by Blaine Rollins, CFA, 361 Capital

When the world becomes uncertain, we retreat towards certainty. Right now there is plenty of significant uncertainty for Global Macro investors in the world: trade wars, Italy’s new populist government, Brazil’s social and economic upheaval, just to name a few major items. As investors have become increasingly uncertain of the outcomes of these events, they will concentrate their bets towards those with more certainty.

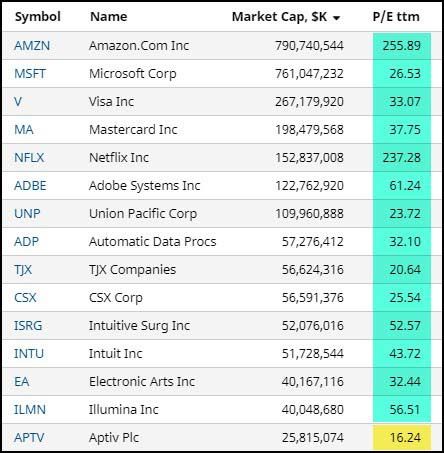

As a result, the global equity markets saw a shift toward U.S. growth stocks last week. Just look at the list below of very large cap stocks which hit all-time highs on Friday. These are high-multiple companies that dominate their industries and are less likely to get caught up in a trade war or suffer from Emerging Market unrest.

While investors backed away from European and U.S. names tied to export trade, several Emerging Markets caught in strong U.S. dollar cross-hairs, and Financial stocks that might have international exposures, they quickly reallocated into U.S. Technology, Biotechnology, as well as domestic Consumer stocks. So the fuse has been lit for growth names once again. As long as the U.S. economy remains solid and uncertainty continues around the globe, I believe this trend will remain. Have a great week.

To receive this weekly briefing directly to your inbox, subscribe now.

From Friday’s ‘all-time high’ list ranked by market cap…

You have to go down to the 15th name to find a stock with a trailing P/E less than 20x.

Mega Caps Amazon and Microsoft leading the way last week for higher growth and high-multiple stocks…

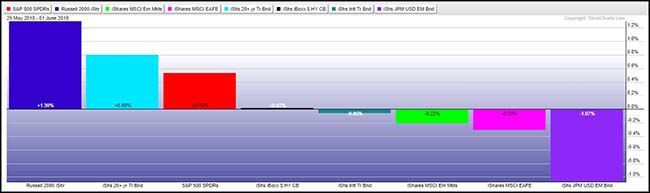

Small Caps led the week again as investors fled international sales exposure and ran toward U.S. based growth…

Among Sectors, the higher growth areas of Technology, Healthcare and Consumer Discretionary were among the best performers last week…

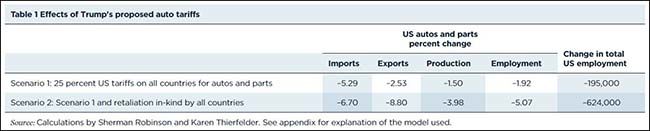

Some good numbers put to paper showing the U.S. loses 624,000 jobs if autos see 25% tariffs…

President Trump is reportedly considering raising US duties to 25 percent on all imports of automobiles—including SUVs, vans, and trucks—and auto parts, invoking the same national security law recently used to impose tariffs on steel and aluminum. A new PIIE analysis shows that if he did this, production in these industries would fall 1.5 percent and cause 195,000 US workers to lose their jobs over a 1- to 3-year period or possibly longer. The US auto and parts industries would shed 1.9 percent of their labor force.1 The analysis assumes there would be no exemptions for any country (or even for North American Free Trade Agreement [NAFTA] partners, as in the steel and aluminum cases). The potential trade action would affect more than $200 billion in US imports.

If other countries retaliate in-kind with tariffs on the same products, production would fall 4 percent, 624,000 US jobs would be lost, and 5 percent of the workforce in the auto and parts industries would be displaced (table 1). This second scenario would also hurt US exports of these products more than imports.

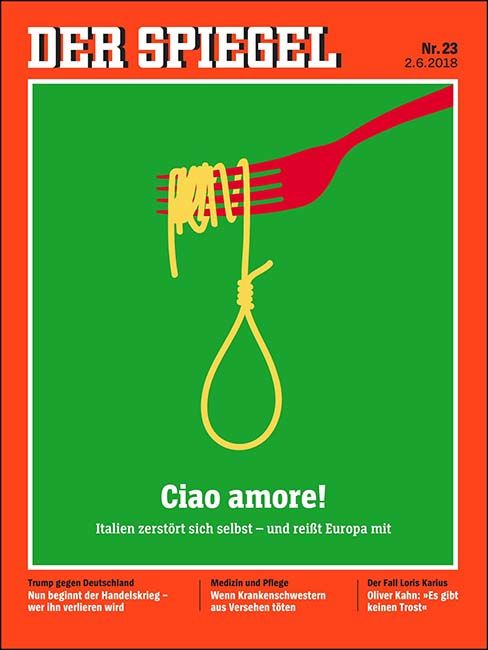

Italy has gone Full Monty…

The remarkable rise of the populists now leaves Italy’s traditional political establishment, left and right, in tatters. It also shocked a European Union that thought it had successfully beaten back an anti-establishment and hard-right insurgency last year.

The populist victory in Italy now could not come at a worse time for the European Union. A corruption scandal in Spain threatens the demise on Friday of a government that had been a model for the central authorities in Brussels. Britain is leaving. Chancellor Angela Merkel of Germany is weakened. President Emmanuel Macron of France is a pro-Europe leader in search of partners. Poland and Hungary are rolling back democracy. The United States president is waging a trade war on European allies, while more and more Europeans look to Russia’s strongman, Vladimir V. Putin, as a model.

But amid all the geopolitical and economic threats to the European Union, Italy represented perhaps the gravest. And as is often the case with Italy, it was overlooked.

Der Spielgel doesn’t hold back this week: “Bye love! Italy destroys itself and tears apart Europe with it”

(@DerSPIEGEL)

Italy now becomes quite difficult to invest into for the long term…

The prospect of Italy’s euroskeptic parties winning power in Rome jostled global markets last week. Yet after a few days of operatic headlines and volatility, the markets settled down—a sign that, for now at least, investors expect Europe’s fourth-largest economy to work through its problems and stay in the euro zone.

Even if Italy’s populist politicians, who began forming a coalition government on Friday, win a broad mandate for change (a big if), they’re unlikely to lead Italy down the path investors fear most: dropping the euro or defaulting on Italy’s 2.3 trillion euro ($2.68 trillion) in sovereign debt. Italian politicians may grouse about the euro, but they’re stuck with it for the same reasons that Greece and other euroskeptics have kept it. A new currency probably would plunge in value, wiping out savings, and undoubtedly decimating asset values for companies and consumers. “The euro is like the Hotel California,” says David Kelly, chief global strategist at JPMorgan Asset Management. “You can never leave.”

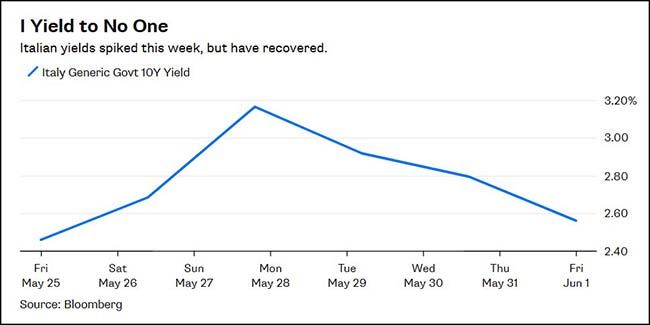

A default looks just as remote, partly because it would deal a devastating blow to Italian institutions and citizens who own nearly half of their nation’s debt, Kelly observes. Mario Draghi, the Italian head of the European Central Bank, won’t let his homeland default on his watch, and the ECB has mechanisms to backstop ailing sovereign debt. So far, the bond market is giving Rome time to sort things out: Italy’s 10-year government bond’s yield spiked by more than a percentage point, to 3.2%, last month. But it recently settled at 2.7%, well below the 7% reached during the 2011 sovereign debt crisis, and lower than the 2.9% yield on 10-year U.S. Treasuries.

