by Patrick Nolan, Investment Strategist, Blackrock

Over the past several years, it had been easy to forget that markets actually can and do go down. But how did portfolios hold up amid recent turmoil?

The markets gave us something from January 29th to February 8th that we haven’t seen in a long time—real volatility and real downside. Over the past several years, it had been easy to forget that markets actually can and do go down.

But how did portfolios hold up? We analyzed 6,500 advisor models to see how they fared relative to their benchmarks during this time period. The short answer: “pretty well,” but there is a cautionary tale to be told.

Advisor models outperformed their benchmarks

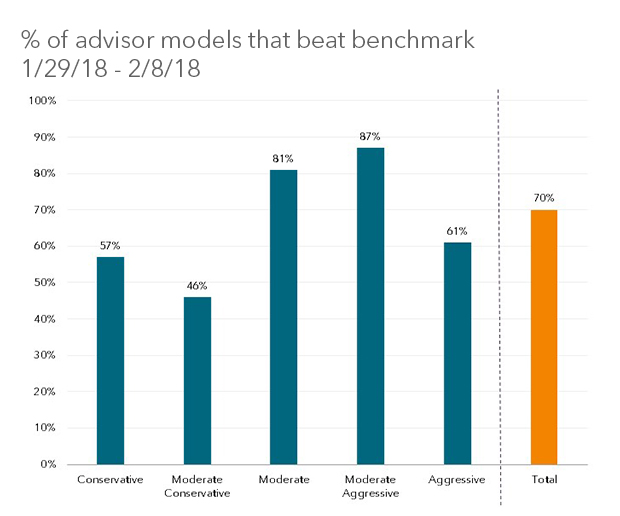

Seventy percent of all models outperformed their category benchmark. When comparing categories, there was a greater percentage of outperformers in the more aggressive categories, while the more conservative ones were a bit more of an even fight. The Moderate and Moderate Aggressive categories fared the best, where at least four out of every five models we collected in those categories outperformed (see % of Advisor Models That Beat Benchmark chart below).

Both individual equity and bond sleeves for the average model typically outperformed the index used for each.

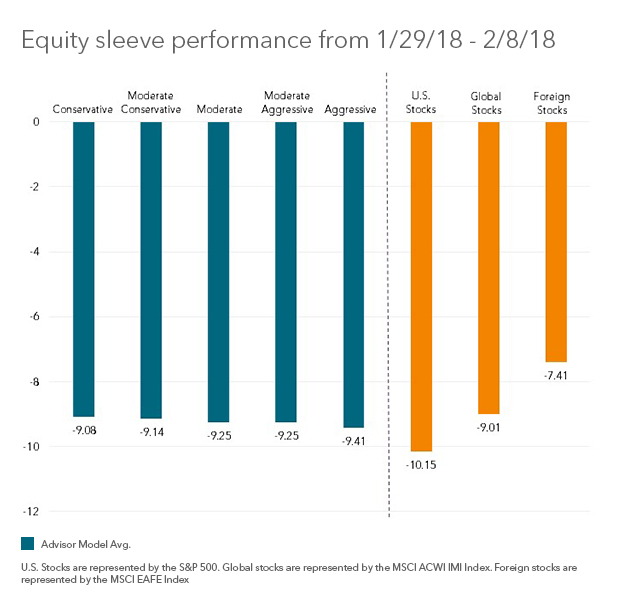

In equities, it was the presence of foreign stocks that helped out. U.S. large cap stocks took a harder hit than developed international markets, and thus, those models that held foreign stocks benefited. We intentionally used a U.S. stock benchmark for this analysis, as investors tend to focus on the U.S. (see Equity Sleeve Performance from 1/29/18–2/8/18 chart below). We also tested versus a set of benchmarks that included foreign stocks, and the average model still outperformed.

The return benefit provided by foreign equities is good to see, as it’s been challenging to own them for most of this decade, and portfolio allocations to foreign stocks have been stagnant at best over that time.

In fixed income, we found that advisor models had lower durations than the benchmark, which was the primary reason for the outperformance during this short stretch. The typical model bond sleeve had duration between 3.6 years and 4.4 years, while the Bloomberg Barclays U.S. Aggregate Bond Index’s duration is currently 5.9 years. Rates rose while stocks fell, hurting bonds with longer maturities more than most other things.

It doesn’t mean portfolios are diversified

While advisor models mostly succeeded, it’s important to recognize the nature of this event. Everything sold off at the same time. There wasn’t much differentiation between asset classes, sectors, industries or exposure types—everything was a shade of red, including assets—like duration—that are meant to be diversifiers.

Negative correlation was nearly impossible to find. This is not uncommon of short, sharp corrections—particularly those that occur within a broader bull market. Importantly, this event serves to remind us that diversification works over time—not all the time. Unless your goals require a short-term perspective, keeping a longer-term view is critical to ensuring your portfolio decisions are sound. For a number of reasons, this type of event is likely not a good one to react to.

In our study, advisor models outperformed simply by owning less of what happened to fall the most in this short time frame: U.S. large cap equities, and to a lesser extent, rate-sensitive bonds. Ironically, this decision to own less of these two items—the exposures that usually provide stability to a portfolio when risk levels rise—was the very thing that worked during this event.

The decision to shift stock holdings away from U.S. large cap was the biggest driver of outperformance and the reason why the more aggressive models (which contain more stocks—and foreign exposure) showed both a greater level of outperformance and a higher percentage of outperformers.

Taking a bow—with restraint

You could argue that advisors made some good calls that led to their success. But their portfolios beat their benchmarks not because they held better diversifiers, nor because of great security picks—they won because they happened to own less of a few things that went down the most. There’s a difference between owning something that will zig when others zag, and owning less of the worst performing items. In this short moment, you just had to be fortunate enough to own less of the stuff that did the worst.

Advisors shouldn’t allow a moment like this to create a false sense of security. When the bull market turns into a bear, or when corrections play out over longer periods of time, the fundamentals that underpin proper diversification will come to the fore, and every investor’s portfolio construction techniques will truly be tested.

If this event was an indicator of more volatility to come, then it likely serves as a great catalyst to ask ourselves this question—If I could build my portfolio today with a clean sheet of paper—without worrying about tax issues or anything else—would I build it in the exact same way? This question contemplates the changing state of markets, risk, rates and other factors that influence returns. It also challenges us to avoid the becoming too comfortable with the terrific equity returns and low volatility of the recent past.

As Warren Buffet is famous for saying, “only when the tide goes out, will you find out who’s swimming naked.” We’re not confident this event qualifies as a low tide, but it’s an important reminder of how quickly market risk can change—and to make sure we’re prepared for it.

Patrick Nolan is the Portfolio Strategist within BlackRock’s Portfolio Solutions group. He is a regular contributor to The Blog.

Copyright © Blackrock