by Liz Ann Sonders, Brad Sorensen, Jeffrey Kleintop, Charles Schwab and Company

Key Points

- Kneejerk, emotionally- (and algorithm-) driven decisions appear to be playing a part in some violent market moves over the past month. Investors who keep the endless flow of news in the proper perspective stand a better chance of being successful.

- Trade risks have risen but for now an actual trade war is not underway; while the U.S. economy remains healthy, inflation isn’t forcing the Fed’s hand, and what is likely to be a strong earnings season is getting under way.

- Military conflict concerns have also risen, but history suggests that unless they become protracted conflicts with economic implications, they have typically had short-lasting impact on markets.

Get a grip!

We often say that panic is not an investing strategy, but the media often takes the opposite view, as they breathlessly rush to report “breaking news” and add “markets in turmoil” specials after particularly volatile days. It must work to gain viewers or they wouldn’t do it but we suggest that investors would be better served taking a step back, keeping emotions in check and maintaining discipline. Within one day recently, we saw a 700 point swing in the Dow Jones Industrial Average from a big loss to a solid gain.

The media has a tendency to want to find the “one” force each day for every move or swing in stocks, as if the stock market were otherwise an inanimate object, waiting for specific news to swing it in one direction or another. The market has always been more complicated than that. Fundamentally, our view expressed in our 2018 outlook, which was published in December, was that market volatility would escalate this year—consistent with late-cycle economic and market tendencies.

Aside from the tendency for volatility to pick up when the economy moves into its later stages of the cycle given implications for inflation and monetary policy, there are shorter-term forces at work as well. Trade—a risk we also cited in our 2018 outlook—has moved to forefront, much as President Trump said it would during his Presidential campaign. But despite the dire headlines of a potential trade war, at this point it seems more like negotiations aimed at getting better and fairer trade deals in place. For all the bluster surrounding the possibility of walking away from the North American Free Trade Agreement (NAFTA), The Wall Street Journal (April 4, 2018) recently reported that President Trump is pushing for a deal announcement in the near future, with many of the sticking points having been agreed to.

That doesn’t mean a deal is assured, but is more reassuring than some of the headlines would have indicated only a couple of months ago. Of course China has been the hot headline lately, with the United States’ opening salvo being proposed tariffs on roughly $50 billion worth of Chinese imports. China came back immediately with proposed tariffs on roughly $50 billion of U.S. imports, followed by the President announcing he’s looking into the possibility of tariffs on an additional $100 billion of Chinese goods (this most recent volley was surprising, not least due to its lack of details). But there’s an important word in there that was often overlooked—proposed.

These tariffs on both sides won’t actually go into effect for at least several weeks—with both sides making sure to note that they continue to negotiate with the hopes of coming to a deal. Although we don’t want to downplay the consequences of a possible trade war, total exports to China represent only 0.7% of U.S. gross domestic product (GDP) (Cornerstone Macro Research).

One effect of this recent volatility has been to further dent investor sentiment—a contrarian indicator at extremes. Overly-optimistic sentiment had been a factor behind our more cautious outlook for 2018, so an easing of the froth which had accompanied the January all-time highs for the major equity indexes is welcome. According to the Ned Davis Research Crowd Sentiment Poll, conditions have moved from the extreme optimism zone, to the cusp of the extreme pessimism zone. The recent selling has also helped to partly alleviate expensive valuations as the forward price/earnings ratio (P/E) for the S&P 500, according to Thomson Reuters, has moved from more than 18 to roughly 16 today—not cheap historically but much closer to median levels historically.

Economy and earnings should regain the spotlight

With all the action surrounding the trade issues and headlines coming from the tech sector (read more about those in Brad Sorensen’s Tech Wreck…or Speedbump? article), it seems that economic developments have moved to the back burner, while earnings season is also beginning with less fanfare than typically seen. Recently, there have been some weaker economic releases, which is not surprising given the tendency over the past 20 years for first quarter weakness, followed by a pick-up in the second quarter.

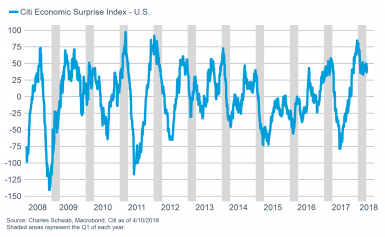

In fact, the Bureau of Economic Analysis (BEA) continues to grapple with the persistence of seasonal patterns affecting growth in the first quarter so frequently. The pattern is likely repeating this year as seen in the retreat by the Citigroup Economic Surprise Index (which measures how data is coming in relative to expectations) as you can see below.

Consistent first quarter softening

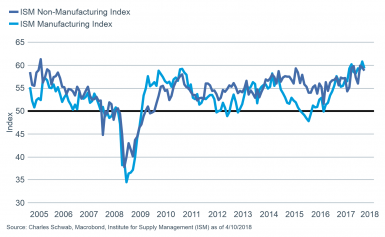

However, this has had the effect of lowering the expectations bar, which should help as we head further into the second quarter. Both the manufacturing and non-manufacturing Institute of Supply Management (ISM) indexes slipped slightly last month, but remain well above the 50 mark which separates expansion from contraction. Also of note, the manufacturing side reported the largest backlog of orders since May 2004, a key leading indicator for the economy historically.