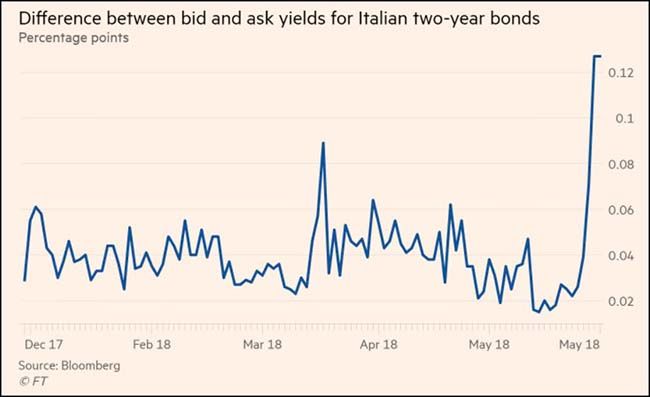

Italian Bond traders made a killing last week…

Italian Bond investors did not…

The mood among investors has nevertheless improved after a rocky week; bond yields have moved sharply lower and Italian stocks higher. The chief reason is President Sergio Mattarella’s veto of Savona’s appointment as finance minister, which shows he won’t let Italy sleepwalk out of the euro without a popular mandate for an “Ital-exit.” This lessens the “re-denomination risk” on Italian assets.

Meanwhile in the Emerging Markets: How do you say ‘Humpty Dumpty’ in Portuguese?

We’ve talked about U.S. dollar pressures putting strain on commodities and investment/currency flows in foreign countries. But, in Brazil things are turning worse quickly. Military control of the government would not be a positive sign for global investors.

SÃO PAULO – I arrived here on Sunday in the middle of the zombie apocalypse. Or so it seemed. A nationwide truckers’ strike was in its seventh day and 99 percent of São Paulo’s service stations had run out of gasoline. The roads of South America’s biggest city were deserted of cars and people, and the skies were a murky gray. The normally hellish drive from the airport, which often lasts two hours or more, took a disconcerting 23 minutes.

Up on Avenida Paulista, the city’s closest thing to a public square, things seemed more normal – at first. Huge crowds milled about, vendors were grilling beef and sausage, and girls in hot pink roller skates clomped by. A quadruple amputee was belting out the falsetto ending of Pearl Jam’s “Black” to an enthralled crowd. The sun was out now, and families sat at wooden tables with sweaty buckets of beer, laughing. Of course, I mused, Brazilians are going to make a party out of a bad situation. I bought a can of Skol and decided to join the fun.

Then I saw it. A huge banner, spanning the entire avenue, carried by a group of protesters:

“SUPPORT FOR THE TRUCK DRIVERS. MILITARY INTERVENTION! ARMED FORCES, URGENT!”

And that was the start of a week where I saw and heard things I never believed I would in Brazil.

The Brazil of mid-2018 is a frightened, leaderless, shockingly pessimistic country. It is a country where four years of scandal, violence and economic destruction have obliterated faith in not just President Michel Temer, not just the political class, but in democracy itself. It is a country where there will be elections in October, but most voters profess little faith in any of the candidates. Given that vacuum, many Brazilians – perhaps 40 percent of them, according to a new private poll circulating among worried politicians – believe the military should somehow act to restore order. Amid this week’s strike, the clamor became so loud that both Temer and a senior military official had to publicly deny the possibility of an imminent coup.

The U.S. economy, on the other hand, looks rock solid and jobless claims continue toward all-time lows…

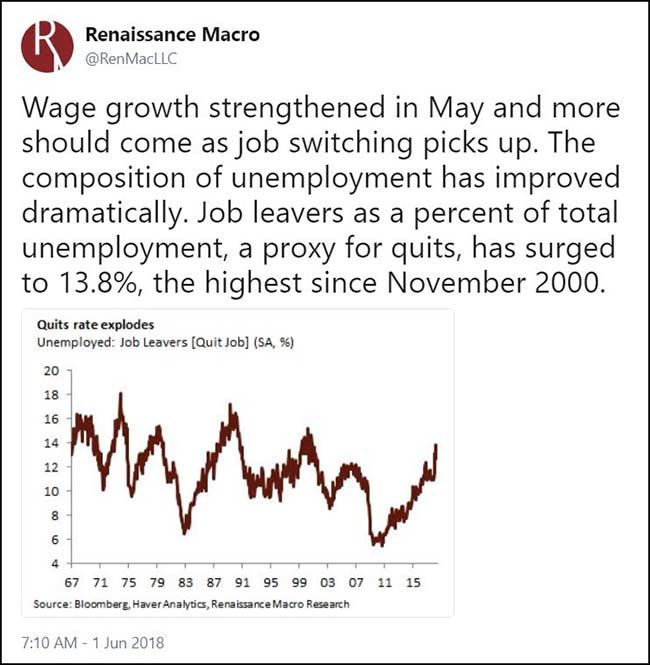

And wage gains continue on a slow, upward path. So, still Goldilocks for now…

But Goldilocks won’t last forever…

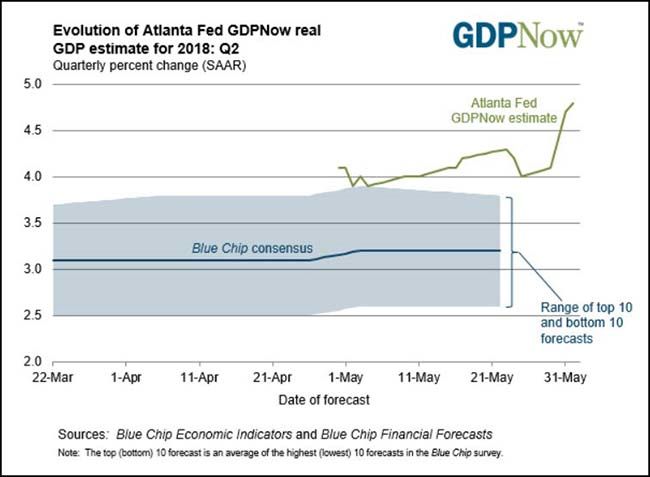

And given last week’s strong U.S. data, the Atlanta Fed is again quickly raising their GDP forecast…

Latest forecast: 4.8 percent — June 1, 2018

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.8 percent on June 1, up from 4.7 percent on May 31. The nowcasts for second-quarter real consumer spending growth and second-quarter real private fixed investment growth increased from 3.4 percent and 4.6 percent, respectively, to 3.5 percent and 5.4 percent, respectively, after the employment report from the U.S. Bureau of Labor Statistics, the construction spending report from the U.S. Census Bureau, and the Manufacturing ISM Report On Business from the Institute for Supply Management were released this morning.

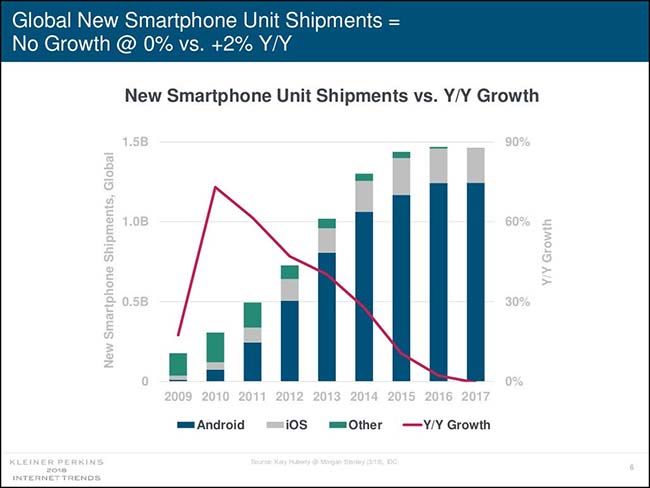

I’ll join the others and share my favorite Mary Meeker charts from last week’s Internet Trends presentation…

First, smartphone growth has stopped…

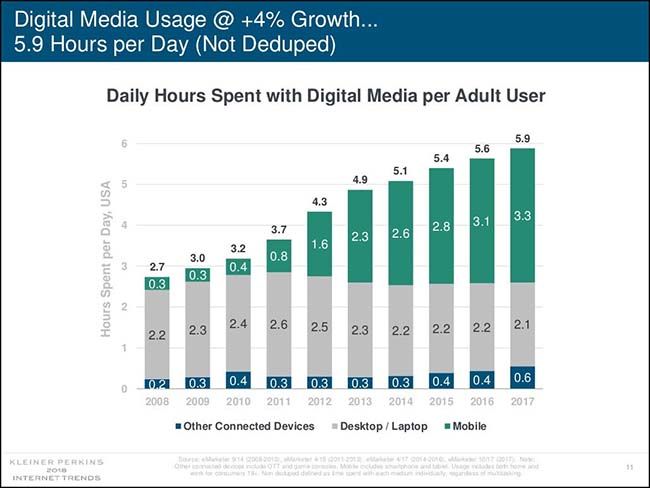

But hours of daily digital media consumption have accelerated…

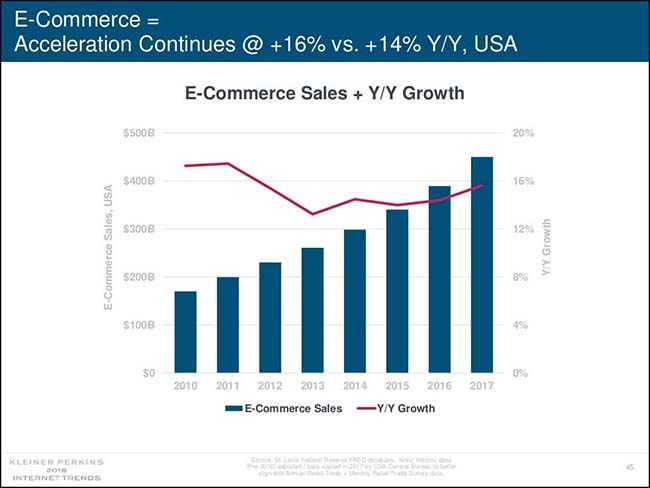

E-commerce has also accelerated…

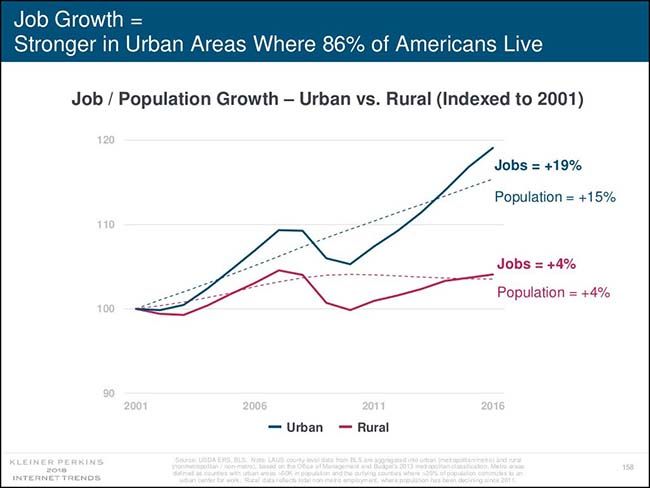

Job growth is mostly urban and accelerating…

But Vermont is attempting to fight the urbanization trend…

Starting in 2019, Vermont will pay people who move there and work remotely for an out-of-state employer $10,000 over two years to cover relocation expenses, coworking memberships, computers, internet, and other work-related expenses. Gov. Phil Scott signed the bill into law on Wednesday (May 30).

