by Blaine Rollins, CFA, 361 Capital

Risks continue to rise for equity investors and many portfolios are now taking on water. For the first time in ten quarters, both U.S. and Global stocks declined in value. If I am still willing to give Washington D.C. credit for the post-election gains, then they are now going to have to accept the blame for this drawdown which is mostly created by their actions.

The trade wars are still a top focus and they accelerated over the weekend with China retaliating with 15-25% tariffs on 128 U.S.-made goods. If the White House moves past steel and aluminum and toward other Chinese goods, expect China to follow (soybeans?). As Fedex said on their earnings call last week, the corporate income tax changes were a positive, but they will be offset by the trade wars.

Concerns have also emerged regarding the individual attacks and threatened regulation on individual companies (like Amazon on Friday). It doesn’t really matter if the facts backing the accusation are incorrect. If someone in the White House wants to regulate Amazon, then it will get regulated. Check in on Congress and all you hear is crickets.

So hopeful predictability in the economy in January, turned to hopeless unpredictability. And if CFOs, business owners, farmers and ranchers are having a more difficult time navigating their future business outlook, then how are investors supposed to be able to maneuver the markets. Risks are up as should your cash levels be.

How much of the post 2016 election move will we give back? One-half of the S&P 500 move would take us back to 2,530 or right at the Feb low. All of it would send us back to 2,200 or down another 10%+. For the past nine years, we have been conditioned to buy the dip because the Fed encouraged it with their zero interest rate policy (ZIRP). But those days are gone. Now if you reach out to buy the dip, the Fed will more likely hit your hand with a hammer. The Fed is no longer accommodating as they are lifting short-term rates due to the balanced U.S. economy, and they are shrinking their balance sheet to be better prepared for the next financial crisis. If you want accommodation, go to Europe where the ECB is still buying bonds of all shapes and sizes which keeps a lid on not only Euro rates but also infects long U.S. rates. This is why our yield curve continues to flatten to 10-year lows.

If you are one of those investors that only buys and holds, or needs to be fully invested, then I am sorry. You had a great last eight years of returns and now is your time to read everything else but the business pages. If you need to invest, look toward U.S. Small Caps (which should go down less during the trade wars) and Emerging Markets (which are cheaper, have more commodity exposures and could win from the trade wars). For everyone else who has the flexibility, there will be increasing opportunities on the long side and short side in most all markets. Just stick to your proven strategies and stay disciplined for it is time to add lots of value.

So what is wrong in the last month?

30-year Treasury Yields are lower…

Volatility is still high…

The U.S. Dollar still stinks…

And High Yield Bonds make me slightly ill…

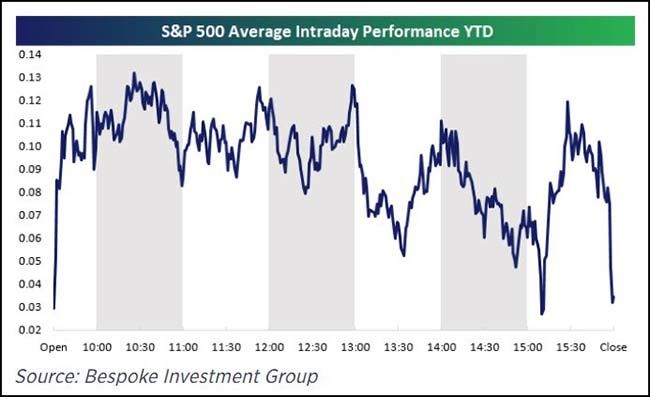

And as Bespoke noted, early morning buying leading to late-day selling also gives me significant pause. Especially given the amount of trading that the passive ETFs are controlling at days end…

(CNBC)

One of the safest places to hide is gathering assets rapidly…

A couple of looks at the yield curve…

The dark blue line shows the continued flattening as we discussed above…

And here is the 10-year vs. 2-year spread which is now less than 50bps…

(WSJ/Daily Shot)

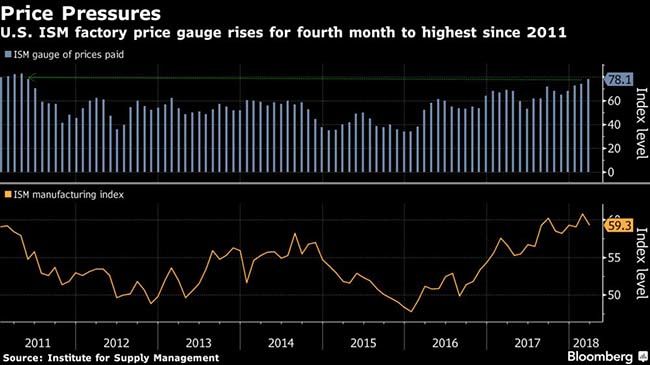

Meanwhile, the ISM Prices Paid hits the highest level in seven years…

The economy is still strong but now the Fed needs to factor tariffs into their reasoning to move rates higher.

Some of the rising costs were attributed to President Donald Trump’s tariffs on imported steel and aluminum, with one respondent in the machinery sector saying “panic buying” is also resulting in shortages for some customers. Timothy Fiore, chairman of the ISM manufacturing survey committee, said about 32 percent of comments related to tariff concerns, and businesses began stocking up in response to the tariff announcement.

“The reason the price index went up this month was primarily because of the tariffs,” Fiore said on a call with reporters. Many of the concerns were less about trade wars and more focused on whether the tariffs would limit availability around production schedules, he said.

(Bloomberg)

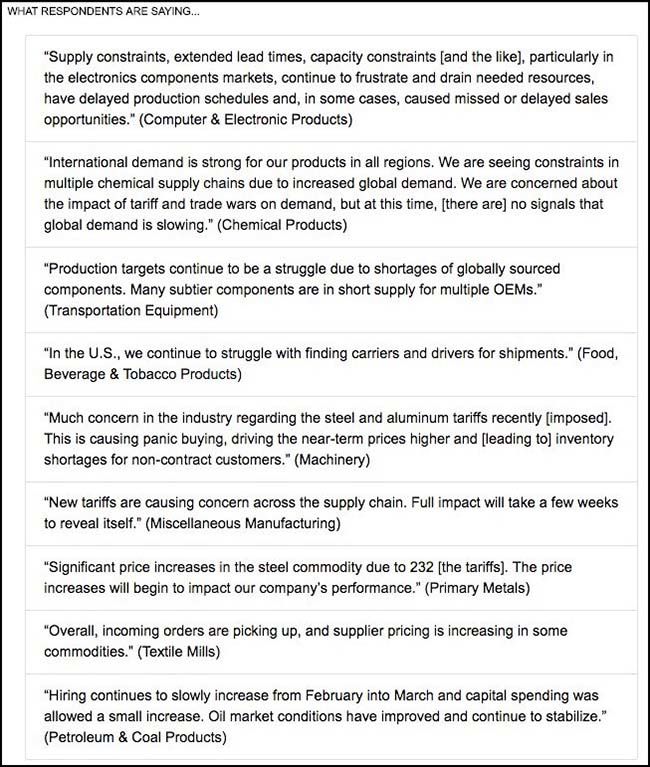

Some interesting comments in the ISM notes…

@conorsen: Lots of concern about capacity constraints and tariffs:

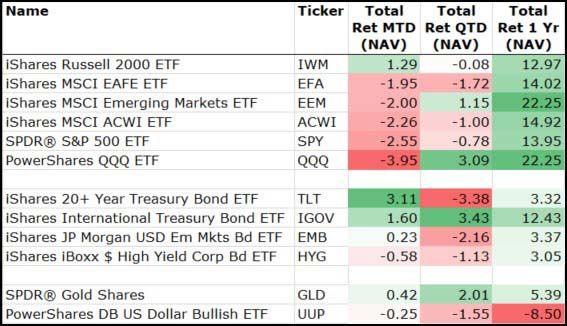

Looking closer at the one, three and 12-month asset returns…

Only International Treasuries and Gold hit positive returns for all time frames. U.S. Small Caps just missed by losing -0.08% in the first quarter. US Dollar easily wins the participation trophy.

Breadth continues to outperform the total market returns…

Again, another sign for the strength of the smaller caps that should fly under the trade wars and also avoid any direct hits from White House tweets.

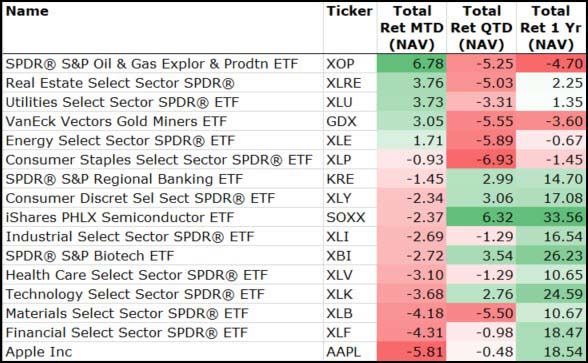

Looking at the sectors…

No perfect scores across all of the time frames. In fact, a near complete rotation from the best performers to the worst performing and vice versa.

(03/30/2018)

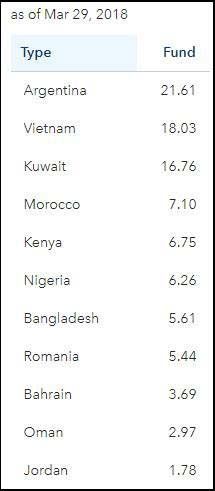

If you are looking for outperformance, check out the riskier-than-emerging market countries…

Think of Argentina, Vietnam, Kenya, etc. Places that you would be more likely to visit on vacation. But next time you are there, look at the business section of their newspaper. Likely to find some good growth there.

The Frontier Market ETF follow the index. Here are the top country weights…

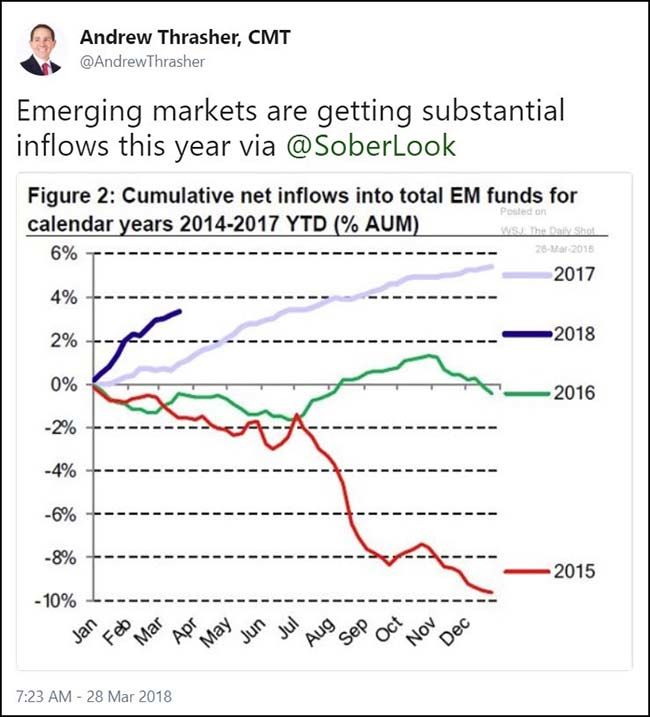

And Emerging Markets continue to gather investment inflows which is a nice tailwind…

This is an incredible screw up by a leader in passive management…

On February 14th, they decided to include LongFin in both the Russell 2000 and 3000 indexes, a list of small and medium sized companies which serves as benchmarks for a range of passive investment products, including exchange traded funds or Exchange Traded Funds.

Among the long list of requirements for a business to be included in a FTSE Russell index is the following provision:

Companies with only a small portion of their shares available in the marketplace are not eligible for the Russell indexes. Companies with 5 per cent or less will be removed from eligibility.

So a business with a small free float of shares available to trade, for a range of reasons including liquidity, cannot be included in any of FTSE Russell’s indexes.

Unfortunately, FTSE Russell had miscalculated Longfin’s float. Only 1.14m of the Class A shares had been placed in the IPO, out of an outstanding 46.5m shares, or roughly 2.5 per cent.

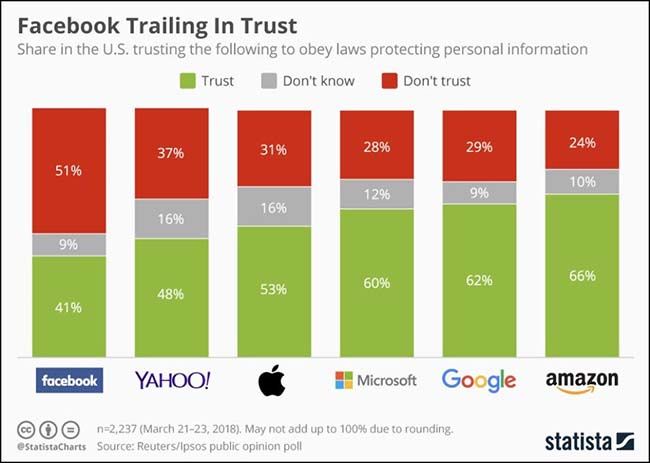

Facebook messed up and is losing trust quickly. Good thing it has Instagram and WhatsApp to hide in while it fixes the core business…

“I think we will dig through this hole, but it will take a few years,” Zuckerberg said. “I wish I could solve all these issues in three months or six months, but I just think the reality is that solving some of these questions is just going to take a longer period of time.”

(Vox)

(@trevornoren)

In other big news over the break, Wal-Mart wants to help fix the U.S. healthcare system…

“These vertical deals are super exciting, mostly for the potential to keep people out of the hospital,” said Zack Cooper, health economist at Yale University.

With a potential Walmart-Humana deal, “there is scope for this new entity to, in a sense, offer a product that has less bells and whistles and is more efficient and lower cost,” he said…

A potential Walmart-Humana deal “should be a concern to everybody in health care,” said Randy Oostra, president and chief executive officer of nonprofit hospital system ProMedica, based in Toledo, Ohio.

Walmart would join an increasingly crowded field of competitors poised to siphon patients and revenue from ProMedica’s outpatient business, which Mr. Oostra said helps to subsidize money-losing hospital services…

As an employer, Walmart has been a very sophisticated negotiator as it buys health benefits, which could increase competitive pressure on services delivered inside the hospital as well, said Dr. Bielamowicz and other industry experts.

Walmart in recent years has increased its use of direct contracting, offering to send employees from around the country to a small group of hospitals that agree to a fixed price and submit data on performance for review, such as rates of infections…

“Our focus has been on improving quality and identifying outstanding hospital systems for our associates,” the company said in a statement.

Walmart could combine this experience building selective, competitive hospital networks with Humana’s infrastructure and data to create new health-plan products for other employers, said Dr. Bielamowicz.

Geisinger Health System in Danville, Pa., one of the providers in Walmart’s program, is paid rates about 10% to 15% lower for Walmart employees who travel to its facilities for procedures, said Jonathan Slotkin, a Geisinger Health System physician involved with the health system’s direct employer contracts.

Maybe Wal-Mart wants to enter healthcare because it will soon be easier to predict than its core retail business?

Around 42% of clothing and 72% of footwear sold in the U.S. comes from China. “It’s the U.S. consumer who will lose at the end of the day,” says Jon Gold of the National Retail Federation.

China matches the U.S. on trade tariffs. Short Iowa and U.S. almonds?

Tariffs on American pork exports help breeders in China, where pig prices are at a cyclical low. But they hit hard in Iowa, home to one-third of US pork production and the US ambassador to China, former governor Terry Branstad. Every county in Iowa saw sharp gains for Republicans in the 2016 compared with 2012. Meanwhile, almonds, and other dried fruits and nuts hit by the Chinese tariffs, are staple products of California’s fertile but drought-prone Central Valley. Farmers there voted heavily for Mr Trump despite the state of California as a whole leaning Democrat. China is the second most important destination for California almonds, according to the state’s almond board. It has overseen a doubling in almond acreage over the past two decades, as orchards replaced thirsty cotton fields.

Our Colorado farmers and ranchers are not happy…

“There is a ripple effect if we close trade markets. I want to see my cattle end up in the Chinese food system. We have to be careful about how we approach China,” Henderson said.

Colorado’s farmers and ranchers exported $2 billion worth of goods last year, representing about 20 percent of their total output, according to the Colorado Department of Agriculture. About 6 percent of those exports, or $128.4 million, went to China.

China is a major buyer of more-difficult-to-sell animal parts, primarily hides, which accounted for $110.9 million in sales. Henderson said the sale of those less desirable parts adds $141 to the price received per cattle, which is about the profit margin per each animal.

The U.S. only recently gained access to sell its beef to China, and the hope was that Chinese consumers would over time buy more expensive cuts.

Hopefully you have a roll of steel in your portfolio?

@scottlincicome: “American Metal Market’s hot-rolled [steel] coil index was at $42.78 per cwt ($855.60 per ton) at the time of publication, up 2.4% from $41.78 per cwt ($835.60 per ton) a week ago and up 31.1% from $32.63 per cwt ($652.60 per ton) at the start of the year”

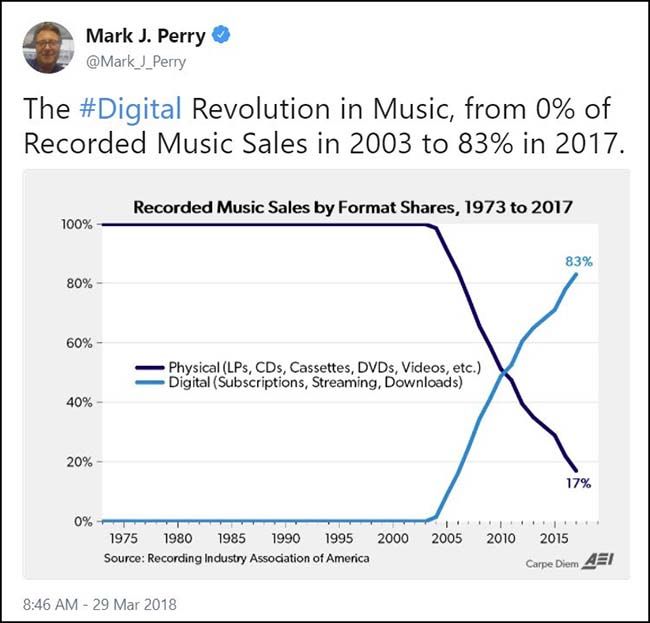

The music industry evolved very quickly…

Powerwall sighting at Home Depot…

‘April Fools Day’ troll award to the UK office of the EU Parliament…

EU passports are red. If you remember, in December the UK decided to change their future color to blue after Brexit to identify themselves as different.

The most bizarre statistic of the week…

Number of the world’s top 100 Scrabble players who live in Nigeria: 28

(Harper’s)

My most unforgettable read of the week…

“I played Carnegie Hall twice before I was 13.”

“I was known for my Bach.”

“They turned me into a trained monkey.”

“If I could forget about music I would.”

When asked to say more, he shrugs, and the stories fade into the barroom haze. But this mysterious specter follows him to his boat. When music is playing on the radio, if a certain violin concerto comes on, he may get up and switch the station off. “The violin upsets me,” he said. “It reminds me of terror.”

Specifically, it reminds him of his gift. A gift he has spent his life trying to forget.

(NY Times)

Copyright © 361 Capital