Slight slip…but still strong

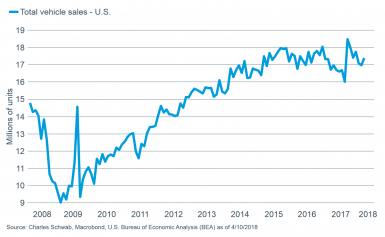

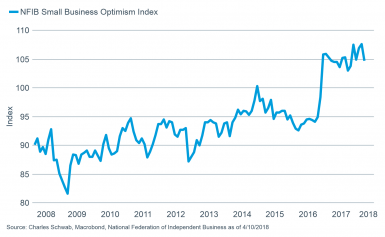

We also got some auto sales reports that exceeded expectations, while despite the “turmoil” in the markets, business confidence remains elevated.

Auto sales ticked up

Business confidence remains elevated

The labor market remains healthy, notwithstanding the soft headline payrolls number from the Department of Labor for March. Although the unemployment rate held steady at 4.1%, only 103,000 jobs were added in March. But if you take the February, which had a robust 326,000 jobs added, and March together, a healthy trend is intact. Further, the average hourly earnings gain of 2.7% year-over-year was still modest but a tick higher than it was the previous month.

Pressure on Fed remains low…for now

The Federal Reserve continues its “normalization” campaign, with ongoing balance sheet withdrawal and likely at least three total rate hikes this year. For now inflation has remained relatively contained, with the Consumer Price Index (CPI) rising a modest 2.1% year-over-year at the core level, excluding food and energy, in March.

With a tight labor market and continued economic growth—combined with the tailwind of tax cuts and the moving of company cash held overseas to the United States—inflation is likely to accelerate further, which is a market risk that investors may be overlooking. If inflation heats up, the Federal Reserve may have to become more aggressive, which in turn would likely negatively impact the market. Valuations tend to fall under the pressure of inflation given that earnings are less valuable when inflation is rising.

From trade war to actual war?

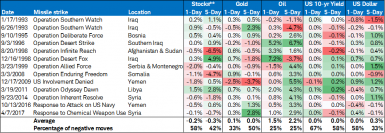

Market worries broadened this past week from fears of a trade war to an actual war, or at least a military strike. Markets had an initial negative reaction when President Trump warned Russia to “get ready” for a U.S. missile strike on Syria over a suspected chemical weapons attack. Airstrikes take place almost daily as part of ongoing campaigns, but focused initial missile strikes and military operations can have an abrupt impact on markets. There is a long history of U.S. missile strikes in the past 25 years we can use to assess the potential market impact. In short, history shows us that the impacts of these geopolitical conflicts have been small and brief.

Markets and U.S. missile strikes*

*excluding U.S. wars: 1991 Gulf War; 2003 Iraq War; War in Afghanistan

**MSCI AC World Index

Gold (NYM $/ozt) Continuous Contract - Futures Price Close

Crude Oil WTI (NYM $/bbl) Continuous Contract - Futures Price Close

US Treasury Constant Maturity - 10 Year - Yield

ICE US Dollar - Price

Source: Charles Schwab, Factset data as of 4/11/2018.

The stock market reaction was most often slightly negative on the first day of missile strikes, with the markets recovering the losses within five days in most instances. Following the two prior U.S. strikes on Syria, stocks were still down five days later, but those declines began before the strikes and appeared driven by economic data.

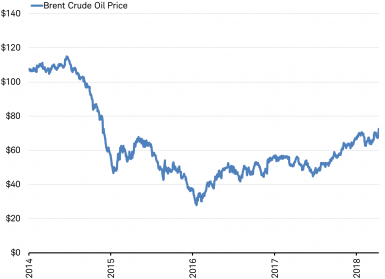

Larger losses of around 5% took place when the strikes occurred during the Asian financial crisis in 1998 and the global financial crisis in 2008. Typically, gold futures, the dollar and bond yields were little changed while oil prices tended to rise. That seems to be playing out in anticipation of the strikes with an initial negative reaction in stock markets while oil prices advanced to the highest level since 2014.

Oil price hits highest level since 2014

Source: Charles Schwab, Bloomberg data as of 4/11/2018.

We believe the pending U.S. missile strike on Syria can be classified as similar to those in the table of missile strikes above; although it may hit a wider range of targets. The decision to strike seems to be to denounce the use of chemical weapons and not intended to start a major military intervention. This suggests that the fears over an actual war may fade quickly.

So what?

Investors are best served when grim headlines are in the news by again keeping things in perspective and remembering that geopolitical risks are a regular part of investing and that a long history of geopolitical developments shows us that holding a well-diversified portfolio may buffer the short-term market moves than are most often the result. Investors should avoid overreacting to geopolitical developments and stick to their long-term financial plans.

Copyright © Charles Schwab and Company