by Blaine Rollins, CFA, 361 Capital

(Dark Side of the Moon/Pink Floyd)

Last week was the 45th anniversary of the release of maybe the greatest album of all time. So, it was only fitting that I was listening to the track ‘Us and Them’ while at the same time, trying to decipher the surprising news of the steel and aluminum tariffs. The week started with a white-hot U.S. economy, rising interest rates and expectations for some new gun control laws in Washington. But somehow the week entered a prism and we ended up with a global trade war and expectations for continued economic growth being shot in the foot.

There is absolutely no reason for tariffs on steel and aluminum unless the U.S. is planning on burning its ties with 100% of our metal-making allies. It makes no economic sense to expand our less efficient U.S. metal capacity. While the tariff news might be a positive for steel and aluminum employees in the U.S., it would be cheaper for all America to just buy every one of the metal employees a new BMW X3 each year rather than send the higher cost of metals through the entire U.S. economy. And of course, the BMW X3 is made in Spartanburg, SC so the U.S. could win a second time. If any journalist, reporter or politician tells you that tariffs are good, ignore them. These people clearly did not read Adam Smith or go to class during college.

Maybe this is all some sort of wild negotiating strategy on global trade that only a few people in the White House are playing. If so, this is also ridiculous because it is also adding uncertainty to the economy and thus the markets. How is anyone supposed to plan anything when they do not know future prices for raw materials or goods or even if foreign countries will retaliate with additional trade barriers.

There are several themes about craziness and mental illness on the Dark Side of the Moon album, so it is a fitting listen for this unhinged time in the economy and markets. While the economic data in the U.S. remains very strong and the Fed wrestles with how to reel it in with rate increases and the unwinding of the balance sheet, maybe a global trade war and spiking prices will do the Fed’s work for it. We will just have to see how this all plays out. In the meantime, this is a distraction that will see many items, issues and plans placed on hold.

To receive this weekly briefing directly to your inbox, subscribe now.

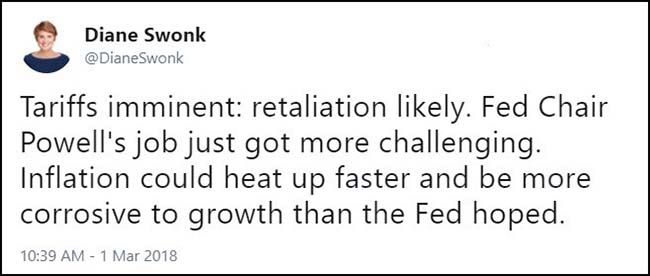

It is difficult to find anyone who supports trade tariffs…

Efficiencies in steelmaking have removed 80% of the industry’s jobs in the last 40 years…

40 jobs hurt for every one helped…

“There are more losers than winners,” said Monica de Bolle, an economist at the Peterson Institute for International Economics. “If the point is to protect American jobs, if the point is to protect small and medium-sized businesses, this is exactly the wrong way to do things.”

The mills and smelters that supply the raw material, and that would directly benefit from the tariffs, have been shrinking for years. Today, those industries employ fewer than 200,000 people. The companies that buy steel and aluminum, to make everything from trucks to chicken coops, employ more than 6.5 million workers, according to a Heritage Foundation analysis of Commerce Department data.

(NY Times)

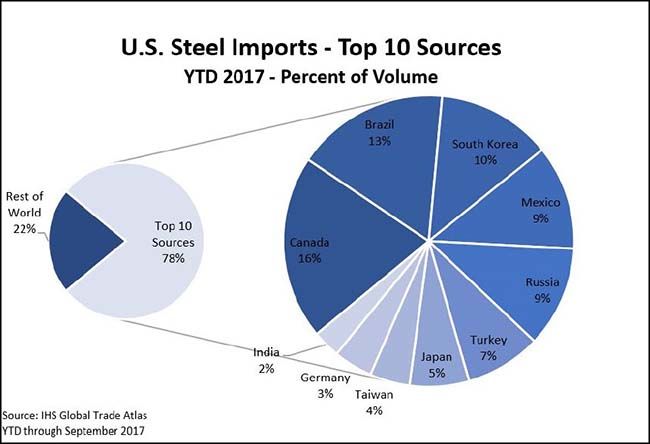

And some important allies of the U.S. will not be happy…

There is a reason that metals are cheaper to produce in Canada…

Trade isn’t a zero-sum game: it raises the productivity and wealth of the world economy. To take a not at all random example, it makes a lot of sense to produce aluminum, a process that uses vast amounts of electricity, in countries like Canada, which have abundant hydropower. So the U.S. gains from importing Canadian aluminum, whether or not we run a trade deficit with Canada.

