by Richard Turnill, Chief Investment Strategist, Blackrock

How should investors consider positioning their portfolios for the economic backdrop we see ahead in 2018? Richard shares some ideas.

This year has been off to a bumpy start. The S&P 500 was up nearly 7.5% at its January peak. Then the early February VIX spike helped spark a reversal, and equity volatility has mostly remained elevated amid trade war worries and technology sector concerns.

Trade risks and U.S. fiscal stimulus have added uncertainty to the economic outlook, and we now see a wider array of potential outcomes ahead than we did late last year. Yet we still believe the synchronized global economic expansion has room to run, one of the three themes we see shaping economies and markets in 2018.

The other themes: an inflation comeback and reduced reward for risk. Inflation has picked up, keeping the Federal Reserve on track to raise rates, but is not high or sticky enough to reverse monetary easing in the euro-zone or Japan. This overall environment is positive for risk assets, in our view, but we expect more muted returns and higher volatility than in 2017.

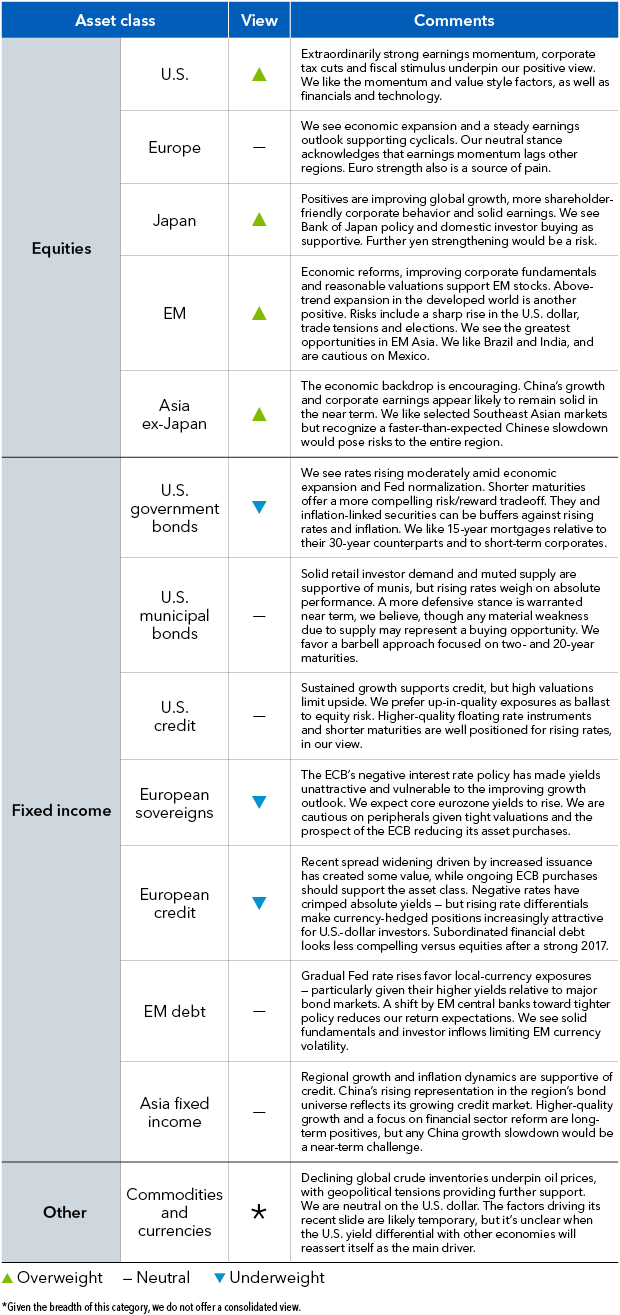

How should investors consider positioning their portfolios against this backdrop? We detail our asset class preferences in our Global Investment Outlook Q2 2018. Here’s a quick look at three of these investing ideas.

1. Seek risk in equities over credit.

Equities look appealing amid a solid economic backdrop and earnings momentum supercharged by U.S. fiscal stimulus. U.S. tax and spending plans have lit a fire under earnings growth, which was already gaining momentum on the back of economic strength. One sign: U.S. earnings upgrades relative to downgrades have shot up as analysts factor in the stimulus. The earnings revision trend goes beyond the U.S. and makes for the healthiest global earnings outlook since the post-crisis bounce.

Dividend payouts and share buybacks are another support for stocks, particularly in the U.S. as companies look to deploy their tax windfalls. Combined with earnings growth, we see these returns of capital to shareholders offsetting some valuation challenges: Investors are typically unwilling to bid up equity valuation multiples when rising interest rates and inflation threaten to erode corporate profit margins.

We favor U.S. and emerging market (EM) equities but we do see choppier markets and less-heady returns than last year ahead. Within equities, we also like technology, financials and the momentum style factor. At the same time, we are neutral on U.S. credit amid tight spreads and increasing sensitivity to rate rises, and prefer up-in-quality exposures. Rising interest rates dim the appeal of credit. Tight credit spreads reflect low default risks against a backdrop of solid global growth and modestly rising inflation. Credit spreads in many markets are trading at the lowest levels as a percentage of their overall yield in a decade. This is leading to a rising correlation with rate swings. Spreads are tightening by less than usual as rates rise—and in some cases are widening. Elsewhere, we are negative on European credit. Spreads are tight after ongoing European Central Bank purchases of corporate debt, and the risk of shifting policy adds uncertainty.

2. Consider short-maturity Treasuries.

We are negative on government bonds overall but see short-maturity Treasuries now offering a compelling risk/reward proposition. Short-maturity bonds offer enough income to offset inflation for the first time in years. Why? Rising U.S. rates. To boot, short-term yields now provide a thicker cushion against further rate rises than longer maturities. Rates would need to jump more than one percentage point to wipe out a year of income in the two-year U.S. Treasury note, we estimate. This is nearly double the cushion on offer two years ago—and far larger than the thin insulation provided by longer-term bonds today. For more details, see A mighty (tail) wind of March 2018.

3. Prefer commodity-linked equities and debt over actual commodities.

Commodity prices are riding the wave of global economic momentum. Healthier demand, tighter inventories and OPEC production cuts have corrected the supply glut that was depressing oil prices, and geopolitical tensions have also provided support. Prices have now bounced back from 2016 lows; however, increased U.S. shale oil production is likely to put a lid on further appreciation, we believe.

U.S. dollar weakness has added to commodity price gains, but we see other factors driving prices from here. Commodities have historically performed better in later parts of the economic cycle as demand for resources outpaces supply. We prefer commodities exposure via related equities and debt. Both have lagged the recovery in underlying spot prices. Major producers’ capex discipline and sharper focus on profitability are encouraging.

Asset class views

Views from a U.S. dollar perspective over a three-month horizon

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.