by Blaine Rollins, CFA, 361 Capital

Some relief from the storm…

Another chaotic week of news, but this time the markets ended at a high point. Gary Cohn’s decision to leave the White House in a disagreement over the tariff decision caused a significant sell-off early in the week. However as the administration began to back pedal and leave exit doors open for some trading partners (like Canada and Mexico), the fears of a broad global trade war slowed down. Also helping the mood was the announcement of a meeting between the U.S. and North Korean leaders, which came out of nowhere. Friday brought a solid U.S. jobs report with not only better than expected gains, but also an expanding available workforce. Also helping to sheath the markets umbrella was a six day run higher in the Nasdaq to all-time new highs. No need to worry about industrial and material stocks when there is an insatiable demand for semi and software stocks! There is still plenty to worry about in the current news flow, but the markets appear to be holding together with several sectors providing significant gains. So if you de-risked and raised cash in February, hopefully you kept a large weighting in technology stocks.

To receive this weekly briefing directly to your inbox, subscribe now.

Friday’s jobs report was surprisingly strong by many measures…

There are 39 pages in the Labor Department’s February report on the employment situation in the United States, but they can be summed up in four words: The economy is humming.

The 313,000 jobs that the nation added in February are far more than are needed to keep up with population growth and continue a surprising burst of job creation to start the year. In the first two months of 2018, the economy has added an average of 276,000 jobs a month, a big step up from 182,000 on average in 2017.

This is not the kind of data you expect in an expansion that is nine years old, or out of a labor market that is already at full employment. It suggests that employers are filling jobs not merely from people they’ve poached from competitors, but also from more people who have entered the work force. And other data in the latest report matches that idea.

(NY Times)

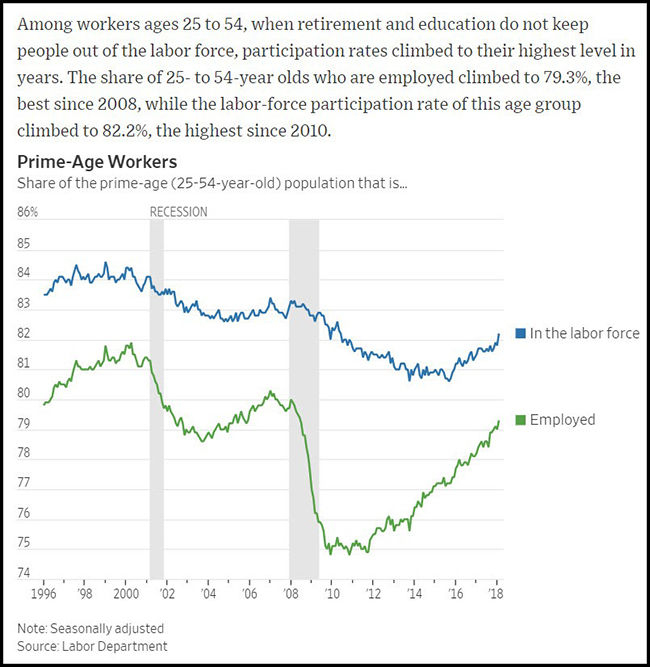

The big jump in the number of people in the workforce got many of us excited…

An expanding available pool means less pressure on future wage inflation.

(WSJ)

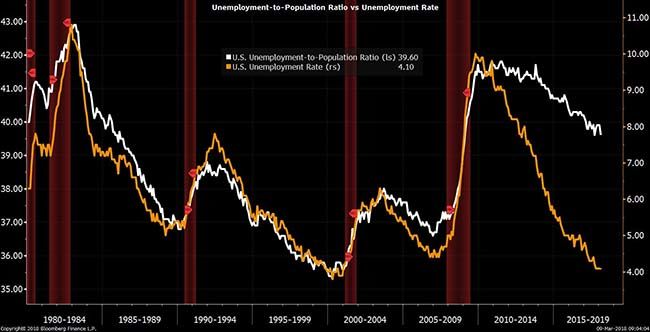

Another way to look at it is the Employment to Population ratio…

The white line shows a lot of room in the event people want to grab a job in this tighter market.

(@M_McDonough)

Mohamed El-Erian summed it up well…

Within the markets, the Nasdaq has re-entered Beast Mode…

(@kkernla)

As you expected, Smaller Caps are leading the charge in breadth…

Small Caps will be much less affected by a global trade war (in the event one breaks out).

@AndrewThrasher: Friday saw small, mid, and large cap advance-decline lines breakout to new highs.

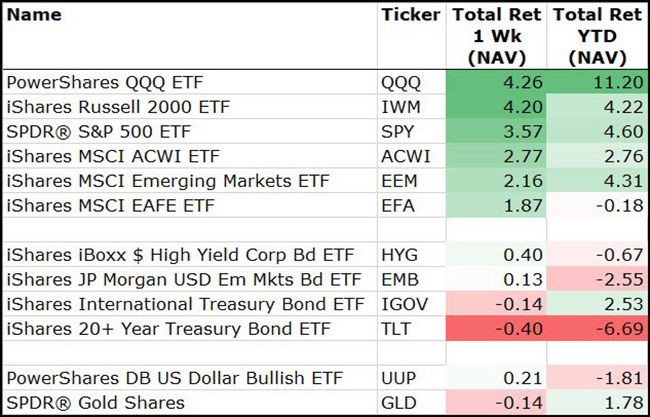

For the week, the Nasdaq and Small Caps led the gains…

(3/9/18)

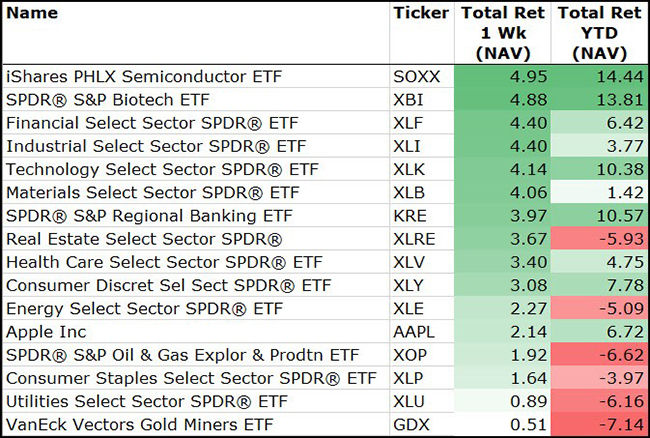

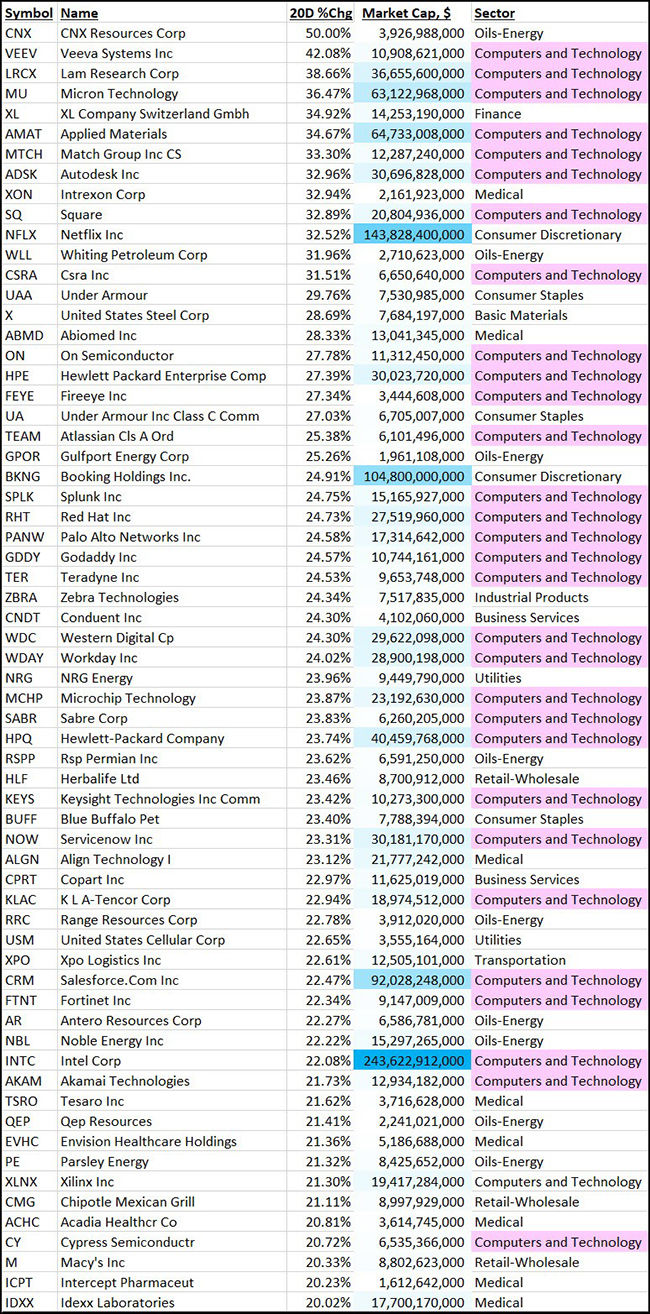

Among Sectors, all of the majors gained on the week…

(3/9/18)

The technology space has been overweight helium-filled tennis balls the past 4 weeks…

From the Feb 9, 2018 reversal low, the Russell 1000 is +8.2%. But over 60 stocks have gained 20%+.

(3/9/18)

By market cap, Tennis Ball #1 = Intel…

Tennis Ball #2 = Netflix…

Tennis Ball #3 = the old Priceline…

Tennis Ball #4 = Salesforce…

Tennis Ball #5 = Applied Materials…

Tennis Ball #6 = Micron…

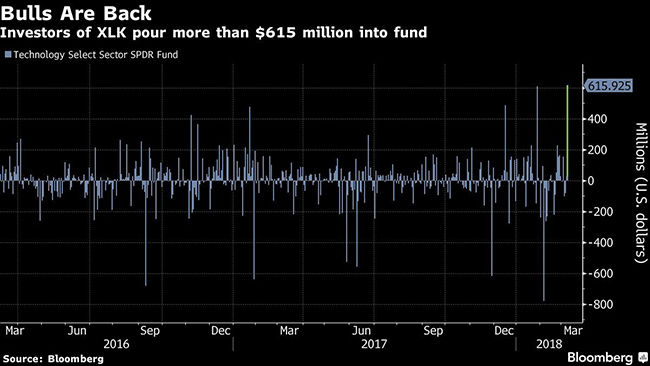

One reason for the explosion in these big Tech stocks are these flows into the XLK…

(@markets)

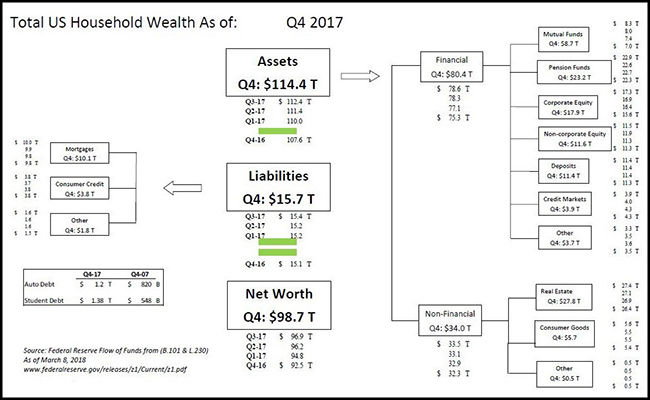

Safe to say that U.S. Household Net Worth is now thru $100 Trillion…

(@MarioGabelli)

Global Trade worries dominated the news flow last week…

And still nearly impossible to find anyone supportive of the new steel and aluminum tariffs.

(@TheEconomist)

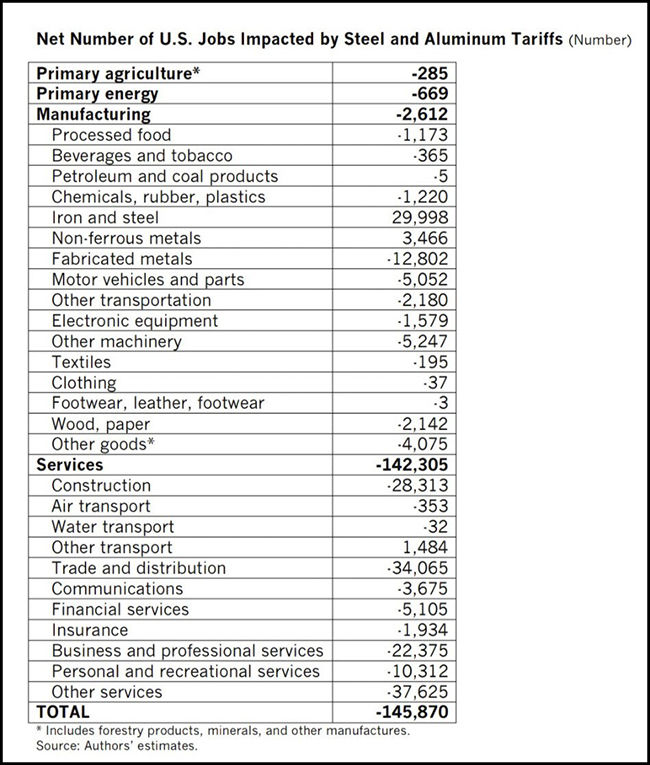

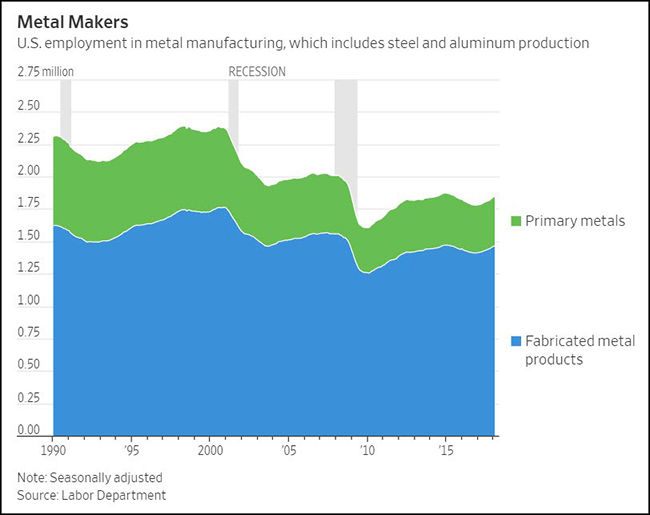

This deep analysis shows only 35k metal jobs created, but 180k other industry jobs lost…

@scottlincicome: NEW: @TradePartnersDC analysis of Trump’s proposed steel & aluminum tariffs shows a net loss of about 146,000 US jobs

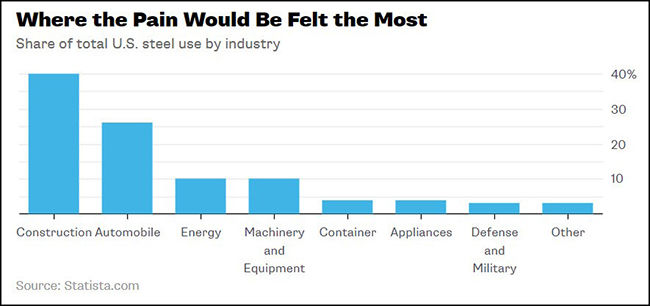

These are the industries that will be most affected by higher steel and aluminum prices…

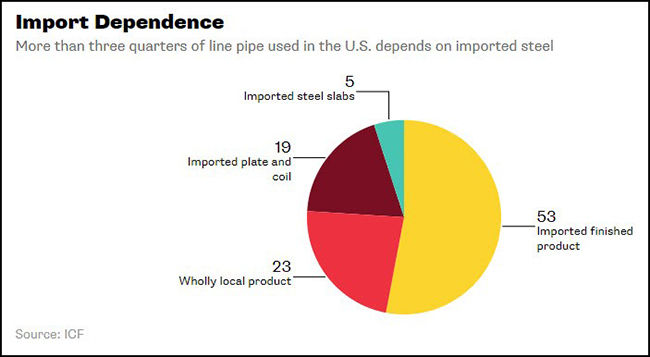

Making OPEC and Russia Great Again?

The U.S. doesn’t, and won’t, make enough steel pipe for transporting energy. Sorry big oil and any American who buys gasoline or other energy fuels.

A study conducted by consultants ICT International on behalf of five pipeline industry bodies found that approximately 77 percent of the steel used in line pipe in recent years was imported, either in the form of finished pipe or the raw material used to fabricate it in the U.S. (The report also noted that while the U.S. imports $2.2 billion of steel products related to line pipe from 29 countries, it exports steel and steel products worth five times as much to those same 29 nations).

So the higher cost of imported product is unlikely to generate a surge of new domestic supply. Once Trump’s tariff becomes law, pipeline companies will see the cost of the steel they need go up — unless they get an exception. If not, then they’ll inevitably pass on higher prices to the oil and gas producers who use their lines.

