by Michael Antonelli, Managing Director, Baird

Equities start the day lower because, I kid you not, I sat down to a tweet about “nice, new, ‘smart’ missiles”. I’ve been writing recaps for 8 years now and this is the first time I sat down to something so wonky that I felt compelled to write almost immediately. Nice new smart missiles? Is this an ad for Raytheon or something? Ok, yea moving on, futures were down 1% after being up 1.6% yesterday but that’s par for the course. 1% moves are the new unchanged; wake me up when the market moves 2%+. Man I can’t even remember the last time I looked at an intraday move and said “yep that’s safe”. Up 1.4% at 3:30pm ET?

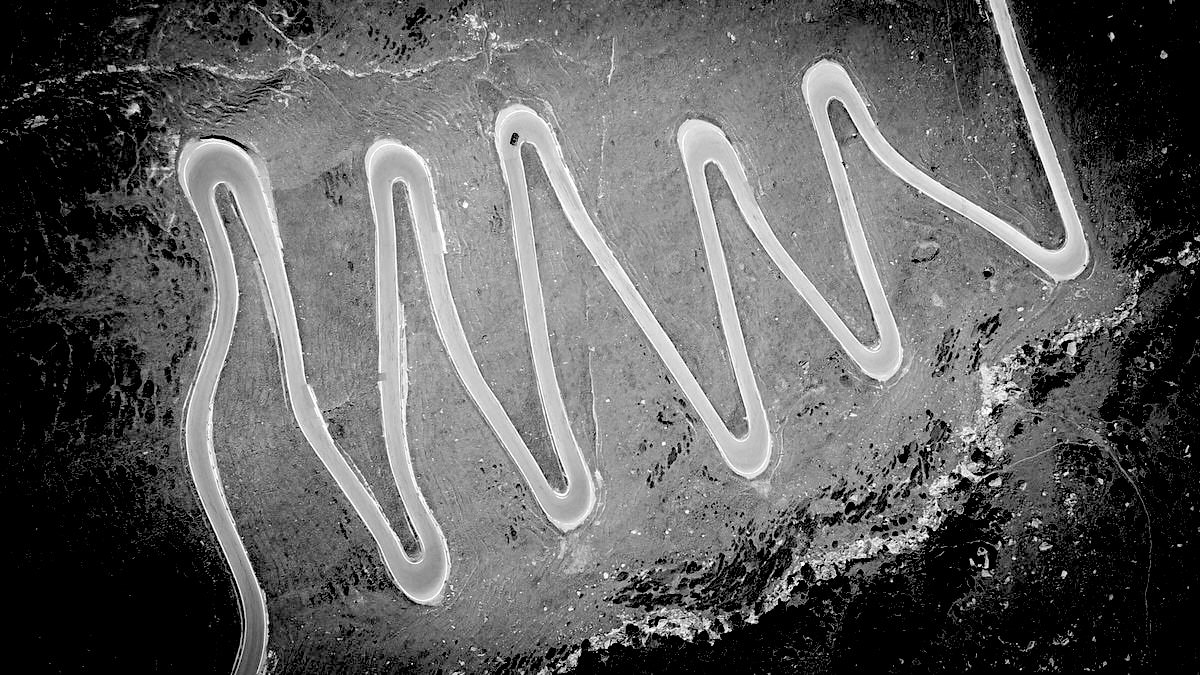

High probability we close flat on the day, things have gone bajungi tilt in the stock market. But for all this sound and fury we sure aren’t going anywhere. We’ve had a record EIGHT 1% moves in the past two weeks yet the total range is <5% (h/t @jlyonsfundmgmt). Why has the trend abandoned us? Why can’t this puppy get going in EITHER direction? Well my friends you’ve come to the right place. Not only can I tell you why but I’ll also drop a gif recipe alongside a fail video at the end. Now I’m going to preface all this with the notion that nobody knows why the market does what it does, you come here to learn a bit and be entertained so don’t @ me saying “mike thinks he knows everything but he really doesn’t”.

Here’s my take: we’ve priced in all the things that can make the market go up. Tax reform, earnings, economic growth, an easy Fed, the Cubs winning another World Series, a business friendly administration but what we are left with offsets all of that: Quantitative tightening, rising rates, a late stage economy, high valuations (including a euphoric Jan top), 30 degrees in early April, talk of smart missiles flying around like confetti, a new Fed Chair, the tech wreck, and midterm elections. Tailwind meet headwind equal this. Do I think the bull market is over? No, but we could chop around for a while here.

