by Blaine Rollins, CFA, 361 Capital

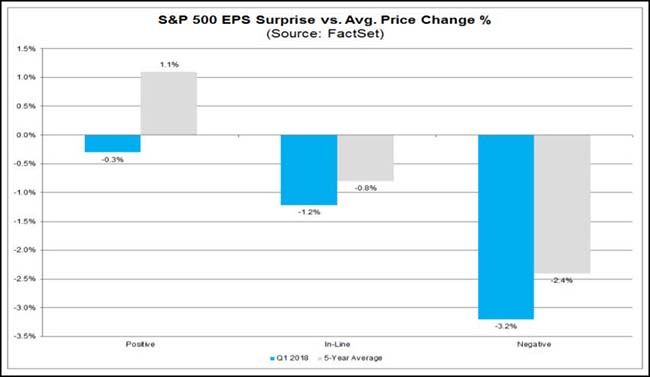

This was a tough quarter to get paid on earnings reports. One can often make extra returns with good earnings beats in a normal market. And in a great stock market, even your ugliest earnings misses can go up as the market looks forward to future opportunities. But today isn’t a great stock market. It was great only if you owned big earnings beats like Apple, Tenet Healthcare and Chipotle. But if you had a diversified portfolio and held many of the ugly misses, then you were rewarded with a handful of cacti. The good news is that 80%+ of the S&P 500 has now reported, so there’s less potential for pain in upcoming weeks.

I have no problem with anyone wanting to play defense right now. If the stock market was rewarding my good, bad and ugly reporting stocks after their earnings, then that is the type of environment that I want to be 100% long equities. But if I am not going to get paid to take risk, then it is going to take a lot to get me to put capital at risk. I’d rather be underinvested and have high certainty in my owned equities at the moment. If I showed you some of my allocation models right now, I’d have to make sure that there were no sharp objects in your immediate vicinity because they are horrifically bearish. But, there are still some areas in the market to invest—either in specific names, sectors, geographies or commodity groups. We just have to work a bit harder and take an extra canteen of water with us.

To receive this weekly briefing directly to your inbox, subscribe now.

The market was tough on all earnings results this quarter…

When highly cyclical stocks underperform on earnings beats, it’s game over. On the flipside, when they pop higher after an earnings miss, back up the truck to buy.

@carlquintanilla: BofA cuts Caterpillar to neutral: “it’s usually not a great sign” when cyclical stocks respond negatively to positive earnings

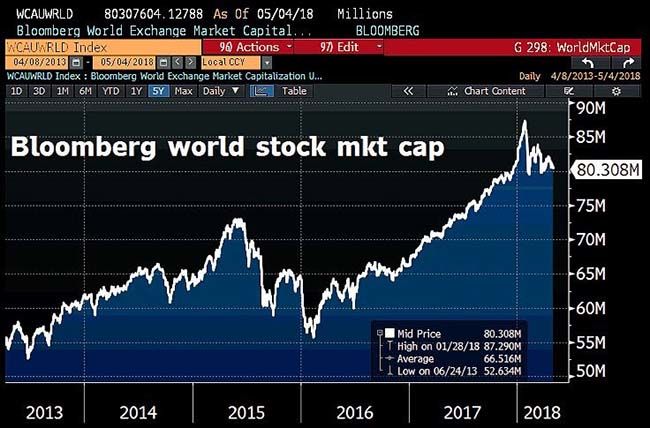

It was a tough week for global equities…

@Schuldensuehner: Global stocks have lost $789bn in mkt cap this week as a combination of moderating global growth, good-but-not-great 1Q earnings, monetary tightening, elevated short-term rates, stronger Dollar and a sustained high VIX, has all weighed on risk appetite.

Rising U.S. interest rates make everything else a bit less interesting, including Emerging Market assets…

US Treasury yields have pushed markedly higher over the past month, with a robust economy expected to prompt the Federal Reserve to increase interest rates a total of three to four times this year. In fact, the 10-year climbed from 2.73 per cent at the start of April to above 3 per cent by April 25.

Higher yields take some of the polish off of the carry trade, in which investors borrow in lower-yielding countries to buy debt in higher-yielding ones. The trade has been a boon for demand of EM currencies, according to analysts.

Emerging Market currencies, stocks and bonds are now solidly caught in the cross hairs of a strengthening U.S. dollar…

An index of developing-market currencies weakened for a fifth week, the longest losing streak in almost three years. The MSCI Emerging Markets Index of equities slumped 1.7 percent, and the Bloomberg Barclays global EM currency government debt index slipped 0.8 percent, its fourth week of losses.

The declines may continue as data this week show U.S. inflation accelerated, underpinning the dollar. The U.S. currency is poised to extend gains as the Fed hikes rates each quarter, according to Mansoor Mohi-uddin, the head of foreign-exchange strategy at NatWest Markets in Singapore.

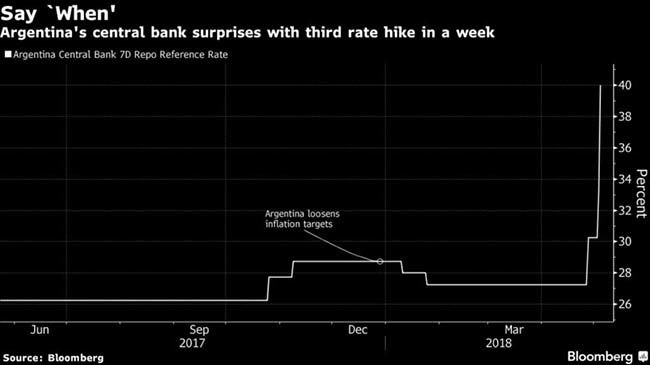

In the wake of a dramatic series of emergency rate hikes to blunt a plunge in the peso, traders will look to Argentina’s central bank for more clarity on how it plans to calm distressed investors. Benchmark rates at 40 percent pulled the currency into positive territory Friday.

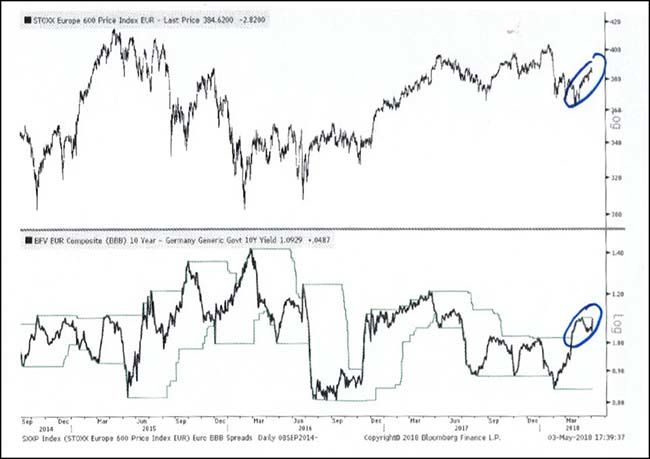

European credit markets are beginning to tighten…

Partially due to the recent soft European economic data plus the fears over trade war tensions, but also there is little doubt that rising U.S. rates and the strengthening U.S. dollar are impacting.

(RenMac)

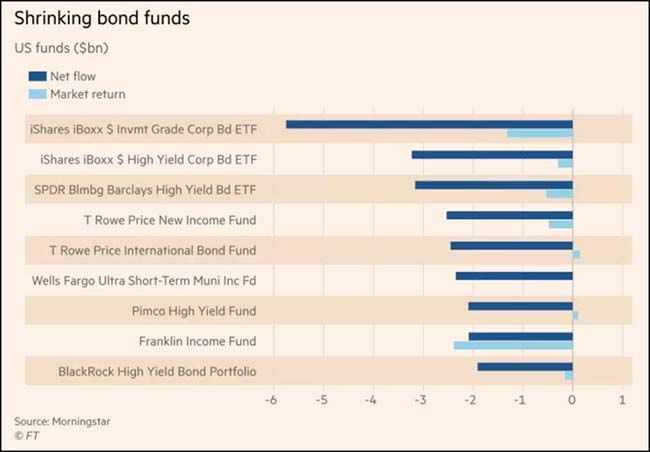

On a global basis, money is flying out of bond funds and ETFs in 2018…

“Clearly market sentiment towards bonds has deteriorated,” said Andreas Utermann, chief executive of Allianz Global Investors, the €498bn fund house that has 40 per cent of its assets in fixed-income products. “Some investors who were in bond funds because they thought they were in a 30-year-plus bull market will pull out, but investing in bonds is also about receiving a stable income.”

Of the 20 funds with the biggest outflows in the US for the first three months of the year, nine were bond funds, with several others also investing in fixed-income assets, according to Morningstar.

