by Urban Carmel, The Fat Pitch

Summary: The conventional wisdom is that "healthy breadth" is necessarily bullish. This sounds intuitively correct: a broader foundation - where more stocks are ticking higher - should equal a more solid market, but it is empirically false. Equities can continue to move higher when breadth is healthy, but new highs in the advance-decline line or in the small cap index have also preceded drops of 10, 20 or even 50% in the equity market.

* * *

The conventional wisdom is that "healthy breadth" leads to higher equity prices. This sounds intuitively correct: a broader foundation - where more stocks are ticking higher - should equal a more solid market. Conversely, a narrowing market should be a warning of a likely market top.

But it is empirically false. Consider some recent research into this issue.

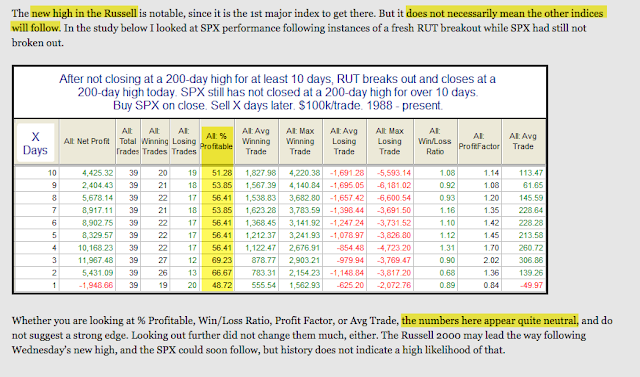

The Russell small cap index (RUT) has been making new highs even as the large cap indices have not. Because there are four times as many stocks in RUT as in SPX, many infer that breadth is broadening and that this must be bullish for all equities. "When the troops lead, the generals will follow."

Yet, as Mark Hulbert points out, small caps have peaked after the major stock indices in more than half of the 29 bull markets since 1926. If the conventional wisdom was correct, small caps should lead by peaking before the major indices, but this happened only a third of the time (Mark's article is here).

Similarly, Rob Hanna notes that when small caps make a new high before the major indices, the odds of the SPX moving higher are no better than random. There is no edge (Rob's article is here).

Breadth can also be measured using the advance-decline (A-D) line, which counts the net number of stocks ticking higher or lower over time. The conventional wisdom is that when more stocks are ticking higher, breadth is broadening and healthy and therefore equity indices will also move higher.

But Dana Lyons shows that this is not empirically true: a month after the A-D makes a new high, SPX was just as likely to be higher as lower. That's striking, as SPX is naturally higher in 60% of all 1 month and 68% of all 3 month periods. In other words, new highs in the A-D line has preceded a lower probability of future gains (Dana's article is here).

Dana's study goes back to 1965. Recent history is no better. Consider the following:

The A-D line peaked in July 2011, two months after the S&P; the index lost nearly 20% in the next 4 weeks. Many consider this a bear market.

The A-D line peaked with equities during the two most recent market calamities, in May 2015 and January 2018, before equity drops of 10-15%. That most recent top was four months ago and SPX is still 5% lower.

Jason Goepfert evaluated all the times since 1940 that the A-D line made a new 52-week high while the SPX was still 5% below its peak (to become a subscriber to Jason's research, click here). His findings:

SPX made a 52-week high in the next three months only 35% of the time and suffered a further decline of more than -5% 50% of the time.

SPX was higher 1, 2 or 3 months later only 48-52% of the time, which is less than random and much less than the rate at which SPX is naturally higher over time.

Using the percentage of SPX stocks trading above their 50-dma or 200-dma as a barometer of healthy breadth is equally flawed. Consider the following:

At the October 2007 peak in the stock market, almost 85% of stocks were above their 50-dma. The index dropped 10% in the next month and 50% over the next year.

In May 2011, 80% of stocks were above their 50-dma and more than 90% above their 200-dma. Just three months later, the index was 20% lower.

Recently, on January 26, 2018, more than 80% of stocks were above their 50-dma and 200-dma; the index peaked that day and then dropped 10% in the next 9 days.

Equities can, of course, continue to move higher when breadth is healthy, as they notably did in 2013 and 2014 (and parts of any year in a bull market). Strong trends are defined by their ability to stay "overbought," which makes timing market tops notoriously difficult. But it is clear that "healthy breadth" on its own is not a reliable indicator of a solid market if the stock market can fall 10, 20 and 50% shortly after breadth is deemed healthy.

Why is the conventional wisdom about healthy breath necessarily leading to higher equity prices wrong? We detailed this in a post last year (here). A brief summary:

Indices have typically been driven higher based on a small number of stocks contributing disproportionately large gains. Over the past 20 years, just 4% of stocks have typically accounted for almost 70% of annual gains in the SPX. The notion that breadth needs to be broad in order for the equity market to be healthy is conceptually incorrect.

Investor's views of what constitutes "healthy breadth" is at odds with their views on healthy sentiment. Important market tops are defined by excessive investor bullishness. But if investors are bullish, they should be less selective about which stocks they own which means market tops should be defined by broad, not narrow, breadth. By the time breadth is "healthy", investors are overwhelmingly bullish and the market tops.

Over the past 5 years, the SPX has gained more than 3 times as much over the following month when breadth was weak compared to when breadth was healthy, and risk/reward has been more than twice as favorable.

In summary, the conventional wisdom is that "healthy breadth" is necessarily bullish. This sounds intuitively correct: a broader foundation - where more stocks are ticking higher - should equal a more solid market, but it is empirically false. Equities can continue to move higher when breadth is healthy, but new highs in the advance-decline line or in the small cap index have also preceded drops of 10, 20 or even 50% in the equity market.