by Richard Brink, Walt Czaicki, and Scott Krauthamer, Equities, AllianceBernstein

It’s been a rocky start to 2018 for equity markets globally—volatility has returned with a bang and February saw the first 10% market correction in a while. So, why are active managers smiling?

It’s hardly breaking news that active management struggled mightily in the years since the global financial crisis, intensifying the questions about the effectiveness of active management and accelerating the surge in investment flows into passive equity strategies. Part of the problem for active was structural. A crowded field, developed over many years of strong markets and inflows, grew a large industry of active managers fighting for alpha.

At the same time, active managers drew closer to the benchmark, limiting the opportunity to outperform. However, based on active share and tracking error, the 20% of managers who were the most active beat their benchmarks substantially.

Equally important, the relative performance of active managers hasn’t been uniform across environments. There were tough times—the buildup to the tech bubble in the late 1990s and the QE-driven period after the global financial crisis. Across those two periods, only 21% of active managers outperformed (Display). But in all other time periods, 50% beat the benchmark.

This performance pattern underscores one of the most important determinants of active-management success: Are we in a beta trade or not?

Active management is challenged during big beta trades. The great rising tides of these markets make individual boats less important—even when they’re better boats. In these environments, dispersion among individual stocks is weak. As dispersion falls, the potential for alpha falls—and vice versa.

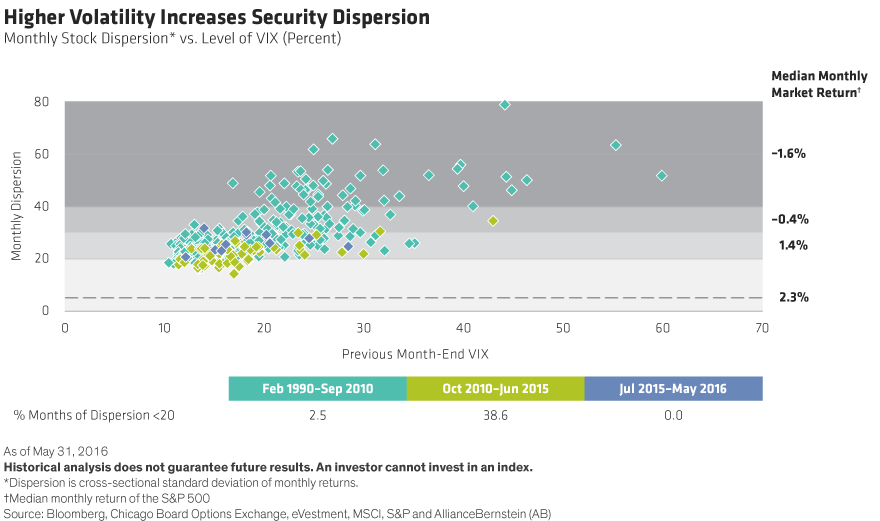

The linchpin of this relationship between beta and alpha is volatility—higher volatility translates to higher dispersion, which works in favor of active managers. But it also tends to create more challenged market conditions (Display). This landscape leaves a lot of space for active managers to add value.

Clearly, volatility is up so far in 2018: the S&P 500 Index experienced more 1% daily moves in the first quarter than it did in all of 2017. There have been plenty of worries to stir the pot further: the end of quantitative easing, rising interest rates, inflation pressures and geopolitical concerns that include populism versus globalism (the possible US-China trade war is a prominent example).

We’ve seen the return of the sell-off, too. In February, the S&P 500 endured its first 10% correction in quite a while. When markets tumble—or even when they’re less than stellar—active management offers the potential to maneuver and avoid trouble spots, playing defense to help protect against the downside. Passive management is locked into a benchmark, so it doesn’t offer that ability.

Just as the wave of growth in active management caused structural problems, the surge in passive investing is creating challenges, too. With the number of indices exceeding seven figures and a wave of money and a herd of passive vehicles chasing so few stocks, the risks of crowded trades breaking are probably as high as they’ve ever been. And so is the potential damage.

The active versus passive debate, for all intents and purposes, is over. Today, it’s about active and passive. Both approaches play useful roles in a portfolio. But given the expectations for markets ahead, we think overlooking the potential in active management as volatility rises could be a mistake.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein