by Kate Moore, Chief Equity Strategist, Blackrock

Kate explains what may constitute the new defense in stocks as rates transition from “lower for longer” to higher at long last.

Equity markets are at a crossroads.

High-yielding “bond proxy” stocks earned their stripes as equity safe havens for much of the bull-market period, as bond yields were slow to revert back to pre-crisis levels. But nine years into the bull run, a synchronized global economic expansion amplified by U.S. fiscal stimulus is stoking higher earnings growth expectations—and interest rates.

Rates transitioning from “lower for longer” to higher at long last means it’s time to rethink equity defense, as we write in our new Global equity outlook Building the right defense in equities.

Taking the offense on equity defense

High-yielding bond proxies did not offer downside protection in the February stock rout. It’s a role they historically have played well in draw-downs caused by economic deterioration and other risk-off periods. But this selloff came amid a steady global expansion. The impetus this time, aside from a technical matter of investors exiting strategies betting on low volatility, was fears over rising rates and inflation.

Strong growth provides a solid foundation for stocks, we believe, but this experience makes it worth considering whether bond proxies can provide the same downside protection in the coming quarters as they have historically. They may even face competition from bonds for the first time in nearly 10 years.

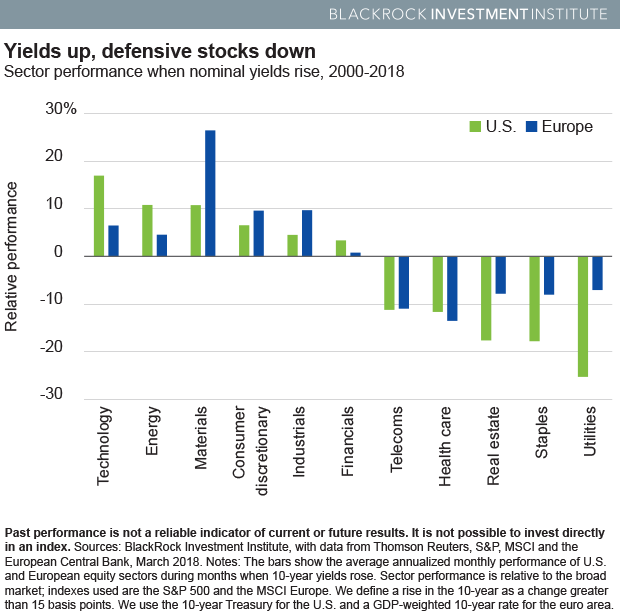

We analyzed S&P 500 sector performance from 2000 to present to isolate vulnerabilities. The findings: Traditional defensive sectors such as utilities, telecommunications, real estate and consumer staples provided minimal protection when nominal yields moved higher.

We considered three cases:

1) Rising 10-year yields.

2) Rising 10-year break evens (a market gauge of expected inflation).

3) Rising 10-year real (inflation-adjusted) yields.

A rate increase greater than 15 basis points in a month constituted a “rise.” Based on our analysis, the split between sectors that benefited from rising nominal yields and those that suffered was clear: Defense-oriented sectors—those that are income-driven but light on growth—fared worse as the opportunity cost for holding them grew. Cyclical stocks, whose performance coincides with an expanding business cycle, predictably performed better. Our analysis reveals this relationship has held outside the U.S. as well. See the Yields up, defensive stocks down chart.

Investors may be tempted to add to bond proxies and related defensive stocks as their premium valuations to the rest of the market have lessened. Yet the nominal and real rate backdrop may well warrant this relative multiple compression. We find some of these companies, in fact, have been unable to increase cash flows—even against an economic backdrop where profitability has reached new highs for most of the market. The weakness in these businesses justifies the de-rating.

We also find the ability of these high-yielding stocks to outperform depends heavily on the economic growth regime. High yielders have tended to outperform broad equity indexes in times of economic contraction, based on our analysis of PMI data. The effect wanes significantly in periods of steady expansion, which is where we are today.

Building a better ballast

We believe stocks need to do more than generate stable income to earn investors’ attention today. Defense in equity portfolios should focus on quality as a style characteristic and dividend growth, in our view. Quality companies, by our definition, are those able to generate and grow free cash flow while maintaining healthy balance sheets. Companies with the fundamental ability—and demonstrated willingness—to increase dividend payouts appear better positioned to offer portfolio protection than those with only high dividend yields.

Dividend growers also show tendencies to be more “all-weather” and we find currently sport relatively attractive valuations versus the highest yielders that were bid up after years of low rates and investor thirst for income.

Read more in the full Global equity outlook, including our take on minimum-volatility strategies and why we believe short-term bonds are an increasingly compelling alternative to “stable” dividend stocks.

Kate Moore is BlackRock’s chief equity strategist, and a member of the BlackRock Investment Institute. She is a regular contributor to The Blog.

Copyright © Blackrock