The northeastern US state of 625,000 people has gorgeous landscapes, great ski slopes—and a rapidly shrinking tax base. Vermont is aging faster than the rest of the US population, an economic crisis that has prompted some creative solutions from state officials. In addition to the remote worker plan, Vermont has also launched a program called “Stay to Stay Weekends” aimed at convincing the state’s 13 million annual tourists to relocate there. Visitors who plan their trips during one of the four designated weekends from April to October can network with employers, entrepreneurs, and realtors.

The first-come, first-served remote worker grants are only available to new residents who relocate on or after Jan. 1, 2019.

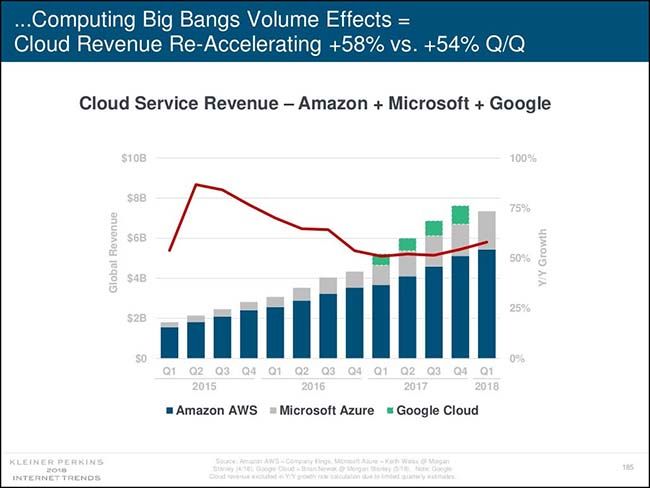

Cloud computing revenues is accelerating even with their price competitions…

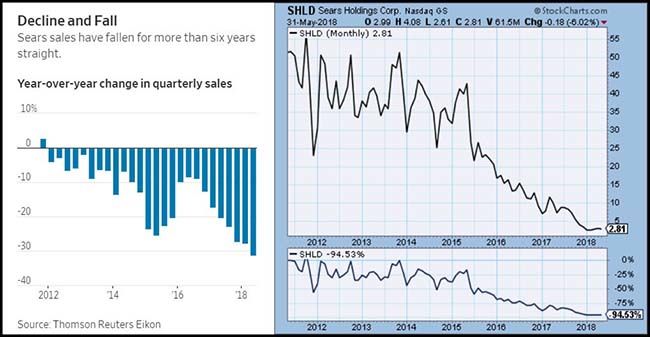

Now for a deceleration…

Sears plus K Mart didn’t work. Stick a fork in it and move on.

In the quarter ended May 5, total revenue dropped 31% from a year earlier to $2.89 billion.

Same-store sales fell 13% at Sears locations and by 9.5% at the company’s Kmart outlets. The retailer operated 894 total locations as of the end of the quarter, down from 1,275 a year earlier.

And, in other dinosaur worries…

Jorge Paulo Lemann, the billionaire co-founder of 3G Capital Inc., said he’s been scrambling to keep up with rapid technological changes.

“I’m a terrified dinosaur” when it comes to technology and disruption, Lemann said Monday at the Milken Institute Global Conference in Beverly Hills, California. “I’ve been adjusting — I’m 78.”

The Brazilian dealmaker orchestrated H.J. Heinz’s merger with Kraft Foods Group in 2015 and formed the world’s biggest beer company, Anheuser-Busch InBev in 2008. He said that, more recently, companies like Starbucks Corp. are showing an ability to evolve with the new economy. There are now hundreds of new brands in supermarkets, and customers are more fickle, according to Lemann.

“I’ve been living in this cozy world,” he said. It used to be that industry trends changed only gradually, and management could “just focus on being very efficient and you’ll do OK. And all of a sudden we’re being disrupted.”

