by Blaine Rollins, CFA, 361 Capital

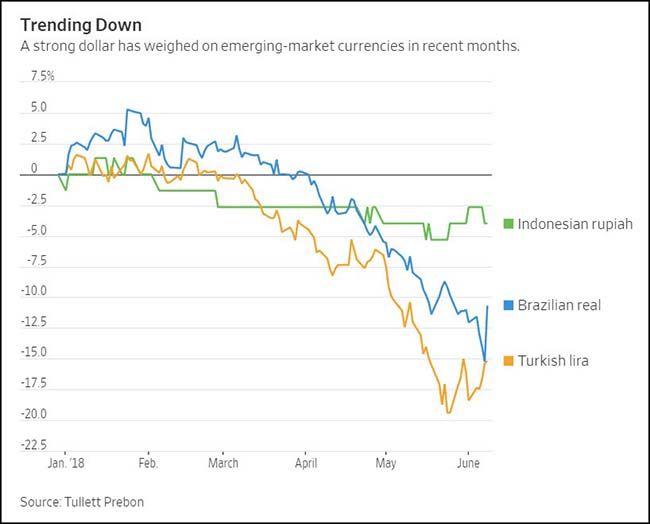

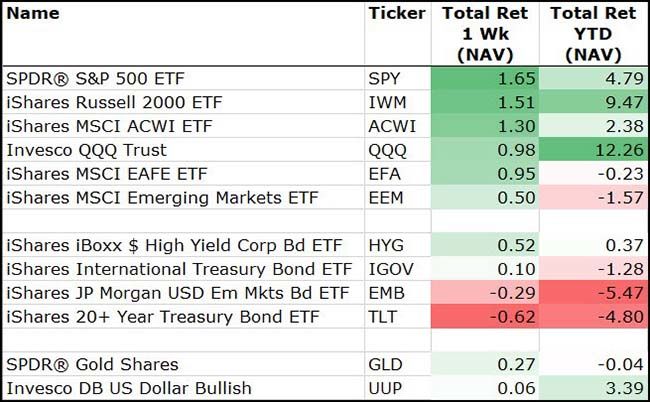

The international financial markets remain full of fear and doubt causing those who look abroad to remain cautious. This hesitancy to commit new monies overseas continues to benefit U.S. risk assets. While most global risk assets pulled back from the edge last week, it was U.S. equities and credit which outperformed. Until emerging market currencies find a floor value and European economic data begins to stabilize, it will take much work to get investors to send their capital abroad.

There is good news for investors with the U.S. economic datapoints showing further strength. And over the weekend, Italy’s new finance minister has also decided to remain in the Euro, which gives Germany and France time to find a creative solution for the Boot. This week will be a big one with central bank decisions from the FOMC, ECB and BoJ. Expect the strong U.S. dollar and trade war uncertainty to appear in the decisions and surrounding conversations. And then on Thursday, the biggest sporting event in the world begins for the next four weeks. Expect trading volumes and financial decision making to be impacted. Good luck with your portfolio and your teams.

And if you know the answer to both, make sure that you enter our 361 Capital World Cup Challenge. Entry deadline is Wednesday, June 13…enter now.

To receive this weekly briefing directly to your inbox, subscribe now.

Great news out of Milan this weekend…

The newly formed government has decided to remain in the Euro. This was a major source of concern a week ago. We have no idea how long the decision will last but it is a start and will help Italy negotiate with the EU.

Italy’s government has no intention of leaving the euro and plans to focus on cutting debt levels, looking to boost growth through investment and structural reforms rather than deficit spending, the new economy minister said.

In his first interview since taking office a week ago, Giovanni Tria told Corriere della Sera newspaper that he aimed to meet existing debt targets for 2018 and 2019, adding that Italy’s debt commitments were fully sustainable.

“Our goal is (to lift) growth and employment. But we do not plan on reviving growth through deficit spending,” Tria said, adding that he would present new economic forecasts and government goals in September.

“These will be fully coherent with the objective of continuing on the path of lowering the debt/GDP ratio,” he said.

But while Italy looks better, the Emerging Markets look worse even with all the IMF and Central Bank assistance…

So far, few believe the weakness in riskier markets threatens the nine-year-long U.S. stock advance, but the recent market moves have bolstered the case for caution. More turbulence could be in store next week, when the European Central Bank and the Federal Reserve hold their monetary policy meetings. Many expect the Fed to raise interest rates, which would increase pressure on emerging markets and test the ability of some countries to repay dollar-denominated debt.

“Rising global real interest rates are the number one predictor of financial problems in vulnerable economies,” said Kenneth Rogoff, a professor at Harvard University and the former chief economist of the International Monetary Fund. “The risks are greater than people realize.”

Dollar strength is a danger for some countries because it weakens their currencies and makes it more difficult to pay back dollar-denominated debt. Higher U.S. rates dim the allure of foreign assets, especially in emerging markets, where investors often take on greater risk in exchange for higher yields and returns.

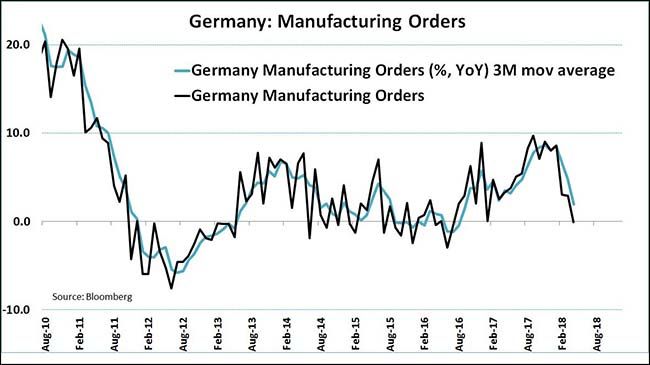

At the same time, Europe economic data continues to slow…

German factory orders just turned negative YoY.

So, there was a G-7 meeting this weekend…

If not for this photo and the post-meeting discussions about special places in Hell, you probably wouldn’t have even known that the G-7 got together.

(Photo made available by the German government)

In addition to nothing getting solved, it looks like the trade wars will worsen…

So, here is your list of vehicles made in Canada in 2017 which will become more expensive in 2018…

A good read on the farmers who are being caught in the middle of the global trade wars…

“Whenever there’s tariff retaliation agriculture is the first thing hit,” he continued. “We just hope the president knows what he’s doing, and we hope he’s negotiating in good faith to get a better deal for us. If he doesn’t, it’s going to be catastrophic for agriculture.”

Mr. Grassley said he didn’t want to make any predictions about the midterm or presidential elections, but said, “If this turns out to be catastrophic, there’s obviously going to be real disappointment” among voters in farm states.

Mr. Trump clearly recognizes the high stakes. In a recent White House meeting with lawmakers and governors from a number of farm states, he pledged that the federal government would support agricultural prices should retaliatory tariffs cause the price of soybeans, corn and other major exports to fall.

“He wasn’t specific, but he assured us Sonny Perdue has a plan,” Mr. Grassley said, referring to the secretary of agriculture. “Our response was unanimous. I’m paraphrasing, but the message was, we don’t want help from the Treasury. We want free and open markets.”

(Whitten Sabbatini for The New York Times)

For the week, U.S. assets led all others…

The head of the Indian Central Bank thinks the Fed’s unwind is causing the chaos in the Emerging Markets…

When the mighty US Federal Reserve started to unwind its bloated $4tn balance sheet last year, some investors braced themselves for a shock. But it did not immediately transpire — or at least not in a way that American cable television shows (or a president) might notice.

On the contrary, US markets seemed so impervious to the unwinding that many investors have almost forgotten that it is happening. Instead, the main, obsessive focus for debate around the Fed right now is whether it will raise policy rates three or four times this year.

But if Urjit Patel, the governor of India’s central bank, is correct, this obsession with US interest rates misses the point. Writing in the Financial Times earlier this week, Mr Patel argued that the Fed’s balance sheet unwinding is quietly contributing to the current turmoil in emerging markets. He warned this could soon get much worse.

This is not because Mr Patel thinks that the Fed was wrong to embark on the unwinding. Instead, he worries that President Donald Trump’s subsequent tax cuts have caused the US deficit to unexpectedly widen, sparking much higher-than-projected issuance of US debt. Indeed, some $2.34tn of treasuries will be sold in the next two years.

