by Kate Moore, Chief Equity Strategist, Blackrock

Momentum was dented in the early February stock market swoon, but we believe its moment isn’t over. Kate explains.

Momentum—and the equity style factor of the same name—was decidedly on in January, following a stellar 2017. Then came the February stock market swoon, which dented momentum strategies (those focused on stocks trending higher).

Is momentum’s moment over? The answer is no, in our view, as we write in our new Global equity outlook Has momentum had its moment?

History reveals this factor is rewarded in times of economic growth—and that support remains firmly in place, we believe. We expect the global economic expansion to continue through 2018, and see upside to consensus forecasts amid tax cuts and robust government spending in the U.S. See Investing after the U.S. tax overhaul. The stimulus may hasten (and shorten) the U.S. economic cycle, but we estimate the cycle can power on amid broad global growth—even if domestic overheating pressures pick up in the near term.

The volatility of the macro environment also matters. We find in our analysis that momentum has outperformed broad indexes in low macro vol regimes and lagged slightly in high macro vol regimes. Our economic regime model indicates we are in a low macro vol regime—and one we believe has staying power. The early-February volatility spike came on the heels of an unusually placid 2017. We do not expect a return to the ultra-calm conditions, nor do we believe this episode represents a shift out of the low-vol regime.

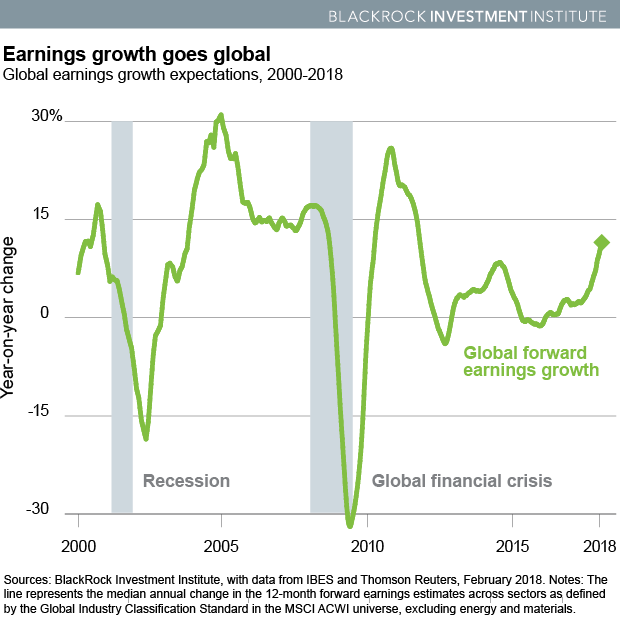

The rosy top-down picture is complemented by a solid earnings backdrop that may lend support to equities and further out-performance of momentum. Every region collectively posted double-digit earnings growth in 2017 for the first time since 2005—excluding the post-global financial crisis pop in 2010. See the Earnings growth goes global chart below.

The trend is poised to accelerate in 2018, with forward earnings estimates rising at the fastest pace since 2003 (excluding 2010 again). Looking at MSCI indexes, we find: U.S. earnings growth of 11% in 2017 was the strongest since 2011. The outlook for 2018? Nearly 20%, with tax cuts providing a boost and lifting earnings growth prospects by 7%. Earnings growth was 26% in emerging markets (EM) Asia last year, with an outlook for more than 13% in 2018. Markets have followed. U.S. equities soared 15% and EM Asia 30% in the past 12 months, a period that includes the early February stock swoon. Solid earnings prospects for 2018 could bode well for momentum here.

Read more market insights in our latest Global equity outlook.

The upbeat earnings story extends beyond geography to sectors. Earnings leader technology has been a large driver of momentum returns, yet other cyclical sectors in developed markets have also played a major role. Consumer discretionary, financials and industrials accounted for 49% of the return of the MSCI World Momentum Index over the last four quarters, we find. Tech accounted for 32%. Sectors with the strongest earnings drive have been the largest contributors to momentum performance. Momentum valuations do not appear excessive, relatively speaking. The MSCI All Country World Index (ACWI) is near its all-time high valuation on data back to 2003 while the ACWI Momentum Index is in the 89th percentile, based on forward price to earnings.

Overall, we see potential for momentum to outperform over the next three to six months absent a deterioration in the economic growth outlook, a significant deceleration in earnings momentum, or a geopolitical crisis that brings into question the bright economic outlook or spoils risk appetite. We particularly like momentum stocks in the U.S. and EM Asia, where the earnings outlook provides strong support.

Kate Moore is BlackRock’s chief equity strategist, and a member of the BlackRock Investment Institute. She is a regular contributor to The Blog.

Copyright © Blackrock