A 25 percent increase in the cost of imported line pipe, fittings and valves would raise the cost of a 280-mile oil pipeline — typical of those needed to carry shale oil from the Permian Basin to the Gulf coast — by $76 million. For a mega-project, like the Dakota Access pipeline, also championed by President Trump, the cost increase could be as much as $300 million.

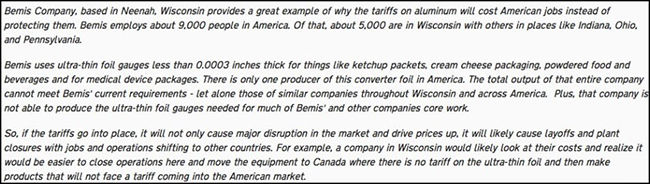

Wisconsin is home to many companies that will be directly affected…

(from Wisconsin Republican Governor Scott Walker weekly statewide radio address)

Higher prices on steel and aluminum gives manufacturers more reasons to outsource overseas…

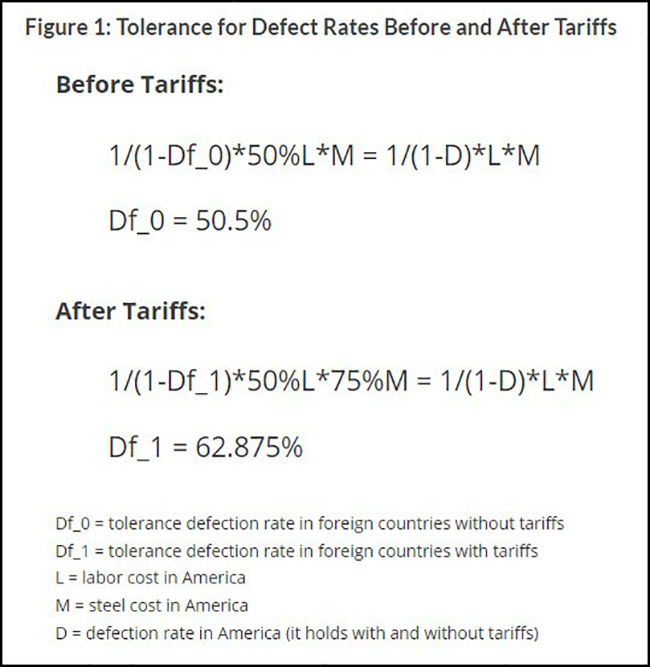

Here is how the math could work on analyzing lower quality good from China. (BVC = Best Value Country)

These tariffs will result in higher steel prices across the board, including US steel, and will thus further widen the production cost gap between the United States and China. This means that some parts that were previously too complex to outsource may now prove more economical to outsource.

Here’s how this would work for a product that is currently made entirely in the United States: lottery machines (the kind found in bars or grocery stores). A quick back-of-the-envelope calculation can illustrate a scenario under which the tariffs can potentially provide an incentive to outsource the manufacture of lottery machines.

Assuming the labor cost in a BVC factory is 50% lower than that of the American factory and that the same BVC factory has a 60% defect rate for producing a part of the lottery machine. As shown in the top equation below, before tariffs the American factory’s tolerance for defective products is only 50.5%, lower than the assumed defect rate of 60% in the BVC factory (See Figure 1). Therefore, the lottery machine makers would likely decide to keep production in the United States.

After the tariff is imposed, however, the BVC factory will use steel that costs 25% less than that in the United States, and assuming the US defect rate and labor cost remain constant, the American factory’s tolerance for defective products goes up to 63%. That rate is higher than the 60% defect rate in the BVC factory, which means the decision becomes easier for the US manufacturer to outsource lottery machine parts to countries like China or Mexico.

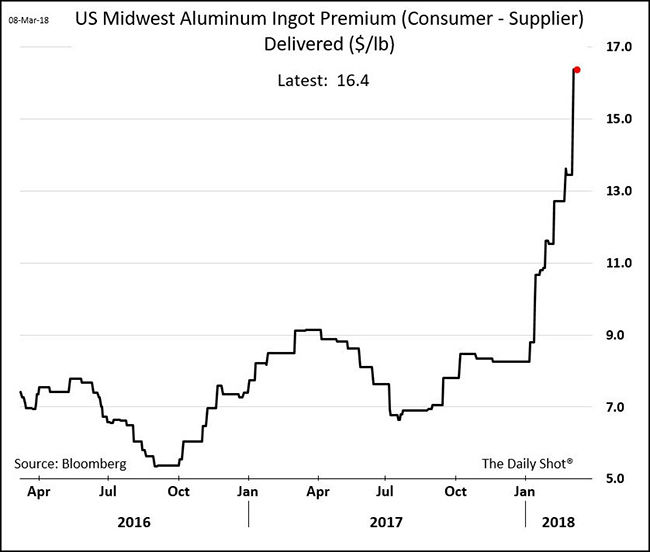

Aluminum prices were already on the move before the implementation of U.S. tariffs…

(@SoberLook)

Another look at the jobs impacted shows four times the number of downstream metal workers versus the primary metal worker…

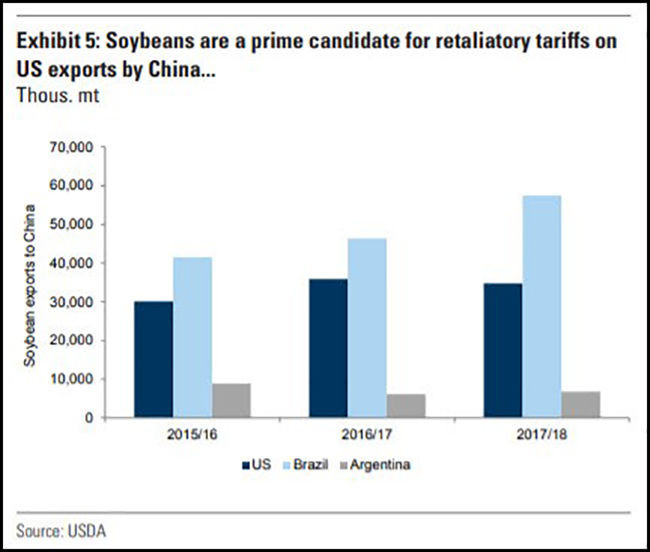

If a trade war bubbles over, foreign nations will quickly look to target our massive agricultural sector…

“The ag economy is not very good right now — fragile is the polite word for it,” Mr. Gould said.

His wife, Sandy, across the table, jumped in: “It’s in the tank is what he means.”

Mr. Gould continued, “So then when you go to great lengths to upset some of your key customers, there’s reason for concern.”

Three out of every five rows of soybeans planted in the United States find their way out of the country; half of those, valued at $14 billion in 2016, go to China alone. Mr. Gould estimates that 90 percent of his soybeans are exported, and 70 percent of his corn, so what he calls Mr. Trump’s “trade antics” — particularly his criticisms of Nafta — nag at him.

(NYTimes)

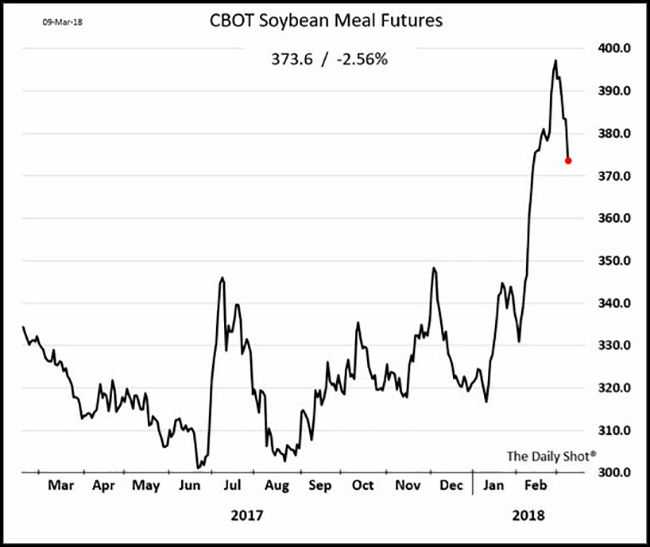

How can farmers plan their Soybean versus Corn planting decision with the uncertainty that China will be a buyer this year?

(Goldman Sachs)

If China reduces their bean buying, then silos could be bursting with supply at year end…

(WSJ/DailyShot)

Some wise words from Kansas on free trade…

Widespread and lasting progress requires the free exchange of ideas, goods and services. It is no coincidence that our quality of life has improved over the years as the average U.S. tariff on imported goods has fallen — from nearly 20 percent in 1932 to less than 4 percent in 2016.

A society that embraces free and open exchange not only provides the greatest abundance, it enables the growth of knowledge and life-enhancing innovations that uplift everyone. Just as the United States benefits from the ideas and skills that opportunity-seeking immigrants bring with them, free trade has been essential to our society’s prosperity and to people improving their lives.

The same has been true throughout history. Countries with the freest trade have tended to not only be the wealthiest but also the most tolerant. Conversely, the restriction of trade — whether through tariffs, quotas or other means — has hurt the economy and pitted people against each other. Tariffs increase prices, limit choices, reduce competition and inhibit innovation. Equally troubling, research shows that they fail to increase the number of jobs overall. Consider the devastation of cities such as Detroit, where trade barriers to aid the auto industry did nothing to halt its decline.

(NYTimes)

North Carolina also has some strong thoughts about tariffs…

Tariffs are taxes. They have always been. So when President Donald Trump announced plans to impose costly tariffs on imports of steel and aluminum into the United States, he was threatening to raise taxes on most American consumers and businesses in order to boost the incomes of special interests.

Trade protectionism has been and will always be about a few using their political connections to steal resources from the many. The pioneer of economic analysis, Adam Smith, warned in 1776 against cabals of self-interested businessmen scheming against the public. His warning is just as valid today. North Carolinians, in particular, have good reason to take it seriously and to encourage their elected representatives to block Trump’s proposed tax hike.

Our state’s economy thrives on international trade. During 2017, business operations in North Carolina exported nearly $33 billion worth of goods and services to consumers in other countries, of which about a third went to Canada and Mexico. This total understates the significance of worldwide commerce to North Carolina’s economy, since interstate and international flows of inputs and outputs within supply chains are so complicated that they are hard to disentangle and measure separately.

Even taking the official numbers at face value, however, we are talking about exports from North Carolina of, for example, $2 billion worth of aircraft and parts, $1 billion worth of motor vehicles and parts, and $732 million worth of other mechanical and machine parts.

As should be obvious, I didn’t pick random examples. These industries are all significant buyers of steel. Levying tariffs to jack up steel prices will hurt these firms, which employ vastly more North Carolinians (and other Americans) than the steel companies do.

No they won’t…

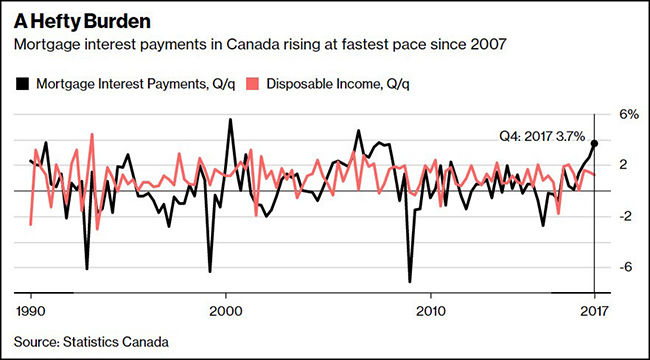

Could Canada’s real estate crisis impact the U.S.?

Canada now has the most expensive housing market in the world on a price-to-rent basis. One half of their mortgage rates are going to adjust higher in the next 12 months, and also, new taxes on foreign buyers and those pesky American tariffs. (h/t to Jared Dillian)

Canada escaped the global financial crisis in 2008 unscathed relative to much of the developed world, but after 15 years of virtually uninterrupted home price appreciation, America’s neighbor to the north might be cooking up a financial crisis of its own.

Loose lending has helped create a housing bubble to rival that of the U.S. in 2006, and with household debt in Canada being among the highest in the world, Canadians have little room in their budgets to absorb rising housing costs.

The next year will be telling because unlike in the U.S., the interest rates on most mortgages in Canada reset to the current rate every five years, and 47 percent of Canadian mortgages will “reset” within the next year. While the Bank of Canada expects the reset rates to be on par with what they were five years ago, even a slight rise could put Canadians with a high amount of debt at risk of default.

(Curbed)

Finally, Embrace the Madness: A Guide to Picking March Madness Upsets…

Our own John Riddle takes a look at how often upsets usually occur in the NCAA Tournament: http://ow.ly/p0vT30iUcUY