by Marina Pomerantz, Portfolio Manager, Trimark Investments, Invesco Canada

The past few weeks have been characterized by significant volatility in the share prices of the world’s largest internet companies, which comprised the once-vaunted cohort of top-performing “FANG” stocks. In the span of less than one month, revelations about social networks permitting unscrupulous access to users’ personal data, upcoming regulatory changes in Europe, and increased attention by U.S. lawmakers have caused a swoon in global technology and internet equities.

This post outlines the recent issues and further details our thoughts on the resulting changes to internet companies’ user data privacy policies. In a subsequent post, I will discuss the implications of upcoming data regulations.

What has caused the sharp selloff in global internet equities?

The issues began with news that Facebook was found to have allowed political consulting firm Cambridge Analytica to obtain unauthorized access to personal data from 50 million Facebook users. This data was used to tailor political messages and advertising on Facebook to influence large groups of people for political purposes.

Facebook’s CEO Mark Zuckerberg’s recent appearance before the U.S. Congress has heightened political scrutiny of companies that use consumer data to sell advertising on their websites, mobile applications, social networks and messaging services.

Upcoming regulatory changes under the European General Data Protection Regulation (GDPR) – which is to be implemented on May 25 of this year – represent another source of potential disruption for global internet firms. To comply with the new rules, these companies will be mandated to allow European consumers to edit, extract, transfer or delete the data that has been collected by these platforms upon request.

If U.S. lawmakers were to adopt a similar legislative approach, global technology firms could be required to substantially change their data collection business models. This could affect their ability to monetize their services by accurately targeting ads to relevant audiences.

Internet companies in the FORS funds

We have been monitoring data privacy issues closely for many years, given the importance of user data to the business models of many internet companies. I believe the outcry over unauthorized access to user data stemmed from the fact Facebook has been found to have lax controls that would enable third-parties within the social network’s vast partner ecosystem to access, download and mine user data.

The FORS global equity portfolios presently do not have a position in Facebook, but we do hold a position in Alphabet, the parent company of Google. The company has also been caught up in the swirl of negative news, based on its exposure to online advertising revenue. Sensational headlines aside, the biggest risk I see to Alphabet’s business is a loss of consumer trust, which could cause them to stop using the company’s services. This could lead to a loss of audience and engagement scale that could affect the dominant position of Alphabet’s internet platforms in the digital advertising industry.

Fortunately, I believe Alphabet and the broader internet industry can withstand the recent challenges and emerge with their business models intact. The key lies in giving users greater control over their own information, and there are signs the industry is endeavouring to do much more in this regard. To remedy prior weaknesses in its data oversight, Facebook has made extensive changes to how third-party developers can access user data and introduced limitations to data gathering from third-party services (i.e., credit bureaus and media measurement companies), while also letting users remove third-party Facebook apps. These changes are designed to restore consumer trust by doing the following:

Mitigating future opportunities for third-party developers to have generous access to users’ data and use it in ways that Facebook has little control over

Limiting the risk that data collected about users from third-party sources (i.e., credit scores and payment history) could be aggregated with Facebook user data to create personally identifiable information (PII) about users without their consent

Giving Facebook users a clearer picture of how the social network and other counterparties use their data, and providing them with the ability to opt-out of data collection on a more granular basis while still choosing to maintain some targeting features that will help Facebook surface relevant content that matches users’ interests

These measures represent a step in the right direction to help users understand how popular internet platforms collect and utilize their data. For a long time, Alphabet, our U.S. internet portfolio holding, has been offering consumers a way to see all the data amassed by the company’s broad portfolio of applications – location data in Google Maps, search history in Google Search, etc. – and to control how frequently such data was collected and with whom it was shared.

Alphabet also requires app developers to sign agreements that promise they will abide by privacy restrictions that are attached to user data these developers receive through Alphabet’s application programming interfaces (APIs), or tools that help developers plug into Alphabet’s datasets to create apps. The language in the agreements is very clear that Alphabet will immediately cut off access for developers that are violating their terms and are using the data for inappropriate purposes. While enforcement of these data-sharing terms isn’t always perfect, Alphabet has been one of the most transparent firms in delineating the different types of data gathered by Google apps, and permitting users to switch off certain types of data collection.

The “utility vs. data” trade-off

Consumers will continue to decide which internet company offers them the best services in exchange for their data and will opt to use applications that provide value-add. Alphabet’s popular internet applications offer significant utility to users seeking to find information on the internet.

In particular, Alphabet collects the majority of its user data using a “pull” model where users provide Alphabet with their data by requesting content from Alphabet’s web tools (i.e., by entering a search query into Google, or an address into Google Maps). In contrast, Facebook relies more on a “push” model where it surfaces relevant content in its users’ newsfeed and urges users to “like” or “share” the content in order to gather data about their background and interests. Such a model is more dependent on continually iterating the content that is shown to users on their Facebook page, and utilizing algorithms to grab users’ attention with a catchy post that will elicit a response.

Alphabet’s significant share in search, mapping, e-mail and web browsing applications suggests that many users around the world place significant value on these services, making the business model sustainable, in our view.

To make its applications free of charge, Alphabet’s business is built around targeting and aggregation of user information to drive advertising sales. To preserve its business model, the company understands that maintaining user trust is the most important element to its survival, and it subjects itself and its developer partners to strict data usage guidelines. Most critically, Alphabet has been clear and upfront with its users about how it harvests user data, and the company should fare quite well in a world where users are increasingly in control of how their data is shared across the internet.

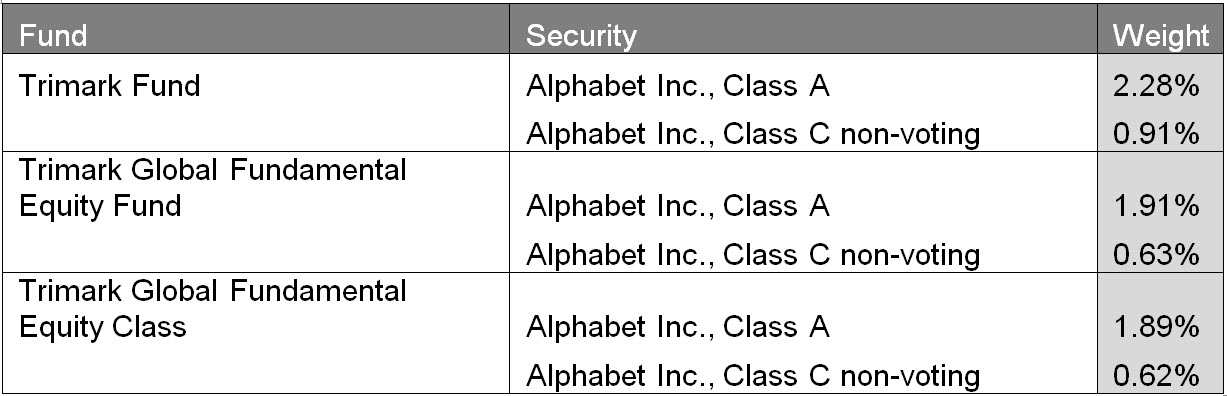

Holdings of Alphabet as at March 31, 2018

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog