by Todd Hedtke, CIO, Allianz Investment Management

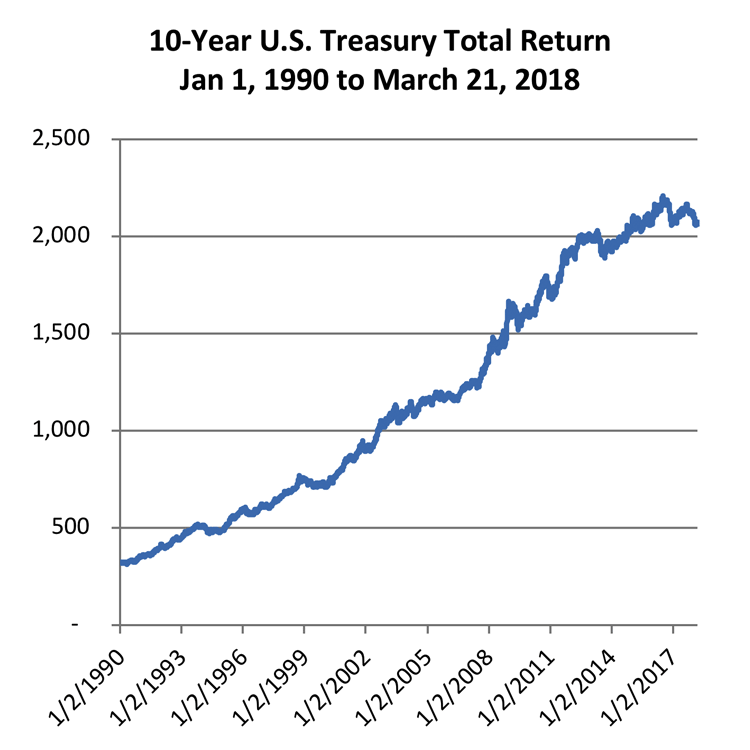

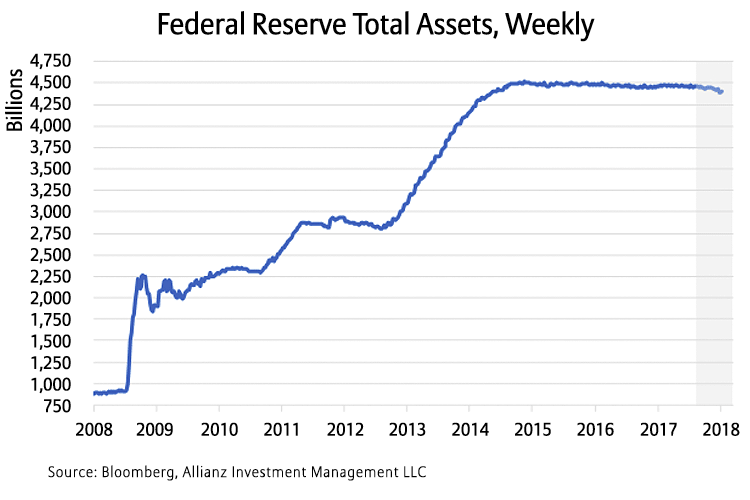

The current equity bull market is the longest in history. We saw extraordinarily low volatility in 2017 and multiple decades-long positive fixed income returns, all fueled by a giant punchbowl of stimulative monetary policy from the Federal Reserve and central banks around the globe for the past decade.

At some point the slopes of these curves will change, perhaps even at the same time, and drive losses in investors’ portfolios. Although the timing and depth of portfolio impacts are up for debate, the fact that it will happen quicker than most investors will be able to react isn’t. Markets move faster today than they have in the past – thus being adequately prepared well in advance is prudent for all investors.

At some point the slopes of these curves will change, perhaps even at the same time, and drive losses in investors’ portfolios. Although the timing and depth of portfolio impacts are up for debate, the fact that it will happen quicker than most investors will be able to react isn’t. Markets move faster today than they have in the past – thus being adequately prepared well in advance is prudent for all investors.

Expectations of sunny skies ahead are understandable

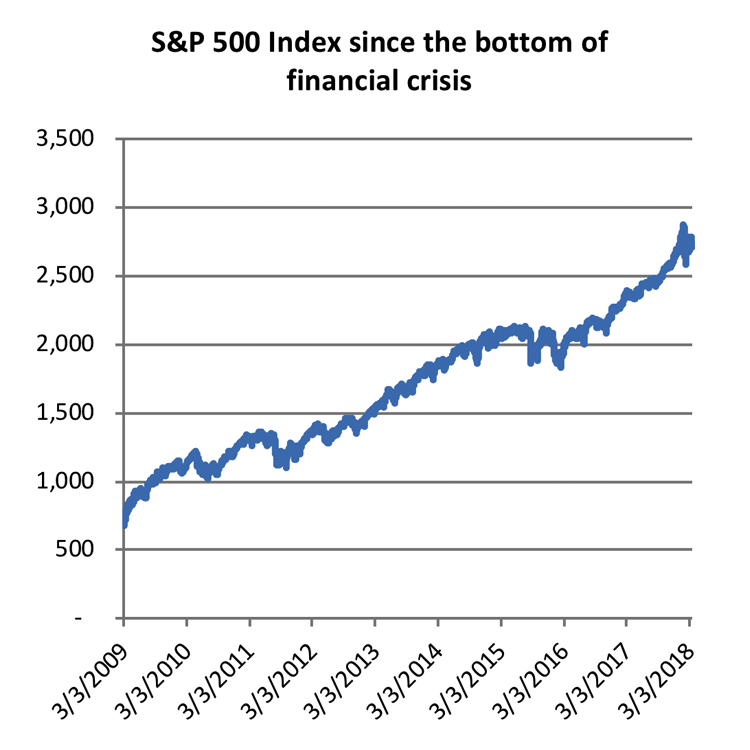

Since the conclusion of the financial crisis nearly nine years ago, we have witnessed an incredibly persistent bull market. The S&P 500® Index is up over 300% from its low in 2009 with few material sell-offs along the way. Just last year the S&P 500® Index posted positive returns every single month, something we have not seen in almost 50 years. A similar story is true for the Dow Jones Industrial Average, which has increased nearly 230% from its crisis low. In addition, the VIX Index, which is commonly referred to as the investor fear gauge, recorded its lowest average level since its inception in 1993.

Looking at the facts, the bulls have plenty of reason for optimism:

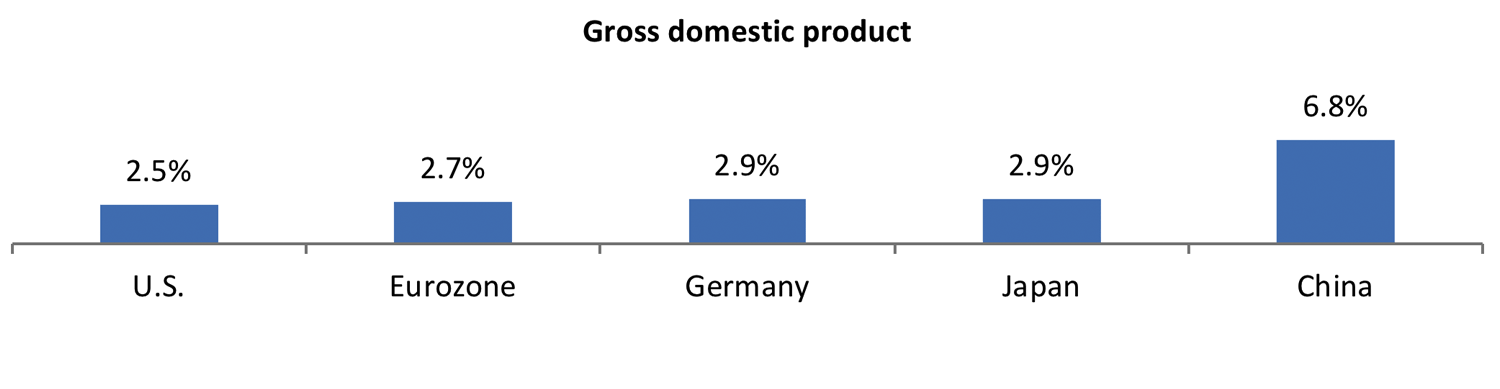

- Global growth is healthy, with all major economies expanding.

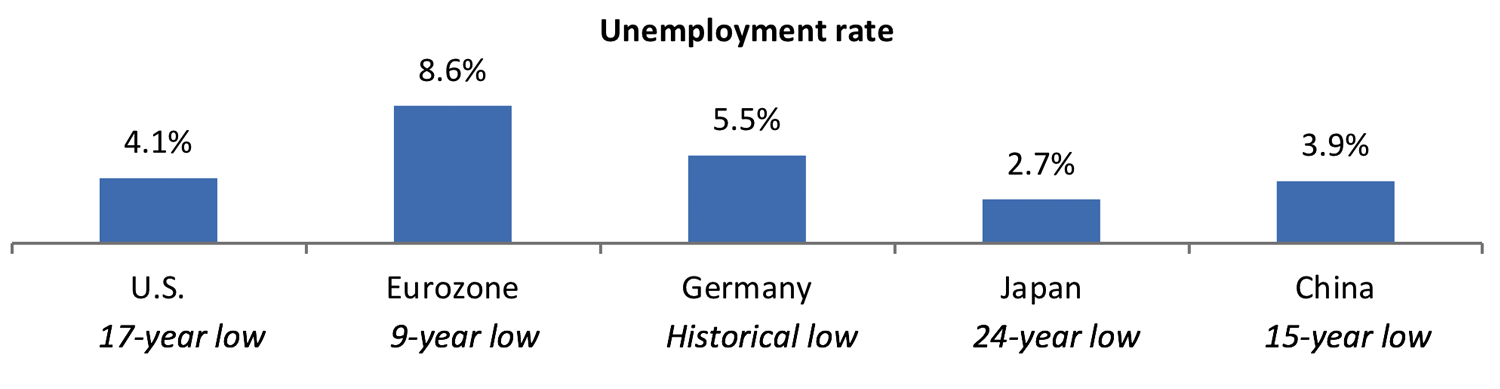

- Global labor markets are strong, with low unemployment rates across major economies.

- The U.S. consumer is more confident.

- Conference Board’s Index of Consumer confidence rose to 130.8 in February – the highest reading since 2001, a 17-year high.

- The U.S. consumer is spending.

- Consumer spending increased at a 3.8% annualized rate in the fourth quarter of 2017 – the strongest acceleration in three years.

- The U.S. labor market is strong.

- The current unemployment rate of 4.1% is the lowest rates since the year 2000, and is expected to reach multi-decade lows later this year.

- Company earnings are also strong.

- And are broadly beating expectations, serving as strong fundamental support to credit markets.

- Earnings per share in the S&P 500® Index has grown from $26 in April of 2016 to $36 in March of 2018, while the estimated long term earnings growth is only 11.2%.

- Manufacturing is looking good as well.

- The ISM Manufacturing Index, which monitors employment, production, inventories, new orders, and supplier deliveries for more than 300 companies, has reached the highest level since 1987 at 60.8.

So what’s the problem?

While these are encouraging statistics, they are also typical late-cycle observations. The following are a few scenarios that could derail the positive momentum within the equity market.

- Balance sheet reduction – as the Fed’s enormous balance sheet slowly unwinds, additional supply will be available in the market. The increase will put upward pressure on bond rates in an effort to entice investors, which could ultimately have a drag on the equity market.

- Aggressive rate hikes by the Fed to provide monetary policy leeway for the next recession could be self-fulfilling, given structural headwinds to inflation.

- Geopolitical tensions persist, cybercrimes seem commonplace, protectionism is escalating, and nationalism is peaking.

- Where does the next bout of good news come from now that the U.S. tax cut is priced into the market?

- Just like buying, selling can be contagious.

Your attention is needed

While I am not calling the top of the market nor foreseeing an immediate bear market on the horizon, I am increasingly concerned about economic news being “too good” and clouding investors’ vision of the potential risks that may be lingering. As the old saying goes, the time to buy an umbrella is not when it has already begun to rain, but rather when the sky is still blue. I caution that while the sky may appear blue right now as growing global economies are supported by strong fundamentals, clouds are forming on the horizon. Just like the weather, market conditions can and do change quickly. Taking the analogy one step further, what is more painful: a wet outfit or a 20% drop in your retirement account?

Concluding thoughts

Times are good right now, very good, one might argue. To this end, it remains important to stay in the market. And while I want all bull market investors to make money, we also must be responsible bulls, and as strange as a bull with an umbrella might sound – you need one now! Markets can move very fast. Talk to your financial professional today and start to pick out your umbrella. May I suggest one with a great brand, and a reputation for excellence and trust.

Back to Connect with Allianz

The views expressed above reflect the views of Allianz Investment Management LLC, as of 4/2018. These views may change as market or other conditions change. This report is not intended and should not be used to provide financial advice and does not address or account for an individual's circumstances. Past performance does not guarantee future results and no forecast should be considered a guarantee either. Allianz Investment Management LLC is a registered investment advisor that is a wholly owned subsidiary of Allianz Life Insurance Company of North America. Allianz Life Insurance Company of New York is also a wholly owned subsidiary of Allianz Life Insurance Company of North America.

Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. In New York, products are issued by Allianz Life Insurance Company of New York, 28 Liberty Street, 38th Floor, New York, NY 10005-1422. Variable products are distributed by their affiliate, Allianz Life Financial Services, LLC, member FINRA, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297.

Copyright © Copyright ©