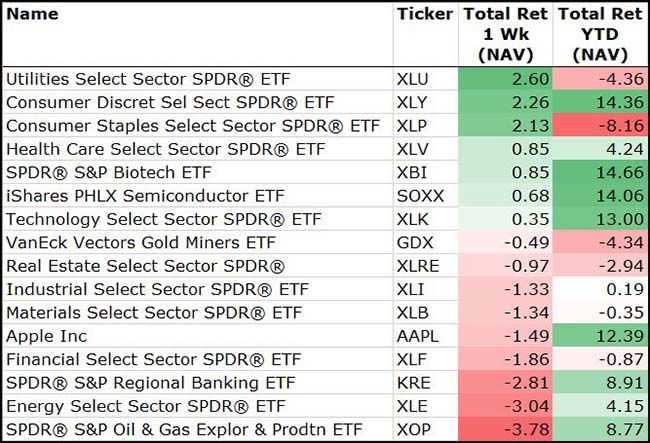

Among sectors Utilities, Consumer Stocks and non-Semi Technology led the market last week…

While Energy, Banks and Financials lagged the market.

(6/15/2018)

Energy stocks are getting skittish ahead of the OPEC meetings this week…

We know that the Saudis and Russians have been talking about letting production increase to offset Venezuela’s current decline. But will the increase be enough with inventory levels near recent lows? Let’s see if Energy stocks and the price of Oil can hold this uptrend.

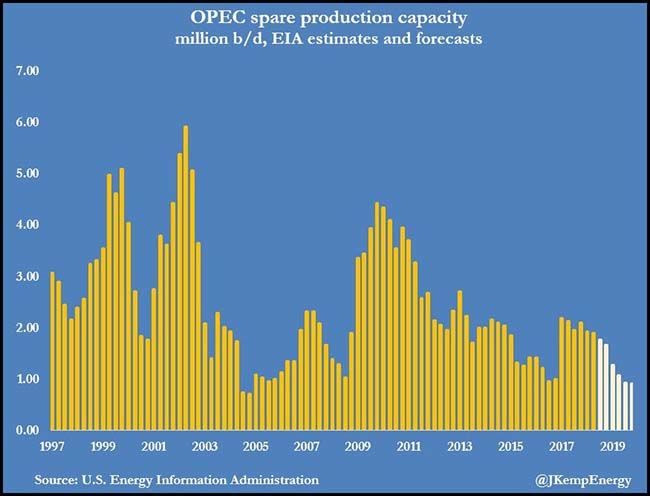

Extra production capacity is becoming scarce which will be a focus of the OPEC discussions…

Late Sunday night, OPEC members might have been narrowing toward a production agreement…

OPEC members are discussing a compromise agreement that would see an oil production increase of between 300,000 and 600,000 barrels a day over the next few months, according to people briefed on the talks.

While Iran said on Sunday it’s opposed to any increase to current quotas, officials from a number of other countries are optimistic that an agreement can be won for a relatively modest hike at this week’s meeting in Vienna, the people said, asking not to be named discussing private conversations…

The compromise output boost, if agreed, would be smaller than the 1.5 million-barrel a day quota increase that Russia has proposed.

OPEC officials are also working on putting the cooperation between the cartel, Russia and other oil producers — the so-called OPEC+ group currently comprising 24 nations — on a permanent footing. That would be a major diplomatic breakthrough for Riyadh and Moscow after just two years of cooperation on oil policy.

The prospect of binding Russia, the world’s largest exporter after Saudi Arabia, more closely to OPEC might help persuade Iran and Venezuela, another skeptic about the need for an increase, to back higher production in the second half of the year.

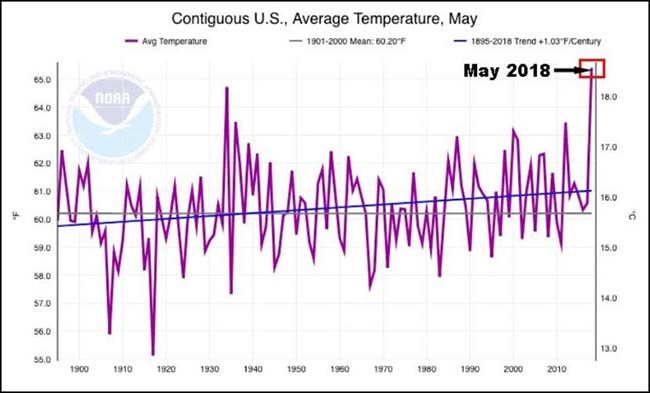

Further adding to energy demand, the month of May was the warmest on record for the U.S…

And given the temps in June, I am not seeing any relief in air conditioner usage.

The underperformance in Financial stocks is beginning to accelerate…

The rise in interest rates is not offsetting the ongoing flattening of the yield curve.

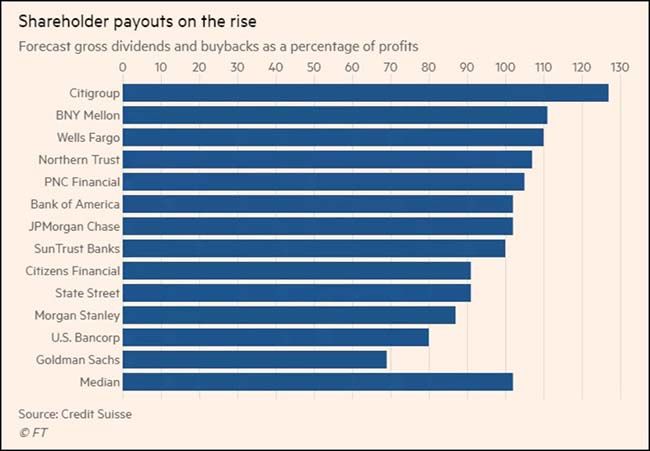

One reason for investor concern in bank stocks…

High shareholder payouts (dividends + buybacks) are a positive, but are investors equally excited when the payouts exceed profits?

A global fight for top lawyers…

US law firms have launched an expensive bidding war for young talent after New York-based Milbank Tweed Hadley & McCloy raised the salary it is offering first-year lawyers to $190,000, forcing their competitors to follow suit.

The $10,000 increase for new starters by Milbank, which also raised salaries for those just below partner level to $330,000, took effect this month. It was echoed by several other leading US firms, including Cravath Swaine & Moore, which normally sets the salary bar — as it did when it sparked a similar pay war two years ago…

June’s pay wars look like leaving behind the leading UK firms, which were slow to react to the 2016 round of US salary raises. First-year lawyers at London “magic circle” firms such as Linklaters and Clifford Chance earn the equivalent of about $120,000.

On Friday Clifford Chance said that it would match the Cravath scale — though only for US-based associates.

“There has been something of a brain drain [from UK] to US firms — not only at partner level, where US profits are often much higher, but also for associates,” said Freddie Lawson, of legal recruitment firm Fox Rodney Search. “There’s a real fight for those guys.”

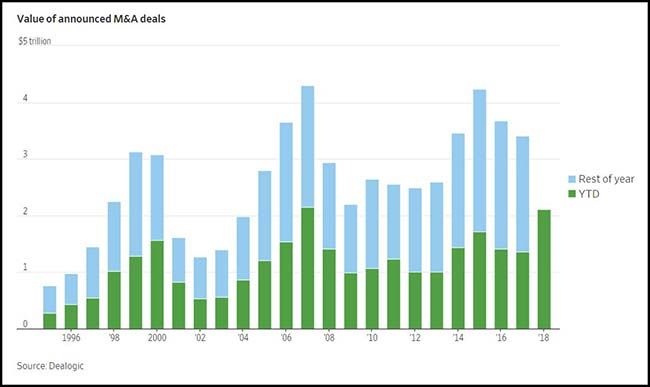

One big reason for increasing demand for legal talent is that global M&A has accelerated…

(WSJ)

One big reason for the spike in global M&A is Netflix…

Netflix’s overthrow of television’s old business model began just seven years ago. That’s when the Silicon Valley company best known for mailing DVDs in little red envelopes outbid AMC and HBO for the rights to a drama from director David Fincher, a remake of the British mini-series House of Cards. It was a big deal at the time, both because of the money Netflix was spending ($100 million for two seasons) and because it was the first hint of the streaming platform’s ambitions to evolve beyond a digital warehouse for other conglomerates’ intellectual property.

House of Cards is airing its final season this fall, and Netflix now makes more television than any network in history. It plans to spend $8 billion on content this year. “I’ve never seen any one company drive the entire business in the way Netflix has right now,” says Chris Silbermann, managing director of ICM Partners and agent for Grey’s Anatomy and Scandal creator Shonda Rhimes, who moved her production company to Netflix last year.