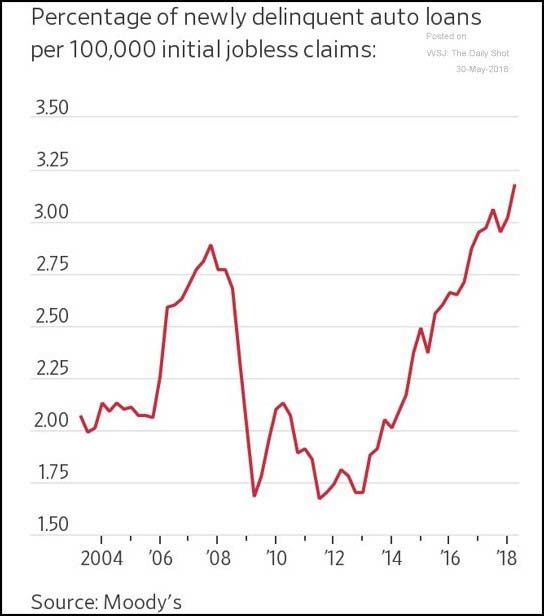

This chart of increasing delinquent auto loans is beginning to get much more notice…

(WSJ/Daily Shot)

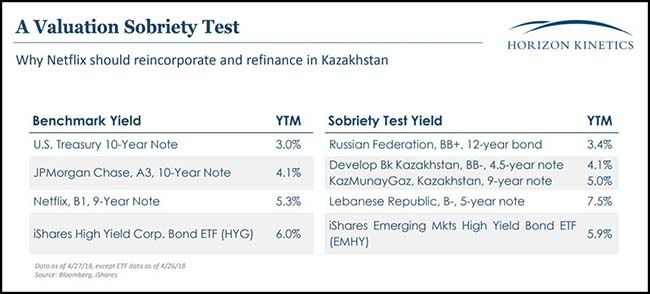

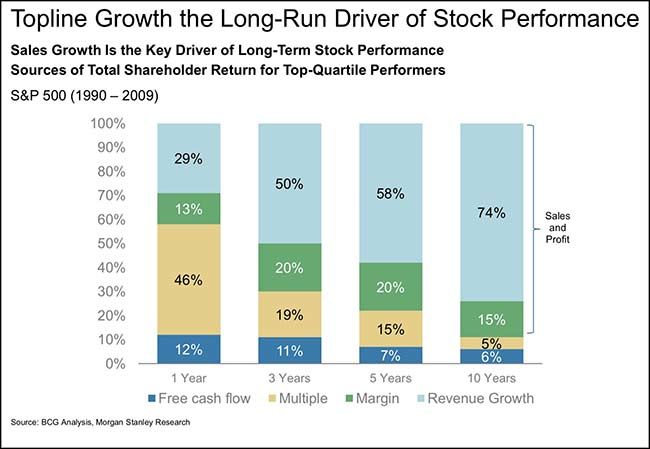

In the short term, the market is a voting machine. In the long term, it is a weighing machine…

(@PScatterpatter)

Example of a voting machine???

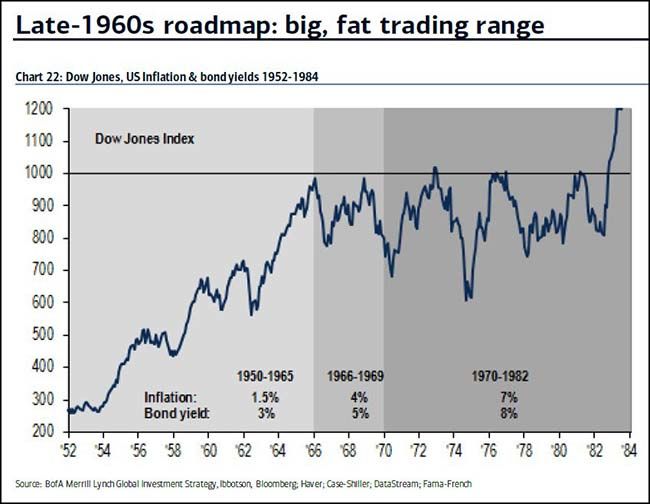

Could the late 1960s be a good roadmap for the current equity market?

1950-65: low inflation, low rates, low volatility, roaring stock markets (Dow Jones 200 to 1000)

1966-69: inflation & rates breakout to upside as budget deficits soar…negative bonds, large, volatile trading range for stocks, outperformance of a deflation-inflation

barbell

(Bank of America/Merrill Lynch)

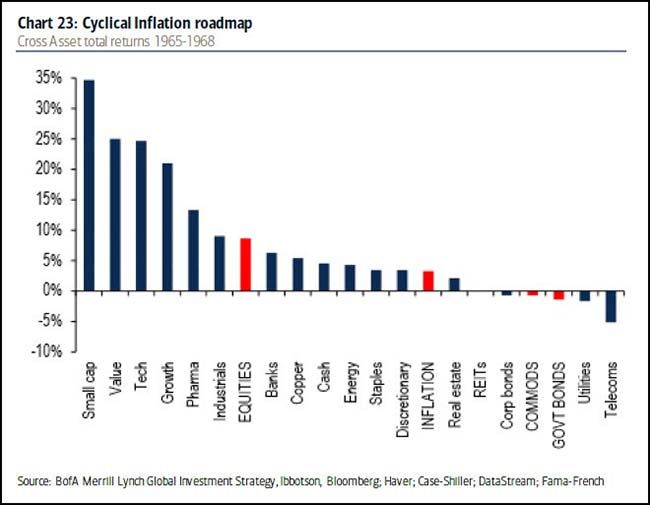

If so, you basically want to own everything that did well last week: Small Caps, Tech, Growth, Healthcare…

Cyclical inflation 1966-69: inflation-deflation barbell of “Nifty-50” and small cap value outperformed (BofA/Merrill Lynch)

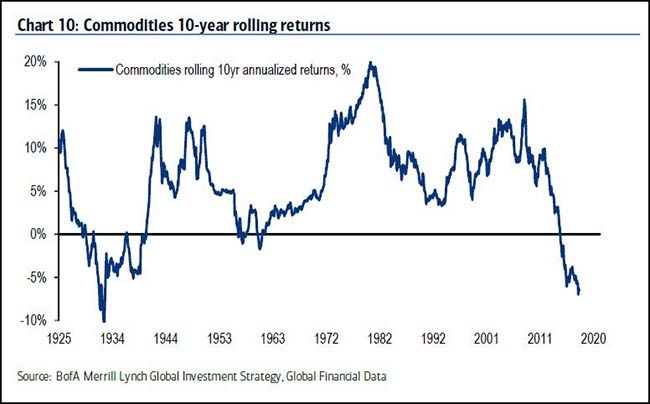

When will commodities revert to the mean?

Speaking of commodities… If you are an enterprising teenager with a pickup truck in Texas…

If the materials, production and delivery cost of a Tesla Model 3 is $28k, could the TSLA shorts calculate the profit per car for TSLA longs?

Also, these German engineers found that Tesla is using a significantly better battery technology than its competitors.

Tesla’s Model 3 can make a profit. This is the result of a German engineering service provider, who has a Model 3 decomposed to the last screw. The material and delivery costs of the $35,000- $78,000 car are only around $18,000; In addition, according to the calculations of the burglars, who are the WirtschaftsWoche, about $10,000 in production costs per car. “If Tesla manages to build the planned 10,000 pieces a week, the Model 3 will deliver a significant positive contribution to earnings,” says a test engineer.

So, if a Bitcoin pro is asking for a 50% premium to transact in the digital currency, what does that tell us about his short-term outlook?

A luxurious Beaux Arts townhouse at 10 East 76th Street, Upper East Side, New York City has been listed for $29.95M USD, and 1.5 times that amount for digital currency.

Wait, what?

Why is de Zanett asking for an extra $15m if you want to pay with your hard-earned crypto HODLings?

Valerie Lettan of Douglas Elliman Real Estate, the brokerage where the property is listed, explained it to us:

The reason for the higher sale price in cryptocurrency is due to the volatility in the market, the value of which has fluctuated substantially in recent months.

Still, he is a strong believer in cryptocurrency.

Hotel of the week…

Landscaper of the week…

Copyright © 361 Capital