(NY Times)

The Energy industry was quick to attack the steel tariffs…

The U.S. oil and gas industry on Thursday slammed President Donald Trump’s plan to impose tariffs on imported steel, saying the move would kill energy jobs by raising costs for big infrastructure projects.

Officials at the nation’s top energy industry trade groups issued statements urging Trump to drop the idea, and a source familiar with Exxon Mobil’s investment plans said the tariff could lead the company to curtail an expansion of one of the country’s biggest oil refineries.

“These tariffs would undoubtedly raise costs for U.S. businesses that rely heavily on steel and aluminum for the majority of their products – and ultimately consumers,” said Jack Gerard, president of the American Petroleum Institute.

(Rig Zone)

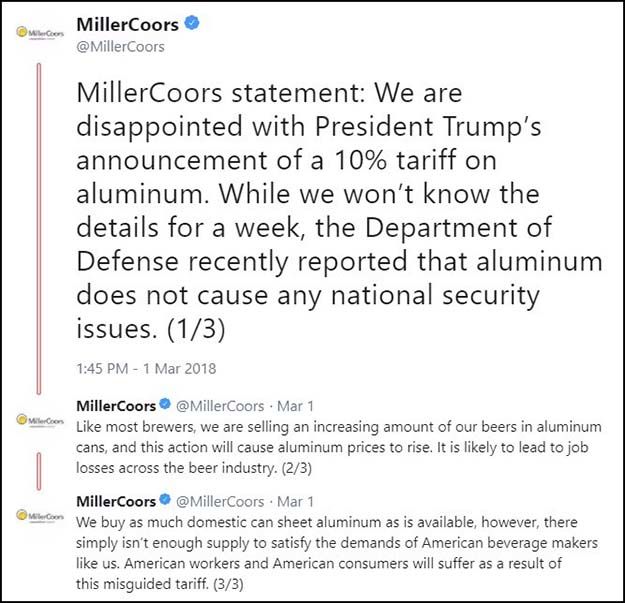

So the White House wants to raise everyone’s beer prices. Those are fighting words in most of Colorado…

“Aluminum is critical to the well-being of America’s beer industry as more than half of the beer produced annually is packed in aluminum cans or aluminum bottles. President Trump’s announcement today that he plans to impose a 10% tariff on aluminum imports will increase the cost of aluminum in the United States and endanger American jobs in the beer industry and throughout the supply chain.

“According to third-party analyses, this 10% tariff will create a new $347.7 million tax on America’s beverage industry, including brewers and beer importers, and result in the loss of 20,291 American jobs. We appreciate the many members of Congress—both Republicans and Democrats—as well members of the cabinet who spoke out against imposing this tariff, many of whom specifically cited their concerns for how this tariff would negatively impact America’s beer industry.

“Imported aluminum used to make beer cans is not a threat to national security. The largest importer of aluminum to the United States is Canada—one of America’s strongest allies.

Did MillerCoors just suggest that there could be a beer can shortage?

Electrolux just paused its factory expansion in Springfield, TN…

Sweden’s Electrolux, Europe’s largest home appliance maker, said on Friday it would delay a planned $250 million investment in Tennessee, after U.S. President Donald Trump announced tariffs on imported aluminum and steel…

“We are putting it on hold. We believe that tariffs could cause a pretty significant increase in the price of steel on the U.S. market,” Electrolux spokesman Daniel Frykholm said.

Electrolux buys all the steel it uses in its U.S. products domestically.

