by John Coumarianos, Analyst, Clarity Financial

Do stocks get less risky the longer you own them? Most financial advisors say Yes; if you’ve got the time, you should own stocks. That’s because although nobody knows what the stock market will do over any one-year period, the market seems to go up over time — and at a rate that has overcome inflation by around 6-7 percentage points. History shows the longer the time period, the higher the chance of producing a positive return. So it’s foolish to own stocks for a one-year period, but also foolish not to own them if you’ve got, say, a decade or longer as a time horizon.

The problem is that a 60-year old planning to retire in five years doesn’t have a long period of time anymore. The typical advisor and the entire financial services business will argue that this hypothetical person does indeed have a long period of time because he will likely not die at 65. That person’s assets must see him through what could be a 30-year retirement. And that’s why most target date funds continue to have significant stock exposure on the date of retirement. The Vanguard Target Retirement 2020 Fund, for example, has 52% of its portfolio is stocks currently, according to Morningstar.

But increased longevity isn’t the final argument regarding asset allocation in retirement either. Last night, my colleagues, Richard Rosso and Danny Ratliff, and I interviewed Professor Zvi Bodie of Boston University who argues that the “stocks for the long run” argument can be misleading. Bodie decried the significant stock exposure that target date funds have at retirement, and argued that investors aren’t guaranteed to earn long term stock market historical averages by increasing their time frames. (Bodie says the same thing in this interview starting at 2:10). Not every 10- or 20-year period produces returns well in excess of inflation. the “risk premium” that stock are supposed to deliver over other asset classes is sometimes absent altogether.

That means if someone has saved enough money to generate the income they need in retirement, one runs the risk of ruining that retirement plan by holding an excessive amount of stocks, whose value can decline significantly. After all, we’ve had two periods over the last 18 years where stocks have declined by 50%. One of those “drawdowns” lasted over two years and one period lasted for a little over one year.

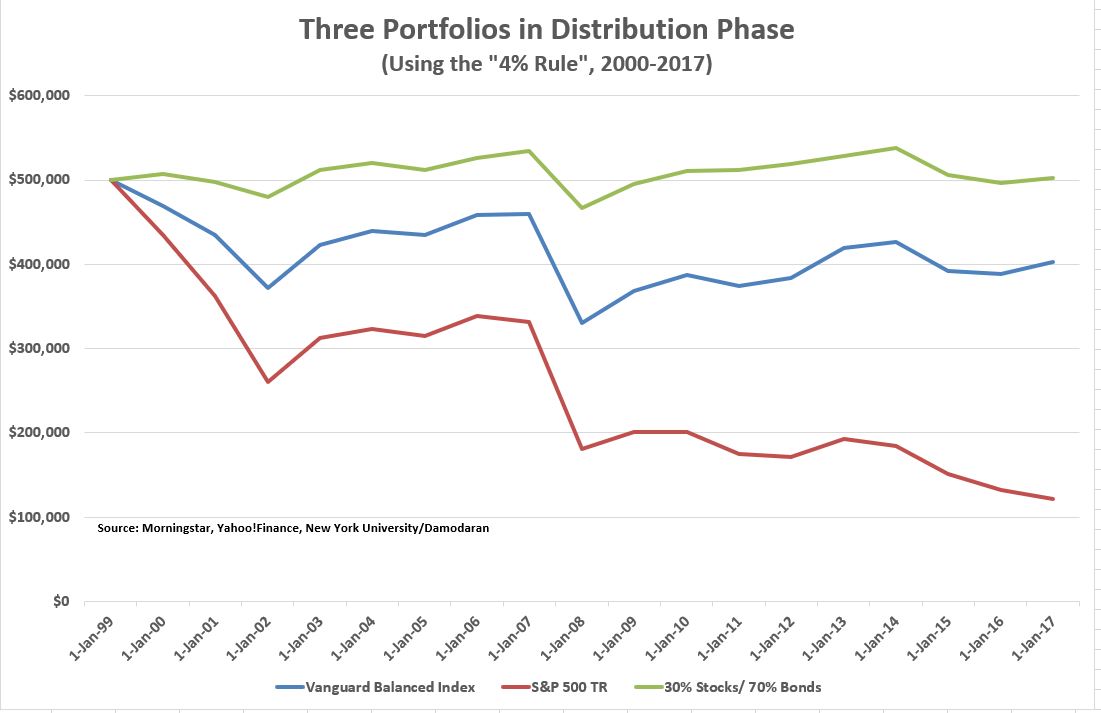

Even if stocks do outperform bonds, the volatility they impose on an investor drawing income from investments can be catastrophic. Below is a chart of three hypothetical retirement scenarios beginning in 2000 and running through 2017. They represent a $500,000 retirement savings account invested in different allocations from which a retiree spends 4% in the first year and grows the initial withdrawal amount by 4% each year thereafter (the so-called 4% retirement income rule). The different allocations are a 30%/70% mix of stocks and bonds, a 60%/40% mix and a 100% stocks portfolio. We use the S&P 500 Index, including dividends, to represent stocks and the Bloomberg Barclay’s U.S. Aggregate Bond Index to represent bonds.

Over this period of time, stocks delivered a 5.4% annualized return, while bonds delivered a 5.1% annualized return. But, although stocks beat bonds marginally, increasing a retiree’s exposure to them didn’t help. The most conservative portfolio was the only one that kept the retiree’s assets intact after distributions. A balanced portfolio eroded the assets and a 100% stock portfolio eroded the assets spectacularly, despite the slight outperformance of stocks on an compounded annualized basis.

This illustration displays “sequence of return risk” well. The better performing asset on a compounded annualized basis was too volatile to keep the retiree’s portfolio intact. Losses came at the beginning of the distribution period so that the combination of losses and distributions in the first few years depleted the portfolio to the extent that a stock market rebound couldn’t elevate it adequately again.

Of course, stocks often beat bonds more resoundingly than they did from 2000 through 2017, though, again, not always. The illustration picks an unusually bad period when the stock market suffered two massive declines. That tends to harm a portfolio in distribution considerably. But investors should think in terms of worst-case scenarios, not just long-term averages.

Furthermore, investors should take starting valuations into consideration when contemplating various scenarios and their likelihoods. While the Shiller PE (current price relative to the past decade’s average, real earnings), for example, is lousy at forecasting crashes and short term returns, it’s pretty good at forecasting the next decade’s worth of returns. And because it has this longer term forecasting ability, it can be useful to retirees as financial planner Michael Kitces shows (here and here).

Currently, the Shiller PE is elevated at 32. Its long term historical average is less than 17. Perhaps a “new normal” for the metric is 20 or even 22, since companies are more profitable now than they were in the past. But even a new normal doesn’t make stocks appear cheap or future returns robust. That means, with stock return prospects so low, investors embarking on retirement probably shouldn’t have more than half their assets in stocks, and many should consider having considerably fewer than half their assets in stocks. In other words, the typical target date fund allocation may not be appropriate for many retirees.

Copyright © Clarity Financial