TV has gone through major transformations in the past — cable and Rupert Murdoch’s Fox toppled the hegemony of the Big Three broadcast networks in the 1980s, for instance — but this leap dwarfs all others. Netflix doesn’t want to be a streaming, supersized clone of HBO or FX or NBC. It’s trying to change the way we watch television. Whether it can do that while turning a profit is another matter, given the more than $6 billion in debt it’s amassed during its expansion. But Wall Street seems optimistic: In recent weeks, its overall market capitalization has at times grown past $150 billion, surpassing Disney to become the most-valued media company in the world.

Another big reason for the spike in media and technology M&A…

Who says video gaming doesn’t pay?

At Electronic Arts, the head of video game production was just paid more than the CEO…

“Patrick Soderlund, who runs EA Worldwide Studios, was the highest paid of the company’s leaders, receiving equity awards totaling $46.3 million, while Chief Executive Officer Andrew Wilson received $35.7 million in total pay, a 79 percent increase from a year earlier, the Redwood City, California-based company said Friday in a regulatory filing. The increases resulted from special equity awards in recognition of the firm’s financial performance over the past four years.”

Looking for a starter home in the Bay Area?

$2,900 a square foot is excessive. But now you have gone too far San Francisco…

A tin of osetra caviar arrives in a crystal bowl of crushed ice. It’s served as a bona fide “bump”— the server spoons the eggs onto your fist along with a dollop of smoked creme fraiche, then drapes it all in a fat slab of barbecued wagyu beef fat. (Yes, all on your fist.) It’s a salty, smoky, slippery slurp, enlivened by a perfect pop. The effect is similar to the drug it alludes to: I immediately wanted more — although not at $68 a hit.

Meanwhile, Costco sells over 100 million hot dogs annually, which is more than every MLB stadium combined…

Taking his words to heart, Jelinek—who became Sinegal’s successor in 2012—has never raised the price on Costco’s hot dog. Incredibly, it has sold for the same $1.50 since the retail club first introduced the dogs to customers in 1984. The quarter-pound, all-beef tube and 20-ounce soda combo appears to be inflation-proof and immune to the whims of food distributors. How does Costco do it?Simple. When it comes to hot dogs, Costco doesn’t price according to what the market will bear. They price according to their own cost and according to the value the hot dogs can afford them.

According to Jelinek, people would pay $1.75, and maybe more, for the deal. But is that extra 25 cents going to be more valuable than the goodwill and foot traffic generated by a combo that’s stuck to its price point for nearly 35 years? Probably not. Customers coming in to shop at Costco are amused, satisfied, and fueled by the hot dog meal. If they get it just before leaving the store, they’re left with a lasting impression of being treated well. That’s worth more than keeping up with inflation.

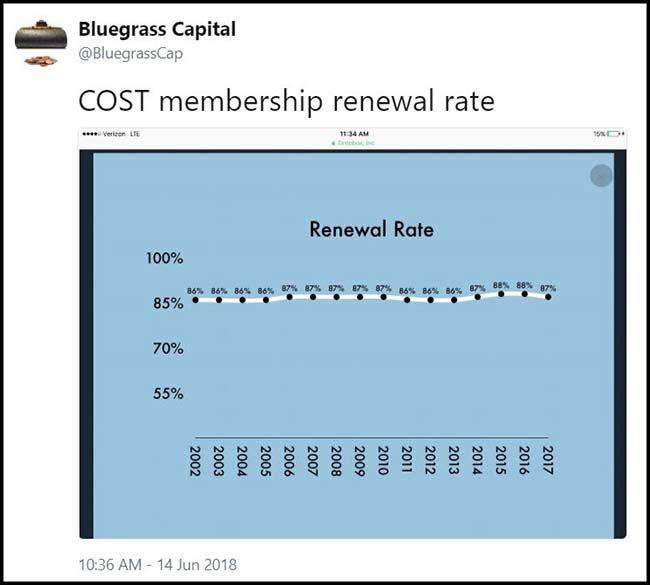

One outcome of Costco’s Hot Dog + Soft Drink combo = a renewal rate to dream about…

Soccer is the world’s sport and it shows in the trading volumes…

An analysis of trading data from 15 global stock exchanges carried out during the 2010 World Cup—which was held in South Africa—found that trading volume dropped by roughly 33% from normal levels during games. The research, by two economists from the European Central Bank and the Dutch central bank, found median trading volume was 55% lower than normal when the national team from an individual exchange’s country was playing.

Finally, the Iceland National Team picked up where it left off four years ago…

Luckily, the Fox Sports coverage does not include the hometown names on a player’s screen shot.

Additional Insights

361 Capital Blog: It is Time for the World Cup to Begin: My Picks…

Copyright © 361 Capital