by Scott Brown, Ph.D, Raymond James

The March reports remained consistent with the view that inflation will move toward the Fed’s 2% goal, perhaps sooner than expected. The FOMC minutes were not expected to surprise, but several Fed officials felt that it might be appropriate to move the federal funds rate above a neutral level for a time. As expected, the Congressional Budget Office is projecting higher deficits for the foreseeable future. Stock market participants ignored all this, buffeted by shifting perceptions of the White House’s trade policy.

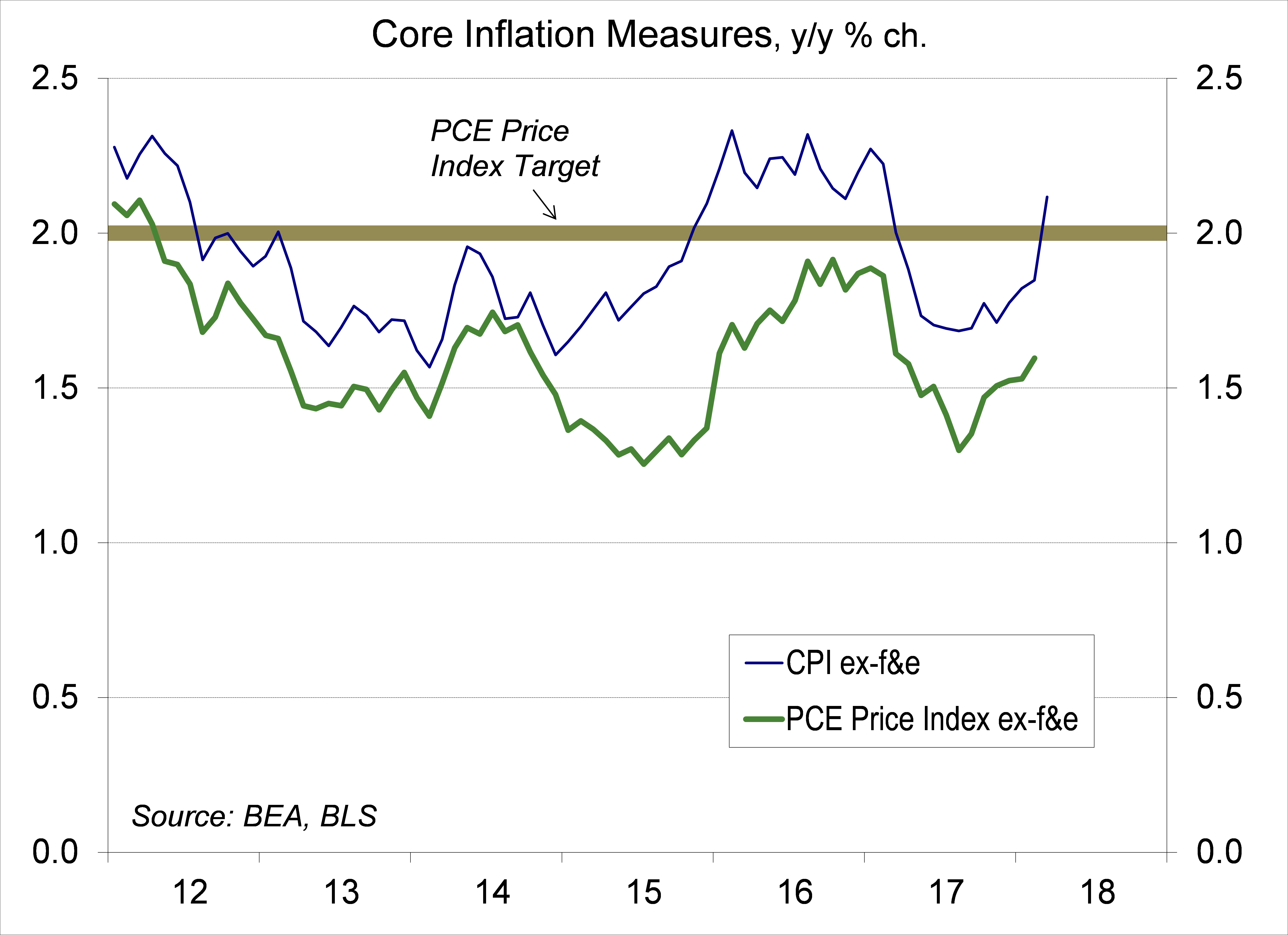

The y/y increase in the core Consumer Price Index rose to 2.1% in March (vs. +1.8% in February), as the March 2017 drop in wireless telecom services rolled off the 12-month calculation. Bear in mind that the Fed uses the PCE Price Index as its inflation gauge, which has been trending about 0.3 percentage point below the CPI. The reports on producer prices and import prices reflected a gradual buildup in pipeline pressures, consistent with the view that the Fed is nearing its inflation goal.

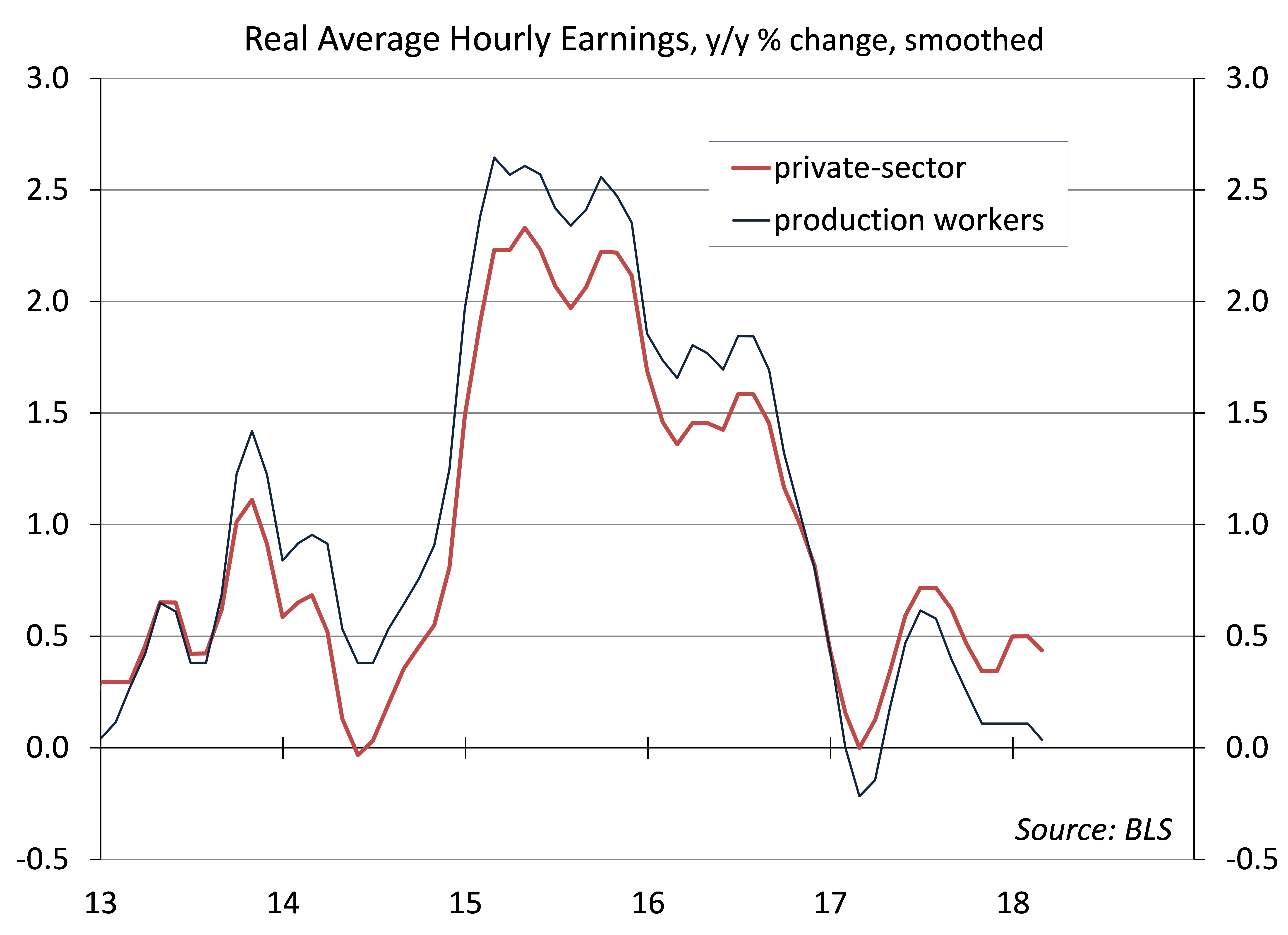

While inflation is still low by historical standards, it’s nearly matched gains in average hourly earnings, leaving inflation-adjusted earnings up modestly from a year ago. This suggests little firepower for consumer spending growth for the typical worker, which is consistent with the softer spending numbers we’ve seen in recent months.

The FOMC minutes from the March policy meeting showed that Fed officials generally saw the soft 1Q17 economic data as “transitory,” and therefore unlikely to deter them from gradually raising short-term interest rates. More importantly, several Fed officials saw growth as likely exceeding its potential, requiring an above-neutral federal funds rate to get back to a long-term sustainable trajectory.