The data provider’s list includes the $32bn iShares iBoxx dollar investment grade corporate bond ETF, which suffered $5.7bn of outflows; the $14bn iShares iBoxx dollar high yield corporate bond ETF, which lost $3.2bn in redemptions; and the SPDR Bloomberg Barclays high-yield bond ETF, from which investors withdrew $3.2bn.

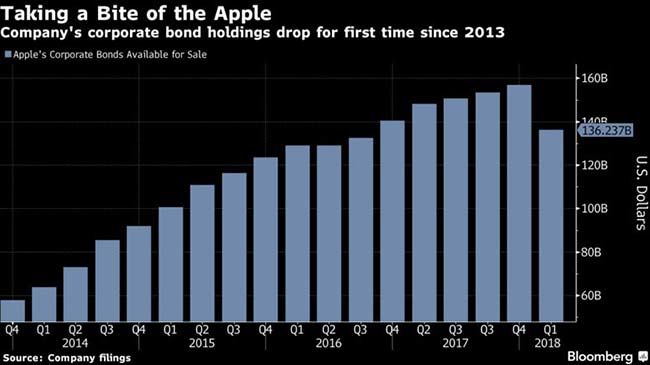

Changes in U.S. corporate income taxes are also causing selling of bonds…

The new U.S. tax law is likely to end a strange debt circle that helped fuel purchases and sales of corporate bonds for years. Previously, companies with extensive profit earned overseas, like Apple and Alphabet Inc., would end up being both big buyers of corporate debt and big issuers of the obligations.

The buying stemmed from the money the companies had earned abroad that would be taxed if it were brought back to the U.S. Instead, they would invest at least some of that money in short-term corporate bonds.

Those companies would also borrow in the U.S. corporate bond markets to fund share buybacks and other cash needs. Apple was the third-largest issuer of corporate bonds last year.

Under new laws, there’s no benefit to keeping money overseas, meaning companies like Apple can just move profit back to the U.S. without the bond markets intermediating. The effects of that change are showing up in corporate debt markets. Prices have fallen and yields have risen for investment-grade bonds that cash-rich companies would buy, namely those with a duration of less than one year, according to data compiled by Bloomberg. And issuance for high-grade bonds has fallen 7 percent this year through Thursday, compared with the some period last year, in part because Apple hasn’t sold any bonds this year.

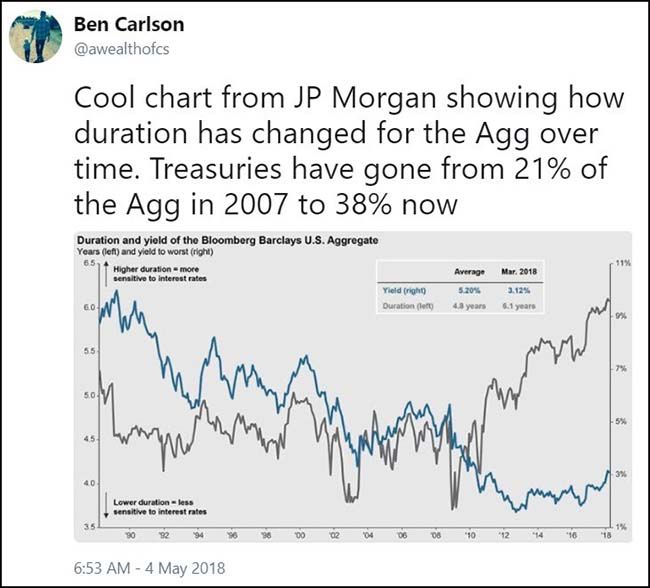

Meanwhile, your U.S. benchmark bond index continues to extend its duration…

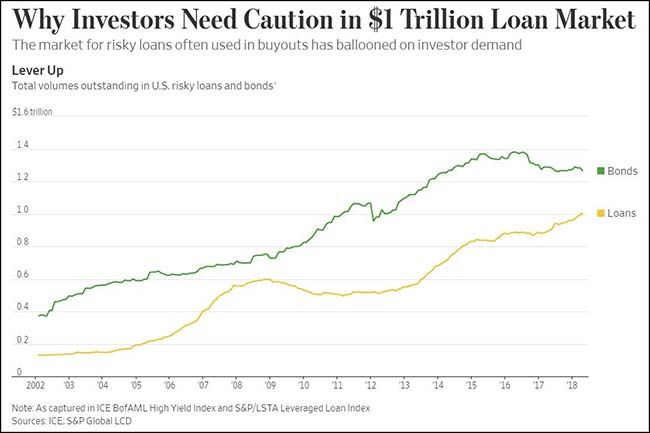

But money is flying into the leveraged loan market…

Not sure if this is such a good idea at this point in the cycle.

