by Jennifer DeLong, AllianceBernstein

Rising US interest rates could pose a challenge for target-date funds (TDFs) that concentrate on “core” US fixed-income exposure. Diversifying across a broad range of bond markets and strategies can create a cushion in a rising-rate environment.

Traditional TDFs often don’t diversify their fixed-income allocations enough, investing mostly in US aggregate bonds. These include investment-grade government, corporate and mortgage securities. With US rates seemingly headed up, this investment could be a risky bet. In reaction to the 2016 presidential election, the US bond market lost 3%* in the fourth quarter of that year. This past January, it lost 1% amid fears that faster growth and inflation could force central banks to tighten monetary policy faster than expected.

In both scenarios, traditional TDFs that were under-diversified in fixed income were shaken. Plan sponsors can ensure that their fixed-income allocations are ready to play defense in the current rising-interest-rate environment by adequately diversifying beyond traditional core US holdings.

What Does “Enough” Fixed-Income Diversification Look Like?

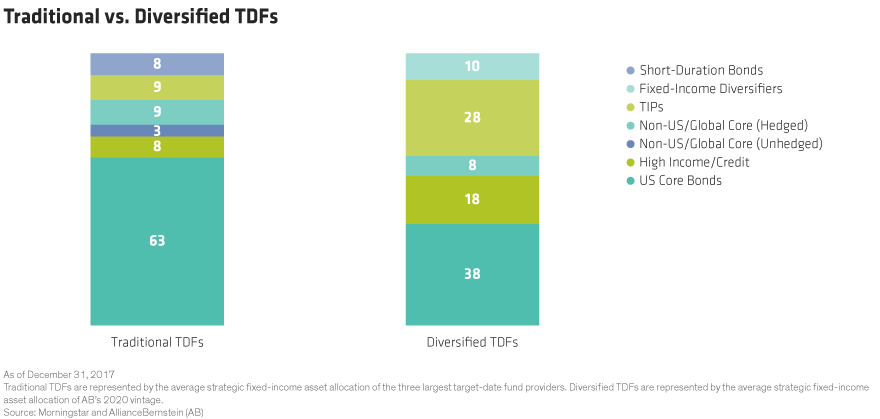

Many larger plans have already diversified their target date’s core bond holdings with a broader mix of fixed-income strategies, and smaller and midsized plans have started to. In our view, that diversification should be across a range of maturities, sectors, geographies and structures (Display).

Here are six elements that we believe can help traditional TDFs keep their bond allocations on track.

1) Reduce sensitivity to rising US rates with global core fixed-income exposure. Going global can help manage economic and interest-rate risk by diversifying across different countries and economic environments. Hedging the non-US currency exposure can also help dampen volatility, better diversify stock exposure in down markets and boost returns versus US-only bonds. Historically, global hedged bonds have outperformed US-only bonds in periods when US rates have risen.

2) Diversify equity risk while limiting duration risk by adding fixed-income diversifiers. Diversifying strategies such as unconstrained bonds and market neutral are designed to generate stable returns without being sensitive to the interest-rate environment. Their returns are driven mostly by managers’ skill rather than broad market exposure. Having these types of exposures would have helped in late January 2018, when stocks and traditional bonds fell at the same time.

3) Cushion from rising rates and inflation with high-yield bonds and TIPS. Credit tends to outperform in rising-rate environments, so including high-yield bonds in a strategy may provide insulation. High yield also has a negative correlation to US Treasuries. TIPS (Treasury Inflation Protected Securities) offer protection from rising prices, and they tend to outperform US Treasuries when inflation is rising. But watch the duration—an intermediate TIPS strategy effectively provides inflation protection, without taking on undue duration risk.

4) Reduce single-manager risk by choosing open architecture. Our research shows that using multiple managers can provide improved and more stable performance versus the benchmark when compared with a single-manager solution. The range of returns across multiple managers are tighter than are those of single managers—this approach may translate into more consistency and a better cushion against losses.

5) Improve the opportunity set with independent manager selection. Advisors who use an independent manager selection process for their TDFs can assess thousands of mutual funds to build the right selection of complementary managers and the best portfolio mix. Decisions are based on an un-conflicted and thorough analysis of asset-class expertise, performance, investment philosophy and other attributes.

6) Manage short-term risk by using dynamic asset allocation. By allocating dynamically, managers can pivot when necessary and adjust the glide path when changing market conditions might hurt performance. Whether it’s market-volatility spikes or changing asset-class correlations, retooling the allocation as needed can help blunt the impact of risk factors.

If plans haven’t done so already, we think it’s time for them to reevaluate their target-date fixed-income allocations and make key enhancements to boost diversification. In our view, a more diversified fixed-income strategy can help participants’ retirement solutions better navigate an always evolving environment and achieve their retirement goals.

*The US bond market is represented by the Bloomberg Barclays US Aggregate Bond Index, October 1, 2016–December 31, 2016.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein