by Stephen Lingard, CFA Senior Vice President, Portfolio Manager Franklin Templeton Multi-Asset Solutions

President Trump’s administration has reignited talk of trade wars after announcing a new round of steel and aluminium tariffs targeting several US allies. Franklin Templeton Multi-Asset Solutions’ Stephen Lingard discusses the implications of a potential trade war and explains why he thinks these tariffs pose threats to the North American auto market in particular.

On May 31, the Trump administration followed through with a previous threat to impose tariffs on steel and aluminium imported from Canada and Mexico, as well as the European Union (EU). The move came two days after the administration said it would proceed with tariffs on goods made in China.

The metal tariffs had been introduced in March, but Canada, Mexico and the EU were given temporary exemptions from the tariffs in April. However, recent discussions with the EU over trade concessions and with Canada and Mexico on rewriting the North American Free Trade Agreement had apparently stalled. As a result, the exemptions were lifted.

In our view, there are no real winners in a trade war. Although US tariffs could lead to an improvement in the US trade balance and current account balance in the long run, we think both could deteriorate in the near term. We don’t see many substitutes for some of the imported products that US consumers currently enjoy. In our view, it would likely take time to create those products in the United States, if it were even possible to do so.

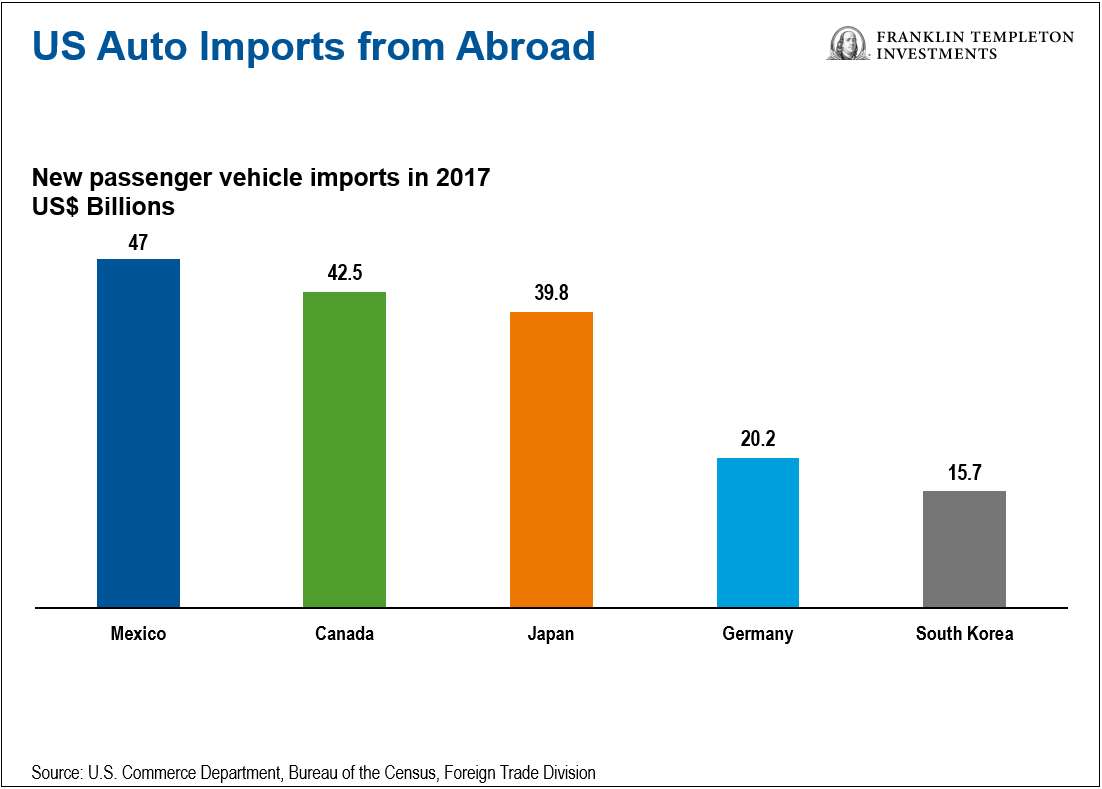

Based on our analysis, the entire North American automobile industry would suffer if Canada and Mexico are forced to pay US tariffs. As the chart below shows, as at 2017, Canada and Mexico are the top two US exporters of vehicles to the United States, so the industry is an important one for all three countries.

Investment Implications

If a trade war develops and slows global growth in an environment of higher inflation and higher budget deficits, we think most global stock markets are likely to fall in tandem.

We would note that while the US stock market has been leading the way lower during some of the recent bouts of volatility, it does offer investors a more defensive sector mix and is less cyclical than other markets such as Europe, which have larger exposure to financials and resources. So, we could see some market or sector bifurcation taking place going forward.

That said, if the current trade skirmish dissipates, we remain optimistic about the prospects for global economic growth and global equity markets. In particular, we see value in select companies located outside the United States that have faster corporate earnings growth, as well as faster operating leverage.

However, as I mentioned in a previous article, the bottom line is unpredictability often reigns with the current US administration. Trump’s personal negotiating style seems to favour creating chaos, often leading to changes that can be positioned as “wins” for his political base.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.