For investors, loans’ big attraction is protection against rising U.S. interest rates because loans pay a floating rate tied to an underlying market interest rate, known as Libor. High-yield bonds, in contrast, pay a fixed coupon, so lose value as rates rise.

However, rising rates will bite eventually. Right now, companies with leveraged loans have plenty of earnings before interest, tax, depreciation and amortization relative to their interest costs. According to UBS , this interest cover is more than three times. But borrowers can only withstand three more rate rises before interest costs start to become more painful—and UBS expects six increases by 2019.

The market is also riskier than it was in 2007, according to LCD. While the cost of loans is in a similar range, more than half of borrowers now are rated single-B+ or lower: In 2007, less than one-third of the market was that poorly rated.

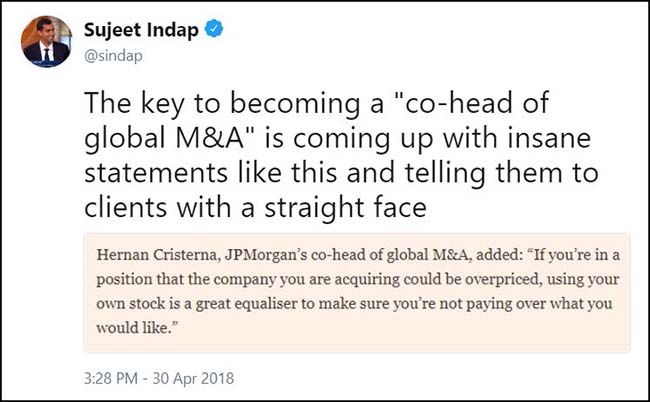

Of course if you wanted a reason to sell everything in your portfolio, you might start by reading this investment banker quote…

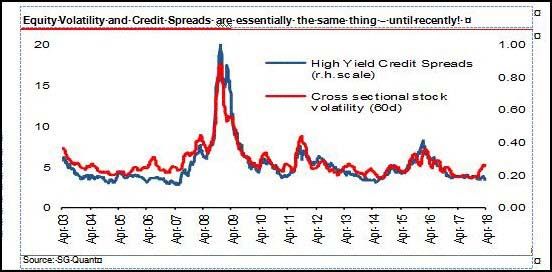

Interesting divergence between stock volatility and credit spreads…

Usually I would say that bonds are smarter than stocks. But not sure I can be so certain of that now, given how much in flows bond funds have taken in over the last decade.

(Society Generale)

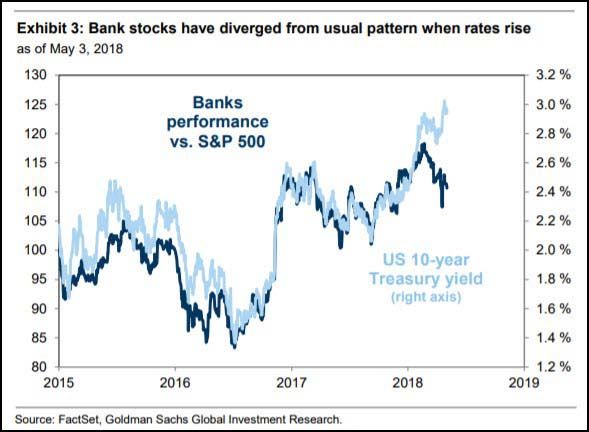

Also an interesting divergence between U.S. interest rates and recent bank stock underperformance…

Maybe the sector is still too overowned and now worried about the flat yield curve?

(Goldman Sachs)

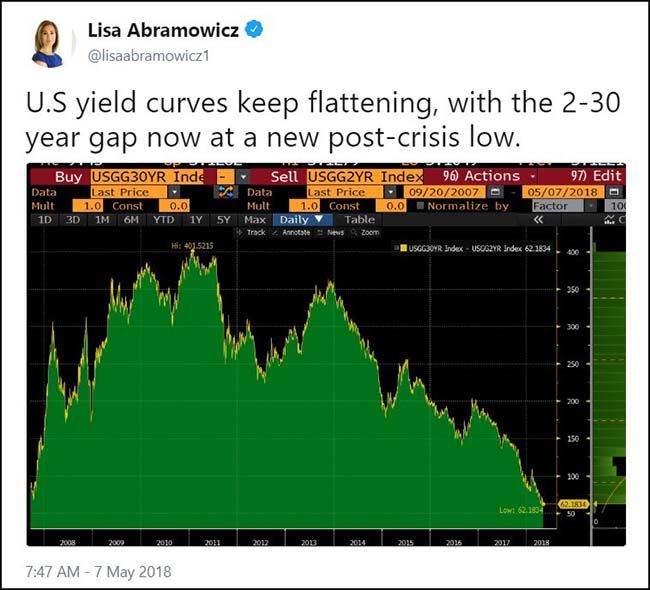

Here is that flat yield curve making new lows…

An important data point last week was that global air freight is slowing…

…which helps to explain the underperformance in FedEx and UPS.

Another new global trade datapoint is that the Chinese have stopped buying U.S. soybeans…

The world’s biggest oilseed processor just confirmed one of the soybean market’s biggest fears: China has essentially stopped buying U.S. supplies amid the brewing trade war.

“Whatever they’re buying is non-U.S.,” Bunge Ltd. Chief Executive Officer Soren Schroder said in a telephone interview Wednesday. “They’re buying beans in Canada, in Brazil, mostly Brazil, but very deliberately not buying anything from the U.S.”

In a move that caught many in U.S. agriculture by surprise, China last month announced planned tariffs on American shipments of soybeans. As the market waited for the measure to take effect, there was some hope among traders and shippers alike that relations between the nations could ease in the meantime and the trade flow would continue. But that doesn’t seem to be the case, at least for now, according to Bunge.

It’s “very clear” that the trade tensions have already stopped China from buying U.S. supplies, Schroder said. “How long that will last, who knows? But so long as there is this big cloud of uncertainty, that’s likely to continue.”

In other news, France is quickly shifting from Socialism to Capitalism…

@Forbes: French President Emmanuel Macron is transforming France into an entrepreneurial hotbed http://on.forbes.com/6016DjqYs

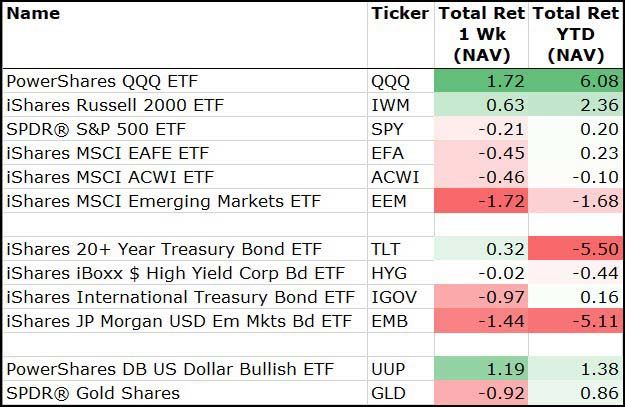

A strong week for Tech earnings and the U.S. dollar…

(5/4/2018)

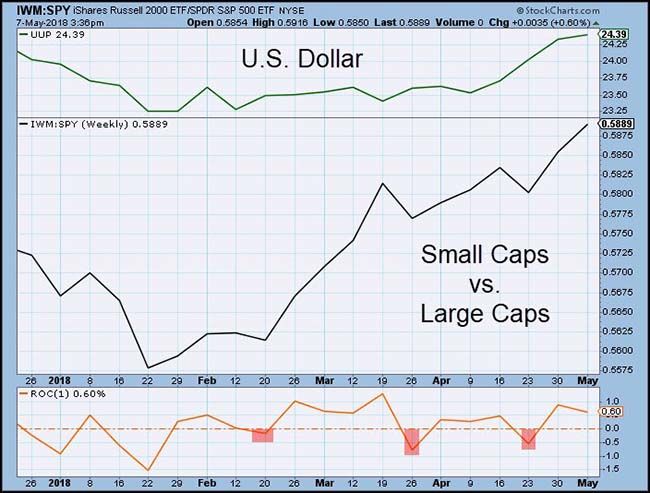

U.S. dollar strength continues to help Small Cap stocks…

Which have now only registered three underperforming weeks since the dollar began its ramp in February.