Global investors will need dollars to buy those bonds. However, the rub is that the Fed’s unwinding is sucking dollars out of the system, currently at a pace of $20bn a month, which is slated to rise to $50bn next year (or a cumulative $1tn of liquidity by December 2019.) That creates a dollar liquidity squeeze, Mr Patel fears, and means that “a crisis in the rest of the dollar bond markets is inevitable”, with a growing “possibility . . . a ‘sudden stop’ for the global economic recovery”. So he wants the Fed to change course — by slowing that unwinding.

(@lisaabramowicz1)

While the U.S. Dollar may be rising from the Fed unwind, last week it was hit by the rising global trade wars…

(@weeklystockchar)

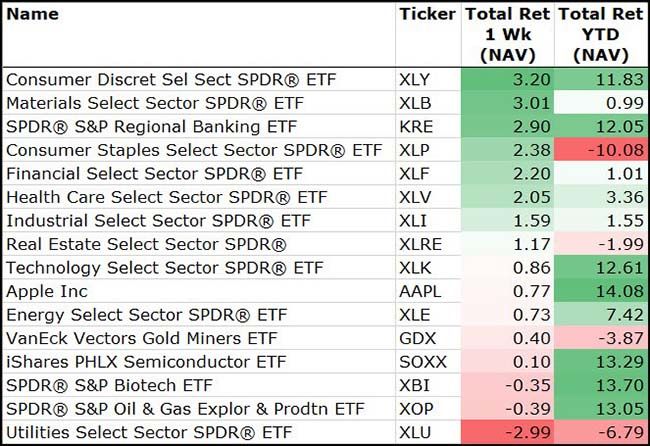

Among sectors last week, a motley crew of Consumer Discretionary, Materials and Bank stocks led the gains…

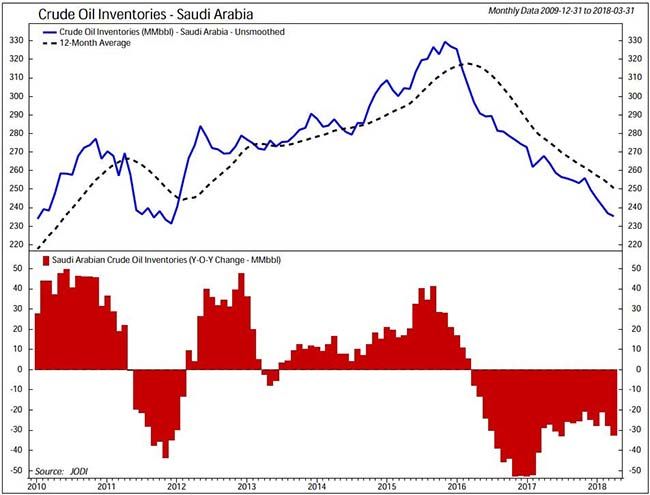

As Saudi Oil inventories revisit seven-year lows, the Saudis are beginning to increase production…

@WarrenPies: KSA inventories now at the lowest level sine 2011…last time the kingdom broke from OPEC and unilaterally raised production. Domestic demand set to seasonally rise as well.

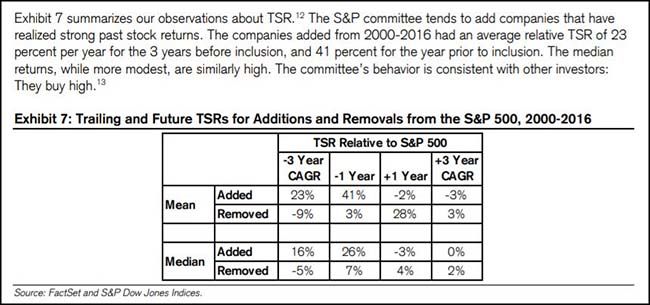

Just a reminder that the stock pickers of the largest stock index are only human…

This chart of Total Shareholder Return by Mike Mauboussin shows that they like to buy high and sell low like many other investors.

Signs of a very strong economy…

FORT COLLINS, Colo.—The fast-growing business offers all the perks a pampered Silicon Valley tech worker might expect: An on-site tap flows with craft beer and the kitchen is stocked with locally roasted espresso beans. There is a putting green and a smoker for brisket lunches. Next up: a yoga studio.

Welcome to the gushing job market…for plumbers.

Colorado’s Neuworks Mechanical Inc. employs 75 plumbers but needs 15 to 20 more. To keep them happy, it offers “a lot of Zen,” says business-development manager Jackie Sindelar. That includes a sharing exercise that “brings out your raw emotions and makes you vulnerable,” she says.

Drained from a labor shortage, the plumbing industry is throwing the kitchen sink at job candidates.

Bonfe’s Plumbing, Heating & Air Service Inc. of South St. Paul, Minn., boasts an array of arcade games and a “quiet room”—a plush hangout space with insulated walls painted a calming sky blue. It has a lockable door, a comfy couch, a recliner and a sound machine that babbles with the soothing audio of ocean waves.

“When people have a bad day they go in there,” says Mr. Bonfe. “They literally check out for a while.” Mr. Bonfe, a veteran plumber and president of the 120-employee family business, could use the room himself some days, noting that the labor market is “the hardest I have ever seen.”

How this would work in Colorado: black sedan during the week, red SUV on the weekends…

Daimler AG’s Mercedes-Benz is starting a car-subscription pilot in two U.S. cities, joining brands from Jeep to Porsche in testing alternatives to traditional vehicle ownership.

The app-based service initially available to drivers in Nashville and Philadelphia has three pricing tiers ranging from $1,095 to $2,995 a month, according to a company statement. Subscribers will get access to 30 different models, from C-Class sedans to GLE sport utility vehicles, and can swap cars as often as they like, depending on what tier they choose.

Mercedes is joining a pack of automakers looking to appeal to younger customers by offering access to cars through service more analogous to how Netflix Inc. sells movies or Uber Technologies Inc. dispatches rides. It’s also challenging its biggest German rival head-on: BMW AG launched a subscription pilot — also in Nashville — in April that charges as much as $3,700 a month. Just last week, Fiat Chrysler Automobiles NV announced it would launch a service starting in 2019 with its Jeep brand.

French students are about to accelerate in learning…

This should be mandatory for all schools. Nothing more distracting to the kids and teachers than to have active cellphones in the classrooms. Luckily, the best schools in Denver already operate under the same rules.

The French government is to ban students from using mobile phones in the country’s primary, junior and middle schools.Children will be allowed to bring their phones to school, but not allowed to get them out at any time until they leave, even during breaks.

A proposed ban was included in Emmanuel Macron’s successful presidential election campaign this year.

Jean-Michel Blanquer, the French education minister, said the measure would come into effect from the start of the next school year in September 2018. It will apply to all pupils from the time they start school at age of six – up to about 15 when they start secondary school.

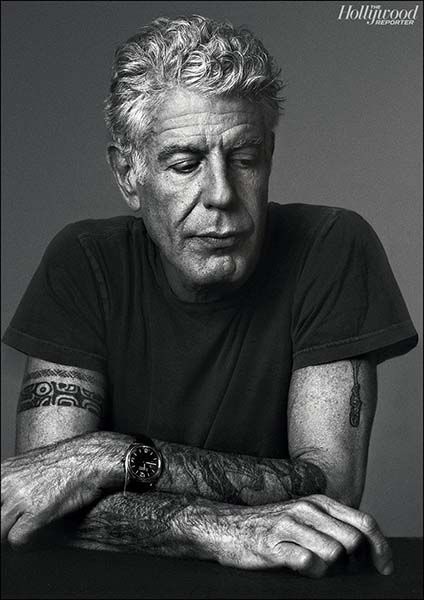

A lasting influence…

“If I’m an advocate for anything, it’s to move. As far as you can, as much as you can. Across the ocean, or simply across the river. The extent to which you can walk in someone else’s shoes or at least eat their food, it’s a plus for everybody. Open your mind, get up off the couch, move.” – A. Bourdain

Few people of my generation have had a more positive impact on the world than Anthony Bourdain. He taught us about trying new foods and thoroughly enjoying existing ones, visiting new places that we might have never considered and opening our minds to walking in other people’s shoes. While some were lucky enough to eat a bowl of noodles with him, the rest of us had equally as much fun living vicariously through him. And when Tony saw wrongs in the world, he called it out, and we loved him for it. I loved his books, his cable shows and his live talks. The world might not get new episodes from Bourdain, but he will continue to have a lasting influence on tens of millions of us. Rest in Peace Anthony.

(Miller Mobley)

Copyright © 361 Capital