by John Lynch, Chief Investment Strategist, LPL Financial and Ryan Detrick, CMT Senior Market Strategist, LPL Financial

KEY TAKEAWAYS

- The May through October period has historically been the weakest six months for equities.

- However, the six-month stretch has recently seen higher equity prices.

- This year, there are factors at play that could lead to equity strength during the next six months.

“Sell in May and go away” is probably the most widely cited stock market cliché in history. Every year a barrage of Wall Street commentaries, media stories, and investor questions flood in about the popular stock market adage. This week, we tackle this commonly cited seasonal pattern, while focusing on some reasons it may not apply this year.

The origin of “sell in May and go away” started in England and was originally called “sell in May and go away until St. Leger’s Day.” This saying was based around the St. Leger Stakes, a popular horse race in September that marked the end of summer and a return of the big traders and market volume.

THE WORST SIX MONTHS OF THE YEAR

“Sell in May and go away” is based on the seasonal stock market pattern in which the six months from May through October are historically weak for stocks, with many believing that it’s better to simply avoid the market altogether and move to cash during the summer months.

As discussed on the LPL Research blog last week, the S&P 500 Index gained 1.5% on average during these six months (since 1950*), compared with 7.1% during the November to April period. In fact, out of all six-month combinations, there has been no worse return, on average, than the May through October period.

*Please note: The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

BEWARE OF MIDTERM YEARS

Midterm years can also be quite troublesome for equities. In fact, out of the four-year presidential cycle, the S&P 500 tends to have an average peak-to-trough pullback of 16.9% during a midterm year, which is the most out of the four-year cycle. The good news is that a year after the calendar year lows are completed, the S&P 500 has been up 32.0% on average.

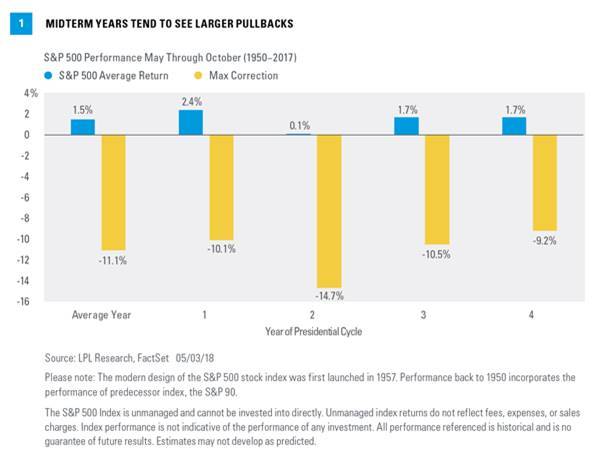

Looking at the May through October period during a midterm year shows a similar pattern. During midterm years, the S&P 500 has gained only 0.1% on average during these six months, the worst out of the four-year presidential cycle. It also sees an average peak-to-trough pullback of 14.7%, the largest pullback during these six months out of the four years [Figure 1]. So the calendar is a potential concern over the coming months, but as we discuss below, we see reasons to believe the pattern may not hold this year.

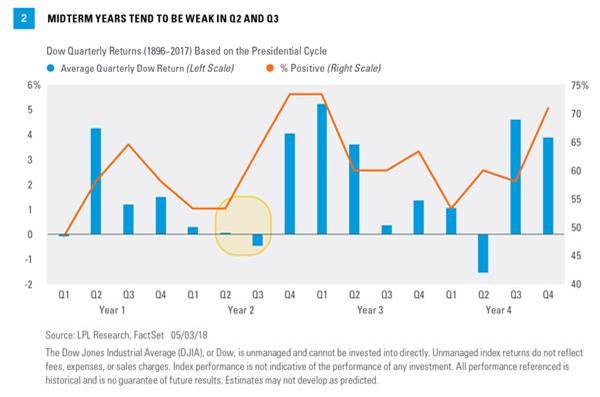

Going all the way back to the origin of the Dow Jones Industrial Average in 1896, we see similar potential seasonal weakness over the coming months. Breaking things down by quarters, the second and third quarters of midterm election years are historically two of the weakest [Figure 2]. Once again, the good news is that stocks tend to rebound strongly after these weak patches.

Why do midterm years tend to see more stock market volatility? One theory is that the party that wins the presidency tends to lose seats in the House and Senate, which greatly increases uncertainty. The uncertainty is alleviated after the election and, during a bull market, stocks may resume their rally.

WHY THE PATTERN MAY NOT HOLD THIS YEAR

So, will the S&P 500 fall over the next six months? We don’t think so—and here’s why. Lately, the “sell in May” adage hasn’t rung true. In fact, the S&P 500 has closed higher in May during each of the past five years and has risen over the entire six-month period during five of the past six years, with an average gain of 4.8%. In fact, the only time equity prices were lower was in 2015, when the S&P 500 lost only 0.3% during these six months.

Taking things a step further, we look at the S&P 500’s 200-day moving average, because we consider prices to be in a bullish trend when they’re above that 200-day moving average.

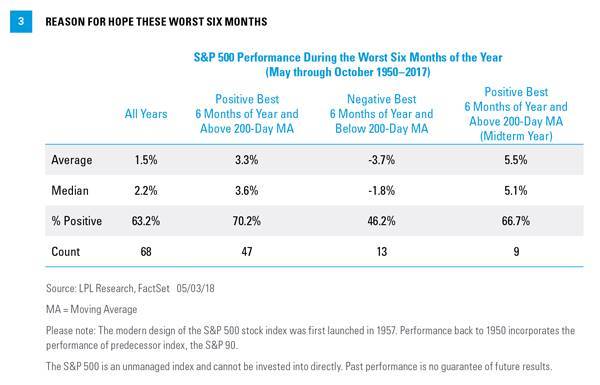

- When the index begins the worst six months of the year above its 200-day moving average and returns have been higher during the previous six months (as is the case for 2018), the return during those upcoming six months has been a respectable 3.3%, with gains more than 70% of the time.

- In comparison, when it starts below the 200-day moving average and returns have been lower during the previous six months, the next six months have been down 3.7% on average, with gains only 46% of the time [Figure 3].

In other words, if prices are in a bullish trend, those worst six months of the year historically aren’t so bad. (Note: We also use a rising or falling 200-day moving average to assess trends.)

Here’s where things get interesting. When the S&P 500 starts the worst six months of the year above the 200-day moving average during a midterm year, and the previous six months were higher (again, like 2018), the results have been quite impressive. The previous nine times that happened since 1950, the S&P 500 gained 5.5% on average and rose 66% of the time.

CONCLUSION

We’re entering the worst six months of the year for stocks, but that doesn’t necessarily mean you should sell and wait on the sidelines. During recent history, these six months have actually seen solid gains—and we expect that may be the case again in 2018. With earnings expanding strongly, improving technicals, and reasonable valuations when factoring in the low interest rate environment, we would suggest suitable investors use any seasonal weakness as a chance to consider adding to equity exposure. We also maintain our forecast for 10% stock market gains in 2018, with leadership coming from small caps, emerging markets, cyclical sectors, and value.

Copyright © LPL Financial

For our full forecasts for 2018, please see the Outlook 2018: Return of the Business Cycle publication.

IMPORTANT DISCLOSURES

The prices of small cap stocks are generally more volatile than large cap stocks.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

All investing involves risk including loss of principal.