by Doug Drabik, Fixed Income, Raymond James

First and foremost, for investors who buy and hold bonds to maturity and utilize them to protect wealth, an enormous advantage is their known outcome versus the speculative outcome which exists for many other asset classes. Attempting to time the market with bond purchases leads to added risk. Although timing rates, predicting inflation and optimizing spreads flawlessly can boost yields, a mistimed market entry can cost yield/protection. Bonds are about long term planning whereas timing risks should be left to growth assets that depend on skilled timing.

That being said, it is still important to be sensible about market rates and trend shifts in order to potentially optimize the portfolio’s known outcome/income. Rising interest rates continue to be met with headwinds despite the Fed’s persistent push of short-term rates. We have talked many times about how the Fed influences short-term rates but does not necessarily have an equal or balanced influence on intermediate- and long-term rates.

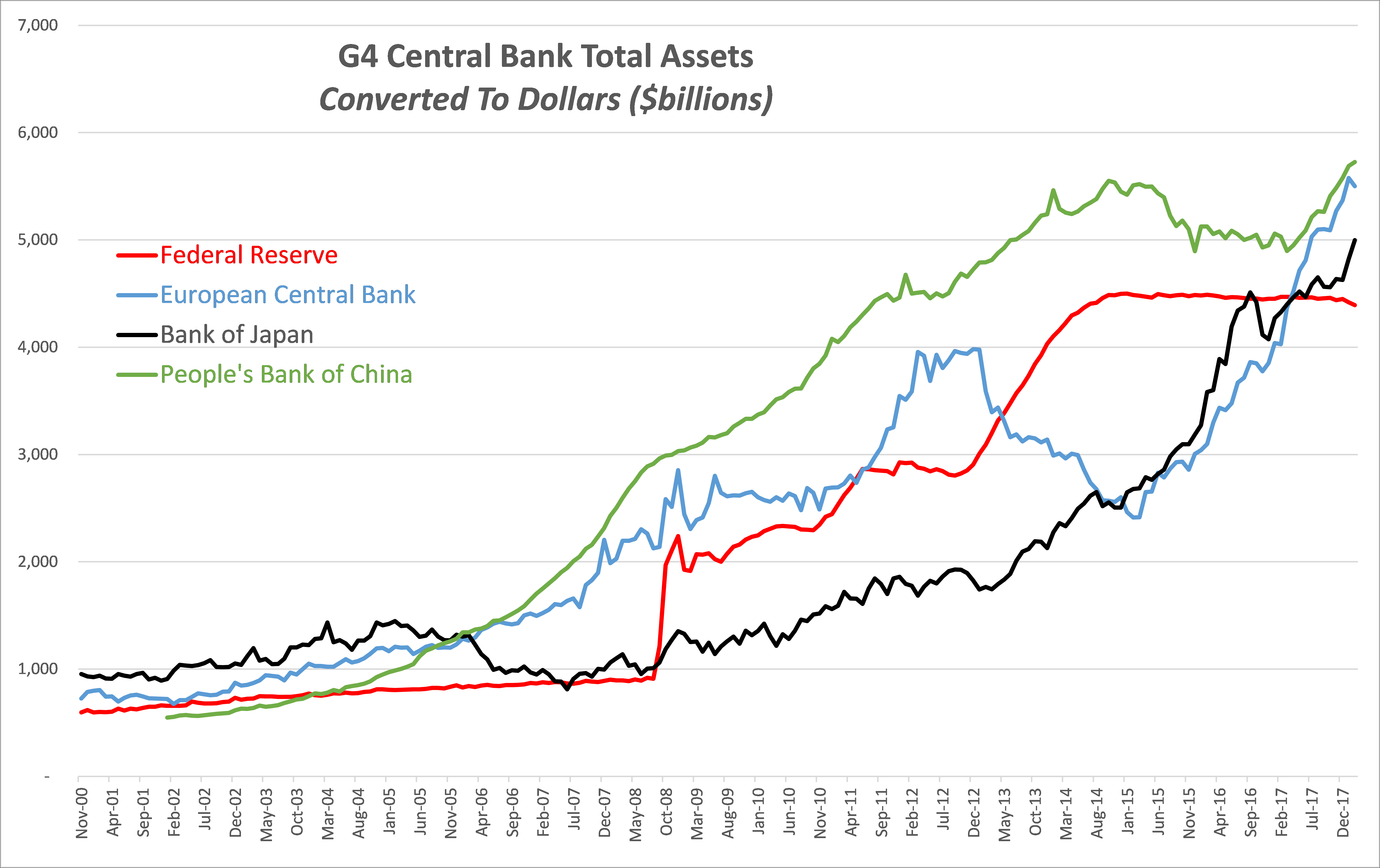

From 2008-2010, three prominent central banks, the Fed, ECB and Bank of Japan (BoJ), all began quantitative easing programs. The programs have ballooned their balance sheets to levels never historically seen and the market affects and non-affects are currently being experienced. The Fed discontinued their QE program when the ECB, BoJ and People’s Bank of China pushed theirs. The four central banks have grown their combined balance sheets to over $20.6 trillion (US). The Fed’s balance sheet is now the smallest of the four.

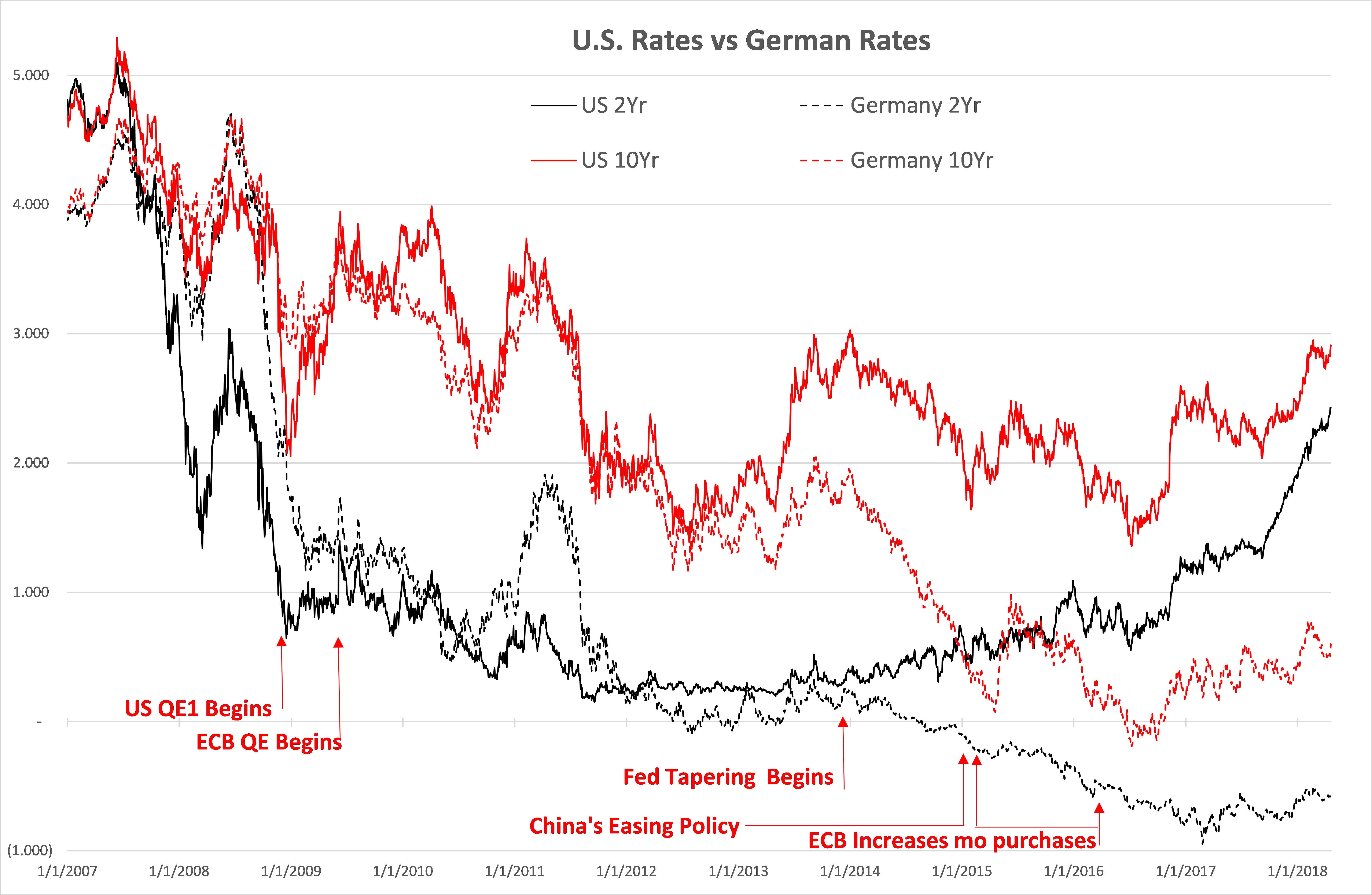

The Federal Open Market Committee (FOMC) began tapering quantitative easing (QE) in December of 2013. Shortly after, the European Central Bank twice increased its monthly bond purchases (QE) despite repeated assertions that they would begin their own tapering. Interestingly, the spread between sovereign rates began to widen considerably about the same time period that the Fed tapered and the ECB accelerated open market purchases. The following graph depicts the largest ECB economy, Germany against the United States 2- (black and black dashed lines) and 10-year rates (red and red dashed lines):

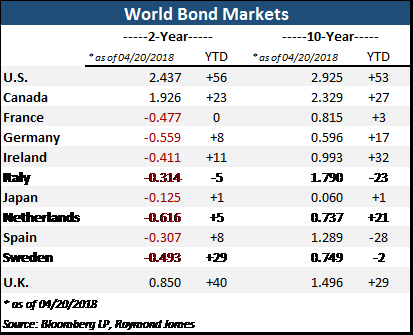

For years prior to and including the quantitative easing periods, German and U.S. rates generally tracked each other. When monetary policy noticeably split in different directions, rate disparity evolved. As long as world monetary policy acts in opposite direction, it is possible it will continue to hinder domestic rates from rising quickly as the higher U.S. rates appeal to foreign interests. Below is a comparison of other world rates and their year-to-date changes:

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James