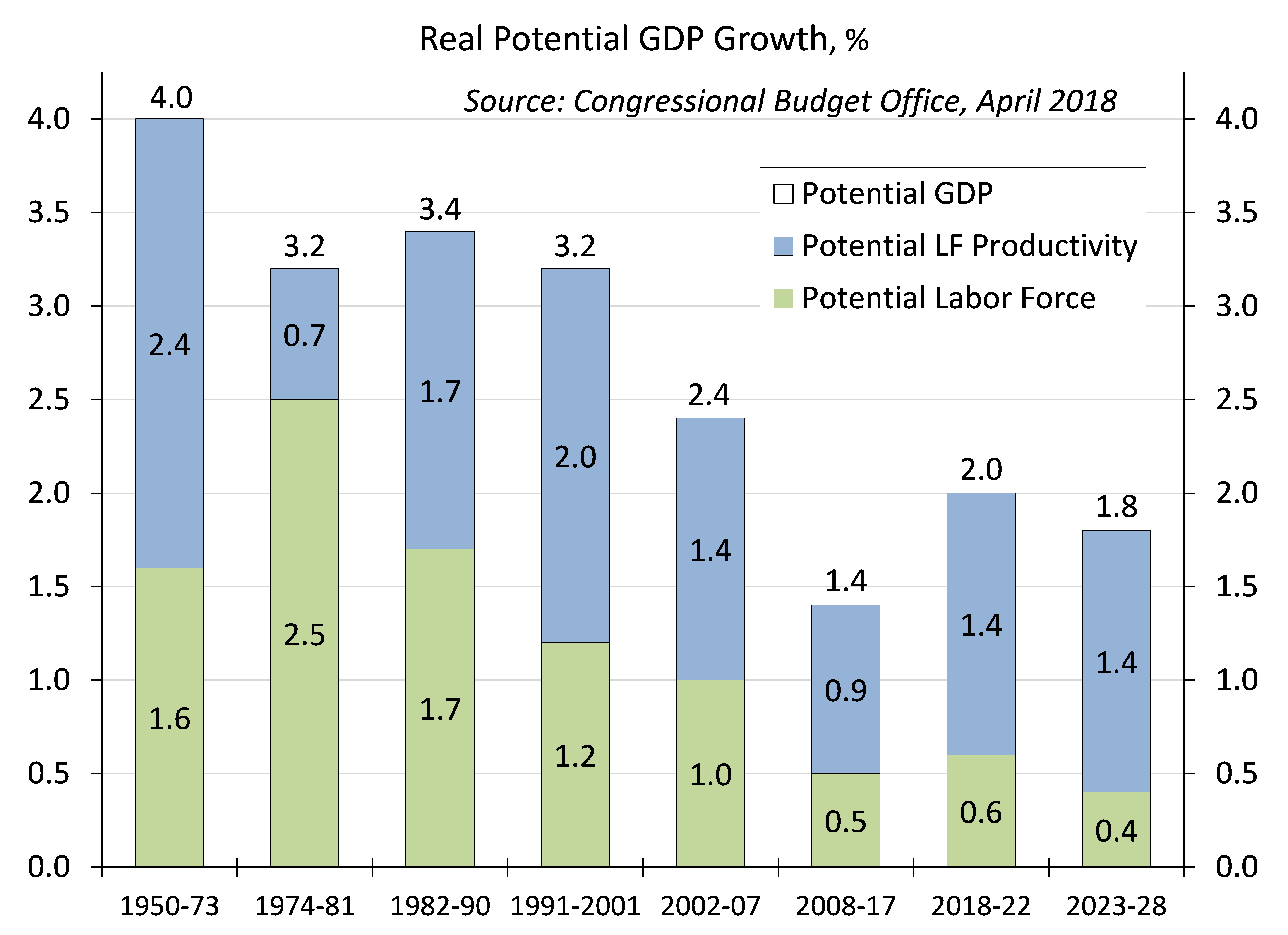

In its revised outlook, the non-partisan Congressional Budget Office is projecting 3.3% GDP growth (4Q18/4Q17), on the high side of the range of most economic forecasters, but short of the 4% or more put forth by administration officials. No surprise, the CBO is projecting higher federal budget deficits over the next several years, exceeding $1 trillion in FY20, and those forecasts are almost certainly too optimistic (as lawmakers have never been able to keep to proposed spending caps).

The CBO expects the TCJA to help fuel business fixed investment, which will boost productivity growth to some extent. However, growth is still seen as exceeding its potential in the near term, leading to a correction (below-trend growth) within a couple of years. The labor market is expected to be the binding constraint for GDP growth over the next ten years.

Meanwhile, China’s President Xi gave a speech that was virtually the same as the one he gave in Davos a few months ago. Market participants took it as “conciliatory.” Emboldened, President Trump indicated an even tougher stance, but he also suggested that he might be down with TPP (that is, negotiating a U.S. entrance to multi-lateral agreement). I can’t even…

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report's conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Copyright © Raymond James