“So this is not the possibility of tariffs directly impacting our costs, but rather the impact it could have on the market and that it could damage the overall competitiveness of our operations in the U.S.,” Frykholm said.

(Rueter’s)

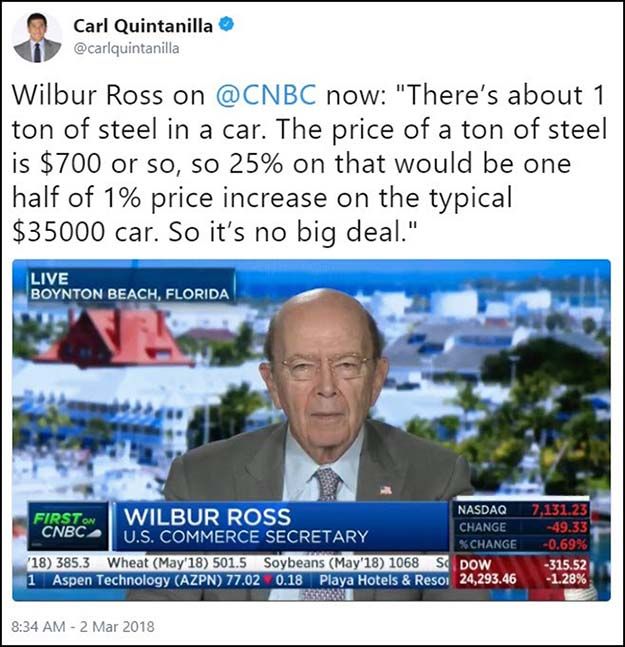

So a new car will cost about $150 more and a new truck or SUV about $250 more…

The average car includes about $830 of steel and $400 of aluminum, according to a Feb. 26 analysis by Colin Langan, an analyst with UBS.

He projected that Ford’s raw material costs were already going to rise by $1 billion this year, and said Thursday that the tariffs would add another $300 million. GM’s raw material costs, already seen climbing $800 million, would rise an additional $200 million from the import measures. Langan characterized rising raw material costs as “manageable.”

Charlie Chesbrough, senior economist for researcher Cox Automotive, estimates the tariffs Trump proposed would add about $200 to the total price of a vehicle.

“It’s unfortunate because it comes at a time when there are already fears about inflation,” he said in an interview. “This is only going to add fuel to that fire.”

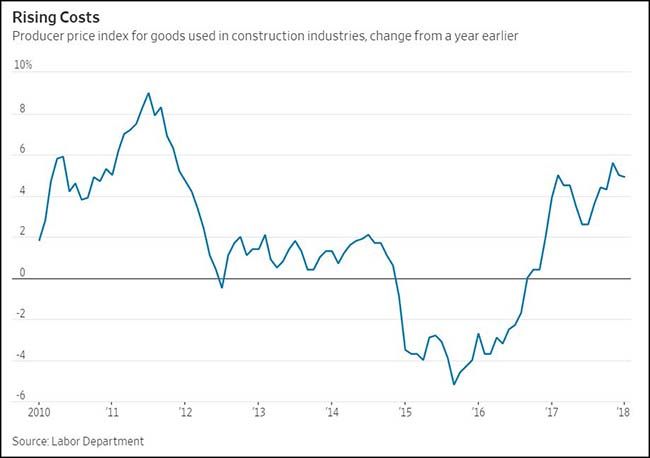

The National Association of Home Builders is fired up…

Randy Noel, chairman of the National Association of Home Builders (NAHB) and a home builder and developer from LaPlace, La., today issued the following statement regarding President Trump’s announcement to impose tariffs on steel and aluminum imports:

“It is unfortunate that President Trump has decided to impose tariffs of 25 percent on steel imports and 10 percent on aluminum imports. These tariffs will translate into higher costs for consumers and U.S. businesses that use these products, including home builders.

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.

“Tariffs hurt consumers and harm housing affordability. We hope the administration will work quickly to resolve these trade disputes regarding lumber and steel so that businesses and consumers have access to an adequate supply at a fair market price.”

(NAHB)

As is the multi-family and commercial building industry…

“Most of our steel is already ordered,” says one project manager involved in a large multifamily development in the Bay Area, “but not our finished aluminum panels. We don’t need them for another six or seven months, but our metals subcontractor says our supplier may be raising prices within the next week to 30 days. A 10 percent increase in raw cost may be 15 or 20 percent for us, so we’re scrambling to get everything approved.”

The price of steel and aluminum may represent only a small share of the final cost of a Toyota Tundra (built in San Antonio) or a Caterpillar tractor-scraper (made in Decatur, Ill.), but it’s a big part of the budget for builders. “Our margins are only 4 percent,” the project manager says. “If we don’t have an agreement that allows for escalation, that could be devastating. If steel is 6 percent of our cost but goes up 25 percent in price, it will significantly eat into that margin. To make projects pencil out, raising that price could make a project not feasible any longer.”

The situation is worse for builders of large commercial projects such as office towers, which are much more steel-intensive than more residential developments. Reshuffling those bids causes chaos in the present, and it also adds to labor and administrative costs.

The cost of that new bridge, tunnel and highway also will jump in price…

The American Iron and Steel Institute estimates that 43% of U.S. steel consumption goes to the construction industry. In 2005, the latest figures available, the Transportation Department estimated that highway construction uses 56 tons of steel for every million dollars in project costs.

“The problem is that the steel-producing sector is a small share of the economy while steel consumption is present almost across the board,” he said. “The construction sector is certainly a big consumer of steel and that is one of the paradoxes of this type of policy: You think you’re really helping the economy but in the end you’re shooting yourself in the foot because the pain you inflict on the consuming sectors is greater than the benefit you’re giving to the producing sector.”

(WSJ)

“I’ve always been mad, I know I’ve been mad, like the most of us… very hard to explain why you’re mad, even if you’re not mad…” (Pink Floyd)

Simon Hallett, Co-chief investment officer, Harding Loevner:

“Imposing trade barriers is a very inefficient way of helping the small minority who don’t benefit from open trade. For equity markets, a trade war would be damaging, but what is more damaging is the fear that economic policy is becoming irrational.”

(Barron’s)

Congressional members in big auto states will be sweating this through election day…

Instead of importing steel to make goods in America, many companies will simply import the finished product made from cheaper steel or aluminum abroad. Mr. Trump fancies himself the savior of the U.S. auto industry, but he might note that Ford Motor shares fell 3% Thursday and GM’s fell 4%. U.S. Steel gained 5.8%. Mr. Trump has handed a giant gift to foreign car makers, which will now have a cost advantage over Detroit. How do you think that will play in Michigan in 2020?

(WSJ)

South Carolina is a very big auto manufacturing state…

Sen. Lindsey Graham (R., S.C.) criticized the administration’s proposed tariffs.

“China wins when we fight with Europe.…China is winning and we’re losing with this tariff regime,” he said Sunday in a CBS interview. “You’re letting China off the hook. You’re punishing the American consumer and our allies. Go after China, not the rest of the world.”

(WSJ)

European retaliation is going to hit in the form of blue jeans, whiskey and Harley Davidson motorbikes…

The EU has drawn up a €2.8bn list of proposed counter-measures comprising roughly one-third steel and aluminium, one-third agricultural products, and one-third other goods. The list, which has been in the works since Mr Trump first issued his tariff threats last year, ranges from commodities such as maize and orange juice to quintessential Americana, notably Harley-Davidson motorcycles, bourbon whiskey and blue jeans.

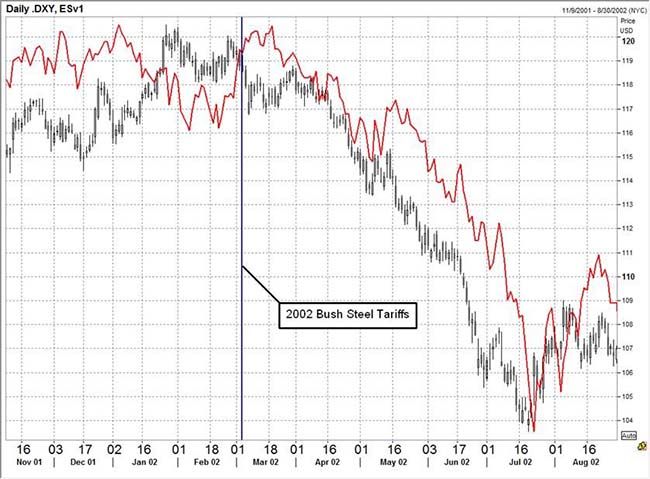

The U.S. tried steel tariffs once before….

Decades ago, the Nobel Prize-winning economist Milton Friedman argued that businessmen themselves are among the biggest dangers to a free-market economy. They often seek government privileges to increase their profits and avoid competition. Indeed, import taxes — putting aside rhetoric about defending jobs — are well-known to have devastating effects on consumers. They are quite effective at lining the pockets of shareholders in protected industries.

We’ve seen this before. In 2002, President George W. Bush implemented his own steel tariffs. As expected, the taxes jacked up the price of domestic steel and temporarily boosted the industry’s profits. Steel-consuming industries, however, weren’t so lucky. According to an estimate from the nonpartisan Trade Partnership Worldwide, a staggering 200,000 people lost their jobs in downstream industries by the following year. That’s more workers than the entire steel industry had at the time.

(NY Times)

It didn’t work out well for the Stock Market or the U.S. Dollar…

S&P 500 and dollar index (candlesticks) around the Bush Steel Tariffs in 2002

(HSBC)

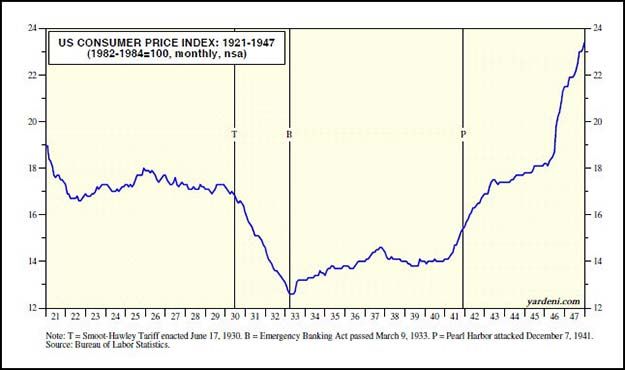

Ed Yardeni even believes that the Smoot-Hawley tariffs triggered the Great Depression…

The 1920s was a period of globalization, with peace, progress, and prosperity. Yet by the early 1930s, the world fell into a depression that was followed by World War II near the end of the decade.

My research led me to conclude that the Great Depression was caused by the Smoot–Hawley Tariff Act of June 1930. During the election of 1928, Republican candidate Herbert Hoover promised US farmers protection from foreign competition to boost depressed farm prices. However, he was appalled by the breadth of the tariff bill that special interest groups had pushed through Congress, denouncing the bill as “vicious, extortionate, and obnoxious.” But he signed it into law under intense political pressure from congressional Republicans.

The tariff triggered a deflationary spiral that had a deadly domino effect. Other countries immediately retaliated by imposing tariffs too. The collapse of world trade pushed commodity prices over a cliff. Exporters and farmers defaulted on their loans, triggering a wave of banking crises. The resulting credit crunch caused industrial production and farm output to plunge and unemployment to soar. In my narrative, the depression caused the stock market crash, not the other way around as is the popular belief.

(Yardeni)

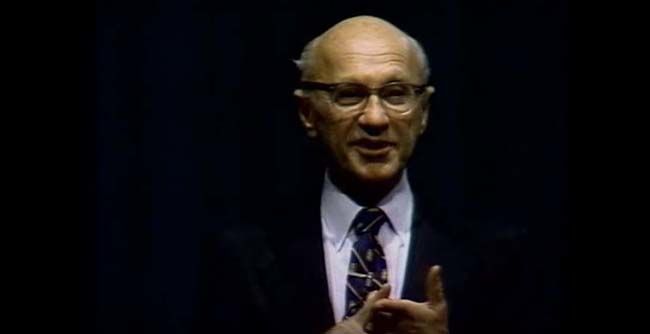

In this short video, Dr. Milton Friedman gives a concise and lucid argument for international free trade at Utah State University in 1978…

The U.S. only imports 1.1m cars from European auto plants. Most European cars are now built in the U.S…

In addition to the metal tariffs being proposed, U.S. trade reps are also fighting on the NAFTA agreements this week…

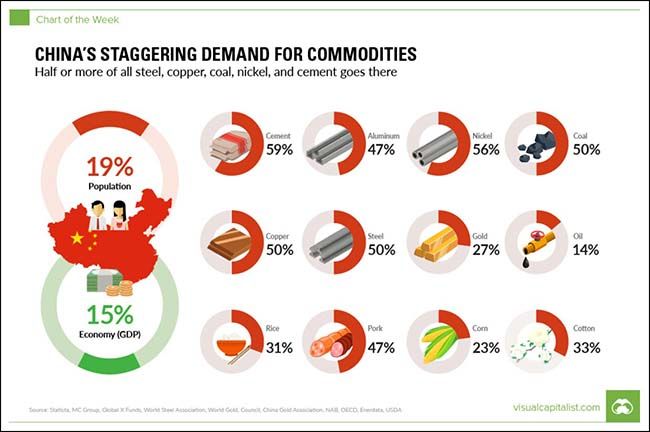

China consumes half the global steel and aluminum output. So U.S. tariffs on imports will only lower the prices they pay in the global marketplace…

For U.S. manufacturers, their business momentum just downshifted…

U.S. manufacturers for more than a year have ramped up hiring and production as they cheered Mr. Trump’s moves to roll back regulations and overhaul a tax code they saw as onerous.

“This is going to unfortunately throw some cold water on that momentum,” said Jason Andringa, chief executive of Vermeer Corp., an Iowa maker of construction and agricultural equipment. “It’s going to bring a dynamic of risk and volatility that we haven’t had to deal with in a while.”

(WSJ)

Bill McBride also notes that the momentum is changing…

We are seeing some economic tailwinds and some headwinds. Although the tax changes are poorly conceived, and mostly benefit high income earners, there should be some short term boost to economic growth. That might lead the Federal Reserve to raise rates a little quicker than anticipated.

And, for housing, the tax changes could negatively impact a segment of the housing market, and rising mortgage rates are another headwind. Note: I’m tracking housing inventory this year to see if there is an impact.

And now the Trump administration is proposing tariffs and talking openly talking of a trade war. That is a downside risk to the economy.

( Calculated Risk )

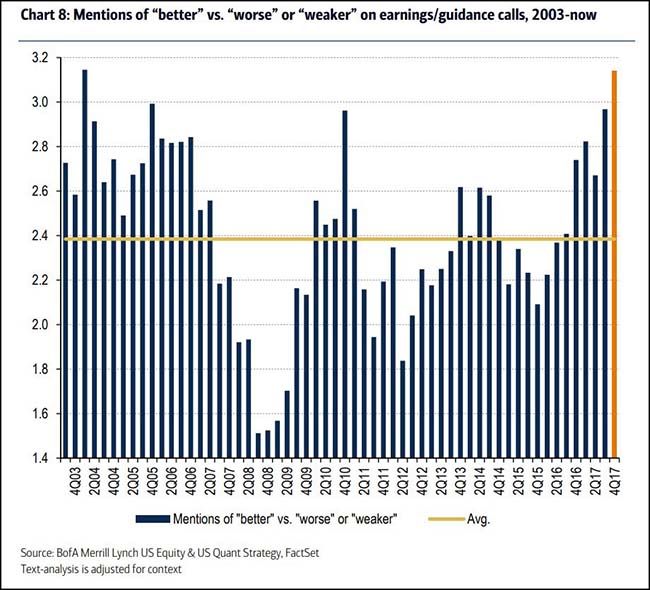

Easy to bet on a peak bar for this cycle…

(@NickatFP)

Can’t wait to see the next release of the Fed minutes…

Safe to bet that there will be some comments about alcohol being present?

So in a global trade war, Small Caps should outperform as they are less affected by tariffs…

(@WalterDeemer)

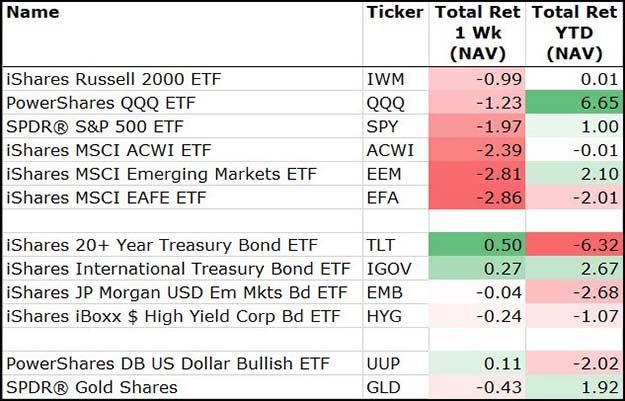

Looking broadly at the markets last week showed it was a broad risk-off week…

Bonds gained as economic uncertainty increases. European markets were hit by the double whammy of political election angst and global trade uncertainty.

(3/2/18)

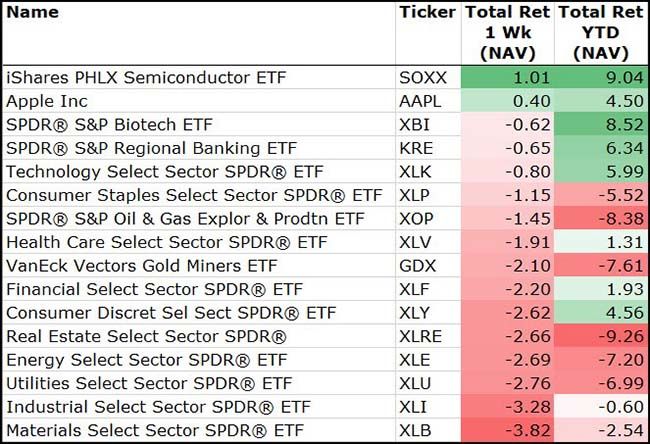

Among sectors, those most touching metal inputs were most impacted: Materials & Industrials…

(3/2/18)

If you have been to a hospital or doctor’s office in the last few months, you have no doubt witnessed the shortages…

Maybe instead of focusing on tariffs to protect a couple of U.S. industries, we can focus on fixing Puerto Rico so that our stressed health care supply chain can be replenished.

ON THE WEBSITE of the Food and Drug Administration, there’s a page where the agency lists drugs that are in short supply in the United States. Last week, there were 90 entries on the list: antibiotics, drugs for anesthesia, compounds to light up veins and organs for imaging, immunosuppressives to prevent organ rejection, tube-feeding solutions, sedatives. For every type of medical problem, an important drug is off the market or in short supply—and this is routine.

In the fall, after Hurricane Maria tore through Puerto Rico, something new joined the list, not a drug but a category of medical equipment: bags of sterile salt water. When the territory’s electrical grid went down, it took out several plants that make bagged saline for US manufacturer Baxter International. Few noticed at first, until this winter’s flu season got bad. One of the first things you do when someone arrives at a hospital weak and feverish is plug them into a quart bag of saline to rehydrate them. Another might be giving them drugs through a smaller bag hooked to an IV drip. In many hospitals, both were suddenly rationed.

(WIRED)

Perfect insight from Shelia Blair in her Barron’s interview…

Banks will make it through this next crisis fine because they are missing the assets with leverage on their balance sheet this cycle. Bet on the investors who bought overvalued assets and added leverage to feel the most pain in the next downturn.

Where, then, do you see potential problems that could trigger the next crisis?

I’d keep an eye on credit-card debt. Subprime auto has been a problem for a couple years, and valuations on loans used to finance leveraged buyouts are high. Any type of secured lending backed by an asset that is overvalued should be a concern. That is what happened with housing. Corporate debt also has not gotten as much attention as it should. It is market-funded, rather than bank-funded, but the banks still have exposure. Then there’s cyber-risk. It took us so long to get around to the reforms postcrisis that we got a little behind on systemic cyber-risk, but regulators are very focused on it now.

That’s a lot to worry about. What does it mean for the economy?

With tax reform combined with deregulation, and the economy finally picking up steam, the economy could generate pretty good growth over the next year or two. But after that, if we keep throwing gas on flames with deficit spending, I worry about how severe the next downturn is going to be—and whether we will have any bullets left. Hopefully, in a couple of years, the Fed will have gotten interest rates up to the point it can ease on a short-term basis.

But on the fiscal side, there is very little breathing room. I worry about when the safe-haven status of Treasuries is questioned. As the Fed raises rates while we are deficit-spending, it will have a negative impact on stocks. These are things I’d like to get ahead of. I don’t think Congress has a clue that the reason they have been able to get away with this profligacy is because we are the best-looking horse in the glue factory. But we are in the glue factory. Our fiscal situation is not a good one.

(Barron’s)

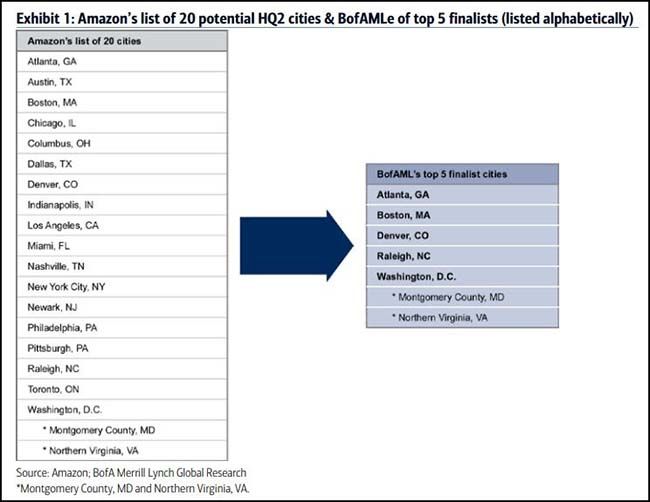

Merrill Lynch has narrowed the list of Amazon 2nd Headquarter choices for you…

And I think that it is safe to say that the politicians in the State of Georgia have eliminated Atlanta from the final five in the last week.

(@NickatFP)

Speaking of Amazon, wow…

(@jdmarkman)

Finally, talk about an incredible ROI on a piece of technology…

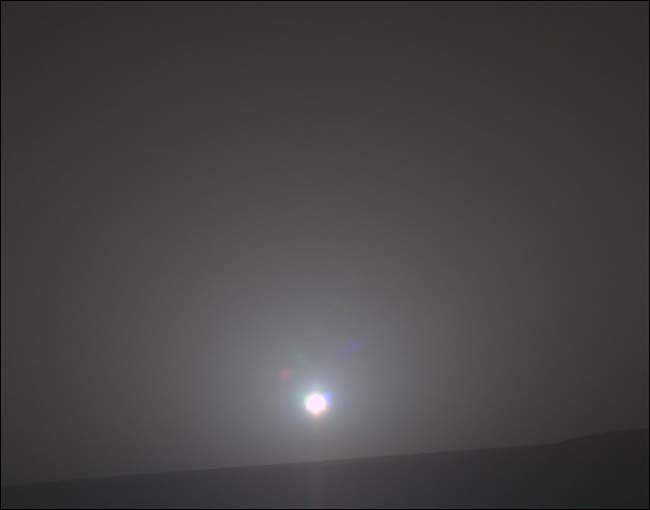

NASA’s Mars Exploration Rover Opportunity recorded the dawn of the rover’s 4,999th Martian day, or sol, with its Panoramic Camera (Pancam) on Feb. 15, 2018, yielding this processed, approximately true-color scene.

The view looks across Endeavour Crater, which is about 14 miles (22 kilometers) in diameter, from the inner slope of the crater’s western rim. Opportunity has driven a little over 28.02 miles (45.1 kilometers) since it landed in the Meridiani Planum region of Mars in January, 2004, for what was planned as a 90-sol mission. A sol lasts about 40 minutes longer than an Earth day.

(JPL/NASA)