According to Goldman Sachs, the best risk-adjusted performing major asset in 2018 is Crude Oil…

And the worst is Investment Grade Bonds.

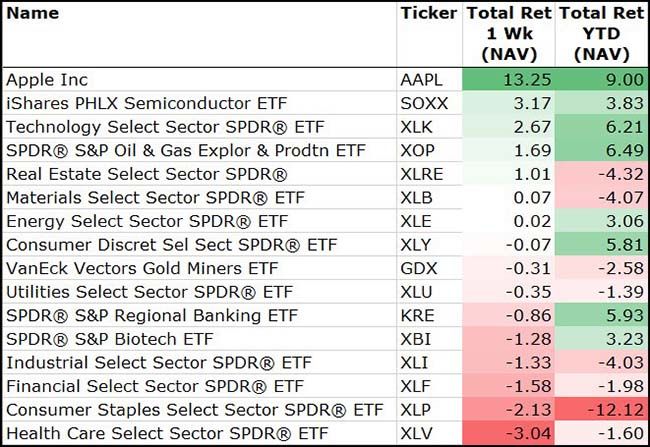

A good week for the largest stock in the world that pulled Tech and Semis with it…

(5/4/2018)

Here is what all-time record highs looks like…

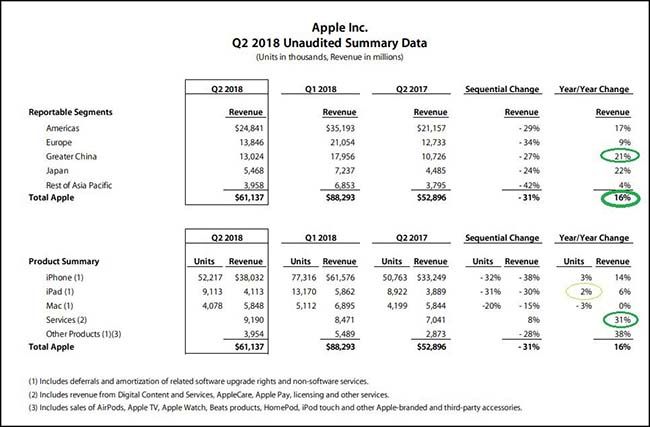

Chalk up the Apple earnings excitement to China and the Services business…

(@macromon)

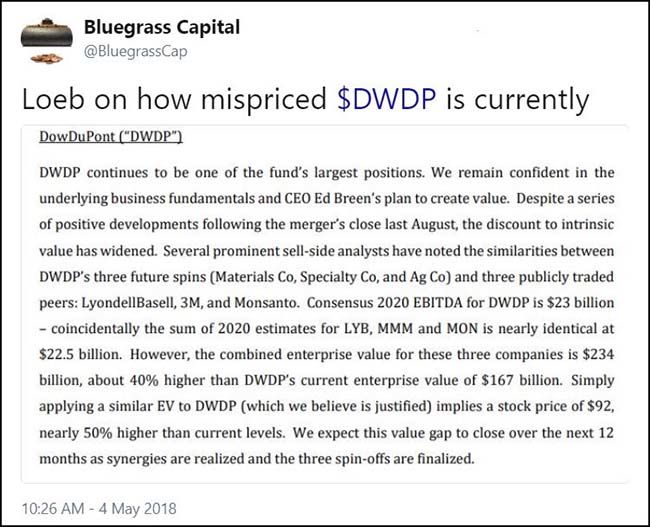

DowDuPont is 21% of the Materials Sector ETF (XLB)…

If Dan Loeb at Third Point is correct, then XLB has wind at its back.

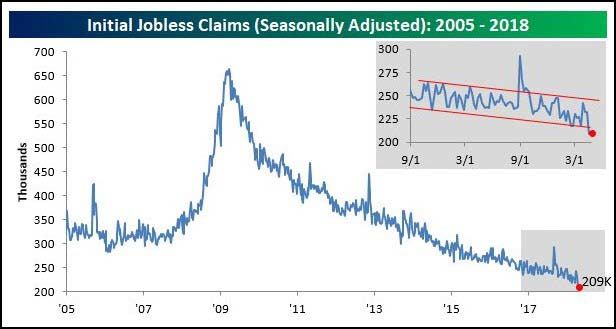

The employment data series is running out of records to break…

@bespokeinvest: No matter how you look at them, jobless claims are at levels not seen in well over 40 years.

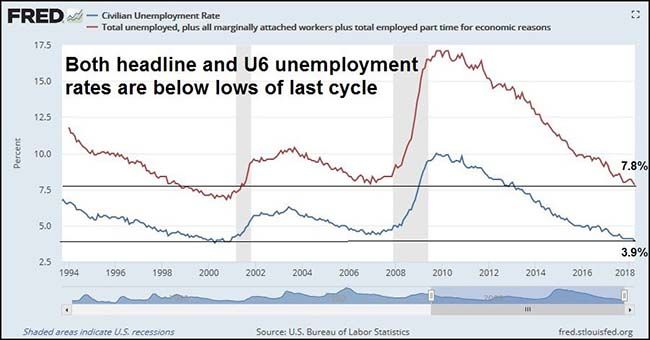

3.9%. Wow.

@HumbleStudent: Strong April Jobs Report: Both headline and U6 unemployment below lows set in last cycle

Of course, if your business is built on low-priced labor, then you are in a most difficult operating environment…

@anthonybrown: In-N-Out Burger, Marin County, CA. +$5 over CA mandated min wage.

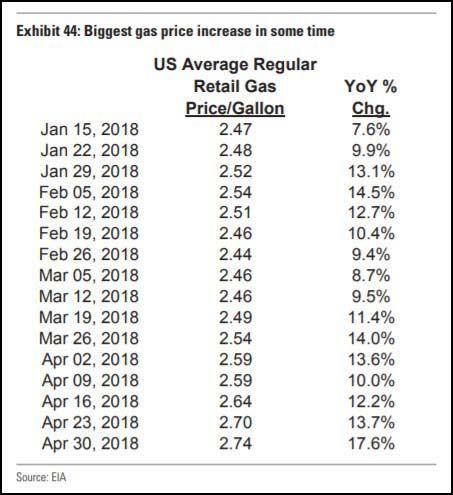

When will consumers notice the price at the gas pump?

(Goldman Sachs)

Ugly Inflation Math… Del Frisco’s comps -3.6% = Prices +5.7% and Traffic -9.3%

@conorsen: The front lines of inflation are consumer-facing companies that just saw their margins obliterated by costs. $DFRG

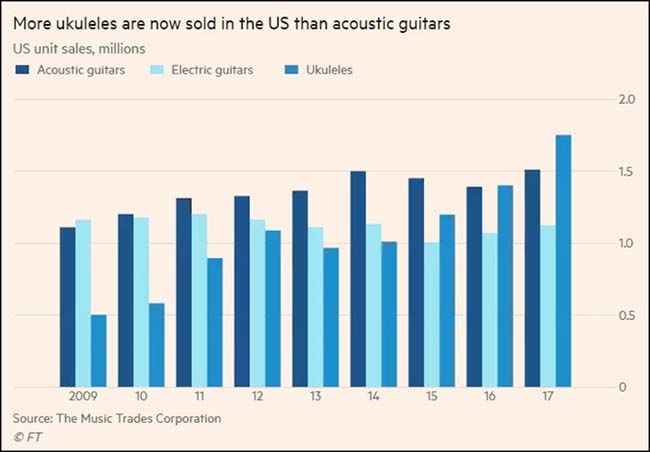

“I just want to say one word to you. Just one word.” Ukuleles.

Very good work by today’s parental units…

(@quantian1)

Great story of the week…

Her name was Sylvia Bloom and even her closest friends and relatives had no idea she had amassed a fortune over the decades. She did this by shrewdly observing the investments made by the lawyers she served.

“She was a secretary in an era when they ran their boss’s lives, including their personal investments,” recalled her niece Jane Lockshin. “So when the boss would buy a stock, she would make the purchase for him, and then buy the same stock for herself, but in a smaller amount because she was on a secretary’s salary.”

Since Ms. Bloom never talked about this, even to those closest to her, the fact that she had carefully cultivated more than $9 million among three brokerage houses and 11 banks, emerged only at the end of her life — “an oh my God moment,” said Ms. Lockshin, the executor of Ms. Bloom’s estate.

“I realized she had millions and she had never mentioned a word,” recalled Ms. Lockshin. “I don’t think she thought it was anybody’s business but her own.”

Ms. Bloom’s will allowed for some money to be left to relatives and friends, but directed that the bulk of the fortune go toward scholarships of Ms. Lockshin’s choice for needy students.

Craziest story of the week…

Copyright © 361 Capital