After the open the market immediately began to rally because if there’s anything I’ve learned in my years of trading it’s “sell missile news overnight and buy it in the morning”. That’s just a hard and fast rule to live by people. Zookerberg came back for a second day of testimony but you know what I realized after watching The Social Network for the 15th time? This guy has been apologizing for reckless privacy breaches since he was a freshman in college! We are basically mad at Wile E Coyote after his hundredth attempt to kill the Road Runner.

That being said, $FB stock has rallied over the past two days so maybe the market likes this dog and pony show he’s been on. We got a fresh look at inflation with March CPI and would you be shocked to know it came in around 2.4% YoY? You know what the arithmetic average of CPI has been since April 2000? 2.2%. But yea Chairman Powell, I’m sure “low inflation” is only transitory. Actually the big story today was Crude Oil touching its highest level since 2014 (67.45). Remember how low energy prices were indicative of a slowing World economy?

How long until the first piece is written that “high energy price are a threat to corporate profits?” 2 weeks? 3? You know I just realized that I’ve been ranting for this entire section so let’s look at the winners HLT, MAT, FLS, HLT, EVHC, RTN (good smart missiles) and the losers FAST, GWW, INCY, RSG, UAL, AAL. By lunch we had recovered most of the overnight losses but sat just shy of green numbers 2,651 down 0.19%. How about this amazingly insightful comment by Rep Billy Long to the Zuck?

The back half of the day brought literally nothing. We spent the last 3 hours going sideways between 2,645 and 2,655 with a close at 2,642 down 0.55% which, admittedly, was a nice break from the roller coaster price action of the past few weeks. Look, things are just crazy right now.

If I read a headline that a purple elephant riding an M1 Abrams tank smashed into the NY Stock Exchange wearing a MAGA hat it wouldn’t even phase me. We are in some wonky crazy territory but you know what? I’ll take this over those boring 2017 sessions where vol got crushed and writing about the market was near impossible. I can’t wait to see what tomorrow brings!!

Final Score: Dow -90bps, S&P500 -55bps, Nasdaq -36bps, Rus2k +22bps.

News Highlights:

- Succinct Summation of the Day’s Events: Woke up to missile talk and the market shrugged, Zuckerberg spoke, inflation was inline, ended near the lows.

- This is a very important tidbit from Matthew Boesler, you need to digest this blurb because more rate hikes isn’t exactly market friendly

- We need to be thinking about risk the right way: “In the aftermath of the global financial crisis, risk management was often used synonymously with risk reduction. In actuality, a sound risk management plan is not just about reducing risk, but rather about calibrating risk appropriately as a means of minimizing the risk of both slow and fast failure”.

- Talking to people about money….this article is SO GOOD: “The best way to talk to people about money is keeping the phrases, “What do you want to do?” or “Whatever works for you,” loaded and ready to fire. You can explain to other people the history of what works and what hasn’t while acknowledging their preference to sleep well at night over your definition of “winning.”

- You probably shouldn’t be using the 200 day mavg as a buy or sell signal. Look, in the end you don’t always have to be right, just make high probability decisions: “An investor who used the 200-day as a signal to get out of the markets would have been able to miss the majority of the losses from the huge market crashes of both 2000-2002 and 2007-2009. But there were plenty of false-positive signals along the way. In fact, the S&P 500 has crossed the 200-day moving average 150 times since 1997. If this were a perfect signal, that would imply 75 separate market corrections. In reality, in that time, there were only 11 market corrections when stocks fell 10 percent or worse. That means the majority of the time when the S&P 500 went below the 200-day it was a head fake, when investors sold out of the market only to buy back higher.”

- Michael Santoli weighs in on market chop: “On the flip side, if better-than-expected earnings can't lift a market that looks cheaper after nine weeks of struggle, it could be a tell that the market is in the grip of something a bit more serious than a curtailment of over-extended optimism and valuation, after all.”

- One of the worst candies of all time is disappearing and people actually care? Necco wafers are awful. AWFUL. I’d rather collect chalk dust and eat it

- I think this is my favorite city on the planet. They have an area named Ba-rang-a-roo for crying out loud, how awesome is that? MEL might be tied though…

- Best use of Alexa ever

- Father’s Day is coming up and this guy might have the gold medal locked up. This guy has the silver. I think I have the Bronze because I won a game of Fortnite with my son

Tonight we’ll end on a People are Awesome vs Fail video which gives us the best of both worlds like peanut butter and chocolate, avocado and toast, my waistline and stretch pants.