by Equities, AllianceBernstein

After an eight-year US economic recovery, many investors are asking whether growth will continue. Beyond the immediate challenges, we think the long-term outlook will be shaped by how environmental and social sustainability are addressed.

Recent market volatility has raised concerns that the good times may be ending for the US economy and stocks. Inflationary pressures, fiscal imbalances and tighter monetary policy are all imminent threats. But today, an economy’s long-term fate isn’t determined by macroeconomic factors alone.

Sustainability Is Not a Luxury

Environmental stewardship and social equity are increasingly viewed as important for a country’s long-term economic health. For example, China’s new five-year plan formalized a shift away from the level of economic growth to the quality of economic growth. What does that mean? China is now squarely focused on preventing major financial risks, alleviating poverty and reducing pollution. For China—and many other countries—sustainability is no longer a luxury; it’s a prerequisite for continued long-term growth.

In the US, sustainability challenges include poverty, income inequality, pollution, healthcare and infrastructure. If left to fester, these problems reduce the US standard of living—and its competitiveness on the world stage.

Can the US rise to these sustainability challenges? We think the answer is yes, no matter what direction official policies take. That’s because demand for many sustainable products and services is being driven by compelling economics, as well as broad support from local and state governments and consumers. As a result, the private sector will lead the way, in our view.

Why the Private Sector?

This seems counterintuitive. Environmental and social issues are often perceived as public sector affairs. Yet the UN Sustainable Development Goals highlight why the private sector is vital. These 17 ambitious goals, to be completed by 2030, center around the broad themes of climate, healthcare, and economic and social empowerment and require $90 trillion in aggregate spending globally. It’s a massive opportunity for investors, especially if government support wanes, leaving even more room for private sector leadership.

Climate

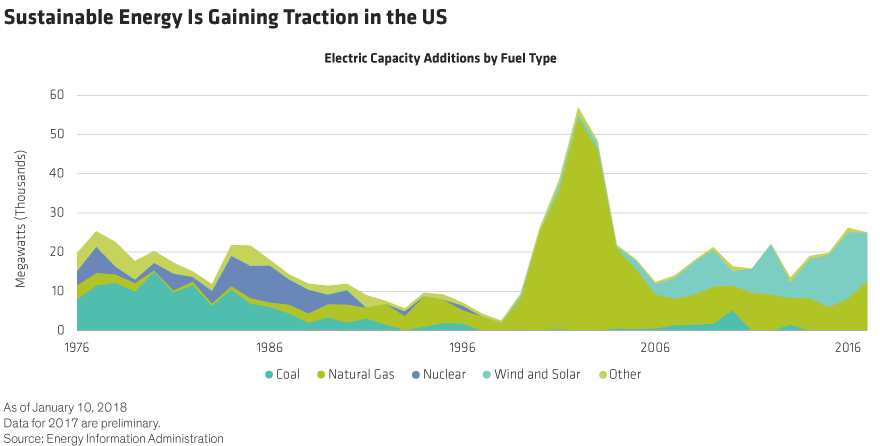

While the US government has pulled out of the Paris accord on climate change, the US private sector has good reasons to stay engaged. Dramatic declines in the cost of wind (–45% from 2008 to 2016) and solar (–74%) power are driving massive investment in renewable technologies. Recently imposed tariffs on imported solar panels are unlikely to blunt the momentum, in our view. While wind and solar currently account for just 6.5% of US energy production, they’ve represented more than half of all new capacity since 2014 and two-thirds in 2016 (Display). US solar module maker First Solar is starting to win projects for battery storage systems, a game-changing development for the industry.

And regardless of political affiliation, US citizens and businesses have strong incentives to reduce energy consumption. The International Energy Agency estimates that global investment in energy efficiency was $221 billion in 2015—two-thirds greater than investment in conventional power generation. Investment opportunities include power semiconductors, home appliances and LED lighting as well as building insulation and fuel-efficient engines and materials. Hexcel, for example, manufactures a carbon fiber composite that is 30% lighter and five times stronger than steel. It’s used to make aircraft and electric vehicles lighter and more fuel efficient and to enable greater power conversion in wind turbine blades.

Water

Water is another focal point—and not just for emerging markets. In 2014, 100,000 residents of Flint, Michigan, were left without access to drinking water after lead seeped into the supply and a state of emergency was declared. In the US, more than 25% of water pipes have been in use for 70 years and 4% are more than 100 years old. About 2 trillion gallons of treated water is lost each year to leaks. An estimated $1 trillion is needed to upgrade US water and wastewater systems over the next 20 years (Display).

Enter Xylem. Based in New York State, Xylem is a leading water infrastructure provider spanning transportation, treatment, testing and desalination. Its water monitoring products allow utility customers to quickly identify and remediate any leaky pipes.

Health

Americans allocate almost 18% of GDP to healthcare, the highest in the developed world. By some estimates, though, nearly a quarter of that spending is wasted, while US health outcomes and quality of service lag developed-market peers.

The private sector is essential for reform, and technology will drive change. Companies engaged in personalized medicine, telehealth and artificial intelligence diagnosis, outpatient clinics, and eldercare all directly address structural challenges in healthcare. For example, UnitedHealthcare draws on its members’ digital information to find new ways of reducing diabetes and other disorders. Bio-Rad, a leading diagnostic player, analyzes “blood, sweat and tears” to detect diseases such as diabetes and to address emerging applications such as liquid biopsies for cancer detection.

Can a greater focus on sustainability prevent the next US recession? Probably not. But we think efforts to address the largest structural issues can mitigate short-term cyclical weakness and pave the way for stronger long-term growth, while creating attractive opportunities for investors, too.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein